Camden Property Trust (NYSE:CPT) announced that its funds from

operations ("FFO") for the second quarter of 2006 totaled $0.89 per

diluted share or $53.4 million, as compared to $0.80 per diluted

share or $47.0 million for the same period in 2005. FFO for the six

months ended June 30, 2006 totaled $1.77 per diluted share or

$105.2 million, as compared to $1.88 per diluted share or $101.5

million for the same period in 2005. FFO for the six months ended

June 30, 2005 included a $0.45 per diluted share impact from the

sale of technology investments, and a $0.26 per diluted share

charge for transaction compensation and merger expenses relating to

Camden's merger with Summit Properties Inc. ("Summit"). Net Income

("EPS") The Company reported net income ("EPS") of $34.6 million or

$0.61 per diluted share for the second quarter of 2006, as compared

to $21.9 million or $0.39 per diluted share for the same period in

2005. EPS for the three months ended June 30, 2006 included a $0.43

per diluted share impact from gain on sale of properties and

discontinued operations, as compared to a $0.39 per diluted share

impact for the same period in 2005. For the six months ended June

30, 2006, net income totaled $76.0 million or $1.36 per diluted

share, as compared to $188.5 million or $3.53 per diluted share for

the same period in 2005. EPS for the six months ended June 30, 2006

included a $0.96 per diluted share impact from gain on sale of

land, joint venture properties and discontinued operations. EPS for

the six months ended June 30, 2005 included a $3.12 per diluted

share impact from gain on sale of properties and discontinued

operations, $0.45 per diluted share income from the sale of

technology investments, and a $0.26 per diluted share charge for

transaction compensation and merger expenses relating to Camden's

merger with Summit Properties Inc. A reconciliation of net income

to FFO is included in the financial tables accompanying this press

release. Same-Property Results For the 50,732 apartment homes

included in consolidated same-property results, second quarter 2006

same-property net operating income ("NOI") growth was 8.7% compared

to the second quarter of 2005, with revenues increasing 7.5% and

expenses increasing 5.5%. On a sequential basis, second quarter

2006 same-property NOI increased 1.7% compared to first quarter

2006, with revenues increasing 1.7% and expenses increasing 1.7%

compared to the prior quarter. On a year-to-date basis, 2006

same-property NOI increased 9.5%, with revenue growth of 7.9% and

expense growth of 5.3% compared to the same period in 2005.

Same-property physical occupancy levels for the combined portfolio

averaged 95.7% during the second quarter of 2006, compared to 95.3%

in the second quarter of 2005 and 96.0% in the first quarter of

2006. The Company defines same-property communities as communities

owned by either Camden or Summit and stabilized as of January 1,

2005, excluding properties held for sale. A reconciliation of net

income to net operating income and same-property net operating

income is included in the financial tables accompanying this press

release. Development Activity As of June 30, 2006, Camden had two

completed apartment communities in lease-up: Camden Dilworth in

Charlotte, NC, an $18.0 million project that is currently 94%

leased; and Camden Westwind in Ashburn, VA, a $97.6 million project

that is currently 58% leased. Camden announced two new development

starts during the quarter: Camden Summerfield in Frederick, MD,

with 291 apartment homes; and Camden Orange Court in Orlando, FL,

with 261 apartment homes. Total budgeted costs for those projects

are $68.0 million and $49.0 million, respectively, with initial

occupancy expected to occur in late 2007 and early 2008

respectively. The Company's current development pipeline includes

11 wholly-owned communities with 3,901 apartment homes and a total

budgeted cost of $721.0 million, and two joint venture communities

with 561 apartment homes and a total budgeted cost of $150.0

million. Of those 13 communities, five are currently in lease-up.

Camden Fairfax Corner in Fairfax, VA is currently 81% leased;

Camden Manor Park in Raleigh, NC is currently 57% leased; Camden

Clearbrook in Frederick, MD is currently 31% leased; Camden Royal

Oaks in Houston, TX is currently 23% leased; and Camden Old Creek

in San Marcos, CA is currently 4% leased. Acquisition/Disposition

Activity During the quarter, Camden disposed of three wholly-owned

apartment communities: Camden Pass, a 456-home apartment community

in Tucson, AZ, for $20.3 million; Camden Trails, a 264-home

apartment community in Dallas, TX, for $8.8 million; and Camden

Wilshire, a 536-home apartment community in Houston, TX, for $20.4

million. Gain on sale of those three properties totaled $23.7

million. In addition, the Company sold a 4.7 acre parcel of

undeveloped land in College Park, MD for a gain of $0.8 million.

Subsequent to quarter-end, the company acquired Camden Stoneleigh,

a 390-home apartment community in Austin, TX for $35.3 million, and

disposed of Camden Oaks, a 446-home apartment community in Dallas,

TX, for $19.2 million. The Company also sold Summit Hollow, a

232-home joint venture apartment community in Charlotte, NC for

$15.5 million subsequent to quarter-end. Camden's pro-rata share of

that disposition totaled $3.9 million. Properties and Land Held for

Sale At June 30, 2006, Camden had three operating communities

consisting of 1,260 apartment homes classified as held for sale.

These properties included: Camden Oaks, a 446-home apartment

community in Dallas, TX; Camden Crossing, a 366-home apartment

community in Houston, TX; and Camden Wyndham, a 448-home apartment

community in Houston, TX. The Company also had 13.9 acres of

undeveloped land in Southeast Florida, Dallas, TX and Long Beach,

CA classified as held for sale at quarter-end. Subsequent to

quarter-end, the Company disposed of Camden Oaks. Earnings Guidance

Camden raised its earnings guidance for 2006 FFO. Full-year 2006

FFO is now expected to be $3.60 to $3.75 per diluted share. The

Company also provided guidance of $0.93 to $0.97 per diluted share

for third quarter 2006 FFO. EPS is expected to be $1.87 to $2.02

per diluted share for full-year 2006, and $0.28 to $0.32 per

diluted share for the third quarter of 2006, excluding any future

gains from operating property sales. The Company's 2006 earnings

guidance is based on projections of same-property revenue growth

between 5.75% and 6.75%, same-property expense growth between 4.5%

and 5.5%, same-property NOI growth between 7.0% and 8.0%,

acquisitions of $100 to $200 million, dispositions of $200 to $400

million and future development starts of $150 to $200 million.

Camden updates its earnings guidance to the market on a quarterly

basis. A reconciliation of expected net income to expected FFO is

included in the financial tables accompanying this press release.

Conference Call The Company will hold a conference call on Friday,

August 4, 2006 at 10:00 a.m. Central Time to review its second

quarter results and discuss its outlook for future performance. To

participate in the call, please dial 877-407-0782 (domestic) or

201-689-8567 (international) by 9:50 a.m. Central Time and request

the Camden Property Trust Second Quarter 2006 Earnings Call, or

join the live webcast of the conference call by accessing the

Investor Relations section of the Company's website at

www.camdenliving.com. Supplemental financial information is

available in the Investor Relations section of the Company's

website under Earnings Releases or by calling Camden's Investor

Relations Department at 800-922-6336. Forward-Looking Statements In

addition to historical information, this press release contains

forward-looking statements under the federal securities law. These

statements are based on current expectations, estimates and

projections about the industry and markets in which Camden

operates, management's beliefs, and assumptions made by management.

Forward-looking statements are not guarantees of future performance

and involve certain risks and uncertainties which are difficult to

predict. About Camden Camden Property Trust is a real estate

company engaged in the ownership, development, acquisition,

management and disposition of multifamily apartment communities.

Camden owns interests in and operates 185 properties containing

63,449 apartment homes across the United States. Upon completion of

13 properties under development, the Company's portfolio will

increase to 67,911 apartment homes in 198 properties. For

additional information, please contact Camden's Investor Relations

Department at 800-922-6336 or 713-354-2787 or access our website at

www.camdenliving.com. -0- *T CAMDEN OPERATING RESULTS (In

thousands, except per share and property data amounts)

----------------------------------------------------------------------

(Unaudited) Three Months Ended Six Months Ended June 30, June 30,

------------------ ------------------ OPERATING DATA 2006 2005 2006

2005 (a) ------------------------------ ------------------

------------------ Property revenues Rental revenues $137,591

$123,442 $272,380 $226,224 Other property revenues 13,582 11,056

26,306 20,446 ------------------ ------------------ Total property

revenues 151,173 134,498 298,686 246,670 Property expenses Property

operating and maintenance 40,520 36,259 79,495 68,437 Real estate

taxes 16,296 15,225 32,726 27,847 ------------------

------------------ Total property expenses 56,816 51,484 112,221

96,284 Non-property income Fee and asset management 3,120 1,834

5,597 9,140 Sale of technology investments - - - 24,199 Interest

and other income 3,611 1,265 4,364 4,488 Income on deferred

compensation plans 2,331 2,095 2,381 2,118 ------------------

------------------ Total non-property income 9,062 5,194 12,342

39,945 Other expenses Property management 4,966 3,922 9,192 7,142

Fee and asset management 3,238 1,043 4,604 2,991 General and

administrative 8,036 6,558 15,450 11,834 Transaction compensation

and merger expenses - 261 - 14,085 Interest 31,379 28,584 62,416

52,085 Depreciation and amortization 41,242 44,182 78,295 75,840

Amortization of deferred financing costs 909 796 1,956 2,017

Expense on deferred compensation plans 2,331 2,095 2,381 2,118

------------------ ------------------ Total other expenses 92,101

87,441 174,294 168,112 ------------------ ------------------ Income

from continuing operations before gain on sale of properties,

equity in income of joint ventures and minority interests 11,318

767 24,513 22,219 Gain on sale of properties, including land 810 -

1,309 132,117 Equity in income of joint ventures 569 245 2,886 355

Minority interests: Distributions on perpetual preferred units

(1,750) (1,750) (3,500) (3,528) Original issuance costs on redeemed

perpetual preferred units - - - (365) Income allocated to common

units and other minority interests (1,182) (570) (2,536) (1,703)

------------------ ------------------ Income (loss) from continuing

operations 9,765 (1,308) 22,672 149,095 Income from discontinued

operations 1,165 1,447 3,031 3,329 Gain on sale of discontinued

operations 23,652 21,724 51,044 36,115 Income from discontinued

operations allocated to common units - (11) (722) (23)

------------------ ------------------ Net income $34,582 $21,852

$76,025 $188,516 ================== ================== PER SHARE

DATA ------------------------------ Net income - basic $0.62 $0.41

$1.38 $3.78 Net income - diluted 0.61 0.39 1.36 3.53 Income (loss)

from continuing operations - basic 0.17 (0.02) 0.41 2.99 Income

(loss) from continuing operations - diluted 0.17 (0.03) 0.41 2.80

Weighted average number of common and common equivalent shares

outstanding: Basic 55,506 53,873 54,901 49,909 Diluted 56,683

55,538 56,083 53,916 PROPERTY DATA ------------------------------

Total operating properties (end of period) (b) 186 191 186 191

Total operating apartment homes in operating properties (end of

period) (b) 63,737 65,992 63,737 65,992 Total operating apartment

homes (weighted average) 56,533 56,296 56,855 53,476 Total

operating apartment homes - excluding discontinued operations

(weighted average) 54,772 52,759 54,575 49,826 (a) The Company's

2005 financial results include the results of Summit subsequent to

February 28, 2005. (b) Includes joint ventures and properties held

for sale. Note: Please refer to the following pages for definitions

and reconciliations of all non-GAAP financial measures presented in

this document. CAMDEN FUNDS FROM OPERATIONS (In thousands, except

per share and property data amounts)

----------------------------------------------------------------------

(Unaudited) Three Months Ended Six Months Ended June 30, June 30,

------------------ ------------------ FUNDS FROM OPERATIONS 2006

2005 2006 2005 (a) ------------------------------

------------------ ------------------ Net income $34,582 $21,852

$76,025 $188,516 Real estate depreciation and amortization from

continuing operations 40,579 43,575 76,978 74,606 Real estate

depreciation from discontinued operations - 1,430 346 2,857

Adjustments for unconsolidated joint ventures 764 1,297 1,545 1,965

Income from continuing operations allocated to common units 1,130

572 2,433 1,705 Income from discontinued operations allocated to

common units - 11 722 23 (Gain) on sale of operating properties - -

- (132,117) (Gain) on sale of discontinued operations (23,652)

(21,724) (51,044) (36,104) (Gain) on sale of joint venture

properties - - (1,763) - ------------------ ------------------

Funds from operations - diluted $53,403 $47,013 $105,242 $101,451

================== ================== PER SHARE DATA

------------------------------ Funds from operations - diluted

$0.89 $0.80 $1.77 $1.88 Cash distributions 0.66 0.64 1.32 1.27

Weighted average number of common and common equivalent shares

outstanding: FFO - diluted 60,083 58,407 59,539 53,916 PROPERTY

DATA ------------------------------ Total operating properties (end

of period) (b) 186 191 186 191 Total operating apartment homes in

operating properties (end of period) (b) 63,737 65,992 63,737

65,992 Total operating apartment homes (weighted average) 56,533

56,296 56,855 53,476 Total operating apartment homes - excluding

discontinued operations (weighted average) 54,772 52,759 54,575

49,826 (a) The Company's 2005 financial results include the results

of Summit subsequent to February 28, 2005. (b) Includes joint

ventures and properties held for sale. Note: Please refer to the

following pages for definitions and reconciliations of all non-GAAP

financial measures presented in this document. CAMDEN BALANCE

SHEETS (In thousands) --------------

------------------------------------------------------- (Unaudited)

Jun 30, Mar 31, Dec 31, Sep 30, Jun 30, 2006 2006 2005 2005 2005

------------------------------------------------------- ASSETS Real

estate assets, at cost Land $697,690 $664,219 $646,854 $660,748

$657,433 Buildings and improvements 4,074,737 3,892,700 3,840,969

3,881,682 3,839,732

------------------------------------------------------- 4,772,427

4,556,919 4,487,823 4,542,430 4,497,165 Accumulated depreciation

(786,208) (732,984) (716,650) (713,991) (694,120)

------------------------------------------------------- Net

operating real estate assets 3,986,219 3,823,935 3,771,173

3,828,439 3,803,045 Properties under development, including land

427,500 419,843 372,976 377,787 368,022 Investments in joint

ventures 8,270 8,199 6,096 6,937 11,830 Properties held for sale

55,562 188,477 172,112 51,741 39,930

------------------------------------------------------- Total real

estate assets 4,477,551 4,440,454 4,322,357 4,264,904 4,222,827

Accounts receivable - affiliates 33,408 33,361 34,084 35,313 35,084

Notes receivable Affiliates 23,327 22,531 11,916 11,505 11,108

Other 9,211 13,264 13,261 24,865 32,283 Other assets, net (a)

111,636 102,269 99,516 100,080 101,475 Cash and cash equivalents

49,700 1,256 1,576 1,076 6,432 Restricted cash 5,194 5,269 5,089

5,829 6,375 -------------------------------------------------------

Total assets $4,710,027 $4,618,404 $4,487,799 $4,443,572 $4,415,584

======================================================= LIABILITIES

AND SHAREHOLDERS' EQUITY Liabilities Notes payable Unsecured

$1,940,693 $2,118,403 $2,007,164 $1,903,094 $1,860,107 Secured

620,592 623,250 625,927 661,723 672,557 Accounts payable and

accrued expenses 117,301 116,215 108,979 102,231 104,216 Accrued

real estate taxes 31,280 17,818 26,070 39,740 29,510 Other

liabilities (b) 99,460 98,327 88,811 84,835 62,753 Distributions

payable 43,031 40,612 38,922 38,933 39,513

------------------------------------------------------- Total

liabil- ities 2,852,357 3,014,625 2,895,873 2,830,556 2,768,656

Commitments and contingencies Minority interests Perpetual

preferred units 97,925 97,925 97,925 97,925 97,925 Common units

106,217 113,034 112,637 115,190 118,119 Other minority interests

10,555 10,512 10,461 10,425 9,878

------------------------------------------------------- Total

minority interests 214,697 221,471 221,023 223,540 225,922

Shareholders' equity Common shares of beneficial interest 649 610

608 607 606 Additional paid-in capital 2,172,616 1,908,099

1,902,595 1,899,713 1,895,018 Distributions in excess of net income

(293,386) (289,482) (295,074) (273,609) (236,954) Employee notes

receivable (2,035) (2,046) (2,078) (2,087) (2,084) Treasury shares,

at cost (234,871) (234,873) (235,148) (235,148) (235,580)

------------------------------------------------------- Total

share- holders' equity 1,642,973 1,382,308 1,370,903 1,389,476

1,421,006 -------------------------------------------------------

Total liabil- ities and share- holders' equity $4,710,027

$4,618,404 $4,487,799 $4,443,572 $4,415,584

======================================================= (a)

includes: net deferred charges of: $13,120 $14,079 $13,061 $13,757

$14,266 value of in place leases of: $431 $1,156 $1,363 $10,561

$18,995 (b) includes: deferred revenues of: $4,408 $4,843 $2,008

$2,152 $2,300 above/below market leases of: $13 $51 $90 $889 $1,675

distrib- utions in excess of invest- ments in joint ventures of:

$12,701 $11,556 $11,256 $18,730 $7,446 CAMDEN NON-GAAP FINANCIAL

MEASURES DEFINITIONS & RECONCILIATIONS (In thousands, except

per share amounts)

----------------------------------------------------------------------

(Unaudited) This document contains certain non-GAAP financial

measures that management believes are useful in evaluating an

equity REIT's performance. Camden's definitions and calculations of

non-GAAP financial measures may differ from those used by other

REITs, and thus may not be comparable. The non-GAAP financial

measures should not be considered as an alternative to net income

as an indication of our operating performance, or to net cash

provided by operating activities as a measure of our liquidity. FFO

--- The National Association of Real Estate Investment Trusts

("NAREIT") currently defines FFO as net income computed in

accordance with generally accepted accounting principles ("GAAP"),

excluding gains or losses from depreciable operating property

sales, plus real estate depreciation and amortization, and after

adjustments for unconsolidated partnerships and joint ventures.

Camden's definition of diluted FFO also assumes conversion of all

dilutive convertible securities, including minority interests,

which are convertible into common equity. The Company considers FFO

to be an appropriate supplemental measure of operating performance

because, by excluding gains or losses on dispositions of operating

properties and excluding depreciation, FFO can help one compare the

operating performance of a company's real estate between periods or

as compared to different companies. A reconciliation of net income

to FFO is provided below: Three Months Ended Six Months Ended June

30, June 30, -------------------- -------------------- 2006 2005

2006 2005 -------------------- -------------------- Net income

$34,582 $21,852 $76,025 $188,516 Real estate depreciation and

amortization from continuing operations 40,579 43,575 76,978 74,606

Real estate depreciation from discontinued operations - 1,430 346

2,857 Adjustments for unconsolidated joint ventures 764 1,297 1,545

1,965 Income from continuing operations allocated to common units

1,130 572 2,433 1,705 Income from discontinued operations allocated

to common units - 11 722 23 (Gain) on sale of operating properties

- - - (132,117) (Gain) on sale of discontinued operations (23,652)

(21,724) (51,044) (36,104) (Gain) on sale of joint venture

properties - - (1,763) - -------------------- --------------------

Funds from operations - diluted $53,403 $47,013 $105,242 $101,451

==================== ==================== Weighted average number

of common and common equivalent shares outstanding: EPS diluted

56,683 55,538 56,083 53,916 FFO diluted 60,083 58,407 59,539 53,916

Net income per common share - diluted $0.61 $0.39 $1.36 $3.53 FFO

per common share - diluted $0.89 $0.80 $1.77 $1.88 Expected FFO

------------ Expected FFO is calculated in a method consistent with

historical FFO, and is considered an appropriate supplemental

measure of expected operating performance when compared to expected

net income (EPS). A reconciliation of the ranges provided for

expected net income per diluted share to expected FFO per diluted

share is provided below: 3Q06 Range 2006 Range Low High Low High

-------------------- -------------------- Expected net income per

share - diluted $0.28 $0.32 $1.87 $2.02 Expected real estate

depreciation 0.61 0.61 2.44 2.44 Expected adjustments for

unconsolidated joint ventures 0.01 0.01 0.05 0.05 Expected income

allocated to common units 0.02 0.02 0.10 0.10 Expected (gain) on

sale of properties held in joint ventures 0.00 0.00 (0.03) (0.03)

Expected (gain) on sale of properties and properties held for sale

0.00 0.00 (0.83) (0.83) -------------------- --------------------

Expected FFO per share - diluted $0.93 $0.97 $3.60 $3.75 Note: This

table contains forward-looking statements. Please see the paragraph

regarding forward-looking statements earlier in this document. Net

Operating Income (NOI) -------------------------- NOI is defined by

the Company as total property income less property operating and

maintenance expenses less real estate taxes. The Company considers

NOI to be an appropriate supplemental measure of operating

performance to net income because it reflects the operating

performance of our communities without allocation of corporate

level property management overhead or general and administrative

costs. A reconciliation of net income to net operating income is

provided below: Three Months Ended Six Months Ended June 30, June

30, -------------------- -------------------- 2006 2005 2006 2005

-------------------- -------------------- Net income $34,582

$21,852 $76,025 $188,516 Fee and asset management (3,120) (1,834)

(5,597) (9,140) Sale of technology investments - - - (24,199)

Interest and other income (3,611) (1,265) (4,364) (4,488) Income on

deferred compensation plans (2,331) (2,095) (2,381) (2,118)

Property management expense 4,966 3,922 9,192 7,142 Fee and asset

management expense 3,238 1,043 4,604 2,991 General and

administrative expense 8,036 6,558 15,450 11,834 Transaction

compensation and merger expenses - 261 - 14,085 Interest expense

31,379 28,584 62,416 52,085 Depreciation and amortization 41,242

44,182 78,295 75,840 Amortization of deferred financing costs 909

796 1,956 2,017 Expense on deferred compensation plans 2,331 2,095

2,381 2,118 Gain on sale of properties, including land (810) -

(1,309) (132,117) Equity in income of joint ventures (569) (245)

(2,886) (355) Distributions on perpetual preferred units 1,750

1,750 3,500 3,528 Original issuance costs on redeemed perpetual

preferred units - - - 365 Income allocated to common units and

other minority interests 1,182 570 2,536 1,703 Income from

discontinued operations (1,165) (1,447) (3,031) (3,329) Gain on

sale of discontinued operations (23,652) (21,724) (51,044) (36,115)

Income from discontinued operations allocated to common units - 11

722 23 -------------------- -------------------- Net Operating

Income (NOI) $94,357 $83,014 $186,465 $150,386 "Same Property"

Communities $83,908 $77,187 $166,386 $135,252 Non-"Same Property"

Communities 7,963 4,431 16,100 7,938 Development and Lease-Up

Communities 1,908 - 2,819 - Dispositions/Other 578 1,396 1,160

7,196 -------------------- -------------------- Net Operating

Income (NOI) $94,357 $83,014 $186,465 $150,386 EBITDA ------ EBITDA

is defined by the Company as earnings before interest, taxes,

depreciation and amortization, including net operating income from

discontinued operations, excluding equity in income of joint

ventures, gain on sale of real estate assets, and income allocated

to minority interests. The Company considers EBITDA to be an

appropriate supplemental measure of operating performance to net

income because it represents income before non-cash depreciation

and the cost of debt, and excludes gains or losses from property

dispositions. A reconciliation of net income to EBITDA is provided

below: Three Months Ended Six Months Ended June 30, June 30,

-------------------- -------------------- 2006 2005 2006 2005

-------------------- -------------------- Net income $34,582

$21,852 $76,025 $188,516 Interest expense 31,379 28,584 62,416

52,085 Amortization of deferred financing costs 909 796 1,956 2,017

Depreciation and amortization 41,242 44,182 78,295 75,840

Distributions on perpetual preferred units 1,750 1,750 3,500 3,528

Original issuance costs on redeemed perpetual preferred units - - -

365 Income allocated to common units and other minority interests

1,182 570 2,536 1,703 Real estate depreciation from discontinued

operations - 1,430 346 2,857 Gain on sale of properties, including

land (810) - (1,309) (132,117) Equity in income of joint ventures

(569) (245) (2,886) (355) Gain on sale of discontinued operations

(23,652) (21,724) (51,044) (36,115) Income from discontinued

operations allocated to common units - 11 722 23

-------------------- -------------------- EBITDA $86,013 $77,206

$170,557 $158,347 *T

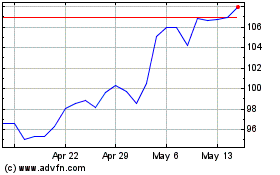

Camden Property (NYSE:CPT)

Historical Stock Chart

From May 2024 to Jun 2024

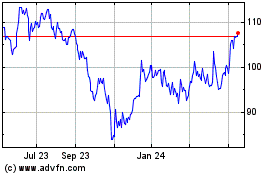

Camden Property (NYSE:CPT)

Historical Stock Chart

From Jun 2023 to Jun 2024