Centene Corporation (NYSE: CNC) today announced its financial

results for the quarter ended March 31, 2006. First Quarter

Highlights -- Revenues of $455.1 million, a 37% increase. -- A 70

basis point increase in sequential quarter health benefits ratio

(HBR) in the Medicaid and SCHIP category, primarily due to pharmacy

costs in Indiana. -- Earnings from operations of $12.6 million. --

Earnings per diluted share of $0.20. -- Membership growth of 12.5%.

-- Operating cash flows of $9.3 million. -- Days in claims payable

of 43.0. -- Closed acquisition of US Script, a pharmacy benefit

manager based in Fresno, California. -- Signed definitive agreement

to acquire MediPlan Corporation through Ohio subsidiary. --

Received preliminary notification of Ohio Medicaid contract awards,

increasing counties served to 27. Michael F. Neidorff, Centene's

chairman and chief executive officer, said: "The first quarter of

2006 met our expectations, although our results were affected by

some market specific factors. In particular, higher pharmacy costs

in Indiana, and to a limited degree in Ohio, impacted our overall

medical costs, adding 70 basis points to our Medicaid and SCHIP

HBR. We have been actively working to address these issues and are

confident that the pharmacy costs will normalize in the short-term.

Importantly, our purchase of US Script has provided us with an

important vehicle to mitigate and positively influence our pharmacy

costs. Indiana and Ohio will be transitioned to US Script in May.

Wisconsin was converted to the US Script platform in March, and we

are already seeing the benefit of this implementation. "We are

pleased with our progress in Kansas and New Jersey, and the new

membership opportunities in Ohio and Georgia. We recently received

notification from the State of Ohio of our preliminary acceptance

to serve Medicaid recipients in the Northwest and East Central

regions, our existing service areas. Together with the MediPlan

acquisition, we are solidly positioned in the State. "On February

15, 2006, the Georgia Department of Community Health issued a

60-day delay in implementing its new managed care initiative to

June 1, 2006. Nevertheless, our subsidiary Peach State Health Plan

is, and will remain, ready to partner with the State's Medicaid and

PeachCare for Kids programs. We have successfully completed all

readiness reviews and are poised for significant growth in this

start-up market. "We look forward to the Georgia and Ohio

implementations, and additional opportunities for growth,"

concluded Neidorff. Membership totaled 874,800 at March 31, 2006, a

12.5% increase from 777,300 at March 31, 2005. The following table

depicts Medicaid Managed Care membership by state at March 31, 2006

and 2005: -0- *T 2006 2005 ------------ ------------ Indiana

193,000 149,900 Kansas 118,200 94,900 Missouri 34,500 41,300 New

Jersey 57,500 52,700 Ohio 59,000 (a) 23,900 Texas 237,500 243,700

Wisconsin 175,100 170,900 ------------ ------------ TOTAL 874,800

777,300 ============ ============ (a) Excludes our pending

acquisition of MediPlan Corporation *T The following table depicts

Medicaid Managed Care membership by member category at March 31,

2006 and 2005: -0- *T 2006 2005 ------------ ------------ Medicaid

683,700 588,100 SCHIP 175,300 178,500 SSI 15,800 (a) 10,700 (b)

------------ ------------ TOTAL 874,800 777,300 ============

============ (a) 8,600 at-risk; 7,200 ASO (b) 4,500 at-risk; 6,200

ASO *T The following table depicts Specialty Services membership by

state at March 31, 2006 and 2005: -0- *T 2006 2005 ------------

------------ Arizona 92,300 - Kansas 39,200 35,400 ------------

------------ TOTAL 131,500 35,400 ============ ============ Note:

Includes behavioral health contracts only. *T Statement of Earnings

Highlights -- For the first quarter of 2006, revenues increased

36.9% to $455.1 million from $332.4 million in the first quarter of

2005. The increase in service revenues for the first quarter of

2006 reflects the acquisitions of both AirLogix and US Script. --

The HBR for Centene's Medicaid and SCHIP populations, which

reflects medical costs as a percent of premium revenues, was 82.8%

for the first quarter of 2006, compared to 80.6% for the same

period in 2005. The results for the first quarter of 2006

reflected: (1) higher utilization trends in certain markets,

especially in January 2006; (2) an increase in pharmacy related

costs in Centene's Indiana and Ohio markets; and (3) Centene's

earlier expansion into new unmanaged markets. The HBR for the SSI

category was 87.6% for the first quarter of 2006 compared to 94.6%

for the first quarter of 2005 and, while approaching Centene's

target range, may be volatile given the small member base. For the

Specialty Services segment, the HBR was 84.1% in the first quarter

of 2006 versus 133.5% in the first quarter of 2005. The Specialty

Services HBR for 2006 included the behavioral health contracts in

Arizona and Kansas, while the 2005 results included only the first

three months of the behavioral health contract in Kansas. --

Medicaid Managed Care general and administrative (G&A) expenses

as a percent of revenues was 11.9% in the first quarter of 2006

compared to 10.8% in the first quarter of 2005, mainly reflecting

Georgia start-up costs and the expensing of stock-based

compensation as the result of Centene's adoption of SFAS No. 123R.

In addition, concurrent with the closing of the US Script

acquisition, the Company altered its corporate function allocation

methodology to more closely align those allocations to the

proportion of costs required to support each business segment. The

effect of this change added 0.7% in G&A expenses to the

Medicaid Managed Care G&A ratio for the first quarter of 2006.

-- Earnings from operations of $12.6 million in the first quarter

of 2006 compared to $21.3 million in the first quarter of 2005,

inclusive of Georgia start-up costs. -- Net earnings were $8.8

million, or $0.20 per diluted share, for the first quarter of 2006,

compared to $14.4 million, or $0.32 per diluted share, for the

first quarter of 2005. Balance Sheet and Cash Flow Highlights At

March 31, 2006, the Company held cash and investments of $339.8

million, a portion of which was restricted due to state regulatory

requirements. Premium and related receivables increased $22.3

million during the first quarter of 2006, primarily reflecting an

increase in capitation receivables and reimbursements due from

providers, including amounts due under capitated risk-sharing

contracts. The increase also reflected customer receivables due to

US Script, which was acquired as of January 1, 2006. Medical claims

liabilities totaled $172.8 million at March 31, 2006, representing

43.0 days in claims payable. A reconciliation of the Company's

change in days in claims payable from the immediately preceding

quarter is highlighted below: -0- *T Days in claims payable,

December 31, 2005 45.4 Decrease in claims inventory (1.8)

Conversion of pharmacy benefits to U.S. Script (0.6) ------------

Days in claims payable, March 31, 2006 43.0 ============ *T The

Company had cash flows from operating activities of $9.3 million

for the quarter ended March 31, 2006. Outlook Karey L. Witty,

Centene's chief financial officer, commented, "For the second

quarter of 2006, we expect revenue in the range of $495 million to

$500 million and earnings per diluted share of $0.25 to $0.30. For

the full-year 2006, we anticipate revenue in the range of $2.08

billion to $2.16 billion and earnings per diluted share of $1.53 to

$1.70. This guidance excludes our recently announced acquisition of

MediPlan Corporation, which we expect to close during the second

quarter of 2006." Conference Call As previously announced, the

Company will host a conference call later today, April 25, 2006, at

8:30 AM Eastern Time to review the financial results for the first

quarter ended March 31, 2006, and to discuss its business outlook.

Michael F. Neidorff and Karey L. Witty will host the conference

call. Investors are invited to participate in the conference call

by dialing (800) 273-1254 in the United States and Canada, and

(706) 679-8592 for international participants, or via a live

Internet broadcast at the Company's website, www.centene.com. A

replay of the call will be available from April 25, 2006, shortly

after completion of the call, until May 9, 2006, at 11:59 PM

Eastern Time. Investors may dial (800) 642-1687 in the United

States and (706) 645-9291 from abroad and enter access number

7620184. About Centene Corporation Centene Corporation is a leading

multi-line healthcare enterprise that provides programs and related

services to individuals receiving benefits under Medicaid,

including Supplemental Security Income (SSI) and the State

Children's Health Insurance Program (SCHIP). The Company operates

health plans in Indiana, Kansas, Missouri, New Jersey, Ohio, Texas

and Wisconsin. In addition, the Company contracts with other

healthcare organizations to provide specialty services including

behavioral health, disease management, nurse triage, pharmacy

benefit management and treatment compliance. Information regarding

Centene is available via the Internet at www.centene.com. The

information provided in the first paragraph following the bullet

listing under "First Quarter Highlights" and in the paragraph under

"Outlook" above contain forward-looking statements that relate to

future events and future financial performance of Centene.

Subsequent events and developments may cause the Company's

estimates to change. The Company disclaims any obligation to update

this forward-looking financial information in the future. Readers

are cautioned that matters subject to forward-looking statements

involve known and unknown risks and uncertainties, including

economic, regulatory, competitive and other factors that may cause

Centene's or its industry's actual results, levels of activity,

performance or achievements to be materially different from any

future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements. Actual

results may differ from projections or estimates due to a variety

of important factors, including Centene's ability to accurately

predict and effectively manage health benefits and other operating

expenses, competition, changes in healthcare practices, changes in

federal or state laws or regulations, inflation, provider contract

changes, new technologies, reduction in provider payments by

governmental payors, major epidemics, disasters and numerous other

factors affecting the delivery and cost of healthcare. The

expiration, cancellation or suspension of Centene's Medicaid

managed care contracts by state governments would also negatively

affect Centene. -0- *T CENTENE CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (In thousands, except share data) March

31, December 31, 2006 2005 ------------ ------------ (Unaudited)

ASSETS Current assets: Cash and cash equivalents $ 118,512 $

147,358 Premium and related receivables, net of allowances of $611

and $343, respectively 66,368 44,108 Short-term investments, at

fair value (amortized cost $71,400 and $56,863, respectively)

71,172 56,700 Other current assets 24,992 24,439 ------------

------------ Total current assets 281,044 272,605 Long-term

investments, at fair value (amortized cost $130,189 and $126,039,

respectively) 127,289 123,661 Restricted deposits, at fair value

(amortized cost $23,081 and $22,821, respectively) 22,788 22,555

Property, software and equipment, net 82,853 67,199 Goodwill

196,986 157,278 Other intangible assets, net 19,341 17,368 Other

assets 7,506 7,364 ------------ ------------ Total assets $ 737,807

$ 668,030 ============ ============ LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Medical claims liabilities $ 172,792 $

170,514 Accounts payable and accrued expenses 47,779 29,790

Unearned revenue 12,494 13,648 Current portion of long-term debt

and notes payable 1,712 699 ------------ ------------ Total current

liabilities 234,777 214,651 Long-term debt 130,940 92,448 Other

liabilities 7,841 8,883 ------------ ------------ Total liabilities

373,558 315,982 Stockholders' equity: Common stock, $.001 par

value; authorized 100,000,000 shares; issued and outstanding

43,072,053 and 42,988,230 shares, respectively 43 43 Additional

paid-in capital 195,669 191,840 Accumulated other comprehensive

income: Unrealized loss on investments, net of tax (2,148) (1,754)

Retained earnings 170,685 161,919 ------------ ------------ Total

stockholders' equity 364,249 352,048 ------------ ------------

Total liabilities and stockholders' equity $ 737,807 $ 668,030

============ ============ CENTENE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS (In thousands, except share

data) Three Months Ended March 31, ------------ ------------ 2006

2005 ------------ ------------ (Unaudited) Revenues: Premium $

435,562 $ 330,944 Service 19,516 1,432 ------------ ------------

Total revenues 455,078 332,376 ------------ ------------ Expenses:

Medical costs 361,672 267,756 Cost of services 15,588 843 General

and administrative expenses 65,222 42,459 ------------ ------------

Total operating expenses 442,482 311,058 ------------ ------------

Earnings from operations 12,596 21,318 Other income (expense):

Investment and other income 3,540 2,120 Interest expense (1,998)

(562) ------------ ------------ Earnings before income taxes 14,138

22,876 Income Tax Expense 5,372 8,465 ------------ ------------ Net

earnings $ 8,766 $ 14,411 ============ ============ Earnings per

share: Basic earnings per common share $ 0.20 $ 0.35 Diluted

earnings per common share $ 0.20 $ 0.32 Weighted average number of

shares outstanding: Basic 42,987,892 41,560,587 Diluted 44,750,271

44,861,989 CENTENE CORPORATION AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands) Three Months Ended March

31, ------------ ------------ 2006 2005 ------------ ------------

(Unaudited) Cash flows from operating activities: Net earnings $

8,766 $ 14,411 Adjustments to reconcile net earnings to net cash

provided by operating activities -- Depreciation and amortization

4,520 2,782 Excess tax benefits from stock compensation -- 2,871

Stock compensation expense 3,417 1,091 Loss (gain) on sale of

investments 12 10 Loss on disposal of property and equipment 30 183

Deferred income taxes 232 (983) Changes in assets and liabilities

-- Premium and related receivables (15,812) (5,512) Other current

assets (2,894) (4,268) Other assets (158) (491) Medical claims

liabilities 2,278 11,602 Unearned revenue (934) (21) Accounts

payable and accrued expenses 9,937 (2,446) Other operating

activities (51) 648 ------------ ------------ Net cash provided by

operating activities 9,343 19,877 ------------ ------------ Cash

flows from investing activities: Purchase of property, software and

equipment (14,136) (3,665) Purchase of investments (53,194)

(21,767) Sales and maturities of investments 33,827 27,542

Acquisitions, net of cash acquired (39,912) -- ------------

------------ Net cash (used in) provided by investing activities

(73,415) 2,110 ------------ ------------ Cash flows from financing

activities: Proceeds from exercise of stock options 2,139 1,390

Proceeds from borrowings 37,000 -- Payment of long-term debt and

notes payable (2,285) (4,121) Excess tax benefits from stock

compensation 1,454 -- Common stock repurchases (3,082) -- Other

financing activities -- (85) ------------ ------------ Net cash

provided by (used in) financing activities 35,226 (2,816)

------------ ------------ Net (decrease) increase in cash and cash

equivalents (28,846) 19,171 ------------ ------------ Cash and cash

equivalents, beginning of period 147,358 84,105 ------------

------------ Cash and cash equivalents, end of period $ 118,512 $

103,276 ============ ============ Interest paid $ 2,037 $ 692

Income taxes paid $ 911 $ 1,133 Supplemental schedule of non-cash

financing activities: Property acquired under capital leases $ 26 $

-- CENTENE CORPORATION SUPPLEMENTAL FINANCIAL DATA Q1 Q4 Q3 Q2 2006

2005 2005 2005 ---------- ---------- ---------- ----------

MEMBERSHIP Medicaid Managed Care: Indiana 193,000 193,300 176,300

152,800 Kansas 118,200 113,300 107,600 103,000 Missouri 34,500

36,000 37,300 39,900 New Jersey 57,500 56,500 50,900 52,900 Ohio

59,000 58,700 58,100 59,600 Texas 237,500 242,000 243,600 243,800

Wisconsin 175,100 172,100 173,900 173,400 ---------- ----------

---------- ---------- TOTAL 874,800 871,900 847,700 825,400

========== ========== ========== ========== Medicaid 683,700

681,100 657,500 637,300 SCHIP 175,300 175,900 176,900 176,200 SSI

15,800 14,900 13,300 11,900 ---------- ---------- ----------

---------- TOTAL 874,800 871,900 847,700 825,400 ==========

========== ========== ========== Specialty Services (a): Arizona

92,300 94,700 94,300 - Kansas 39,200 38,800 37,500 37,100

---------- ---------- ---------- ---------- TOTAL 131,500 133,500

131,800 37,100 ========== ========== ========== ========== (a)

Includes behavioral health contracts only. REVENUE PER MEMBER (b) $

157.17 $ 152.48 $ 147.73 $ 143.41 CLAIMS (b) Period-end inventory

229,800 255,000 206,900 195,500 Average inventory 175,200 153,500

148,300 170,300 Period-end inventory per member 0.26 0.29 0.24 0.24

(b) Revenue per member and claims information are presented for the

Medicaid Managed Care segment. DAYS IN CLAIMS PAYABLE (c) 43.0 45.4

41.4 49.5 (c) Days in Claims Payable is a calculation of Medical

Claims Liabilities at the end of the period divided by average

claims expense per calendar day for such period. CASH AND

INVESTMENTS (in millions) Regulated $ 314.0 $ 322.6 $ 305.1 $ 260.5

Unregulated 25.8 27.7 27.7 27.4 ---------- ---------- ----------

---------- TOTAL $ 339.8 $ 350.3 $ 332.8 $ 287.9 ==========

========== ========== ========== ANNUALIZED RETURN ON EQUITY (d)

9.8% 16.2% 14.9% 20.0% (d) Annualized Return on Equity is

calculated as follows: (net income for quarter x 4) divided by

((beginning of period equity + end of period equity) divided by 2).

HEALTH BENEFITS RATIO BY CATEGORY: Three Months Ended March 31,

------------ ------------ 2006 2005 ------------ ------------

Medicaid and SCHIP 82.8% 80.6% SSI 87.6 94.6 Specialty Services

84.1 133.5 GENERAL AND ADMINISTRATIVE EXPENSE RATIO BY BUSINESS

SEGMENT: Three Months Ended March 31, ------------ ------------

2006 2005 ------------ ------------ Medicaid Managed Care 11.9%

10.8% Specialty Services 22.3 50.2 MEDICAL CLAIMS LIABILITIES (In

thousands) Four rolling quarters of the changes in medical claims

liabilities are summarized as follows: Balance, March 31, 2005 $

177,582 Acquisitions - Incurred related to: Current period

1,332,120 Prior period (11,295) ------------ Total incurred

1,320,825 ------------ Paid related to: Current period 1,160,178

Prior period 165,437 ------------ Total paid 1,325,615 ------------

Balance, March 31, 2006 $ 172,792 ============ *T Centene's claims

reserving process utilizes a consistent actuarial methodology to

estimate Centene's ultimate liability. Any reduction in the

"Incurred related to: Prior period" claims may be offset as Centene

actuarially determines "Incurred related to: Current period." As

such, only in the absence of a consistent reserving methodology

would favorable development of prior period claims liability

estimates reduce medical costs. Centene believes it has

consistently applied its claims reserving methodology in each of

the periods presented.

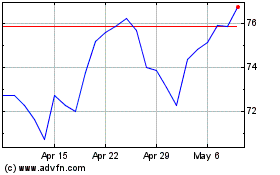

Centene (NYSE:CNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Centene (NYSE:CNC)

Historical Stock Chart

From Jul 2023 to Jul 2024