Camden Property Trust Revises Tax Characteristics of 2009 Distributions

January 21 2010 - 1:15PM

Business Wire

Camden Property Trust (NYSE:CPT) announced today that it has

revised the income tax characteristics of its 2009 distributions

paid to shareholders as they will be reported on Form 1099-DIV. The

Company is releasing information at this time to aid banks,

brokerage firms, and institutional investors that are required to

issue Form 1099s to their account holders. The revised, final

classifications of the distributions for 2009 are as follows:

Camden Property Trust – Common Shares (CUSIP –

133131102)

Record

Date

Payment

Date

Cash

Distribution

Per Share

Ordinary

Taxable

Dividend (1)

Total

CapitalGainDistributions

UnrecapturedSec.

1250Capital Gain25% Rate

Return ofCapital

03/31/09 04/17/09 $

0.7000 84.8377 % 12.0928

% 3.0695 % 0.0000

% 06/30/09 07/17/09 $

0.4500 84.8377 % 12.0928

% 3.0695 % 0.0000

% 09/30/09 10/16/09 $

0.4500 84.8377 % 12.0928

% 3.0695 % 0.0000

% 12/21/09 01/18/10 $

0.4500 84.8377 % 12.0928

% 3.0695 % 0.0000

%

(1) None of the dividends classified as ordinary taxable

dividends represents “qualified dividend income” and, therefore,

are not eligible for the lower tax rate.

Based on the above percentages, the following represents a

1099-DIV for one share of common stock:

Form 1099-DIV (Boxes 1a + 2a + 3) Box 1a Box

2a Box 2b Box 3

CashDistributionPer Share

OrdinaryTaxableDividend (1)

TotalCapital

GainDistributions

UnrecapturedSec. 1250

Gain(2)

NondividendDistributions(3)

Total $ 2.0500 $

1.7392 $ 0.3108 $

0.0629 $ 0.0000

(2) Amounts in Box 2b are included in Box 2a.

(3) Amounts in Box 3 are also known as Return of Capital.

For corporate shareholders the Section 291(a) preference item is

0.6139% of the total distribution.

Also, the company did not incur any foreign taxes during

2009.

In addition to historical information, this press release

contains forward-looking statements under the federal securities

law. These statements are based on current expectations, estimates

and projections about the industry and markets in which Camden

operates, management’s beliefs, and assumptions made by management.

Forward-looking statements are not guarantees of future performance

and involve certain risks and uncertainties which are difficult to

predict.

Camden Property Trust, an S&P 400 Company, is a real estate

company engaged in the ownership, development, acquisition,

management and disposition of multifamily apartment communities.

Camden owns interests in and operates 183 properties containing

63,286 apartment homes across the United States. Upon completion of

two properties under development, the Company’s portfolio will

increase to 63,658 apartment homes in 185 properties. Camden was

recently named to FORTUNE® Magazine for the third consecutive year

as one of the “100 Best Companies to Work For” in America.

For additional information, please contact Camden's Investor

Relations Department at (800) 922-6336 or (713) 354-2787 or access

our website at camdenliving.com.

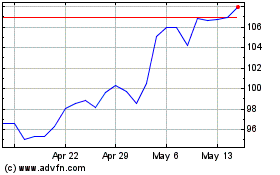

Camden Property (NYSE:CPT)

Historical Stock Chart

From May 2024 to Jun 2024

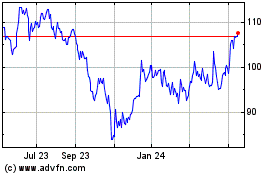

Camden Property (NYSE:CPT)

Historical Stock Chart

From Jun 2023 to Jun 2024