Regulator Approves Capital One Purchase Of HSBC Credit Card Portfolio

March 09 2012 - 4:29PM

Dow Jones News

A U.S. banking regulator said Friday it approved Capital One

Financial Corp.'s (COF) $2.6 billion purchase of the U.S.

credit-card business of HSBC Holdings PLC (HBC).

The deal was approved by the Office of the Comptroller of the

Currency, which regulates national banks. After the deal Capital

One, based in McLean, Va., would remain the fourth-largest U.S.

credit-card issuer.

The deal includes about $30 billion of credit-card loans, prime

and subprime, as well as so-called private-label credit cards that

banks issue in the name of others, including retailers. It will

make Capital One the third-largest issuer of private-label credit

cards; it ranks sixth now, and General Electric Co. is No. 1.

Once the deal closes, Capital One would issue credit cards for

General Motors Co., the AFL-CIO, Saks Inc., Neiman Marcus Inc. and

Best Buy Co., among others.

The move comes after the Federal Reserve Board voted last month

to approve Capital One's plan to buy ING Groep NV's U.S.

online-banking business. That deal will make Capital One the

nation's fifth-largest bank based on deposit size and bolsters

Capital One's transformation from a credit-card lender into a large

national bank.

The OCC said it reviewed numerous complaints that Capital One

had not done enough to serve the interests of low-income

communities. It rejected those arguments, saying that Capital One

has met community needs "through community development lending,

qualified investments, and community development services."

-By Alan Zibel, Dow Jones Newswires; 202-862-9263;

alan.zibel@dowjones.com

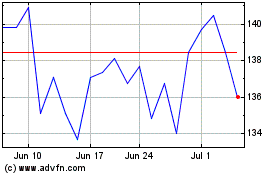

Capital One Financial (NYSE:COF)

Historical Stock Chart

From May 2024 to May 2024

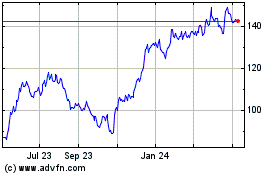

Capital One Financial (NYSE:COF)

Historical Stock Chart

From May 2023 to May 2024