Carlisle Companies Incorporated (NYSE:CSL) reported net sales

from continuing operations of $604.6 million for the quarter ended

September 30, 2009, a 27% decline from $832.5 million in the third

quarter of 2008. Sales were down across all segments, with organic

sales decreasing by 26% from the third quarter of the prior year.

The impact of foreign currency exchange rates on net sales was a

reduction of less than 1% in the third quarter of 2009.

Net income from continuing operations declined 11% to $45.0

million, or $0.73 per diluted share, in the third quarter 2009

compared with $50.6 million, or $0.83 per diluted share, in the

third quarter of 2008. 2009 net income was negatively impacted by

lower sales volume as well as restructuring expenses related to

previously announced plant consolidations. 2009 net income was

positively impacted by favorable raw material pricing, lower

operating expenses and efficiencies gained through the Carlisle

Operating System.

Comment

David A. Roberts, Chairman, President and CEO, said, “We

continue to improve our operating margins despite our challenging

end-markets. Although sales declined 27% in the third quarter, our

operating margins improved to 11.7% from 9.8% for the third quarter

2008. We were especially pleased with margins at our Construction

Materials and Applied Technologies segments. Within the

Construction Materials segment, operating margins increased to

17.7%, as compared to 13.6% for the same period last year, despite

a 24% decline in sales. Our Applied Technologies segment increased

their operating margin to 12.5%, as compared to 9.7% for the same

period last year, despite a 19% decline in sales.

“In addition to the margin improvements, we continued our strong

cash flow performance in the quarter generating $94.4 million of

cash from operations. We used our cash flow to fund the $33 million

acquisition of Jerrik, contribute $25 million to our pension fund,

and pay down the remaining $25 million portion of our short-term

debt.”

Roberts continued, “We are encouraged by the current acquisition

environment where we have found strategic opportunities as

evidenced by our recently announced acquisitions of Jerrik and

Electronic Cable Specialists, both in the Applied Technologies

segment. These types of bolt-on acquisitions, which expand our

product and engineering capabilities as well as introduce us to new

global and domestic markets, will continue to be the focus of our

acquisition efforts.

“For the full-year 2009, we continue to plan for an approximate

25% revenue decline as compared to 2008. Our goal is to exceed the

8.2% operating margin reported last year. Our plant restructuring

remains on track with expenses estimated at $22 million in 2009,

with savings of approximately $12 million in the current year.”

Roberts concluded by stating, “As we operate in these

challenging markets, we will continue to implement the Carlisle

Operating System, focusing on improving operating margins and

generating strong cash flow. Our balance sheet and available credit

lines position us to take advantage of additional acquisitions and

further invest in our businesses.”

Segment Results

Construction Materials: Third quarter 2009 net sales

declined 24% to $340.1 million from $448.1 million, and operating

income was $60.3 million compared to $60.8 million for the same

period in 2008. The decrease in sales was across all product lines

and is consistent with declines in the overall construction

industry. Despite the lower sales volume, operating margins

increased from 13.6% in the third quarter 2008 to 17.7% in the

third quarter of the current year. The improvement in margins was

due to the combination of favorable raw material costs, reduction

in selling and administration expenses and efficiency gains from

the Carlisle Operating System as well as continued improvements in

the operating performance at Insulfoam and the waterproofing

business.

Transportation Products: Third quarter 2009 net sales

declined 37% to $129.2 million from $205.2 million, and operating

income declined by 54% to $4.0 million from $8.7 million for the

same period in 2008. Sales were down in all markets in the

Transportation Products segment, with sales of trailers decreasing

64% from the prior year. Operating income was negatively impacted

by the combination of the lower sales volume as well as $4.1

million of restructuring costs from previously announced plant

consolidations. Operating income was positively impacted by cost

reductions and lower raw material pricing.

Applied Technologies: Third quarter 2009 net sales

declined 19% to $105.8 million from $131.2 million, and operating

income increased 3.9% to $13.2 million from $12.7 million for the

same period in 2008. The largest sales declines were in the

aerospace, test and measurement and core foodservice markets.

Despite the decline in sales, operating margins improved from 9.7%

in the third quarter 2008 to 12.5% in the current quarter. The

improvement in operating margins was primarily due to cost

reduction efforts implemented in late 2008 and early 2009 as well

as higher selling prices and efficiencies gained through the

Carlisle Operating System.

Specialty Products: Third quarter 2009 net sales declined

39% to $29.5 million from $48.0 million, and operating income

declined to $0.9 million from $8.2 million for the same period in

2008. The decrease in third quarter sales and operating income was

primarily attributable to weak sales in the agriculture and

construction markets in the off-highway brake business as well as

lower sales in the refrigerated truck body business.

Corporate

Expense

Corporate expense of $7.7 million for the third quarter of 2009

compared with $8.6 million for the third quarter 2008. The decrease

was primarily due to a reduction in overall operating costs for the

quarter.

Interest Expense,

Net

Net interest expense of $2.0 million for the third quarter 2009

compared with $6.1 million for the third quarter 2008. The decrease

was due to the reduction in outstanding debt during 2009.

Discontinued

Operations

Income from discontinued operations of $1.6 million for the

third quarter 2009 compared with a loss of $0.2 million for the

third quarter 2008. In April 2008, Carlisle announced plans to

dispose of Power Transmission and Motion Control. During the first

quarter of 2009, the Company made the decision to exit, rather than

sell, the on-highway friction and brake shoe business and dispose

of the assets as part of a planned dissolution. The disposition of

the friction and brake shoe assets has been substantially completed

with the sale of certain real estate remaining. The Power

Transmission business remains in discontinued operations and

continues to operate profitably and generate positive cash

flows.

Net Income

Net income for the third quarter 2009 was $46.6 million, or

$0.75 per diluted share, compared to net income of $50.4 million,

or $0.82 per diluted share, for the third quarter 2008. The

negative impact on net income from lower sales volume was partially

offset by favorable raw material prices and lower operating

expenses as well as efficiency gains from the Carlisle Operating

System during the third quarter of 2009.

Year-to-Date

Net sales of $1.73 billion for the nine months ended September

30, 2009 decreased 26% as compared with $2.35 billion for the same

period in 2008. Sales decreased across all segments. September 30,

2009 year-to-date income from continuing operations of $110.7

million, or $1.79 per diluted share, compared with income from

continuing operations of $135.7 million, or $2.21 per diluted

share, for the same period in 2008. 2009 operating income was

positively impacted by a $27.0 million gain from a fire insurance

recovery, selling price increases, favorable raw material pricing,

efficiencies gained through the Carlisle Operating System and

additional income contributed from the Carlyle acquisition. These

positive impacts were more than offset by lower sales volume as

well as restructuring expenses.

Net income for the nine months ended September 30, 2009 was

$108.7 million, or $1.76 per diluted share. Net income for the nine

months ended September 30, 2008 was $42.1 million, or $0.69 per

diluted share, and included after-tax impairment charges of $89.5

million, or $1.47 per diluted share, related to the power

transmission belt business and on-highway brake business. Both

businesses are reported in discontinued operations.

Cash flow provided by operations of $363.4 million for the nine

months ended September 30, 2009 compared with cash flow provided by

operations of $142.1 million for the same period in 2008. During

the first nine months of the year, debt was reduced by $234.6

million. Cash generated from working capital and other assets and

liabilities of $184.0 million for 2009 compared with cash used of

$54.8 million in 2008. 2009 cash flow provided by operations

includes $54.5 million of proceeds relating to the insurance

recovery from the fire at the Bowdon, Georgia facility. Cash used

in investing activities of $61.0 million in 2009 includes $33.0

million for the acquisition of Jerrik for the interconnect

technologies business. Cash used in investing activities was $346.0

million in 2008 and included cash used for acquisitions of $294.8

million for the purchases of Dinex for the foodservice business and

Carlyle for the interconnect technologies business. Capital

expenditures of $34.9 million in 2009 compared with $55.8 million

in 2008.

Conference Call and

Webcast

The Company will discuss third quarter 2009 results on a

conference call at 10:00 a.m. ET today. The call may be accessed

live at http://www.carlisle.com/investors/conference_call.html, or

the taped call may be listened to shortly following the live call

at the same website location.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements are based on management's current

expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to changes in global economic, business,

competitive, market and regulatory factors. More detailed

information about these factors is contained in the Company's

filings with the Securities and Exchange Commission. The Company

undertakes no duty to update forward-looking statements.

About Carlisle

Companies

Carlisle is a diversified global manufacturing company

serving the construction materials, commercial roofing, specialty

tire and wheel, power transmission, heavy-duty brake and friction,

heavy-haul truck trailer, refrigerated truck body, foodservice,

aerospace, and test and measurement industries.

CARLISLE COMPANIES INCORPORATED Consolidated

Statement of Earnings For the periods ended September 30

(In millions, except share and per share amounts)

(Unaudited) Third Quarter Nine

Months 2009 2008 % Change

2009

2008 % Change Net sales

$ 604.6

$ 832.5 -27 %

$ 1,734.2

$ 2,347.9 -26 % Cost and expenses:

Cost of goods sold

462.3 668.4 -31 %

1,362.2 1,886.0 -28 % Selling and administrative expenses

66.6 79.1 -16 %

207.1 234.9 -12 % Research and

development expenses

3.2 3.2 0 %

9.9 9.8 1 % Gain

related to fire settlement

- - NM

(27.0 ) - NM

Other operating expenses

1.8 -

NM

9.9 -

NM Operating income

70.7 81.8

-14 %

172.1 217.2 -21 % Other non-operating income,

net

(0.8 ) (0.6 ) NM

- (1.4 ) NM Interest

expense, net

2.0 6.1

-67 %

7.0 15.3

-54 % Earnings before income taxes

69.5 76.3

-9 %

165.1 203.3 -19 % Income tax expense

24.5 25.7 -5 %

54.4 67.6 -20 %

Income from continuing operations

45.0

50.6 -11 %

110.7

135.7 -18 % Income (loss) from

discontinued operations

1.6 (0.2

) NM

(2.0 ) (93.6

) NM Net income

$ 46.6

$ 50.4 -8 %

$ 108.7

$ 42.1 158 %

Basic earnings (loss) per share

(1)

Continuing operations

$ 0.73 $ 0.83 -12 %

$

1.81 $ 2.22 -18 % Discontinued operations

0.03

- NM

(0.04

) (1.53 ) NM Basic earnings per

share $ 0.76 $ 0.83 -8 % $ 1.77

$ 0.69 157 %

Diluted earnings (loss) per share

(1)

Continuing operations

$ 0.73 $ 0.83 -12 %

$

1.79 $ 2.21 -19 % Discontinued operations

0.02

(0.01 ) NM

(0.03

) (1.52 ) NM Diluted earnings

per share $ 0.75 $ 0.82 -9 % $ 1.76

$ 0.69 155 % Average shares

outstanding - in thousands Basic

60,612

60,528

60,588

60,543 Diluted

61,237

60,805

61,153 60,826

Dividends

$ 9.8 $ 9.5

3 %

$ 28.8 $ 27.2

6 % Dividends per share

$ 0.160

$ 0.155 3 %

$ 0.470 $

0.445 6 % (1) Numerator for basic and diluted

EPS calculated based on "two class" method: Income from continuing

operations

$ 44.5 $ 50.2

$ 109.5 $ 134.5 Net income

$ 46.1 $ 50.0

$

107.5 $ 41.7 NM = Not Meaningful

CARLISLE COMPANIES INCORPORATED Segment Financial

Data For the periods ended September 30 (In

millions) (Unaudited)

Third Quarter Nine Months 2009 2008 %

Change

2009 2008 % Change

Net Sales

Construction Materials

$ 340.1 $ 448.1 -24 %

$

862.2 $ 1,171.8 -26 % Transportation Products

129.2

205.2 -37 %

470.8 691.0 -32 % Applied Technologies

105.8 131.2 -19 %

311.5 350.7 -11 % Specialty

Products

29.5 48.0 -39 %

89.7 134.4 -33 % Total Net Sales

$ 604.6 $ 832.5 -27 %

$

1,734.2 $ 2,347.9 -26 %

Operating Income Construction Materials

$

60.3 $ 60.8 -1 %

$ 116.7 $ 129.8 -10 %

Transportation Products

4.0 8.7 -54 %

44.9 53.7 -16 %

Applied Technologies

13.2 12.7 4 %

30.4 36.0 -16 %

Specialty Products

0.9 8.2 -89 %

5.9 21.7 -73 % Segment Operating

Income

78.4 90.4 -13 %

197.9 241.2 -18 % Corporate

(7.7 ) (8.6 ) 10 %

(25.8

) (24.0 ) -8 % Total Operating Income

$

70.7 $ 81.8 -14 %

$ 172.1

$ 217.2 -21 %

Operating Margins

Construction Materials

17.7 % 13.6 %

13.5

% 11.1 % Transportation Products

3.1 % 4.2 %

9.5 % 7.8 % Applied Technologies

12.5 %

9.7 %

9.8 % 10.3 % Specialty Products

3.1 % 17.1 %

6.6 %

16.1 % Segment Operating Margin

13.0 % 10.9 %

11.4 % 10.3 % Corporate

-1.3 %

-1.1 %

-1.5 % -1.0 % Total

Operating Margin

11.7 % 9.8 %

9.9 % 9.3 %

CARLISLE COMPANIES

INCORPORATED Comparative Condensed Consolidated Balance

Sheet (In millions) September 30,

December 31,

2009 2008

Assets

(Unaudited) Current Assets Cash and cash equivalents

$ 81.2 $ 42.7 Receivables

342.4 317.0

Inventories

299.8 424.2 Prepaid expenses and other

69.1 94.1 Current assets held for sale

46.5

90.1

Total current assets 839.0

968.1 Property, plant and equipment, net

444.1

470.7 Other assets

608.8 589.2 Non-current assets held for

sale

46.1 47.9

Total Assets

$ 1,938.0 $ 2,075.9

Liabilities and

Shareholders' Equity Current Liabilities Short-term

debt, including current maturities

$ - $ 127.0

Accounts payable

139.5 123.6 Accrued expenses

184.0

163.0 Current liabilities associated with assets held for sale

14.1 28.9

Total current

liabilities 337.6 442.5 Long-term

debt

156.7 273.3 Other liabilities

253.1 266.0

Shareholders' equity

1,190.6 1,094.1

Total Liabilities and Shareholders' Equity $

1,938.0 $ 2,075.9

CARLISLE COMPANIES INCORPORATED Comparative

Condensed Consolidated Statement of Cash Flows For the Nine

Months Ended September 30 (In millions)

(Unaudited) 2009 2008

Operating

activities Net income

$ 108.7 $ 42.1

Reconciliation of net income to operating cash flows: Depreciation

and amortization

50.8 53.3 Non-cash compensation

10.9

9.0 Loss on writedown of assets

10.6 124.3 Deferred taxes

3.1 (30.7 ) Change in working capital and other assets and

liabilities

184.0 (54.8 ) Other

(4.7 )

(1.1 )

Net cash provided by operating

activities 363.4 142.1

Investing activities Capital expenditures

(34.9 ) (55.8 ) Acquisitions, net of cash acquired

(33.0 ) (294.8 ) Proceeds from investments and

disposal of property and equipment

6.7 4.1 Other

0.2 0.5

Net cash used in

investing activities (61.0 )

(346.0 )

Financing activities Net change in short-term debt

and revolving credit lines

(234.6 ) 353.2 Reductions

of long-term debt

- (100.0 ) Dividends paid

(28.8

) (27.2 ) Excess tax benefits on share-based compensation

(0.2 ) - Treasury shares and stock options, net

(0.2 ) (1.7 ) Treasury share repurchases

- (4.8 )

Net cash (used in) provided

by financing activities (263.8 )

219.5

Effect of exchange rate changes on cash

(0.1 ) (2.3 )

Change in cash

and cash equivalents 38.5 13.3

Cash and cash

equivalents Beginning of period

42.7

88.4 End of period

$ 81.2

$ 101.7

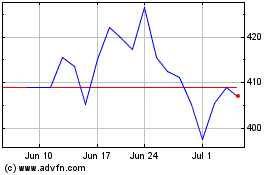

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Sep 2024 to Oct 2024

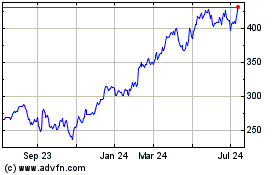

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Oct 2023 to Oct 2024