CBL & Associates Properties, Inc. (NYSE:CBL):

- FFO per share was $0.80 and

$3.22 in the fourth quarter and year ended December 31, 2008,

respectively.

- Portfolio occupancy was 92.3% as

of December 31, 2008 compared with 93.2% as of December 31,

2007.

- Same Center NOI declined 1.5%

for the year ended December 31, 2008.

- The Company entered into more

than $1.0 billion of new financings and loan extensions in the year

ended December 31, 2008.

CBL & Associates Properties, Inc. (NYSE:CBL) announced

results for the fourth quarter and year ended December 31, 2008. A

description of each non-GAAP financial measure and the related

reconciliation to the comparable GAAP measure is located at the end

of this news release.

Funds from Operations (�FFO�) allocable to common shareholders

for the fourth quarter ended December 31, 2008 was $52,774,000 or

$0.80 per diluted share, compared with $54,519,000, or $0.83 per

diluted share for the fourth quarter ended December 31, 2007. FFO

allocable to common shareholders for the year ended December 31,

2008 was $212,933,000, or $3.22 per diluted share, compared with

$203,613,000, or $3.10 per diluted share, for the year ended

December 31, 2007, representing an increase of 3.9% on a per

diluted share basis. FFO allocable to common shareholders for the

fourth quarter and year ended December 31, 2008 was impacted by an

increase in abandoned projects expense of $8,146,000 and

$10,135,000, respectively, related to the write-off of

predevelopment costs for projects the Company is no longer

pursuing. The write-offs were related to projects in various stages

of pre-development, but did not impact any projects that are

currently under construction.

FFO of the operating partnership for the fourth quarter ended

December 31, 2008, was $93,207,000, compared with $96,614,000 for

the fourth quarter ended December 31, 2007. FFO of the operating

partnership for the year ended December 31, 2008, was $376,273,000,

compared with $361,528,000 for the year ended December 31,

2007.

Net loss available to common shareholders for the fourth quarter

ended December 31, 2008, was ($10,055,000), or ($0.15) per diluted

share, compared with net income of $13,418,000, or $0.20 per

diluted share�for the prior-year period. Net income available to

common shareholders for the year ended December 31, 2008, was

$9,768,000, or $0.15 per diluted share, compared with $59,372,000,

or $0.90 per diluted share, for the year ended December 31,

2007.

Net income (loss) available to common shareholders for the

fourth quarter and year ended December 31, 2008 included

$29,298,000 and $40,300,000, respectively, of additional

depreciation expense resulting from the write-offs of tenant

improvements, deferred lease costs, and in-place lease intangibles

for tenants that closed during the fourth quarter 2008. Net income

(loss) available to common shareholders for the fourth quarter and

year ended December 31, 2008 was also impacted by an increase in

abandoned projects expense over the prior year periods of

$8,146,000 and $10,135,000, respectively, related to the write-off

of predevelopment costs for projects the Company is no longer

pursuing.

HIGHLIGHTS

- Total revenues increased 2.0%

during the fourth quarter ended December 31, 2008, to $299,398,000

from $293,638,000 in the prior-year period. Total revenues

increased 9.4% during the year ended December 31, 2008 to

$1,138,218,000 from $1,039,944,000 in the prior year.

- Same-center net operating income

(�NOI�), for the fourth quarter and year ended December 31, 2008,

declined 4.0% and 1.5%, respectively, over the prior year periods.

Same-center NOI was primarily impacted by loss of rent and an

increase in bad debt expense from bankruptcy and stores

closures.

- Same-store sales for mall

tenants of 10,000 square feet or less for stabilized malls as of

December 31, 2008, declined 4.3% to $331 per square foot compared

with $346 per square foot in the prior year period.

- The debt-to-total-market

capitalization ratio as of December 31, 2008, was 86.3% based on

the common stock closing price of $6.50 and a fully converted

common stock share count of 117,010,000 shares as of the same date.

The debt-to-total-market capitalization ratio as of December 31,

2007, was 64.0% based on the common stock closing price of $23.91

and a fully converted common stock share count of 116,814,000

shares as of the same date.

- Consolidated and unconsolidated

variable rate debt of $1,629,869,000 represents 21.2% of the total

market capitalization for the Company and 24.6% of the Company's

share of total consolidated and unconsolidated debt.

CBL�s Chairman and Chief Executive Officer, Charles B. Lebovitz,

said, �While 2008 represented the most challenging year in our

history, the underlying strength and resilience of our portfolio

reinforces our dominant mall strategy that has generated an

impressive thirty year track record. In the face of a record level

of bankruptcy activity in 2008, we experienced only a 90 basis

point decline in portfolio occupancy and achieved a record level of

lease signings at positive spreads due to the collective efforts of

the leasing and property level management teams. We will continue

this aggressive and proactive approach in the current economic

environment and are confident that we will be successful despite

the challenges that lay ahead.

�In addition to maximizing the performance of our existing

portfolio, strengthening our balance sheet remains a top priority.

We completed more than $1.0 billion of new financings in 2008 and

are making excellent progress in addressing 2009 loan maturities.

We have continued our efforts to reduce operating expenses and

achieve efficiencies in our organization with meaningful results

to-date. The leadership of CBL will continue to make the prudent

and sometimes difficult decisions necessary to preserve CBL's

long-term shareholder value.�

PORTFOLIO OCCUPANCY

�

December 31,

2008

�

2007

Portfolio occupancy 92.3% 93.2% Mall portfolio 92.6% 93.4%

Stabilized malls 92.9% 93.6% Non-stabilized malls 86.5% 90.0%

Associated centers 92.2% 95.9% Community centers 92.1% 86.7%

DISPOSITIONS

In December 2008, CBL completed the sale of an office building

and adjacent land in Greensboro, NC, for $14.6 million.

In 2008, CBL completed the sale of seven community centers, one

community center expansion and two office buildings for

approximately $67.8 million.

FINANCING

During the fourth quarter, CBL closed the previously announced

$40.0 million term loan secured by Meridian Mall in Lansing,

MI.

In 2008, CBL completed more than $1.0 billion of financings

including eight new construction loans with total capacity of

approximately $331.0 million, more than $365.0 million of new

financings or extensions on maturing mortgages and approximately

$344.0 million of new term facilities.

OUTLOOK AND GUIDANCE

Based on today's outlook and the Company's fourth quarter

results, the Company is providing guidance for 2009 FFO of $3.10 to

$3.25 per share. The full year guidance assumes $0.08 to $0.11 of

outparcel sales and same-center NOI growth in the range of (1.5%)

to (3.5%), excluding the impact of lease termination fees from both

applicable periods. The guidance excludes the impact of any future

unannounced acquisitions or dispositions. The Company expects to

update its annual guidance after each quarter's results.

� Low � High Expected diluted earnings per common share $ 0.43 $

0.58 Adjust to fully converted shares from common shares (0.18 )

(0.25 ) Expected earnings per diluted, fully converted common share

0.25 0.33 Add: depreciation and amortization 2.67 2.67 Add:

minority interest in earnings of Operating Partnership 0.18 0.25 �

Expected FFO per diluted, fully converted common share $ 3.10 $

3.25

INVESTOR CONFERENCE CALL AND SIMULCAST

CBL & Associates Properties, Inc. will conduct a conference

call at 11:00 a.m. ET on Thursday, February 5, 2009, to discuss the

fourth quarter results. The number to call for this interactive

teleconference is (303)�262-2130. A seven-day replay of the

conference call will be available by dialing (303)�590-3000 and

entering the passcode 11111004#. A transcript of the Company's

prepared remarks will be furnished on a Form 8-K following the

conference call.

To receive the CBL & Associates Properties, Inc., fourth

quarter earnings release and supplemental information please visit

our website at cblproperties.com or contact Investor Relations at

423-490-8312.

The Company will also provide an online Web simulcast and

rebroadcast of its 2008 fourth quarter earnings release conference

call. The live broadcast of CBL's quarterly conference call will be

available online at the Company's Web site at cblproperties.com, as

well as www.streetevents.com and www.earnings.com, Thursday,

February 5, 2009, beginning at 11:00 a.m. ET. The online replay

will follow shortly after the call and continue through February

12, 2009.

CBL is one of the largest and most active owners and developers

of malls and shopping centers in the United States. CBL owns, holds

interests in or manages 158 properties, including 87 regional

malls/open-air centers. The properties are located in 27 states and

total 85.8 million square feet including 2.2 million square feet of

non-owned shopping centers managed for third parties. CBL currently

has seven projects under construction totaling 3.0 million square

feet including Settlers Ridge in Pittsburgh, PA; The Pavilion at

Port Orange in Port Orange, FL; Hammock Landing in West Melbourne,

FL; The Promenade in D�Iberville, MS; two lifestyle/associated

centers, and one mall expansion. Headquartered in Chattanooga, TN,

CBL has regional offices in Boston (Waltham), MA, Dallas, TX, and

St. Louis, MO. Additional information can be found at

cblproperties.com.

NON-GAAP FINANCIAL MEASURES

Funds From Operations

FFO is a widely used measure of the operating performance of

real estate companies that supplements net income (loss) determined

in accordance with GAAP. The National Association of Real Estate

Investment Trusts (�NAREIT�) defines FFO as net income (loss)

(computed in accordance with GAAP) excluding gains or losses on

sales of operating properties, plus depreciation and amortization,

and after adjustments for unconsolidated partnerships and joint

ventures and minority interests. Adjustments for unconsolidated

partnerships and joint ventures and minority interests are

calculated on the same basis. The Company defines FFO allocable to

common shareholders as defined above by NAREIT less dividends on

preferred stock. The Company�s method of calculating FFO allocable

to common shareholders may be different from methods used by other

REITs and, accordingly, may not be comparable to such other

REITs.

The Company believes that FFO provides an additional indicator

of the operating performance of its properties without giving

effect to real estate depreciation and amortization, which assumes

the value of real estate assets declines predictably over time.

Since values of well-maintained real estate assets have

historically risen with market conditions, the Company believes

that FFO enhances investors� understanding of its operating

performance. The use of FFO as an indicator of financial

performance is influenced not only by the operations of the

Company�s properties and interest rates, but also by its capital

structure.

The Company presents both FFO of its operating partnership and

FFO allocable to common shareholders, as it believes that both are

useful performance measures. The Company believes FFO of its

operating partnership is a useful performance measure since it

conducts substantially all of its business through its operating

partnership and, therefore, it reflects the performance of the

properties in absolute terms regardless of the ratio of ownership

interests of the Company�s common shareholders and the minority

interest in the operating partnership. The Company believes FFO

allocable to common shareholders is a useful performance measure

because it is the performance measure that is most directly

comparable to net income (loss) available to common

shareholders.

In the reconciliation of net income (loss) available to common

shareholders to FFO allocable to common shareholders, the Company

makes an adjustment to add back minority interest in earnings of

its operating partnership in order to arrive at FFO of its

operating partnership. The Company then applies a percentage to FFO

of its operating partnership to arrive at FFO allocable to common

shareholders. The percentage is computed by taking the weighted

average number of common shares outstanding for the period and

dividing it by the sum of the weighted average number of common

shares and the weighted average number of operating partnership

units outstanding during the period.

FFO does not represent cash flows from operations as defined by

accounting principles generally accepted in the United States, is

not necessarily indicative of cash available to fund all cash flow

needs and should not be considered as an alternative to net income

(loss) for purposes of evaluating the Company�s operating

performance or to cash flow as a measure of liquidity.

Same-Center Net Operating Income

NOI is a supplemental measure of the operating performance of

the Company's shopping centers. The Company defines NOI as

operating revenues (rental revenues, tenant reimbursements and

other income) less property operating expenses (property operating,

real estate taxes and maintenance and repairs).

Similar to FFO, the Company computes NOI based on its pro rata

share of both consolidated and unconsolidated properties. The

Company's definition of NOI may be different than that used by

other companies and, accordingly, the Company's NOI may not be

comparable to that of other companies. A reconciliation of

same-center NOI to net income (loss) is located at the end of this

earnings release.

Since NOI includes only those revenues and expenses related to

the operations of its shopping center properties, the Company

believes that same-center NOI provides a measure that reflects

trends in occupancy rates, rental rates and operating costs and the

impact of those trends on the Company's results of operations.

Additionally, there are instances when tenants terminate their

leases prior to the scheduled expiration date and pay the Company

one-time, lump-sum termination fees. These one-time lease

termination fees may distort same-center NOI trends and may result

in same-center NOI that is not indicative of the ongoing operations

of the Company's shopping center properties. Therefore, the Company

believes that presenting same-center NOI, excluding lease

termination fees, is useful to investors.

Pro Rata Share of Debt

The Company presents debt based on its pro rata ownership share

(including the Company's pro rata share of unconsolidated

affiliates and excluding minority investors' share of consolidated

properties) because it believes this provides investors a clearer

understanding of the Company's total debt obligations which affect

the Company's liquidity. A reconciliation of the Company's pro rata

share of debt to the amount of debt on the Company's consolidated

balance sheet is located at the end of this earnings release.

Information included herein contains "forward-looking

statements" within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company's various filings with the Securities and Exchange

Commission, including without limitation the Company's Annual

Report on Form 10-K and the "Management's Discussion and Analysis

of Financial Condition and Results of Operations" incorporated by

reference therein, for a discussion of such risks and

uncertainties.

CBL & Associates Properties, Inc. Consolidated

Statements of Operations (Unaudited; in thousands, except per

share amounts) � � � � �

Three Months Ended

December

31,

Year Ended

December

31,

2008 2007

2008 2007 REVENUES:

Minimum rents

$ 188,300 $ 181,000

$

716,570 $ 645,753 Percentage rents

8,509 10,632

18,375 22,472 Other rents

9,372 11,179

22,887

23,121 Tenant reimbursements

85,183 83,056

336,173

318,755 Management, development and leasing fees

2,459 1,418

19,393 7,983 Other �

5,575 � �

6,353 � �

24,820 � �

21,860 � Total revenues �

299,398

� �

293,638 � �

1,138,218 � �

1,039,944 � �

EXPENSES: Property operating

49,274 45,646

190,148 169,489 Depreciation and

amortization

102,369 67,576

332,475 243,522 Real

estate taxes

23,658 22,518

95,393 87,552 Maintenance

and repairs

17,258 16,285

65,617 58,111 General and

administrative

11,973 8,780

45,241 37,852 Other �

14,643 � �

6,437 � �

33,333 � �

18,525 � Total expenses

�

219,175 � �

167,242 � �

762,207 � �

615,051 � Income from

operations

80,223 126,396

376,011 424,893 Interest

and other income

2,942 3,305

10,076 10,923 Interest

expense

(79,473 ) (80,154 )

(313,209 )

(287,884 ) Loss on extinguishment of debt

- -

- (227

) Impairment of marketable securities

(11,403 )

(18,456 )

(17,181 ) (18,456 ) Gain on sales of real

estate assets

279 5,005

12,401 15,570 Equity in

earnings of unconsolidated affiliates

1,523 734

2,831

3,502 Income tax provision

(738 ) (4,030 )

(13,495 ) (8,390 ) Minority interest in (earnings)

losses: Operating partnership

7,700 (10,360 )

(7,495

) (46,246 ) Shopping center properties �

(6,010 ) �

(5,797 ) �

(23,959

) �

(12,215 ) Income

(loss) from continuing operations

(4,957 ) 16,643

25,980 81,470 Operating income of discontinued operations

347 76

1,809 1,621 Gain on discontinued operations �

10 � �

2,154 � �

3,798 � �

6,056 � Net income

(loss)

(4,600 ) 18,873

31,587 89,147 Preferred

dividends �

(5,455 ) �

(5,455 ) �

(21,819

) �

(29,775 ) Net

income (loss) available to common shareholders

$ (10,055

) $ 13,418 �

$ 9,768 �

$

59,372 � Basic per share data: Income (loss) from

continuing operations, net of preferred dividends

$

(0.16 ) $ 0.17

$ 0.06 $ 0.79

Discontinued operations �

0.01 � �

0.03 � �

0.09 � �

0.12 � Net income (loss) available to common

shareholders

$ (0.15

) $ 0.20 �

$ 0.15 �

$

0.91 � � Weighted average common shares outstanding

66,085 65,590

66,005 65,323 � Diluted per share data:

Income (loss) from continuing operations, net of preferred

dividends

$ (0.16 ) $ 0.17

$

0.06 $ 0.78 Discontinued operations �

0.01 � �

0.03 � �

0.09 � �

0.12 � Net income (loss)

available to common shareholders

$

(0.15 ) $

0.20 �

$ 0.15

�

$ 0.90 � �

Weighted average common and

potential dilutive common shares outstanding

66,085 65,952

66,148 65,913 The Company's calculation

of FFO allocable to Company shareholders is as follows: (in

thousands, except per share data) �

Three Months

Ended

December

31,

�

Year Ended

December

31,

2008 �

2007

2008 �

2007 � Net income

(loss) available to common shareholders

$ (10,055

) $ 13,418

$ 9,768 $ 59,372 Minority interest

in earnings (losses) of operating partnership

(7,700

) 10,360

7,495 46,246 Depreciation and amortization

expense of: Consolidated properties

102,369 67,576

332,475 243,522 Unconsolidated affiliates

8,875 6,776

29,987 17,326 Discontinued operations

- 317

892 1,297 Non-real estate assets

(257 ) (229 )

(1,027 ) (919 )

Minority investors' share of

depreciation and amortization

(15 ) (322 )

(958 ) (132 ) Gain on

discontinued operations

(10 ) (2,154 )

(3,798

) (6,056 ) Income tax provision on disposal of discontinued

operations �

- � �

872 � �

1,439 � �

872 � Funds from

operations of the operating partnership

$

93,207 �

$ 96,614 �

$ 376,273 �

$

361,528 � � Funds from operations per diluted share

$ 0.80 �

$

0.83 �

$ 3.22

�

$ 3.10 �

Weighted average common and

potential dilutive common shares outstanding with operating

partnership units fully converted

116,806 116,585

116,781 116,584 �

Reconciliation of FFO of the

operating partnership to FFO allocable to Company

shareholders:

Funds from operations of the operating partnership

$

93,207 $ 96,614

$ 376,273 $ 361,528 Percentage

allocable to Company shareholders (1) �

56.62

% �

56.43 % �

56.59 % �

56.32 % Funds from operations allocable

to Company shareholders

$

52,774 �

$ 54,519 �

$ 212,933 �

$

203,613 � �

(1) Represents the weighted

average number of common shares outstanding for the period divided

by the sum of the weighted average number of common shares and the

weighted average number of operating partnership units outstanding

during the period. See the reconciliation of shares and operating

partnership units on page 9.

� �

SUPPLEMENTAL FFO INFORMATION: � Lease termination fees

$ 1,994 $ 612

$ 11,250 $ 6,407 Lease

termination fees per share

$ 0.02 $ 0.01

$

0.10 $ 0.05 � Straight-line rental income

$

2,056 $ 2,143

$ 6,137 $ 5,876 Straight-line

rental income per share

$ 0.02 $ 0.02

$

0.05 $ 0.05 � Gains on outparcel sales

$ 1,720

$ 5,600

$ 15,963 $ 16,651 Gains on outparcel sales

per share

$ 0.01 $ 0.05

$ 0.14 $ 0.14 �

Amortization of acquired above- and below-market leases

$

3,850 $ 2,299

$ 10,735 $ 10,579 Amortization

of acquired above- and below-market leases per share

$

0.03 $ 0.02

$ 0.09 $ 0.09 � Amortization of

debt premiums

$ 1,991 $ 1,935

$ 7,909 $

7,714 Amortization of debt premiums per share

$ 0.02

$ 0.02

$ 0.07 $ 0.07 � Income tax provision

$

(738 ) $ (3,158 )

$ (12,056 ) $

(7,518 ) Income tax provision per share

$ (0.01

) $ (0.03 )

$ (0.10 ) $ (0.06 ) �

Impairment of marketable securities

$ (11,403

) $ (18,456 )

$ (17,181 ) $ (18,456 )

Impairment of marketable securities per share

$ (0.10

) $ (0.16 )

$ (0.15 ) $ (0.16 ) �

Abandoned projects

$ (9,407 ) $

(1,261 ) $ (12,351 ) $

(2,216 ) Abandoned projects per share

$

(0.08 ) $ (0.01 ) $

(0.11 ) $ (0.02 ) (Dollars in

thousands) � � � �

Three Months Ended

December 31,

Year Ended

December 31,

2008 2007

2008 2007 � Net income

(loss)

$ (4,600 ) $ 18,873

$

31,587 $ 89,147 � Adjustments: Depreciation and amortization

102,369 67,576

332,475 243,522 Depreciation and

amortization from unconsolidated affiliates

8,875 6,776

29,987 17,326 Depreciation and amortization from

discontinued operations

- 317

892 1,297

Minority investors' share of

depreciation and amortization in shopping center properties

(15 ) (322 )

(958 ) (132 ) Interest

expense

79,473 80,154

313,209 287,884 Interest

expense from unconsolidated affiliates

7,653 7,904

28,525 20,480

Minority investors' share of

interest expense in shopping center properties

(135 ) (466 )

(1,492 ) (831 ) Loss on

extinguishment of debt

- -

- 227 Abandoned projects

expense

9,407 1,261

12,351 2,216 Gain on sales of

real estate assets

(279 ) (5,005 )

(12,401

) (15,570 ) Gain on sales of real estate assets of

unconsolidated affiliates

(832 ) (473 )

(3,548

) (1,706 ) Impairment of marketable securities

11,403

18,456

17,181 18,456

Minority investors' share of gain

on sales of shopping center real estate assets

- -

- 621 Income tax provision

738 4,030

13,495 8,390 Minority interest in earnings (losses) of

operating partnership

(7,700 ) 10,360

7,495

46,246 Gain on discontinued operations �

(10

) �

(2,154 ) �

(3,798 ) �

(6,056 ) Operating partnership's share of

total NOI

206,347 207,287

765,000 711,517 General and

administrative expenses

11,973 8,780

45,241 37,852

Management fees and non-property level revenues �

(8,025 ) �

(10,020 ) �

(36,607

) �

(35,756 )

Operating partnership's share of property NOI

210,295

206,047

773,634 713,613 NOI of non-comparable centers �

(25,317 ) �

(13,379 ) �

(89,121

) �

(18,934 ) Total

same-center NOI

$ 184,978 �

$ 192,668 �

$

684,513 �

$ 694,679 �

� Malls

$ 171,871 $ 178,979

$ 630,616 $

639,439 Associated centers

7,445 8,068

31,340 32,592

Community centers

1,815 1,903

7,682 6,922 Other �

3,847 � �

3,718 � �

14,875 � �

15,726 � Total

same-center NOI

184,978 192,668

684,513 694,679 Less

lease termination fees �

(601

) �

(600 ) �

(8,425 ) �

(6,397 ) Total same-center NOI, excluding

lease termination fees

$

184,377 �

$ 192,068 �

$ 676,088 �

$

688,282 � �

Percentage Change: Malls

-4.0 % -1.4 % Associated centers

-7.7 % -3.8 % Community centers

-4.6 % 11.0 % Other �

3.5

% �

-5.4 % Total same-center NOI �

-4.0 % �

-1.5 % Total same-center

NOI, excluding lease termination fees �

-4.0 % �

-1.8 % Company's Share of Consolidated and

Unconsolidated Debt (Dollars in thousands) � �

December 31,

2008 Fixed Rate �

Variable Rate �

Total

Consolidated debt

$ 4,608,347 $

1,487,329 $ 6,095,676 Minority investors'

share of consolidated debt

(23,648 ) (928

) (24,576 ) Company's share of unconsolidated

affiliates' debt �

418,761 � �

143,468 � �

562,229 � Company's share of consolidated and unconsolidated

debt

$ 5,003,460 �

$ 1,629,869 �

$ 6,633,329 � Weighted average interest rate �

5.96 % �

2.02 % �

4.99 %

�

December 31, 2007 Fixed Rate Variable Rate

Total Consolidated debt $ 4,543,515 $ 1,325,803 $ 5,869,318

Minority investors' share of consolidated debt (24,236 ) (2,517 )

(26,753 ) Company's share of unconsolidated affiliates' debt �

335,903 � � 49,475 � � 385,378 � Company's share of consolidated

and unconsolidated debt $ 4,855,182 � $ 1,372,761 � $ 6,227,943 �

Weighted average interest rate � 5.79 % � 6.14 % � 5.87 % � �

Debt-To-Total-Market Capitalization Ratio as of December 31,

2008 (In thousands, except stock price)

Shares

Outstanding Stock Price (1)

Value Common stock and operating partnership

units 117,010 $ 6.50 $ 760,565 7.75% Series C Cumulative Redeemable

Preferred Stock 460 250.00 115,000 7.375% Series D Cumulative

Redeemable Preferred Stock 700 250.00 � 175,000 � Total market

equity 1,050,565 Company's share of total debt � 6,633,329 � Total

market capitalization $ 7,683,894 � Debt-to-total-market

capitalization ratio � 86.3 % � (1) Stock price for common stock

and operating partnership units equals the closing price of the

common stock on December 31, 2008. The stock price for the

preferred stock represents the liquidation preference of each

respective series of preferred stock. � � �

Reconciliation of

Shares and Operating Partnership Units Outstanding (In

thousands)

Three Months Ended Year Ended December

31, December 31, 2008: Basic

Diluted Basic Diluted Weighted average shares

- EPS

66,085 66,085 66,005 66,148

Weighted average dilutive shares for FFO (1)

- 93

- - Weighted average operating partnership units �

50,628 � �

50,628 � �

50,633 � �

50,633

� Weighted average shares- FFO �

116,713 � �

116,806

� �

116,638 � �

116,781 � �

2007: Weighted

average shares - EPS 65,590 65,952 65,323 65,913 Weighted average

operating partnership units � 50,637 � � 50,633 � � 50,671 � �

50,671 � Weighted average shares- FFO � 116,227 � � 116,585 � �

115,994 � � 116,584 � � �

Dividend Payout Ratio Three

Months Ended Year Ended December 31, December

31, 2008 2007 2008 2007 Weighted

average dividend per share

$ 0.37255 $ 0.55047

$ 2.02396 $ 2.08260 FFO per diluted, fully converted

share

$ 0.80 � $ 0.83 �

$ 3.22 � $ 3.10

� Dividend payout ratio �

46.7 % � 66.3 % �

62.8 % � 67.2 % � � �

(1) Because the Company incurred a

net loss during the three months ended December 31, 2008, there are

no potentially dilutive shares recognized in the number of diluted

weighted average shares for EPS purposes for that period due to

their anti-dilutive nature. However, because FFO was positive

during the fourth quarter of 2008, the dilutive shares are

recognized in the number of diluted weighted average shares for

purposes of calculating FFO per share.

Consolidated Balance Sheets � � (Unaudited, in thousands

except share data)

December 31,

2008

December 31,

2007

ASSETS Real estate assets: Land

$ 902,504 $

917,578 Buildings and improvements �

7,503,334

� �

7,263,907 �

8,405,838 8,181,485 Accumulated

depreciation �

(1,310,173 )

�

(1,102,767 ) 7,095,665 7,078,718

Developments in progress �

225,815 � �

323,560 � Net investment in real estate assets

7,321,480 7,402,278 Cash and cash equivalents

51,227

65,826 Cash in escrow

2,700 - Receivables: Tenant, net of

allowance

74,402 72,570 Other

12,145 10,257 Mortgage

and other notes receivable

58,961 135,137 Investments in

unconsolidated affiliates

207,618 142,550 Intangible lease

assets and other assets �

305,802 � �

276,429 �

$

8,034,335 �

$

8,105,047 �

LIABILITIES AND SHAREHOLDERS'

EQUITY Mortgage and other notes payable

$

6,095,676 $ 5,869,318 Accounts payable and accrued

liabilities �

329,991 � �

394,884

� Total liabilities �

6,425,667 � �

6,264,202 � Commitments and contingencies Minority

interests �

815,010 � �

920,297 �

Shareholders' equity: Preferred Stock, $.01 par value, 15,000,000

shares authorized:

7.75% Series C Cumulative

Redeemable Preferred Stock, 460,000 shares outstanding

5 5

7.375% Series D Cumulative

Redeemable Preferred Stock, 700,000 shares outstanding

7 7

Common Stock, $.01 par value,

180,000,000 shares authorized, 66,394,844 and 66,179,747 issued and

outstanding in 2008 and 2007, respectively

664 662 Additional paid-in capital

1,008,883 990,048

Accumulated other comprehensive loss

(22,594 ) (20 )

Accumulated deficit �

(193,307

) �

(70,154 ) Total

shareholders' equity �

793,658 � �

920,548 �

$

8,034,335 �

$

8,105,047 �

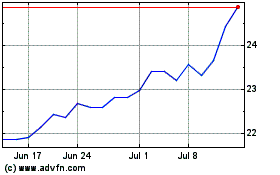

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jun 2024 to Jul 2024

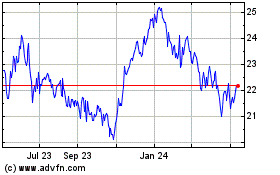

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jul 2023 to Jul 2024