Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 01 2021 - 8:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 or

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2021

Commission File Number: 001-14946

CEMEX, S.A.B. de C.V.

(Translation of Registrant’s name into English)

Avenida

Ricardo Margáin Zozaya #325, Colonia Valle del Campestre

San Pedro Garza García, Nuevo León, 66265,

México

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

We may disclose to prospective investors certain information that has not been previously

publicly reported. This report is neither an offer to sell nor a solicitation of an offer to purchase any securities. We have elected to provide the information in this report for informational purposes.

This report contains forward-looking statements within the meaning of the U.S. federal securities laws. We intend these forward-looking

statements to be covered by the safe harbor provisions for forward-looking statements within the meaning of the U.S. federal securities laws. In some cases, these statements can be identified by the use of forward-looking words such as

“may,” “assume,” “might,” “should,” “could,” “continue,” “would,” “can,” “consider,” “anticipate,” “estimate,” “expect,”

“envision,” “plan,” “believe,” “foresee,” “predict,” “potential,” “target,” “strategy,” “intend,” “aimed” or other similar words. These

forward-looking statements reflect, as of the date such forward-looking statements are made, or unless otherwise indicated, our current expectations and projections about future events based on our knowledge of present facts and circumstances and

assumptions about future events. These statements necessarily involve risks and uncertainties that could cause actual results to differ materially from our expectations. Some of the risks, uncertainties and other important factors that could cause

results to differ, or that otherwise could have an impact on us or our consolidated entities, include, but are not limited to:

|

|

•

|

|

the impact of pandemics, epidemics or outbreaks of infectious diseases and the response of governments and other

third parties, including with respect to the novel strain of the coronavirus identified in China in late 2019 (“COVID-19”), which have affected and may continue to adversely affect, among other

matters, the ability of our operating facilities to operate at full or any capacity, supply chains, international operations, availability of liquidity, investor confidence and consumer spending, as well as availability of, and demand for, our

products and services;

|

|

|

•

|

|

the cyclical activity of the construction sector;

|

|

|

•

|

|

our exposure to other sectors that impact our and our clients’ businesses, such as, but not limited to, the

energy sector;

|

|

|

•

|

|

availability of raw materials and related fluctuating prices;

|

|

|

•

|

|

competition in the markets in which we offer our products and services;

|

|

|

•

|

|

general political, social, health, economic and business conditions in the markets in which we operate or that

affect our operations and any significant economic, health, political or social developments in those markets, as well as any inherent risks to international operations;

|

|

|

•

|

|

the regulatory environment, including environmental, energy, tax, antitrust, labor and acquisition-related rules

and regulations;

|

|

|

•

|

|

our ability to satisfy our obligations under our material debt agreements, the indentures that govern our

outstanding Senior Secured Notes (as defined below) and our other debt instruments and financial obligations, including our Perpetual Debentures (as defined below);

|

|

|

•

|

|

the availability of short-term credit lines or working capital facilities, which can assist us in connection with

market cycles;

|

|

|

•

|

|

the impact of our below investment grade debt rating on our cost of capital and on the cost of the products and

services we purchase;

|

|

|

•

|

|

loss of reputation of our brands;

|

|

|

•

|

|

our ability to consummate asset sales, fully integrate newly acquired businesses, achieve cost-savings from our

cost-reduction initiatives, implement our pricing initiatives for our products and generally meet our “Operation Resilience” strategy’s goals;

|

|

|

•

|

|

the increasing reliance on information technology infrastructure for our sales, invoicing, procurement, financial

statements and other processes that can adversely affect our sales and operations in the event that the infrastructure does not work as intended, experiences technical difficulties or is subjected to cyber-attacks;

|

|

|

•

|

|

changes in the economy that affect demand for consumer goods, consequently affecting demand for our products and

services;

|

|

|

•

|

|

weather conditions, including, but not limited to, excessive rain and snow, and disasters such as earthquakes and

floods;

|

|

|

•

|

|

trade barriers, including tariffs or import taxes and changes in existing trade policies or changes to, or

withdrawals from, free trade agreements, including the United States-Mexico-Canada Agreement;

|

|

|

•

|

|

terrorist and organized criminal activities as well as geopolitical events;

|

|

|

•

|

|

declarations of insolvency or bankruptcy, or becoming subject to similar proceedings;

|

|

|

•

|

|

natural disasters and other unforeseen events (including global health hazards such as COVID-19); and

|

|

|

•

|

|

the other risks and uncertainties described under “Item 3—Key Information—Risk Factors” of

our annual report on Form 20-F for the year ended December 31, 2020 and under “Risk Factors” in this report.

|

Readers are urged to read this report and carefully consider the risks, uncertainties and other factors that affect our business and

operations. The information contained in this report is subject to change without notice, and we are not obligated to publicly update or revise forward-looking statements after the date hereof or to reflect the occurrence of anticipated or

unanticipated events or circumstances. Readers should review future reports filed by us with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, CEMEX, S.A.B. de C.V. has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CEMEX, S.A.B. de C.V.

|

|

|

|

|

|

|

|

(Registrant)

|

|

Date: June 1, 2021

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Rafael Garza Lozano

|

|

|

|

|

|

|

|

Name: Rafael Garza Lozano

|

|

|

|

|

|

|

|

Title: Chief Comptroller

|

EXHIBIT INDEX

|

|

|

|

|

EXHIBIT NO.

|

|

DESCRIPTION

|

|

|

|

|

1

|

|

Certain information with respect to CEMEX, S.A.B. de C.V. (NYSE: CX) and its direct and indirect subsidiaries.

|

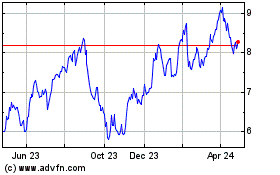

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Aug 2024 to Sep 2024

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Sep 2023 to Sep 2024