Camden Property Trust (NYSE:CPT) announced that its funds from

operations (�FFO�) for the third quarter of 2006 totaled $1.24 per

diluted share or $77.8 million, as compared to $0.76 per diluted

share or $44.4 million for the same period in 2005. FFO for the

three months ended September 30, 2006 included a $0.40 per diluted

share impact from gain on sale of land. FFO for the nine months

ended September 30, 2006 totaled $3.02 per diluted share or $183.1

million, as compared to $2.63 per diluted share or $145.8 million

for the same period in 2005. FFO for the nine months ended

September 30, 2006 included a $0.44 per diluted share impact from

gain on sale of land. FFO for the nine months ended September 30,

2005 included a $0.44 per diluted share impact from the sale of

technology investments, and a $0.25 per diluted share charge for

transaction compensation and merger expenses relating to Camden�s

merger with Summit Properties Inc. (�Summit�). Net Income (�EPS�)

The Company reported net income (�EPS�) of $125.5 million or $2.07

per diluted share for the third quarter of 2006, as compared to a

net loss of $2.3 million or ($0.05) per diluted share for the same

period in 2005. EPS for the three months ended September 30, 2006

included a $2.07 per diluted share impact from gain on sale of

land, operating properties, joint venture properties and

discontinued operations. For the nine months ended September 30,

2006, net income totaled $201.5 million or $3.46 per diluted share,

as compared to $186.2 million or $3.38 per diluted share for the

same period in 2005. EPS for the nine months ended September 30,

2006 included a $3.07 per diluted share impact from gain on sale of

land, operating properties, joint venture properties and

discontinued operations. EPS for the nine months ended September

30, 2005 included a $3.03 per diluted share impact from gain on

sale of operating properties and discontinued operations, $0.44 per

diluted share income from the sale of technology investments, and a

$0.25 per diluted share charge for transaction compensation and

merger expenses relating to Camden�s merger with Summit. A

reconciliation of net income to FFO is included in the financial

tables accompanying this press release. Same-Property Results For

the 46,565 apartment homes included in consolidated same-property

results, third quarter 2006 same-property net operating income

(�NOI�) growth was 8.1% compared to the third quarter of 2005, with

revenues increasing 7.6% and expenses increasing 7.0%. On a

sequential basis, third quarter 2006 same-property NOI decreased

0.7% compared to second quarter 2006, with revenues increasing 2.2%

and expenses increasing 7.0% compared to the prior quarter. On a

year-to-date basis, 2006 same-property NOI increased 9.4%, with

revenue growth of 8.0% and expense growth of 5.7% compared to the

same period in 2005. Same-property physical occupancy levels for

the combined portfolio averaged 94.9% during the third quarter of

2006, compared to 96.1% in the third quarter of 2005 and 95.7% in

the second quarter of 2006. The Company defines same-property

communities as communities owned by either Camden or Summit and

stabilized as of January 1, 2005, excluding properties held for

sale. A reconciliation of net income to net operating income and

same-property net operating income is included in the financial

tables accompanying this press release. Development Activity As of

September 30, 2006, Camden had four completed apartment communities

in lease-up: Camden Fairfax Corner in Fairfax, VA, an $82.0 million

project that is currently 86% leased; Camden Manor Park in Raleigh,

NC, a $52.0 million project that is currently 69% leased; Camden

Westwind in Ashburn, VA, a $97.6 million project that is currently

64% leased; and Camden Royal Oaks in Houston, TX, a $22.0 million

project that is currently 31% leased. Camden announced one new

joint venture development start during the quarter: Camden College

Park in College Park, MD, a $139.9 million project with 508

apartment homes scheduled for initial occupancy in late 2007. The

Company�s current development pipeline includes eight wholly-owned

communities with 2,693 apartment homes and a total budgeted cost of

$565.0 million, and three joint venture communities with 1,069

apartment homes and a total budgeted cost of $289.9 million. Of

those 11 communities, two are currently in lease-up. Camden

Clearbrook in Frederick, MD is currently 60% leased; and Camden Old

Creek in San Marcos, CA is currently 17% leased.

Acquisition/Disposition Activity During the quarter, the Company

acquired Camden Stoneleigh, a 390-home apartment community in

Austin, TX for $35.3 million, and disposed of Camden Oaks, a

446-home apartment community in Dallas, TX, for $19.2 million. Gain

on sale of Camden Oaks totaled $8.8 million. The Company also sold

Summit Hollow, a 232-home joint venture apartment community in

Charlotte, NC for $15.5 million. Camden�s pro-rata share of that

disposition totaled $3.9 million, and a $1.1 million gain on sale

was recognized. In addition, the Company sold 8.7 acres of

undeveloped land in Long Beach, CA, Orlando, FL, Fort Lauderdale,

FL and Dallas, TX, and contributed 10.6 acres of undeveloped land

in College Park, MD to a joint venture during the quarter. The

combined sales price for those transactions totaled $69.6 million,

and gains of $25.2 million were recorded. Camden contributed nine

existing multifamily communities with 3,237 apartment homes located

in Camden�s Midwest markets to a newly created $239.0 million joint

venture. Camden retained a 15% ownership interest in the venture

and continues to serve as the property manager for all nine

communities. The Company recorded a gain of $91.6 million as a

result of this transaction. Properties and Land Held for Sale At

September 30, 2006, Camden had five operating communities

consisting of 1,744 apartment homes classified as held for sale.

These properties included: Camden Crossing, a 366-home apartment

community in Houston, TX; Camden Wyndham, a 448-home apartment

community in Houston, TX; Camden Downs, a 254-home apartment

community in Louisville, KY; Camden Taravue, a 304-home apartment

community in St. Louis, MO; and Camden Trace, a 372-home apartment

community in St. Louis, MO. The Company also had 5.7 acres of

undeveloped land in Miami, FL, Boca Raton, FL and Dallas, TX

classified as held for sale at quarter-end. Earnings Guidance 2006

FFO is now expected to be $3.82 to $3.88 per diluted share for

full-year 2006, and $0.81 to $0.87 per diluted share for fourth

quarter 2006. EPS is expected to be $3.60 to $3.66 per diluted

share for full-year 2006, and $0.17 to $0.23 per diluted share for

the fourth quarter of 2006. Guidance for 2006 includes a charge of

$0.07 per diluted share during the fourth quarter of 2006 relating

to early vesting of previously granted share awards. The Company�s

2006 earnings guidance is based on projections of same-property

revenue growth between 7.00% and 7.75%, same-property expense

growth between 5.00% and 5.50%, and same-property NOI growth

between 8.25% and 9.25%. No acquisitions, dispositions or new

development starts are expected for the remainder of 2006. Camden

expects to release its fourth quarter and full year 2006 earnings

on February 1, 2007, and hold a conference call on February 2,

2007. The Company plans to discuss its 2006 results and earnings

guidance for 2007 at that time. A reconciliation of expected net

income to expected FFO is included in the financial tables

accompanying this press release. Conference Call The Company will

hold a conference call on Friday, November 3, 2006 at 10:00 a.m.

Central Time to review its third quarter results and discuss its

outlook for future performance. To participate in the call, please

dial 877-407-0782 (domestic) or 201-689-8567 (international) by

9:50 a.m. Central Time and request the Camden Property Trust Third

Quarter 2006 Earnings Call, or join the live webcast of the

conference call by accessing the Investor Relations section of the

Company�s website at www.camdenliving.com. Supplemental financial

information is available in the Investor Relations section of the

Company�s website under Earnings Releases or by calling Camden�s

Investor Relations Department at 800-922-6336. Forward-Looking

Statements In addition to historical information, this press

release contains forward-looking statements under the federal

securities law. These statements are based on current expectations,

estimates and projections about the industry and markets in which

Camden operates, management's beliefs, and assumptions made by

management. Forward-looking statements are not guarantees of future

performance and involve certain risks and uncertainties which are

difficult to predict. About Camden Camden Property Trust is a real

estate company engaged in the ownership, development, acquisition,

management and disposition of multifamily apartment communities.

Camden owns interests in and operates 188 properties containing

64,657 apartment homes across the United States. Upon completion of

11 properties under development, the Company�s portfolio will

increase to 68,419 apartment homes in 199 properties. For

additional information, please contact Camden�s Investor Relations

Department at 800-922-6336 or 713-354-2787 or access our website at

www.camdenliving.com. CAMDEN OPERATING RESULTS (In thousands,

except per share and property data amounts) � � � � � � � � � �

(Unaudited) Three Months Ended Nine Months Ended September 30,

September 30, OPERATING DATA 2006� � 2005� 2006� � 2005 (a)

Property revenues Rental revenues $139,354� $125,125� $408,581�

$348,250� Other property revenues 15,202� � 11,507� 41,172� �

31,612� Total property revenues 154,556� 136,632� 449,753� 379,862�

� Property expenses Property operating and maintenance 45,806�

38,697� 124,089� 105,960� Real estate taxes 16,345� � 14,870�

48,845� � 42,512� Total property expenses 62,151� 53,567� 172,934�

148,472� � Non-property income Fee and asset management 5,433�

1,789� 11,030� 10,929� Sale of technology investments 1,602� -�

1,602� 24,199� Interest and other income 1,733� 1,913� 6,097�

6,401� Income on deferred compensation plans 1,927� � 3,209� 4,308�

� 5,327� Total non-property income 10,695� 6,911� 23,037� 46,856� �

Other expenses Property management 4,629� 4,208� 13,821� 11,350�

Fee and asset management 3,689� 2,008� 8,293� 4,999� General and

administrative 9,849� 6,183� 25,299� 18,017� Transaction

compensation and merger expenses -� -� -� 14,085� Interest 29,176�

29,331� 91,592� 81,416� Depreciation and amortization 40,399�

44,030� 117,945� 119,117� Amortization of deferred financing costs

941� 855� 2,897� 2,872� Expense on deferred compensation plans

1,927� � 3,209� 4,308� � 5,327� Total other expenses 90,610� �

89,824� 264,155� � 257,183� � Income from continuing operations

before gain on sale of properties, equity in income (loss) of joint

ventures and minority interests 12,490� 152� 35,701� 21,063� Gain

on sale of properties, including land 96,247� -� 97,556� 132,117�

Equity in income (loss) of joint ventures 1,628� (1,827) 4,514�

(1,472) Minority interests: Distributions on perpetual preferred

units (1,750) (1,750) (5,250) (5,278) Original issuance costs on

redeemed perpetual preferred units -� -� -� (365) Income allocated

to common units and other minority interests (12,413) � (261)

(14,750) � (1,756) Income (loss) from continuing operations 96,202�

(3,686) 117,771� 144,309� Income from discontinued operations 665�

1,481� 4,998� 6,118� Gain on sale of discontinued operations

29,350� -� 80,394� 36,115� Income from discontinued operations

allocated to common units (760) � (112) (1,681) � (343) Net income

(loss) $125,457� � ($2,317) $201,482� � $186,199� � PER SHARE DATA

Net income (loss) - basic $2.15� ($0.04) $3.59� $3.63� Net income

(loss) - diluted 2.07� (0.05) 3.46� 3.38� Income (loss) from

continuing operations - basic 1.65� (0.07) 2.10� 2.81� Income

(loss) from continuing operations - diluted 1.58� (0.07) 2.03�

2.63� � Weighted average number of common and common equivalent

shares outstanding: � Basic 58,348� 54,018� 56,063� 51,294� Diluted

61,250� 55,671� 58,904� 55,494� � PROPERTY DATA Total operating

properties (end of period) (b) 188� 193� 188� 193� Total operating

apartment homes in operating properties (end of period) (b) 64,657�

66,619� 64,657� 66,619� Total operating apartment homes (weighted

average) 56,161� 56,150� 56,624� 54,368� Total operating apartment

homes - excluding discontinued operations (weighted average)

54,350� 52,119� 53,880� 49,970� � � (a) The Company's 2005

financial results include the results of Summit subsequent to

February 28, 2005. � (b) Includes joint ventures and properties

held for sale. � Note: Please refer to the following pages for

definitions and reconciliations of all non-GAAP financial measures

presented in this document. CAMDEN FUNDS FROM OPERATIONS (In

thousands, except per share and property data amounts) � � � � � �

� � � � � (Unaudited) Three Months Ended Nine Months Ended

September 30, September 30, FUNDS FROM OPERATIONS 2006� � 2005�

2006� � 2005 (a) � Net income (loss) $125,457� ($2,317) $201,482�

$186,199� Real estate depreciation and amortization from continuing

operations 39,735� 43,386� 115,964� 117,239� Real estate

depreciation from discontinued operations 255� 1,777� 1,350� 5,387�

Adjustments for unconsolidated joint ventures 760� 1,284� 2,305�

3,249� Income from continuing operations allocated to common units

12,365� 129� 14,599� 1,626� Income from discontinued operations

allocated to common units 760� 112� 1,681� 343� (Gain) on sale of

operating properties (91,581) -� (91,581) (132,117) (Gain) on sale

of discontinued operations (8,842) -� (59,886) (36,104) (Gain) on

sale of joint venture properties (1,085) � -� (2,848) � -� Funds

from operations - diluted $77,824� � $44,371� $183,066� � $145,822�

� PER SHARE DATA Funds from operations - diluted $1.24� $0.76�

$3.02� $2.63� Cash distributions 0.66� 0.64� 1.98� 1.91� � Weighted

average number of common and common equivalent shares outstanding:

� FFO - diluted 62,885� 58,600� 60,666� 55,494� � PROPERTY DATA

Total operating properties (end of period) (b) 188� 193� 188� 193�

Total operating apartment homes in operating properties (end of

period) (b) 64,657� 66,619� 64,657� 66,619� Total operating

apartment homes (weighted average) 56,161� 56,150� 56,624� 54,368�

Total operating apartment homes - excluding discontinued operations

(weighted average) 54,350� 52,119� 53,880� 49,970� � (a) The

Company's 2005 financial results include the results of Summit

subsequent to February 28, 2005. � (b) Includes joint ventures and

properties held for sale. � Note: Please refer to the following

pages for definitions and reconciliations of all non-GAAP financial

measures presented in this document. CAMDEN BALANCE SHEETS (In

thousands) � � � � � � � � (Unaudited) Sep 30, Jun 30, Mar 31, Dec

31, Sep 30, 2006� 2006� 2006� 2005� 2005� ASSETS Real estate

assets, at cost Land $683,645� $697,690� $664,219� $646,854�

$660,748� Buildings and improvements 3,988,031� 4,074,737�

3,892,700� 3,840,969� 3,881,682� 4,671,676� 4,772,427� 4,556,919�

4,487,823� 4,542,430� Accumulated depreciation (725,790) (786,208)

(732,984) (716,650) (713,991) Net operating real estate assets

3,945,886� 3,986,219� 3,823,935� 3,771,173� 3,828,439� Properties

under development, including land 351,246� 427,500� 419,843�

372,976� 377,787� Investments in joint ventures 8,266� 8,270�

8,199� 6,096� 6,937� Properties held for sale 45,074� 55,562�

188,477� 172,112� 51,741� Total real estate assets 4,350,472�

4,477,551� 4,440,454� 4,322,357� 4,264,904� Accounts receivable -

affiliates 33,624� 33,408� 33,361� 34,084� 35,313� Notes receivable

Affiliates 31,037� 23,327� 22,531� 11,916� 11,505� Other 3,855�

9,211� 13,264� 13,261� 24,865� Other assets, net (a) 112,801�

111,636� 102,269� 99,516� 100,080� Cash and cash equivalents 8,061�

49,700� 1,256� 1,576� 1,076� Restricted cash 5,541� 5,194� 5,269�

5,089� 5,829� Total assets $4,545,391� $4,710,027� $4,618,404�

$4,487,799� $4,443,572� � LIABILITIES AND SHAREHOLDERS' EQUITY

Liabilities Notes payable Unsecured $1,693,106� $1,940,693�

$2,118,403� $2,007,164� $1,903,094� Secured 587,347� 620,592�

623,250� 625,927� 661,723� Accounts payable and accrued expenses

120,566� 117,301� 116,215� 108,979� 102,231� Accrued real estate

taxes 41,165� 31,280� 17,818� 26,070� 39,740� Other liabilities (b)

101,332� 99,460� 98,327� 88,811� 84,835� Distributions payable

43,056� 43,031� 40,612� 38,922� 38,933� Total liabilities

2,586,572� 2,852,357� 3,014,625� 2,895,873� 2,830,556� �

Commitments and contingencies � Minority interests Perpetual

preferred units 97,925� 97,925� 97,925� 97,925� 97,925� Common

units 116,776� 106,217� 113,034� 112,637� 115,190� Other minority

interests 10,002� 10,555� 10,512� 10,461� 10,425� Total minority

interests 224,703� 214,697� 221,471� 221,023� 223,540� �

Shareholders' equity Common shares of beneficial interest 650� 649�

610� 608� 607� Additional paid-in capital 2,176,170� 2,172,616�

1,908,099� 1,902,595� 1,899,713� Distributions in excess of net

income (206,442) (293,386) (289,482) (295,074) (273,609) Employee

notes receivable (2,047) (2,035) (2,046) (2,078) (2,087) Treasury

shares, at cost (234,215) (234,871) (234,873) (235,148) (235,148)

Total share-holders' equity 1,734,116� 1,642,973� 1,382,308�

1,370,903� 1,389,476� Total liabilities and share-holders' equity

$4,545,391� $4,710,027� $4,618,404� $4,487,799� $4,443,572� � � �

(a) includes: net deferred charges of: $11,155� $13,120� $14,079�

$13,061� $13,757� value of in place leases of: $452� $431� $1,156�

$1,363� $10,561� � (b) includes: deferred revenues of: $5,256�

$4,408� $4,843� $2,008� $2,152� above/below market leases of: $80�

$13� $51� $90� $889� distri-butions in excess of investments in

joint ventures of: $18,044� $12,701� $11,556� $11,256� $18,730�

CAMDEN NON-GAAP FINANCIAL MEASURES DEFINITIONS &

RECONCILIATIONS (In thousands, except per share amounts) � � � � �

� � � (Unaudited) � This document contains certain non-GAAP

financial measures management believes are useful in evaluating an

equity REIT's performance. Camden's definitions and calculations of

non-GAAP financial measures may differ from those used by other

REITs, and thus may not be comparable. The non-GAAP financial

measures should not be considered as an alternative to net income

as an indication of our operating performance, or to net cash

provided by operating activities as a measure of our liquidity. �

FFO The National Association of Real Estate Investment Trusts

(�NAREIT�) currently defines FFO as net income computed in

accordance with generally accepted accounting principles (�GAAP�),

excluding gains or losses from depreciable operating property

sales, plus real estate depreciation and amortization, and after

adjustments for unconsolidated partnerships and joint ventures.

Camden�s definition of diluted FFO also assumes conversion of all

dilutive convertible securities, including minority interests,

which are convertible into common equity. The Company considers FFO

to be an appropriate supplemental measure of operating performance

because, by excluding gains or losses on dispositions of operating

properties and excluding depreciation, FFO can help one compare the

operating performance of a company's real estate between periods or

as compared to different companies. A reconciliation of net income

to FFO is provided below: � � Three Months Ended Nine Months Ended

September 30, September 30, 2006� 2005� 2006� 2005� Net income

(loss) $125,457� ($2,317) $201,482� $186,199� Real estate

depreciation and amortization from continuing operations 39,735�

43,386� 115,964� 117,239� Real estate depreciation from

discontinued operations 255� 1,777� 1,350� 5,387� Adjustments for

unconsolidated joint ventures 760� 1,284� 2,305� 3,249� Income from

continuing operations allocated to common units 12,365� 129�

14,599� 1,626� Income from discontinued operations allocated to

common units 760� 112� 1,681� 343� (Gain) on sale of operating

properties (91,581) -� (91,581) (132,117) (Gain) on sale of

discontinued operations (8,842) -� (59,886) (36,104) (Gain) on sale

of joint venture properties (1,085) -� (2,848) -� Funds from

operations - diluted $77,824� $44,371� $183,066� $145,822� �

Weighted average number of common and common equivalent shares

outstanding: � EPS diluted 61,250� 55,671� 58,904� 55,494� FFO

diluted 62,885� 58,600� 60,666� 55,494� � Net income (loss) per

common share - diluted $2.07� ($0.05) $3.46� $3.38� FFO per common

share - diluted $1.24� $0.76� $3.02� $2.63� � Expected FFO Expected

FFO is calculated in a method consistent with historical FFO, and

is considered an appropriate supplemental measure of expected

operating performance when compared to expected net income (EPS). A

reconciliation of the ranges provided for expected net income per

diluted share to expected FFO per diluted share is provided below:

� 4Q06 Range 2006 Range Low High Low High � Expected net income per

share - diluted $0.17� $0.23� $3.60� $3.66� Expected difference

between EPS and fully diluted FFO shares (0.03) (0.03) (0.17)

(0.17) Expected real estate depreciation 0.64� 0.64� 2.57� 2.57�

Expected adjustments for unconsolidated joint ventures 0.01� 0.01�

0.05� 0.05� Expected income allocated to common units 0.02� 0.02�

0.29� 0.29� Expected (gain) on sale of properties held in joint

ventures 0.00� 0.00� (0.05) (0.05) Expected (gain) on sale of

properties and properties held for sale 0.00� 0.00� (2.47) (2.47)

Expected FFO per share - diluted $0.81� $0.87� $3.82� $3.88� �

Note: This table contains forward-looking statements. Please see

the paragraph regarding forward-looking statements earlier in this

document. Net Operating Income (NOI) NOI is defined by the Company

as total property income less property operating and maintenance

expenses less real estate taxes. The Company considers NOI to be an

appropriate supplemental measure of operating performance to net

income because it reflects the operating performance of our

communities without allocation of corporate level property

management overhead or general and administrative costs. A

reconciliation of net income to net operating income is provided

below: � Three Months Ended Nine Months Ended September 30,

September 30, 2006� 2005� 2006� 2005� Net income (loss) $125,457�

($2,317) $201,482� $186,199� Fee and asset management (5,433)

(1,789) (11,030) (10,929) Sale of technology investments (1,602) -�

(1,602) (24,199) Interest and other income (1,733) (1,913) (6,097)

(6,401) Income on deferred compensation plans (1,927) (3,209)

(4,308) (5,327) Property management expense 4,629� 4,208� 13,821�

11,350� Fee and asset management expense 3,689� 2,008� 8,293�

4,999� General and administrative expense 9,849� 6,183� 25,299�

18,017� Transaction compensation and merger expenses -� -� -�

14,085� Interest expense 29,176� 29,331� 91,592� 81,416�

Depreciation and amortization 40,399� 44,030� 117,945� 119,117�

Amortization of deferred financing costs 941� 855� 2,897� 2,872�

Expense on deferred compensation plans 1,927� 3,209� 4,308� 5,327�

Gain on sale of properties, including land (96,247) -� (97,556)

(132,117) Equity in income (loss) of joint ventures (1,628) 1,827�

(4,514) 1,472� Distributions on perpetual preferred units 1,750�

1,750� 5,250� 5,278� Original issuance costs on redeemed perpetual

preferred units -� -� -� 365� Income allocated to common units and

other minority interests 12,413� 261� 14,750� 1,756� Income from

discontinued operations (665) (1,481) (4,998) (6,118) Gain on sale

of discontinued operations (29,350) -� (80,394) (36,115) Income

from discontinued operations allocated to common units 760� 112�

1,681� 343� Net Operating Income (NOI) $92,405� $83,065� $276,819�

$231,390� � "Same Property" Communities $78,032� $72,215� $233,936�

$197,187� Non-"Same Property" Communities 8,416� 4,939� 24,633�

12,877� Development and Lease-Up Communities 2,838� 29� 5,540� 29�

Dispositions / Other 3,119� 5,882� 12,710� 21,297� Net Operating

Income (NOI) $92,405� $83,065� $276,819� $231,390� � � EBITDA

EBITDA is defined by the Company as earnings before interest,

taxes, depreciation and amortization, including net operating

income from discontinued operations, excluding equity in income of

joint ventures, gain on sale of real estate assets, and income

allocated to minority interests. The Company considers EBITDA to be

an appropriate supplemental measure of operating performance to net

income because it represents income before non-cash depreciation

and the cost of debt, and excludes gains or losses from property

dispositions. A reconciliation of net income to EBITDA is provided

below: � Three Months Ended Nine Months Ended September 30,

September 30, 2006� 2005� 2006� 2005� Net income (loss) $125,457�

($2,317) $201,482� $186,199� Interest expense 29,176� 29,331�

91,592� 81,416� Amortization of deferred financing costs 941� 855�

2,897� 2,872� Depreciation and amortization 40,399� 44,030�

117,945� 119,117� Distributions on perpetual preferred units 1,750�

1,750� 5,250� 5,278� Original issuance costs on redeemed perpetual

preferred units -� -� -� 365� Income allocated to common units and

other minority interests 12,413� 261� 14,750� 1,756� Real estate

depreciation from discontinued operations 255� 1,777� 1,350� 5,387�

Gain on sale of properties, including land (96,247) -� (97,556)

(132,117) Equity in income (loss) of joint ventures (1,628) 1,827�

(4,514) 1,472� Gain on sale of discontinued operations (29,350) -�

(80,394) (36,115) Income from discontinued operations allocated to

common units 760� 112� 1,681� 343� EBITDA $83,926� $77,626�

$254,483� $235,973� Camden Property Trust (NYSE:CPT) announced that

its funds from operations ("FFO") for the third quarter of 2006

totaled $1.24 per diluted share or $77.8 million, as compared to

$0.76 per diluted share or $44.4 million for the same period in

2005. FFO for the three months ended September 30, 2006 included a

$0.40 per diluted share impact from gain on sale of land. FFO for

the nine months ended September 30, 2006 totaled $3.02 per diluted

share or $183.1 million, as compared to $2.63 per diluted share or

$145.8 million for the same period in 2005. FFO for the nine months

ended September 30, 2006 included a $0.44 per diluted share impact

from gain on sale of land. FFO for the nine months ended September

30, 2005 included a $0.44 per diluted share impact from the sale of

technology investments, and a $0.25 per diluted share charge for

transaction compensation and merger expenses relating to Camden's

merger with Summit Properties Inc. ("Summit"). Net Income ("EPS")

The Company reported net income ("EPS") of $125.5 million or $2.07

per diluted share for the third quarter of 2006, as compared to a

net loss of $2.3 million or ($0.05) per diluted share for the same

period in 2005. EPS for the three months ended September 30, 2006

included a $2.07 per diluted share impact from gain on sale of

land, operating properties, joint venture properties and

discontinued operations. For the nine months ended September 30,

2006, net income totaled $201.5 million or $3.46 per diluted share,

as compared to $186.2 million or $3.38 per diluted share for the

same period in 2005. EPS for the nine months ended September 30,

2006 included a $3.07 per diluted share impact from gain on sale of

land, operating properties, joint venture properties and

discontinued operations. EPS for the nine months ended September

30, 2005 included a $3.03 per diluted share impact from gain on

sale of operating properties and discontinued operations, $0.44 per

diluted share income from the sale of technology investments, and a

$0.25 per diluted share charge for transaction compensation and

merger expenses relating to Camden's merger with Summit. A

reconciliation of net income to FFO is included in the financial

tables accompanying this press release. Same-Property Results For

the 46,565 apartment homes included in consolidated same-property

results, third quarter 2006 same-property net operating income

("NOI") growth was 8.1% compared to the third quarter of 2005, with

revenues increasing 7.6% and expenses increasing 7.0%. On a

sequential basis, third quarter 2006 same-property NOI decreased

0.7% compared to second quarter 2006, with revenues increasing 2.2%

and expenses increasing 7.0% compared to the prior quarter. On a

year-to-date basis, 2006 same-property NOI increased 9.4%, with

revenue growth of 8.0% and expense growth of 5.7% compared to the

same period in 2005. Same-property physical occupancy levels for

the combined portfolio averaged 94.9% during the third quarter of

2006, compared to 96.1% in the third quarter of 2005 and 95.7% in

the second quarter of 2006. The Company defines same-property

communities as communities owned by either Camden or Summit and

stabilized as of January 1, 2005, excluding properties held for

sale. A reconciliation of net income to net operating income and

same-property net operating income is included in the financial

tables accompanying this press release. Development Activity As of

September 30, 2006, Camden had four completed apartment communities

in lease-up: Camden Fairfax Corner in Fairfax, VA, an $82.0 million

project that is currently 86% leased; Camden Manor Park in Raleigh,

NC, a $52.0 million project that is currently 69% leased; Camden

Westwind in Ashburn, VA, a $97.6 million project that is currently

64% leased; and Camden Royal Oaks in Houston, TX, a $22.0 million

project that is currently 31% leased. Camden announced one new

joint venture development start during the quarter: Camden College

Park in College Park, MD, a $139.9 million project with 508

apartment homes scheduled for initial occupancy in late 2007. The

Company's current development pipeline includes eight wholly-owned

communities with 2,693 apartment homes and a total budgeted cost of

$565.0 million, and three joint venture communities with 1,069

apartment homes and a total budgeted cost of $289.9 million. Of

those 11 communities, two are currently in lease-up. Camden

Clearbrook in Frederick, MD is currently 60% leased; and Camden Old

Creek in San Marcos, CA is currently 17% leased.

Acquisition/Disposition Activity During the quarter, the Company

acquired Camden Stoneleigh, a 390-home apartment community in

Austin, TX for $35.3 million, and disposed of Camden Oaks, a

446-home apartment community in Dallas, TX, for $19.2 million. Gain

on sale of Camden Oaks totaled $8.8 million. The Company also sold

Summit Hollow, a 232-home joint venture apartment community in

Charlotte, NC for $15.5 million. Camden's pro-rata share of that

disposition totaled $3.9 million, and a $1.1 million gain on sale

was recognized. In addition, the Company sold 8.7 acres of

undeveloped land in Long Beach, CA, Orlando, FL, Fort Lauderdale,

FL and Dallas, TX, and contributed 10.6 acres of undeveloped land

in College Park, MD to a joint venture during the quarter. The

combined sales price for those transactions totaled $69.6 million,

and gains of $25.2 million were recorded. Camden contributed nine

existing multifamily communities with 3,237 apartment homes located

in Camden's Midwest markets to a newly created $239.0 million joint

venture. Camden retained a 15% ownership interest in the venture

and continues to serve as the property manager for all nine

communities. The Company recorded a gain of $91.6 million as a

result of this transaction. Properties and Land Held for Sale At

September 30, 2006, Camden had five operating communities

consisting of 1,744 apartment homes classified as held for sale.

These properties included: Camden Crossing, a 366-home apartment

community in Houston, TX; Camden Wyndham, a 448-home apartment

community in Houston, TX; Camden Downs, a 254-home apartment

community in Louisville, KY; Camden Taravue, a 304-home apartment

community in St. Louis, MO; and Camden Trace, a 372-home apartment

community in St. Louis, MO. The Company also had 5.7 acres of

undeveloped land in Miami, FL, Boca Raton, FL and Dallas, TX

classified as held for sale at quarter-end. Earnings Guidance 2006

FFO is now expected to be $3.82 to $3.88 per diluted share for

full-year 2006, and $0.81 to $0.87 per diluted share for fourth

quarter 2006. EPS is expected to be $3.60 to $3.66 per diluted

share for full-year 2006, and $0.17 to $0.23 per diluted share for

the fourth quarter of 2006. Guidance for 2006 includes a charge of

$0.07 per diluted share during the fourth quarter of 2006 relating

to early vesting of previously granted share awards. The Company's

2006 earnings guidance is based on projections of same-property

revenue growth between 7.00% and 7.75%, same-property expense

growth between 5.00% and 5.50%, and same-property NOI growth

between 8.25% and 9.25%. No acquisitions, dispositions or new

development starts are expected for the remainder of 2006. Camden

expects to release its fourth quarter and full year 2006 earnings

on February 1, 2007, and hold a conference call on February 2,

2007. The Company plans to discuss its 2006 results and earnings

guidance for 2007 at that time. A reconciliation of expected net

income to expected FFO is included in the financial tables

accompanying this press release. Conference Call The Company will

hold a conference call on Friday, November 3, 2006 at 10:00 a.m.

Central Time to review its third quarter results and discuss its

outlook for future performance. To participate in the call, please

dial 877-407-0782 (domestic) or 201-689-8567 (international) by

9:50 a.m. Central Time and request the Camden Property Trust Third

Quarter 2006 Earnings Call, or join the live webcast of the

conference call by accessing the Investor Relations section of the

Company's website at www.camdenliving.com. Supplemental financial

information is available in the Investor Relations section of the

Company's website under Earnings Releases or by calling Camden's

Investor Relations Department at 800-922-6336. Forward-Looking

Statements In addition to historical information, this press

release contains forward-looking statements under the federal

securities law. These statements are based on current expectations,

estimates and projections about the industry and markets in which

Camden operates, management's beliefs, and assumptions made by

management. Forward-looking statements are not guarantees of future

performance and involve certain risks and uncertainties which are

difficult to predict. About Camden Camden Property Trust is a real

estate company engaged in the ownership, development, acquisition,

management and disposition of multifamily apartment communities.

Camden owns interests in and operates 188 properties containing

64,657 apartment homes across the United States. Upon completion of

11 properties under development, the Company's portfolio will

increase to 68,419 apartment homes in 199 properties. For

additional information, please contact Camden's Investor Relations

Department at 800-922-6336 or 713-354-2787 or access our website at

www.camdenliving.com. -0- *T CAMDEN OPERATING RESULTS (In

thousands, except per share and property data amounts)

----------------------------------------------------------------------

(Unaudited) Three Months Ended Nine Months Ended September 30,

September 30, ------------------- ------------------- OPERATING

DATA 2006 2005 2006 2005 (a) ------------------------------

------------------- ------------------- Property revenues Rental

revenues $139,354 $125,125 $408,581 $348,250 Other property

revenues 15,202 11,507 41,172 31,612 -------------------

------------------- Total property revenues 154,556 136,632 449,753

379,862 Property expenses Property operating and maintenance 45,806

38,697 124,089 105,960 Real estate taxes 16,345 14,870 48,845

42,512 ------------------- ------------------- Total property

expenses 62,151 53,567 172,934 148,472 Non-property income Fee and

asset management 5,433 1,789 11,030 10,929 Sale of technology

investments 1,602 - 1,602 24,199 Interest and other income 1,733

1,913 6,097 6,401 Income on deferred compensation plans 1,927 3,209

4,308 5,327 ------------------- ------------------- Total

non-property income 10,695 6,911 23,037 46,856 Other expenses

Property management 4,629 4,208 13,821 11,350 Fee and asset

management 3,689 2,008 8,293 4,999 General and administrative 9,849

6,183 25,299 18,017 Transaction compensation and merger expenses -

- - 14,085 Interest 29,176 29,331 91,592 81,416 Depreciation and

amortization 40,399 44,030 117,945 119,117 Amortization of deferred

financing costs 941 855 2,897 2,872 Expense on deferred

compensation plans 1,927 3,209 4,308 5,327 -------------------

------------------- Total other expenses 90,610 89,824 264,155

257,183 ------------------- ------------------- Income from

continuing operations before gain on sale of properties, equity in

income (loss) of joint ventures and minority interests 12,490 152

35,701 21,063 Gain on sale of properties, including land 96,247 -

97,556 132,117 Equity in income (loss) of joint ventures 1,628

(1,827) 4,514 (1,472) Minority interests: Distributions on

perpetual preferred units (1,750) (1,750) (5,250) (5,278) Original

issuance costs on redeemed perpetual preferred units - - - (365)

Income allocated to common units and other minority interests

(12,413) (261) (14,750) (1,756) -------------------

------------------- Income (loss) from continuing operations 96,202

(3,686) 117,771 144,309 Income from discontinued operations 665

1,481 4,998 6,118 Gain on sale of discontinued operations 29,350 -

80,394 36,115 Income from discontinued operations allocated to

common units (760) (112) (1,681) (343) -------------------

------------------- Net income (loss) $125,457 ($2,317) $201,482

$186,199 =================== =================== PER SHARE DATA

------------------------------ Net income (loss) - basic $2.15

($0.04) $3.59 $3.63 Net income (loss) - diluted 2.07 (0.05) 3.46

3.38 Income (loss) from continuing operations - basic 1.65 (0.07)

2.10 2.81 Income (loss) from continuing operations - diluted 1.58

(0.07) 2.03 2.63 Weighted average number of common and common

equivalent shares outstanding: Basic 58,348 54,018 56,063 51,294

Diluted 61,250 55,671 58,904 55,494 PROPERTY DATA

------------------------------ Total operating properties (end of

period) (b) 188 193 188 193 Total operating apartment homes in

operating properties (end of period) (b) 64,657 66,619 64,657

66,619 Total operating apartment homes (weighted average) 56,161

56,150 56,624 54,368 Total operating apartment homes - excluding

discontinued operations (weighted average) 54,350 52,119 53,880

49,970 (a) The Company's 2005 financial results include the results

of Summit subsequent to February 28, 2005. (b) Includes joint

ventures and properties held for sale. Note: Please refer to the

following pages for definitions and reconciliations of all non-GAAP

financial measures presented in this document. *T -0- *T CAMDEN

FUNDS FROM OPERATIONS (In thousands, except per share and property

data amounts)

----------------------------------------------------------------------

(Unaudited) Three Months Ended Nine Months Ended September 30,

September 30, ------------------- ------------------- FUNDS FROM

OPERATIONS 2006 2005 2006 2005 (a) ------------------------------

------------------- ------------------- Net income (loss) $125,457

($2,317) $201,482 $186,199 Real estate depreciation and

amortization from continuing operations 39,735 43,386 115,964

117,239 Real estate depreciation from discontinued operations 255

1,777 1,350 5,387 Adjustments for unconsolidated joint ventures 760

1,284 2,305 3,249 Income from continuing operations allocated to

common units 12,365 129 14,599 1,626 Income from discontinued

operations allocated to common units 760 112 1,681 343 (Gain) on

sale of operating properties (91,581) - (91,581) (132,117) (Gain)

on sale of discontinued operations (8,842) - (59,886) (36,104)

(Gain) on sale of joint venture properties (1,085) - (2,848) -

------------------- ------------------- Funds from operations -

diluted $77,824 $44,371 $183,066 $145,822 ===================

=================== PER SHARE DATA ------------------------------

Funds from operations - diluted $1.24 $0.76 $3.02 $2.63 Cash

distributions 0.66 0.64 1.98 1.91 Weighted average number of common

and common equivalent shares outstanding: FFO - diluted 62,885

58,600 60,666 55,494 PROPERTY DATA ------------------------------

Total operating properties (end of period) (b) 188 193 188 193

Total operating apartment homes in operating properties (end of

period) (b) 64,657 66,619 64,657 66,619 Total operating apartment

homes (weighted average) 56,161 56,150 56,624 54,368 Total

operating apartment homes - excluding discontinued operations

(weighted average) 54,350 52,119 53,880 49,970 (a) The Company's

2005 financial results include the results of Summit subsequent to

February 28, 2005. (b) Includes joint ventures and properties held

for sale. Note: Please refer to the following pages for definitions

and reconciliations of all non-GAAP financial measures presented in

this document. *T -0- *T CAMDEN BALANCE SHEETS (In thousands)

----------------------------------------------------------------------

(Unaudited) Sep 30, Jun 30, Mar 31, Dec 31, Sep 30, 2006 2006 2006

2005 2005 -------------------------------------------------------

ASSETS Real estate assets, at cost Land $683,645 $697,690 $664,219

$646,854 $660,748 Buildings and improvements 3,988,031 4,074,737

3,892,700 3,840,969 3,881,682

------------------------------------------------------- 4,671,676

4,772,427 4,556,919 4,487,823 4,542,430 Accumulated depreciation

(725,790) (786,208) (732,984) (716,650) (713,991)

------------------------------------------------------- Net

operating real estate assets 3,945,886 3,986,219 3,823,935

3,771,173 3,828,439 Properties under development, including land

351,246 427,500 419,843 372,976 377,787 Investments in joint

ventures 8,266 8,270 8,199 6,096 6,937 Properties held for sale

45,074 55,562 188,477 172,112 51,741

------------------------------------------------------- Total real

estate assets 4,350,472 4,477,551 4,440,454 4,322,357 4,264,904

Accounts receivable - affiliates 33,624 33,408 33,361 34,084 35,313

Notes receivable Affiliates 31,037 23,327 22,531 11,916 11,505

Other 3,855 9,211 13,264 13,261 24,865 Other assets, net (a)

112,801 111,636 102,269 99,516 100,080 Cash and cash equivalents

8,061 49,700 1,256 1,576 1,076 Restricted cash 5,541 5,194 5,269

5,089 5,829 -------------------------------------------------------

Total assets $4,545,391 $4,710,027 $4,618,404 $4,487,799 $4,443,572

======================================================= LIABILITIES

AND SHAREHOLDERS' EQUITY Liabilities Notes payable Unsecured

$1,693,106 $1,940,693 $2,118,403 $2,007,164 $1,903,094 Secured

587,347 620,592 623,250 625,927 661,723 Accounts payable and

accrued expenses 120,566 117,301 116,215 108,979 102,231 Accrued

real estate taxes 41,165 31,280 17,818 26,070 39,740 Other

liabilities (b) 101,332 99,460 98,327 88,811 84,835 Distributions

payable 43,056 43,031 40,612 38,922 38,933

------------------------------------------------------- Total

liabilities 2,586,572 2,852,357 3,014,625 2,895,873 2,830,556

Commitments and contingencies Minority interests Perpetual

preferred units 97,925 97,925 97,925 97,925 97,925 Common units

116,776 106,217 113,034 112,637 115,190 Other minority interests

10,002 10,555 10,512 10,461 10,425

------------------------------------------------------- Total

minority interests 224,703 214,697 221,471 221,023 223,540

Shareholders' equity Common shares of beneficial interest 650 649

610 608 607 Additional paid-in capital 2,176,170 2,172,616

1,908,099 1,902,595 1,899,713 Distributions in excess of net income

(206,442) (293,386) (289,482) (295,074) (273,609) Employee notes

receivable (2,047) (2,035) (2,046) (2,078) (2,087) Treasury shares,

at cost (234,215) (234,871) (234,873) (235,148) (235,148)

------------------------------------------------------- Total

share- holders' equity 1,734,116 1,642,973 1,382,308 1,370,903

1,389,476 -------------------------------------------------------

Total liabilities and share- holders' equity $4,545,391 $4,710,027

$4,618,404 $4,487,799 $4,443,572

======================================================= (a)

includes: net deferred charges of: $11,155 $13,120 $14,079 $13,061

$13,757 value of in place leases of: $452 $431 $1,156 $1,363

$10,561 (b) includes: deferred revenues of: $5,256 $4,408 $4,843

$2,008 $2,152 above/below market leases of: $80 $13 $51 $90 $889

distri- butions in excess of investments in joint ventures of:

$18,044 $12,701 $11,556 $11,256 $18,730 *T -0- *T CAMDEN NON-GAAP

FINANCIAL MEASURES DEFINITIONS & RECONCILIATIONS (In thousands,

except per share amounts)

----------------------------------------------------------------------

(Unaudited) This document contains certain non-GAAP financial

measures management believes are useful in evaluating an equity

REIT's performance. Camden's definitions and calculations of

non-GAAP financial measures may differ from those used by other

REITs, and thus may not be comparable. The non-GAAP financial

measures should not be considered as an alternative to net income

as an indication of our operating performance, or to net cash

provided by operating activities as a measure of our liquidity. FFO

------------------------------ The National Association of Real

Estate Investment Trusts ("NAREIT") currently defines FFO as net

income computed in accordance with generally accepted accounting

principles ("GAAP"), excluding gains or losses from depreciable

operating property sales, plus real estate depreciation and

amortization, and after adjustments for unconsolidated partnerships

and joint ventures. Camden's definition of diluted FFO also assumes

conversion of all dilutive convertible securities, including

minority interests, which are convertible into common equity. The

Company considers FFO to be an appropriate supplemental measure of

operating performance because, by excluding gains or losses on

dispositions of operating properties and excluding depreciation,

FFO can help one compare the operating performance of a company's

real estate between periods or as compared to different companies.

A reconciliation of net income to FFO is provided below: Three

Months Ended Nine Months Ended September 30, September 30,

------------------- ------------------- 2006 2005 2006 2005

------------------- ------------------- Net income (loss) $125,457

($2,317) $201,482 $186,199 Real estate depreciation and

amortization from continuing operations 39,735 43,386 115,964

117,239 Real estate depreciation from discontinued operations 255

1,777 1,350 5,387 Adjustments for unconsolidated joint ventures 760

1,284 2,305 3,249 Income from continuing operations allocated to

common units 12,365 129 14,599 1,626 Income from discontinued

operations allocated to common units 760 112 1,681 343 (Gain) on

sale of operating properties (91,581) - (91,581)(132,117) (Gain) on

sale of discontinued operations (8,842) - (59,886) (36,104) (Gain)

on sale of joint venture properties (1,085) - (2,848) -

------------------- ------------------- Funds from operations -

diluted $77,824 $44,371 $183,066 $145,822 ===================

=================== Weighted average number of common and common

equivalent shares outstanding: EPS diluted 61,250 55,671 58,904

55,494 FFO diluted 62,885 58,600 60,666 55,494 Net income (loss)

per common share - diluted $2.07 ($0.05) $3.46 $3.38 FFO per common

share - diluted $1.24 $0.76 $3.02 $2.63 Expected FFO

------------------------------ Expected FFO is calculated in a

method consistent with historical FFO, and is considered an

appropriate supplemental measure of expected operating performance

when compared to expected net income (EPS). A reconciliation of the

ranges provided for expected net income per diluted share to

expected FFO per diluted share is provided below: 4Q06 Range 2006

Range Low High Low High ------------------- -------------------

Expected net income per share - diluted $0.17 $0.23 $3.60 $3.66

Expected difference between EPS and fully diluted FFO shares (0.03)

(0.03) (0.17) (0.17) Expected real estate depreciation 0.64 0.64

2.57 2.57 Expected adjustments for unconsolidated joint ventures

0.01 0.01 0.05 0.05 Expected income allocated to common units 0.02

0.02 0.29 0.29 Expected (gain) on sale of properties held in joint

ventures 0.00 0.00 (0.05) (0.05) Expected (gain) on sale of

properties and properties held for sale 0.00 0.00 (2.47) (2.47)

------------------- ------------------- Expected FFO per share -

diluted $0.81 $0.87 $3.82 $3.88 Note: This table contains

forward-looking statements. Please see the paragraph regarding

forward-looking statements earlier in this document. *T -0- *T Net

Operating Income (NOI) ------------------------------ NOI is

defined by the Company as total property income less property

operating and maintenance expenses less real estate taxes. The

Company considers NOI to be an appropriate supplemental measure of

operating performance to net income because it reflects the

operating performance of our communities without allocation of

corporate level property management overhead or general and

administrative costs. A reconciliation of net income to net

operating income is provided below: Three Months Ended Nine Months

Ended September 30, September 30, -------------------

------------------- 2006 2005 2006 2005 -------------------

------------------- Net income (loss) $125,457 ($2,317) $201,482

$186,199 Fee and asset management (5,433) (1,789) (11,030) (10,929)

Sale of technology investments (1,602) - (1,602) (24,199) Interest

and other income (1,733) (1,913) (6,097) (6,401) Income on deferred

compensation plans (1,927) (3,209) (4,308) (5,327) Property

management expense 4,629 4,208 13,821 11,350 Fee and asset

management expense 3,689 2,008 8,293 4,999 General and

administrative expense 9,849 6,183 25,299 18,017 Transaction

compensation and merger expenses - - - 14,085 Interest expense

29,176 29,331 91,592 81,416 Depreciation and amortization 40,399

44,030 117,945 119,117 Amortization of deferred financing costs 941

855 2,897 2,872 Expense on deferred compensation plans 1,927 3,209

4,308 5,327 Gain on sale of properties, including land (96,247) -

(97,556)(132,117) Equity in income (loss) of joint ventures (1,628)

1,827 (4,514) 1,472 Distributions on perpetual preferred units

1,750 1,750 5,250 5,278 Original issuance costs on redeemed

perpetual preferred units - - - 365 Income allocated to common

units and other minority interests 12,413 261 14,750 1,756 Income

from discontinued operations (665) (1,481) (4,998) (6,118) Gain on

sale of discontinued operations (29,350) - (80,394) (36,115) Income

from discontinued operations allocated to common units 760 112

1,681 343 ------------------- ------------------- Net Operating

Income (NOI) $92,405 $83,065 $276,819 $231,390 "Same Property"

Communities $78,032 $72,215 $233,936 $197,187 Non-"Same Property"

Communities 8,416 4,939 24,633 12,877 Development and Lease-Up

Communities 2,838 29 5,540 29 Dispositions / Other 3,119 5,882

12,710 21,297 ------------------- ------------------- Net Operating

Income (NOI) $92,405 $83,065 $276,819 $231,390 EBITDA

------------------------------ EBITDA is defined by the Company as

earnings before interest, taxes, depreciation and amortization,

including net operating income from discontinued operations,

excluding equity in income of joint ventures, gain on sale of real

estate assets, and income allocated to minority interests. The

Company considers EBITDA to be an appropriate supplemental measure

of operating performance to net income because it represents income

before non-cash depreciation and the cost of debt, and excludes

gains or losses from property dispositions. A reconciliation of net

income to EBITDA is provided below: Three Months Ended Nine Months

Ended September 30, September 30, -------------------

------------------- 2006 2005 2006 2005 -------------------

------------------- Net income (loss) $125,457 ($2,317) $201,482

$186,199 Interest expense 29,176 29,331 91,592 81,416 Amortization

of deferred financing costs 941 855 2,897 2,872 Depreciation and

amortization 40,399 44,030 117,945 119,117 Distributions on

perpetual preferred units 1,750 1,750 5,250 5,278 Original issuance

costs on redeemed perpetual preferred units - - - 365 Income

allocated to common units and other minority interests 12,413 261

14,750 1,756 Real estate depreciation from discontinued operations

255 1,777 1,350 5,387 Gain on sale of properties, including land

(96,247) - (97,556)(132,117) Equity in income (loss) of joint

ventures (1,628) 1,827 (4,514) 1,472 Gain on sale of discontinued

operations (29,350) - (80,394) (36,115) Income from discontinued

operations allocated to common units 760 112 1,681 343

------------------- ------------------- EBITDA $83,926 $77,626

$254,483 $235,973 *T

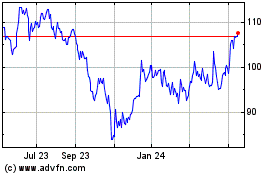

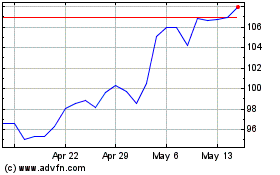

Camden Property (NYSE:CPT)

Historical Stock Chart

From May 2024 to Jun 2024

Camden Property (NYSE:CPT)

Historical Stock Chart

From Jun 2023 to Jun 2024