Carlisle Companies Incorporated (NYSE:CSL) reported net sales

from continuing operations of $555.2 million for the quarter ended

December 31, 2009, a 15% decline from $651.2 million in the fourth

quarter of 2008. Sales were down across all segments, with organic

sales decreasing by 17% from the fourth quarter of the prior year.

The Interconnect Technologies segment’s acquisitions of Jerrik and

Electronic Cable Specialists and the Engineered Transportation

Solutions segment’s acquisition of Japan Power Brake contributed

$14.6 million of sales in the fourth quarter. The impact of foreign

currency exchange rates on net sales was an increase of less than

1% in the fourth quarter of 2009.

Income from continuing operations increased 131% to $35.6

million, or $0.57 per diluted share, in the fourth quarter 2009

compared with $15.4 million, or $0.25 per diluted share, in the

fourth quarter 2008. 2009 income was positively impacted by

favorable raw material pricing, lower interest expense as well as

efficiencies gained through the Carlisle Operating System. Fourth

quarter 2009 net income also includes the release of a $19.6

million deferred tax accrual, previously provided with respect to

un-repatriated earnings. The Company has now identified appropriate

long-term uses for these earnings outside the United States. 2009

fourth quarter net income was negatively impacted by lower sales

volume, lower pricing and restructuring expenses related to plant

consolidations.

Comment

David A. Roberts, Chairman, President and CEO, said, “We

expected 2009 to be challenging but were committed to improving our

margins. Despite a sales decline of 23% for the full-year, we were

able to improve our EBIT (Earnings Before Interest and Income

Taxes) margin to 8.7% in 2009. Our management teams did an

excellent job managing through difficult market conditions by

cutting costs to match revenue levels, while continuing to invest

in their businesses for the long-term. We were especially pleased

with margins in our Construction Materials and FoodService Products

segments. The Construction Materials segment increased their EBIT

margin to 13.8%, as compared to 10.3% for the same period last

year, despite a 24% decline in sales. Our FoodService Products

segment increased their EBIT margin to 10.1%, as compared to 7.8%

for the same period last year, despite an 8% decline in sales.

“In addition to the margin improvements, we continued our strong

cash flow performance generating $447 million of cash flow from

operations during the year. We used a portion of our cash flow to

fund the Jerrik, Electronic Cable Specialists and Japan Power Brake

acquisitions and to contribute $53 million to our pension fund.

Additionally, our strong cash flow allowed us to reduce our

outstanding debt by $235 million during 2009, which contributed to

the $19 million reduction in 2009 interest expense.”

Roberts continued, “Yesterday, we completed the sale of Johnson

Truck Bodies, our refrigerated truck body business with 2009 annual

sales of $51.5 million. Although profitable, Johnson Truck Bodies

was not one of our growth platforms. We anticipate recognizing a

small gain in the first quarter of 2010 as a result of this

disposition. Also, at year-end we completed the sale of EcoStar,

our residential roofing tile business with 2009 sales of $17

million, to more fully focus on the product lines in our

Construction Materials segment that serve non-residential

markets.”

Roberts also said, “As recently announced, we decided to retain

and fully integrate our power transmission belt business with our

tire and wheel business. We also combined our industrial brake and

friction business with our tire and wheel, and belt businesses to

form one fully integrated strategic operating unit, Carlisle

Engineered Transportation Solutions, strengthening our position

with major global agriculture and construction equipment

manufacturers and creating opportunities to leverage synergies and

best practices.

“Consistent with our lean focus and company-wide implementation

of the Carlisle Operating System, we simplified our management

structure by eliminating the Group President layer of management.

As a result of this change and the integration of our tire and

wheel, industrial brake and friction, and power transmission belt

businesses, we realigned our segments during the fourth quarter as

follows:

- Carlisle Construction

Materials

- Carlisle Engineered

Transportation Solutions, which includes the tire and wheel,

industrial brake and friction, and power transmission belt product

lines

- Carlisle Interconnect

Technologies

- Carlisle FoodService

Products

- Carlisle Specialty

Products, which includes Trail King and Johnson Truck Bodies

(Johnson Truck Bodies is included in the Specialty Products segment

for 2009 reporting purposes; however, in 2010, Johnson Truck Bodies

will be reported in Discontinued Operations through the date of

disposition.)

Our 2009 segment results and disclosures have been adjusted to

reflect the new segment structure.”

Roberts concluded by stating, “For the full-year 2010, we are

planning for modest revenue growth and continued improvement in our

EBIT margins. During 2009, we made significant progress with our

implementation of the Carlisle Operating System with every

organization embracing the lean processes that are the foundation

of the system’s philosophy. Our employees not only enthusiastically

welcomed the idea of making our manufacturing operations more

productive, but went to work streamlining our back office, new

product development and other non-manufacturing activities. The

Carlisle Operating System will be a key driver in enabling us to

achieve our long-term goals.”

Segment Results

Construction Materials: Fourth quarter 2009 net sales

declined 12% to $263.7 million from $300.5 million, and EBIT

increased 82% to $38.7 from $21.3 million for the same period in

2008. The decrease in sales was across all major product lines and

is consistent with declines in the overall non-residential

construction industry. Despite the lower sales volume, the EBIT

margin more than doubled from 7.1% in the fourth quarter 2008 to

14.7% in the fourth quarter of the current year. The improvement in

margin was due to the combination of favorable raw material costs

and efficiency gains from the Carlisle Operating System. These

improvements more than offset the impact from the sales volume

decrease and selling price decreases that occurred in the fourth

quarter of 2009 as compared to the same period in 2008. Fourth

quarter 2008 operating results included a $5.9 million

restructuring charge related to the Insulfoam business.

Engineered Transportation Solutions: Fourth quarter 2009

net sales declined 18% to $148.0 million from $179.8 million, and

an EBIT loss of $8.6 million compared to an EBIT loss of $2.2

million for the same period in 2008. Sales were down in all markets

in this segment with the most significant declines in the

agriculture and construction markets. EBIT was negatively impacted

by lower sales volume, and restructuring and impairment charges of

$12.8 million, including $6.7 million attributable to the

integration of the power transmission belt business with the tire

and wheel, and industrial brake and friction businesses. Lower raw

materials pricing and savings realized from the Carlisle Operating

System had a favorable impact on EBIT in the fourth quarter of

2009.

Interconnect Technologies: Fourth quarter 2009 net sales

increased 6.3% to $54.4 million from $51.2 million, and EBIT

declined to $2.6 million from $7.5 million for the same period in

2008. The positive sales impact from the acquisitions of Jerrik and

Electronic Cable Specialists was partially offset by a 14% decline

in organic sales in the quarter. The decline in EBIT was due to a

combination of the organic sales decline and a $3.1 million

restructuring charge related to plant consolidations announced in

the fourth quarter of 2009.

FoodService Products: Fourth quarter 2009 net sales

declined 6.4% to $58.2 million from $62.2 million, and EBIT

increased to $6.3 million from $2.8 million for the same period in

2008. Sales declined across all product lines; however, the decline

was at a more moderate rate than previous quarters. Despite the

decline in sales, the EBIT margin more than doubled from 4.5% in

the fourth quarter 2008 to 10.8% in the current quarter. The

improvement in margin was primarily due to the combination of

favorable raw material costs and efficiency gains from the Carlisle

Operating System. In addition, fourth quarter 2008 operating

results included a $2.2 million restructuring charge related to

plant consolidations.

Specialty Products: Fourth quarter 2009 net sales

declined 46% to $30.9 million from $57.5 million, and EBIT was a

loss of $0.7 million as compared to a positive EBIT of $7.9 million

for the same period in 2008. The decrease in fourth quarter 2009

sales and EBIT was primarily attributable to weak sales in the

specialty trailer market.

Corporate

Expense

Corporate expense of $11.4 million for the fourth quarter of

2009 compared with $9.4 million for the fourth quarter 2008. The

increase was due to higher management restructuring costs and

medical expenses incurred in the fourth quarter 2009 as compared to

the same period of the prior year.

Interest Expense,

Net

Net interest expense of $1.9 million for the fourth quarter 2009

compared with $12.3 million for the fourth quarter 2008. Interest

expense in the fourth quarter 2008 included a $7.3 million pre-tax

charge for the termination of a treasury lock. Also contributing to

the year-over-year decrease in interest expense was the reduction

of outstanding debt during 2009.

Income Tax

Expense

Income tax benefit from continuing operations was $10.6 million

for the fourth quarter 2009, compared to income tax expense of $0.2

million for the same period in 2008. The tax benefit resulted from

the release in the fourth quarter 2009 of a $19.6 million deferred

tax accrual.

Net Income

Net income for the fourth quarter 2009 was $35.9 million, or

$0.58 per diluted share, compared to net income of $13.7 million,

or $0.22 per diluted share for the fourth quarter 2008. Net income

was positively impacted by a favorable tax adjustment, favorable

raw material prices and lower interest expense as well as

efficiency gains from the Carlisle Operating System during the

fourth quarter of 2009. These positive impacts to income were

partially offset by lower sales volume, plant restructuring charges

and lower selling prices.

Year-to-Date

Net sales of $2,379.5 million for the year ended December 31,

2009 decreased 23% as compared with $3,110.1 million for the same

period in 2008. Sales decreased across all segments.

Full-year 2009 EBIT of $206.9 million increased 11% from $186.6

million in the prior year. 2009 EBIT was positively impacted by

selling price increases, favorable raw material pricing,

efficiencies gained through the Carlisle Operating System and a

$27.0 million gain from a fire insurance settlement. These positive

impacts were offset by lower sales volume and restructuring

expenses. 2008 results included an impairment charge on goodwill

and certain other assets of Carlisle Power Transmission of $68.6

million.

Net income for the year ended December 31, 2009 was $144.6

million, or $2.34 per diluted share. Net income for the year ended

December 31, 2008 was $55.8 million, or $0.91 per diluted share,

and included after-tax impairment charges of $45.3 million, or

$0.74 per diluted share, related to the on-highway brake business,

which is reported in discontinued operations, and $44.2 million, or

$0.73 per diluted share from the previously noted impairment charge

on the assets of Carlisle Power Transmission. 2009 net income

included the reversal of a $19.6 million deferred tax accrual.

Cash Flow

Cash flow provided from operations of $447.2 million for the

year ended December 31, 2009 is a 63% increase over 2008 and is the

third consecutive year for establishing a new record for the

Company. During 2009, outstanding debt was reduced by $235.4

million. Cash generated from working capital and other assets and

liabilities of $195.1 million for 2009 compared with cash generated

of $25.6 million in 2008. 2009 cash flow provided from operations

includes $54.5 million of proceeds relating to the insurance

settlement from the fire at the tire and wheel facility in Bowdon,

Georgia. Cash used in investing activities of $119.5 million in

2009 includes $80.8 million primarily for the acquisitions of

Jerrik and Electronic Cable Specialists in the Interconnect

Technologies segment. Cash used in investing activities was $354.2

million in 2008 and included cash used for acquisitions of $290.7

million for the purchase of Dinex in the FoodService Products

segment and Carlyle in the Interconnect Technologies segment.

Capital expenditures of $48.2 million in 2009 compared with $68.0

million in 2008.

Conference Call and

Webcast

The Company will discuss fourth quarter 2009 results on a

conference call at 10:00 a.m. ET today. The call may be accessed

live by going to the Investor Relations section of the Carlisle

website (http://www.carlisle.com/investors/conference_call.html),

or the taped call may be listened to shortly following the live

call at the same website location.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements are based on management's current

expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to changes in global economic, business,

competitive, market and regulatory factors. More detailed

information about these factors is contained in the Company's

filings with the Securities and Exchange Commission. The Company

undertakes no duty to update forward-looking statements.

About Carlisle

Companies

Carlisle is a diversified global manufacturing company

serving the construction materials, commercial roofing, specialty

tire and wheel, power transmission, heavy-duty brake and friction,

heavy-haul truck trailer, foodservice, aerospace, and test and

measurement industries.

CARLISLE COMPANIES INCORPORATED Consolidated

Statement of Earnings For the periods ended December 31

(In millions, except share and per share amounts)

(Unaudited) Fourth Quarter Twelve

Months 2009 2008 % Change

2009 2008 %

Change Net sales

$ 555.2 $ 651.2 -15 %

$

2,379.5

$ 3,110.1 -23 % Cost and expenses: Cost of goods sold

440.0

539.5 -18 %

1,875.6 2,516.8 -25 % Selling and administrative

expenses

75.1 73.3 2 %

289.0 316.3 -9 % Research and

development expenses

4.2 3.8 11 %

16.6 16.2 2 % Gain

related to fire settlement

- - NM

(27.0 ) - NM

Goodwill impairment

- - NM

- 55.5 NM Other expense,

net

9.0 6.7 34 %

18.4 18.7 -2 % Earnings before

interest and income taxes

26.9 27.9 -4 %

206.9 186.6

11 % Interest expense, net

1.9 12.3

-85 %

9.0 27.7 -68 %

Earnings before income taxes

25.0 15.6 60 %

197.9 158.9 25 % Income tax (benefit) expense

(10.6 ) 0.2 NM

46.1

45.3 2 % Income from continuing

operations

35.6 15.4 131 %

151.8 113.6 34 % Income

(loss) from discontinued operations

0.3

(1.7 ) NM

(7.2 ) (57.8 ) NM Net

income

$ 35.9 $ 13.7 162 %

$

144.6 $ 55.8 159 %

Basic earnings (loss) per share

(1)

Continuing operations

$ 0.58 $ 0.25 132 %

$

2.48 $ 1.86 33 % Discontinued operations

0.01

(0.03 ) NM

(0.12 ) (0.95

) NM Basic earnings per share

$ 0.59 $ 0.22

168 %

$ 2.36 $ 0.91 159 %

Diluted earnings (loss) per share

(1)

Continuing operations

$ 0.57 $ 0.25 128 %

$

2.45 $ 1.85 32 % Discontinued operations

0.01

(0.03 ) NM

(0.11 ) (0.94

) NM Diluted earnings per share

$ 0.58 $ 0.22

164 %

$ 2.34 $ 0.91 157 %

Average shares outstanding - in thousands Basic

60,640 60,532

60,601

60,541 Diluted

61,340

60,877

61,234 60,848

Dividends

$ 9.8 $ 9.4 4 %

$ 38.6 $ 36.6 5 % Dividends per share

$ 0.160 $ 0.155 3 %

$

0.630 $ 0.600 5 %

(1) Numerator for basic and

diluted EPS calculated based on "two class" method of computing

earnings per share:

Income from continuing operations

$ 35.2

$ 15.3

$ 150.1 $ 112.7

Net income

$ 35.5 $ 13.6

$

143.0 $ 55.3 NM = Not Meaningful

* 2008 figures have been restated to reflect the reclassification

of Carlisle Power Transmission from discontinued operations to

continuing operations.

CARLISLE COMPANIES

INCORPORATED Segment Financial Data For the periods

ended December 31 (In millions)

(Unaudited)

Fourth Quarter Twelve Months

2009

2008

% Change

2009

2008

% Change

Net Sales Construction

Materials

$ 263.7 $ 300.5 -12 %

$

1,125.9 $ 1,472.3 -24 % Engineered Transportation Solutions

148.0 179.8 -18 %

708.1 928.2 -24 % Interconnect

Technologies

54.4 51.2 6 %

180.5 197.9 -9 %

FoodService Products

58.2 62.2 -6 %

243.6 266.2 -8 %

Specialty Products

30.9 57.5 -46

%

121.4 245.5 -51 % Total Net

Sales

$ 555.2 $ 651.2 -15 %

$

2,379.5 $ 3,110.1 -23 %

Earnings Before Interest and Income Taxes (EBIT)

Construction Materials

$ 38.7 $ 21.3 82 %

$

155.2 $ 151.1 3 % Engineered Transportation Solutions

(8.6 ) (2.2 ) -291 %

54.2 (12.9 ) 520 %

Interconnect Technologies

2.6 7.5 -65 %

14.3 25.2 -43

% FoodService Products

6.3 2.8 125 %

24.7 20.7 19 %

Specialty Products

(0.7 ) 7.9

-109 %

(5.0 ) 33.5 -115 %

Segment EBIT

38.3 37.3 3 %

243.4 217.6 12 % Corporate

(11.4 ) (9.4 ) -21 %

(36.5 ) (31.0 ) -18 % Total EBIT

$

26.9 $ 27.9 -4 %

$ 206.9

$ 186.6 11 %

EBIT Margins

Construction Materials

14.7 % 7.1 %

13.8

% 10.3 % Engineered Transportation Solutions

-5.8

% -1.2 %

7.7 % -1.4 % Interconnect

Technologies

4.8 % 14.6 %

7.9 % 12.7 %

FoodService Products

10.8 % 4.5 %

10.1

% 7.8 % Specialty Products

-2.3 %

13.7 %

-4.1 % 13.6 % Segment

EBIT Margin

6.9 % 5.7 %

10.2 % 7.0 %

Corporate

-2.1 % -1.4 %

-1.5 % -1.0 % Total EBIT Margin

4.8 % 4.3 %

8.7 %

6.0 %

CARLISLE COMPANIES INCORPORATED Comparative

Condensed Consolidated Balance Sheet (In millions)

December 31, December 31,

2009 2008

Assets (Unaudited) Current Assets Cash and

cash equivalents

$ 96.3 $ 42.7 Receivables

292.5 331.2 Inventories

345.8 468.5 Prepaid expenses

and other

65.2 94.9 Current assets held for sale

- 30.8

Total current assets

799.8 968.1 Property, plant and equipment, net

482.6 513.3 Other assets

629.8 589.2 Non-current

assets held for sale

1.9 5.3

Total

Assets $ 1,914.1 $ 2,075.9

Liabilities

and Shareholders' Equity Current Liabilities Short-term

debt, including current maturities

$ - $ 127.0

Accounts payable

135.7 128.7 Accrued expenses

165.4

166.3 Current liabilities associated with assets held for sale

- 20.5

Total current liabilities

301.1 442.5 Long-term debt

156.1 273.3 Other

liabilities

238.3 266.0 Shareholders' equity

1,218.6 1,094.1

Total Liabilities and

Shareholders' Equity $ 1,914.1 $ 2,075.9 *

2008 figures have been restated to reflect the reclassification of

Power Transmission as "held and used" from "held for sale."

CARLISLE COMPANIES INCORPORATED Comparative Condensed

Consolidated Statement of Cash Flows For the Twelve Months

Ended December 31 (In millions) (Unaudited)

2009 2008

Operating activities Net income

$ 144.6 $ 55.8 Reconciliation of net income to

operating cash flows: Depreciation and amortization

67.5

69.0 Non-cash compensation

13.9 12.0 Loss on writedown of

assets

20.9 131.8 Deferred taxes

8.3 (22.4 ) Change

in working capital and other assets and liabilities

195.1

25.6 Other

(3.1 ) 2.4

Net

cash provided by operating activities 447.2

274.2

Investing activities Capital

expenditures

(48.2 ) (68.0 ) Acquisitions, net of

cash acquired

(80.8 ) (290.7 ) Proceeds from

investments and disposal of property and equipment

9.2 4.1

Other

0.3 0.4

Net cash used

in investing activities (119.5 )

(354.2 )

Financing activities Net change in short-term debt

and revolving credit lines

(235.4 ) 178.4 Reductions

of long-term debt

- (100.0 ) Dividends paid

(38.6

) (36.6 ) Excess tax benefits on share-based compensation

0.1 0.1 Treasury shares and stock options, net

1.0

(1.9 ) Treasury share repurchases

(1.3 )

(4.8 )

Net cash (used in) provided by financing

activities (274.2 ) 35.2

Effect of exchange rate changes on cash 0.1

(0.9 )

Change in cash and cash equivalents

53.6 (45.7 )

Cash and cash equivalents Beginning of

period

42.7 88.4 End of period

$ 96.3 $ 42.7

CARLISLE

COMPANIES INCORPORATED Schedule of Significant Items

Fourth Quarter 2009 Significant

Items

Engineered Construction Transportation

Interconnect FoodService Specialty (pre-tax

amounts, in millions)

Materials Solutions

Technologies Products Products

Corporate Total Asset impairment charges $ - $

(8.5 ) $ (1.8 ) $ - $ - $ - $ (10.3 ) Restructuring charges

- (4.3 ) (1.3 ) - (0.5 )

(0.9 ) (7.0 )

Total -

(12.8 ) (3.1 ) - (0.5 )

(0.9 ) (17.3 )

Fourth Quarter 2008 Significant

Items

Engineered Construction Transportation

Interconnect FoodService Specialty (pre-tax

amounts, in millions)

Materials Solutions

Technologies Products Products

Corporate Total Asset impairment charges $

(4.3 ) $ - $ - $ (1.5 ) $ - $ - $ (5.8 ) Restructuring charges (1.6

) (0.8 ) - (0.7 ) - - (3.1 ) Treasury-lock termination -

- - - -

(7.3 ) (7.3 )

Total (5.9

) (0.8 ) - (2.2 ) -

(7.3 ) (16.2 )

Year-to-Date 2009 Significant

Items

Engineered Construction Transportation

Interconnect FoodService Specialty (pre-tax

amounts, in millions)

Materials Solutions

Technologies Products Products

Corporate Total Asset impairment charges $

(1.6 ) $ (14.4 ) $ (2.1 ) $ - $ (3.8 ) $ - $ (21.9 ) Restructuring

charges - (10.3 ) (1.6 ) - (1.2 ) (3.2 ) (16.3 ) Gain related to

fire settlement - 27.0 -

- - - 27.0

Total $ (1.6 ) $ 2.3 $ (3.7 ) $ - $

(5.0 ) $ (3.2 ) $ (11.2 )

Year-to-Date 2008 Significant

Items

Engineered Construction Transportation

Interconnect FoodService Specialty (pre-tax

amounts, in millions)

Materials Solutions

Technologies Products Products

Corporate Total Goodwill impairment charges $

- $ (55.5 ) - $ - $ - $ - $ (55.5 ) Asset impairment charges (4.3 )

(13.1 ) - (1.5 ) - - (18.9 ) Restructuring charges (1.6 ) (0.8 ) -

(0.7 ) - - (3.1 ) Treasury-lock termination -

- - - -

(7.7 ) (7.7 )

Total $ (5.9 ) $ (69.4 ) $ -

$ (2.2 ) $ - $ (7.7 ) $ (85.2 )

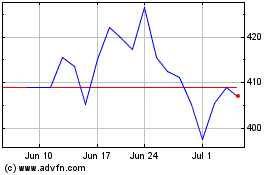

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From May 2024 to Jun 2024

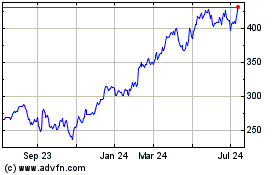

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Jun 2023 to Jun 2024