Weak Market Conditions Result in Lower Revenues and Earnings; Focus

on Cash Flow and Cost Reductions LAKE FOREST, Ill., Jan. 29

/PRNewswire-FirstCall/ -- Brunswick Corporation (NYSE:BC) reported

today results for the fourth quarter of 2008, which included the

following: -- Total sales for the fourth quarter of $837.7 million

were down 42 percent versus a year ago, primarily the result of

marine sales that had dropped 50 percent, as weakness in the global

marine marketplace accelerated during the quarter. -- A net loss

from continuing operations of $66.3 million, or $0.75 per diluted

share, for the fourth quarter of 2008, which includes $0.34 per

diluted share of restructuring charges, $0.59 per diluted share of

non- cash tax charges and a benefit of $0.56 per diluted share from

the reversal of variable compensation accruals. -- Cash on hand at

year's end was $317.5 million, down slightly from the 2007 year-end

balance of $331.4 million. "The continued decline in global

recreational marine markets experienced throughout the first nine

months of the year increased during the fourth quarter of 2008,

driven by the accelerating decline in global economic conditions.

We also began to see the weakening global economy affect our

Fitness and Bowling & Billiards segments in the quarter," said

Brunswick's Chairman and Chief Executive Officer Dustan E. McCoy.

"In this difficult economic climate we remain focused on three

principles: -- "Maintain strong liquidity, without increasing debt.

We ended the year with $317.5 million of cash without any

borrowings under our revolving credit agreement, compared with

$331.4 million of cash at year-end 2007. We also enhanced our

liquidity and financial flexibility by completing an amendment to

our revolving credit facility in the fourth quarter of 2008; --

"Take actions necessary to maintain dealer health. During 2008 we

reduced the dealer pipeline by 6,700 units, a 22 percent reduction,

and ended the year with 34.5 weeks of product in the pipeline on a

trailing 12 months retail basis, compared with 34 weeks at the end

of 2007. Our weeks-on-hand and the decline in the absolute number

of boats in the pipeline are remarkable in the current retail

environment, but burdened our earnings as we exited 2008 with the

percentage decline in our fiberglass boat manufacturing volumes

more than double the percentage of decline we saw in retail demand;

and, -- "Position our businesses to emerge from the global economic

crisis stronger than before. Brunswick continues to execute a

comprehensive set of plans to reduce our manufacturing footprint,

reduce brands and models, reduce headcount, consolidate functional

activities across businesses, reduce fixed costs, improve our

sourcing and logistics effectiveness, reduce layers of management,

consolidate businesses, and a myriad of other actions to improve

our costs, productivity and effectiveness in the future. The

results of our work to date are demonstrated by significant

reductions in operating expenses and improving the operating

leverage decline as our sales weaken. These actions position

Brunswick to exit this global economic crisis with a significantly

improved cost structure, a more agile operating model and an

increased focus on the most profitable segments of our business."

Fourth Quarter Results For the quarter ended Dec. 31, 2008, the

company reported net sales of $837.7 million, down from $1,436.0

million a year earlier. For the quarter, the company reported an

operating loss of $38.4 million, which included $48.9 million of

restructuring charges and an $81.2 million benefit from the

reversal of variable compensation accruals which benefited each of

our operating segments. In the fourth quarter of 2007, the company

had operating earnings of $14.2 million, which included $8.8

million of restructuring charges. For the fourth quarter of 2008,

Brunswick reported a net loss from continuing operations of $66.3

million, or $0.75 per diluted share, as compared with net earnings

from continuing operations of $12.1 million, or $0.14 per diluted

share for the fourth quarter of 2007. Diluted earnings per share

for the fourth quarter of 2008 included restructuring charges of

$0.34 per diluted share, non-cash tax charges of $0.59 per diluted

share and a benefit from the reversal of variable compensation

accruals of $0.56 per diluted share. Diluted earnings per share for

the fourth quarter of 2007 included $0.07 per diluted share of

restructuring charges and $0.05 per diluted share of tax-related

benefits. 2008 Results For the year ended Dec. 31, 2008, the

company had net sales of $4,708.7 million, compared with $5,671.2

million in 2007. For the year, Brunswick reported an operating loss

of $611.6 million, including $511.1 million of non- cash goodwill

and trade name impairment charges and $177.3 million of

restructuring charges. This compares with operating earnings of

$107.2 million in 2007, which included $66.4 million of trade name

impairment charges and $22.2 million of restructuring charges. For

2008, the company had a net loss from continuing operations of

$788.1 million, or $8.93 per diluted share, which included $4.43

per diluted share of goodwill and trade name impairment charges,

$1.25 per diluted share of restructuring charges, $0.11 per diluted

share gain on investment sales and $3.90 per diluted share of

non-cash tax charges, primarily related to amounts prescribed by

SFAS No. 109, "Accounting for Income Taxes" and FIN 48, "Accounting

for Uncertainty in Income Taxes." This compares with net earnings

from continuing operations of $79.6 million, or $0.88 per diluted

share in 2007, which included $0.46 per diluted share of trade name

impairment charges, $0.17 per diluted share of restructuring

charges, and $0.11 per diluted share benefit from special tax

items. Boat Segment The Brunswick Boat Group comprises the Boat

segment and includes 17 boat brands, as well as a marine parts and

accessories business. The Boat segment reported net sales for the

fourth quarter of 2008 of $293.7 million, down 54 percent compared

with $645.2 million in the fourth quarter of 2007. International

sales, which represented 57 percent of total segment sales in the

quarter, increased by 6 percent during the period. For the fourth

quarter of 2008, the Boat segment reported an operating loss of

$63.9 million, including restructuring charges of $40.6 million.

This compares with an operating loss of $29.9 million, including

restructuring charges of $6.0 million in the fourth quarter of

2007. For 2008, Boat segment sales were down approximately 25

percent to $2,011.9 million from $2,690.9 million in 2007.

International sales, which represented 38 percent of total segment

sales in 2008, increased by 13 percent on a year-to-year basis. For

the year, the Boat segment reported an operating loss of $653.7

million for 2008, including goodwill and trade name impairment

charges of $483.7 million and restructuring charges of $101.7

million. This compares with an operating loss of $81.4 million for

2007, including $66.4 million of trade name impairment charges and

$15.9 million in restructuring charges. "In 2008, we continued to

take a number of significant steps to both address the deepening

drop in demand in global marine markets, as well as position our

boat businesses to move forward aggressively when markets

stabilize," McCoy explained. "We reduced production, brands,

models, the manufacturing footprint, employees, functions,

non-manufacturing facilities and other costs, while taking steps to

improve productivity and effectiveness by such actions as moving

multiple brands into single production facilities." Marine Engine

Segment The Marine Engine segment, consisting of the Mercury Marine

Group, reported net sales of $297.5 million in the fourth quarter

of 2008, down 46 percent from $548.6 million in the year-ago fourth

quarter. International sales, which represented 55 percent of total

segment sales in the quarter, declined by 42 percent on a

year-to-year basis. For the fourth quarter, the Marine Engine

segment reported an operating loss of $8.4 million, which benefited

from a $2.0 million gain related to restructuring activities. This

compares with operating earnings of $21.2 million in the year-ago

quarter. For the full year, Marine Engine segment net sales were

down 17 percent to $1,955.9 million from $2,357.5 million.

International sales, which represented 53 percent of total segment

sales in 2008, declined by 8 percent on a year-to- year basis.

Operating earnings for the full year in 2008 were $68.3 million

versus $183.7 million in 2007. In 2008, the segment recorded $4.5

million of trade name impairments and $29.4 million of

restructuring charges, compared with $3.4 million of restructuring

charges during the same period in 2007. For the quarter, sales were

off across all Marine Engine operations, including a double-digit,

year-over-year drop in markets outside the United States,

reflecting the breadth and rapid decline in the global marine

marketplace. In the United States, declines in outboard and

sterndrive sales tracked those of boat results, reflecting the

difficult market conditions in the final three months of 2008.

Consistent with actions taken in the Boat Group, Mercury also cut

production rates and instituted plant furloughs during the quarter

to address pipeline levels. Reduced fixed-cost absorption on lower

sales had an adverse effect on operating earnings. Fitness Segment

The Fitness segment is comprised of the Life Fitness Division,

which manufactures and sells Life Fitness and Hammer Strength

fitness equipment. Fitness segment sales in the fourth quarter of

2008 totaled $171.8 million, down 20 percent from $214.5 million in

the year-ago quarter. International sales, which represented 49

percent of total segment sales in the quarter, declined by 18

percent on a year-to-year basis. Operating earnings declined 21

percent to $25.6 million from $32.4 million. The segment recorded

$1.2 million in restructuring charges during the fourth quarter of

2008. For 2008, the Fitness segment reported net sales of $639.5

million, down 2 percent from $653.7 million in 2007. International

sales, which represented 49 percent of total segment sales in 2008,

increased by 3 percent on a year- to-year basis. Operating earnings

in 2008 declined 13 percent to $52.2 million from $59.7 million.

The segment recorded $3.3 million in restructuring charges for the

full year during 2008. Commercial equipment sales, which account

for the largest percentage of Fitness segment sales, declined by

double digits in the quarter as gym and fitness club operators were

cautious about ordering equipment in the final months of the year.

Consumer sales also were down double digits year-over- year,

reflecting the effects of the weakening economy. Likewise,

international sales were off, particularly in Europe, due to

increasing economic pressures during the quarter. Operating

earnings reflected the favorable effects of continued efforts to

reduce operating costs, but were offset by reduced sales levels and

higher steel and fuel costs, which did not begin to subside until

late in the quarter. Bowling & Billiards Segment The Bowling

& Billiards segment is comprised of the Brunswick retail

bowling centers; bowling equipment and products; and billiards, Air

Hockey and foosball tables. Segment sales in the fourth quarter of

2008 totaled $113.2 million, down 8 percent compared with $123.3

million in the year-ago quarter. Operating earnings in the quarter

were $16.6 million versus $11.1 million in the comparable quarter

in 2007, which included $3.8 million and $2.8 million of

restructuring costs in 2008 and 2007, respectively. For 2008, the

segment reported net sales of $448.3 million, slightly higher than

$446.9 million recorded for 2007. For the year, the segment had an

operating loss of $12.7 million, which included $22.9 million of

goodwill and trade name impairments, and $21.7 million of

restructuring charges. The segment's 2007 operating earnings of

$16.5 million included $2.8 million in restructuring charges. For

the quarter, a mid-single digit increase in bowling product sales

partially offset lower sales in billiards and retail bowling.

Although historically recession resistant, economic pressures drove

revenues lower by mid-single digits at retail bowling centers.

Operating earnings benefited from cost reductions throughout the

segment, partially offset by lower levels of revenue. Company

Outlook "As we had anticipated, 2008 proved to be a very

challenging year for our businesses and we expect 2009 to also be

difficult. We will continue to focus on maintaining our strong

liquidity, taking actions necessary to maintain dealer health and

positioning ourselves to exit this global downturn as a better

business," McCoy said. "Although we have limited visibility to a

very volatile marketplace entering the year, we expect our revenues

to be lower in 2009 with higher relative percentage declines

occurring in the first half of the year. Our expectation of lower

revenues reflects our view that retail demand will continue to

decline, at least through the first six months of the year, and we

are planning for production at rates well below the retail rate of

decline. "Our overall profitability versus 2008 will be affected by

the expected lower production and sales levels, restructuring

charges that will decline to approximately $50 million pretax and

incremental pension-related expenses of $75 million pretax.

Partially offsetting these factors will be nearly $200 million of

net cost reductions resulting from the full-year effect of actions

taken in 2008, as well as further cost reduction activities

implemented and planned in 2009. "Liquidity remains important, and

although our earnings will be down significantly, we believe we can

exit 2009 with cash at or above the amount that we reported on our

balance sheet at year-end 2008, without increased borrowings. This

net result will be reflective of our continued focus on managing

our businesses for cash, which includes vigorous working capital

management plans, primarily centered on reducing our overall

inventory levels. "We will continue to carefully and periodically

evaluate our re-sizing efforts, including manufacturing footprint,

production levels and work force requirements, as the market

continues to evolve, while weighing capital spending needs and

pursuing continued cost savings efforts. We believe when this

economic downturn subsides, we will be well positioned to compete

and prosper," McCoy said. Conference Call Scheduled Brunswick will

host a conference call today at 10 a.m. CST, hosted by Dustan E.

McCoy, chairman and chief executive officer, Peter B. Hamilton,

senior vice president and chief financial officer, and Bruce J.

Byots, vice president -- corporate and investor relations. The call

will be broadcast over the Internet at http://www.brunswick.com/.

To listen to the call, go to the Web site at least 15 minutes

before the call to register, download and install any needed audio

software. Security analysts and investors wishing to participate

via telephone should call (800) 857-1754 (passcode: Brunswick Q4).

Callers outside of North America should call +1 (517) 308-9227 to

be connected. These numbers can be accessed 15 minutes before the

call begins, as well as during the call. A replay of the conference

call will be available through midnight CST Thursday, Feb. 5, 2009,

by calling (888) 568-0334 or (402) 530-7881. The replay will also

be available at http://www.brunswick.com/. Forward-Looking

Statements Certain statements in this news release are forward

looking as defined in the Private Securities Litigation Reform Act

of 1995. These statements involve certain risks and uncertainties

that may cause actual results to differ materially from

expectations as of the date of this news release. These risks

include, but are not limited to: the effect of (i) the amount of

disposable income available to consumers for discretionary

purchases, and (ii) the level of consumer confidence on the demand

for marine, fitness, billiards and bowling equipment, products and

services; the ability to successfully complete restructuring

efforts in the timeframe and cost anticipated; the ability to

successfully complete the disposition of non-core assets; the

effect of higher product prices due to technology changes and added

product features and components on consumer demand; the effect of

competition from other leisure pursuits on the level of

participation in boating, fitness, bowling and billiards

activities; the effect of interest rates and fuel prices on demand

for marine products; the ability to successfully manage pipeline

inventories; the financial strength of dealers, distributors and

independent boat builders; the ability to maintain mutually

beneficial relationships with dealers, distributors and independent

boat builders; the ability to maintain effective distribution and

to develop alternative distribution channels without disrupting

incumbent distribution partners; the ability to maintain market

share, particularly in high-margin products; the success of new

product introductions; the ability to maintain product quality and

service standards expected by customers; competitive pricing

pressures; the ability to develop cost-effective product

technologies that comply with regulatory requirements; the ability

to transition and ramp up certain manufacturing operations within

time and budgets allowed; the ability to successfully develop and

distribute products differentiated for the global marketplace;

shifts in currency exchange rates; adverse foreign economic

conditions; the success of global sourcing and supply chain

initiatives; the ability to obtain components and raw materials

from suppliers; increased competition from Asian competitors;

competition from new technologies; the ability to complete

environmental remediation efforts and resolve claims and litigation

at the cost estimated; and the effect of weather conditions on

demand for marine products and retail bowling center revenues.

Additional factors are included in the company's Annual Report on

Form 10-K for 2007 and Quarterly Report on Form 10-Q/A for the

quarter ended Sept. 27, 2008. About Brunswick Headquartered in Lake

Forest, Ill., Brunswick Corporation endeavors to instill "Genuine

Ingenuity"(TM) in all its leading consumer brands, including

Mercury and Mariner outboard engines; Mercury MerCruiser

sterndrives and inboard engines; MotorGuide trolling motors;

Teignbridge propellers; Arvor, Bayliner, Bermuda, Boston Whaler,

Cabo Yachts, Crestliner, Cypress Cay, Harris, Hatteras, Kayot,

Lowe, Lund, Maxum, Meridian, Ornvik, Princecraft, Quicksilver,

Rayglass, Sea Ray, Sealine, Triton, Trophy, Uttern and Valiant

boats; Attwood marine parts and accessories; Land 'N' Sea, Kellogg

Marine, Diversified Marine and Benrock parts and accessories

distributors; IDS dealer management systems; Life Fitness and

Hammer Strength fitness equipment; Brunswick bowling centers,

equipment and consumer products; Brunswick billiards tables; and

Dynamo, Tornado and Valley pool tables, Air Hockey and foosball

tables. For more information, visit http://www.brunswick.com/.

Brunswick Corporation Comparative Consolidated Statements of

Operation (in millions, except per share data) Three Months Ended

December 31 2008 2007 % Change (unaudited) Net sales $837.7

$1,436.0 -42% Cost of sales 719.8 1,174.5 -39% Selling, general and

administrative expense 82.3 204.2 -60% Research and development

expense 25.1 34.3 -27% Goodwill impairment charges - - NM Trade

name impairment charges - - NM Restructuring, exit and other

impairment charges 48.9 8.8 NM Operating earnings (loss) (38.4)

14.2 NM Equity earnings (loss) (3.6) 4.9 NM Investment sale gain -

- NM Other income (expense), net (4.2) 0.5 NM Earnings (loss)

before interest and income taxes (46.2) 19.6 NM Interest expense

(18.6) (12.6) -48% Interest income 1.3 3.1 -58% Earnings (loss)

before income taxes (63.5) 10.1 NM Income tax provision (benefit)

2.8 (2.0) Net earnings (loss) from continuing operations (66.3)

12.1 NM Discontinued operations: Loss from discontinued operations,

net of tax - (6.4) NM Gain on disposal of discontinued operations,

net of tax - 1.1 NM Net loss from discontinued operations - (5.3)

NM Net earnings (loss) $(66.3) $6.8 NM Earnings per common share:

Basic Net earnings (loss) from continuing operations $(0.75) $0.14

NM Loss from discontinued operations, net of tax - (0.07) NM Gain

on disposal of discontinued operations, net of tax - 0.01 NM Net

earnings (loss) $(0.75) $0.08 NM Diluted Net earnings (loss) from

continuing operations $(0.75) $0.14 NM Loss from discontinued

operations, net of tax - (0.07) NM Gain on disposal of discontinued

operations, net of tax - 0.01 NM Net earnings (loss) $(0.75) $0.08

NM Weighted average shares used for computation of: Basic earnings

per share 88.3 88.5 0% Diluted earnings per share 88.3 88.6 0%

Effective tax rate -4.4% -19.8% Supplemental Information Diluted

net earnings (loss) from continuing operations $(0.75) $0.14 NM

Restructuring, exit and other impairment charges, net of tax 0.34

0.07 NM Special tax items 0.59 (0.05) NM Diluted net earnings from

continuing operations, as adjusted $0.18 $0.16 13% Brunswick

Corporation Comparative Consolidated Statements of Operation (in

millions, except per share data) Years Ended December 31 2008 2007

% Change (unaudited) Net sales $4,708.7 $5,671.2 -17% Cost of sales

3,841.3 4,513.4 -15% Selling, general and administrative expense

668.4 827.5 -19% Research and development expense 122.2 134.5 -9%

Goodwill impairment charges 377.2 - NM Trade name impairment

charges 133.9 66.4 NM Restructuring, exit and other impairment

charges 177.3 22.2 NM Operating earnings (loss) (611.6) 107.2 NM

Equity earnings 6.5 21.3 -69% Investment sale gains 23.0 - NM Other

income (expense), net (2.6) 7.8 NM Earnings (loss) before interest

and income taxes (584.7) 136.3 NM Interest expense (54.2) (52.3)

-4% Interest income 6.7 8.7 -23% Earnings (loss) before income

taxes (632.2) 92.7 NM Income tax provision 155.9 13.1 Net earnings

(loss) from continuing operations (788.1) 79.6 NM Discontinued

operations: Earnings from discontinued operations, net of tax - 2.2

NM Gain on disposal of discontinued operations, net of tax - 29.8

NM Net earnings from discontinued operations - 32.0 NM Net earnings

(loss) $(788.1) $111.6 NM Earnings per common share: Basic Net

earnings (loss) from continuing operations $(8.93) $0.88 NM

Earnings from discontinued operations, net of tax - 0.02 NM Gain on

disposal of discontinued operations, net of tax - 0.34 NM Net

earnings (loss) $(8.93) $1.24 NM Diluted Net earnings (loss) from

continuing operations $(8.93) $0.88 NM Earnings from discontinued

operations, net of tax - 0.02 NM Gain on disposal of discontinued

operations, net of tax - 0.34 NM Net earnings (loss) $(8.93) $1.24

NM Weighted average shares used for computation of: Basic earnings

per share 88.3 89.8 -2% Diluted earnings per share 88.3 90.2 -2%

Effective tax rate -24.7% 14.1% Supplemental Information Diluted

net earnings (loss) from continuing operations $(8.93) $0.88 NM

Goodwill impairment charges, net of tax 3.40 - NM Trade name

impairment charges, net of tax 1.03 0.46 NM Restructuring, exit and

other impairment charges, net of tax 1.25 0.17 NM NBK investment

sale gain, net of tax (0.11) - NM Special tax items 3.90 (0.11) NM

Diluted net earnings from continuing operations, as adjusted $0.54

$1.40 -61% Brunswick Corporation Selected Financial Information (in

millions) (unaudited) Segment Information Three Months Ended

December 31 Operating Net Sales Operating Earnings(1) Margin 2008

2007 Change 2008 2007 Change 2008 2007 Boat $293.7 $645.2 -54%

$(63.9) $(29.9) NM -21.8% -4.6% Marine Engine 297.5 548.6 -46%

(8.4) 21.2 NM -2.8% 3.9% Marine eliminations(38.4) (95.6) - - Total

Marine 552.8 1,098.2 -50% (72.3) (8.7) NM -13.1% -0.8% Fitness

171.8 214.5 -20% 25.6 32.4 -21% 14.9% 15.1% Bowling & Billiards

113.2 123.3 -8% 16.6 11.1 50% 14.7% 9.0% Eliminations (0.1) - - -

Corp/Other - - (8.3) (20.6) 60% Total $837.7 $1,436.0 -42% $(38.4)

$14.2 NM -4.6% 1.0% Years Ended December 31 Operating Net Sales

Operating Earnings(2) Margin 2008 2007 Change 2008 2007 Change 2008

2007 Boat $2,011.9 $2,690.9 -25% $(653.7) $(81.4) NM -32.5% -3.0%

Marine Engine 1,955.9 2,357.5 -17% 68.3 183.7 -63% 3.5% 7.8% Marine

elimin- ations (346.7) (477.6) - - Total Marine 3,621.1 4,570.8

-21% (585.4) 102.3 NM -16.2% 2.2% Fitness 639.5 653.7 -2% 52.2 59.7

-13% 8.2% 9.1% Bowling & Billiards 448.3 446.9 0% (12.7) 16.5

NM -2.8% 3.7% Elimin- ations (0.2) (0.2) - - Corp/ Other - - (65.7)

(71.3) 8% Total $4,708.7 $5,671.2 -17% $(611.6) $107.2 NM -13.0%

1.9% (1) Operating earnings in the fourth quarter of 2008 include

$48.9 million of pretax restructuring, exit and other impairment

charges. The $48.9 million charge consists of $40.6 million in the

Boat segment, ($2.0) million in the Marine Engine segment, $3.8

million in the Bowling & Billiards segment, $1.2 million in the

Fitness segment and $5.3 million in Corp/Other. Operating earnings

in the fourth quarter of 2007 include $8.8 million of pretax

restructuring, exit and other impairment charges. The $8.8 million

consists of $6.0 million in the Boat segment and $2.8 million in

the Bowling & Billiards segment. (2) Operating earnings in 2008

include $688.4 million of pretax goodwill impairment charges, trade

name impairment charges and restructuring, exit and other

impairment charges. The $688.4 million consists of $585.4 million

in the Boat segment, $33.9 million in the Marine Engine segment,

$44.6 million in the Bowling & Billiards segment, $3.3 million

in the Fitness segment and $21.2 million in Corp/Other. Operating

earnings in 2007 include $88.6 million of pretax trade name

impairment charges and restructuring, exit and other impairment

charges. The $88.6 million consists of $82.3 million in the Boat

segment, $3.4 million in the Marine Engine segment, $2.8 million in

the Bowling & Billiards segment and $0.1 million in Corp/Other.

Brunswick Corporation Comparative Condensed Consolidated Balance

Sheets (in millions) December 31, December 31, 2008 2007

(unaudited) Assets Current assets Cash and cash equivalents $317.5

$331.4 Accounts and notes receivables, net 444.8 572.4 Inventories

Finished goods 457.7 446.7 Work-in-process 248.2 323.4 Raw

materials 105.8 136.6 Net inventories 811.7 906.7 Deferred income

taxes 103.2 249.9 Prepaid expenses and other 59.7 53.9 Current

assets 1,736.9 2,114.3 Net property 917.6 1,052.8 Other assets

Goodwill, net 290.9 678.9 Other intangibles, net 86.6 245.6

Investments 75.4 132.1 Other long-term assets 116.5 141.9 Other

assets 569.4 1,198.5 Total assets $3,223.9 $4,365.6 Liabilities and

shareholders' equity Current liabilities Short-term debt $3.2 $0.8

Accounts payable 301.3 437.3 Accrued expenses 696.7 858.1 Current

liabilities 1,001.2 1,296.2 Long-term debt 728.5 727.4 Other

long-term liabilities 764.3 449.1 Common shareholders' equity 729.9

1,892.9 Total liabilities and shareholders' equity $3,223.9

$4,365.6 Supplemental Information Debt-to-capitalization rate 50.1%

27.8% Brunswick Corporation Comparative Condensed Consolidated

Statements of Cash Flows (in millions) Year Ended December 31 2008

2007 (unaudited) Cash flows from operating activities Net earnings

(loss) $(788.1) $111.6 Less: net earnings from discontinued

operations - 32.0 Net earnings (loss) from continuing operations

(788.1) 79.6 Depreciation and amortization 177.2 180.1 Changes in

non-cash current assets and current liabilities (100.0) 3.5

Goodwill impairment charges 377.2 - Trade name impairment charges

133.9 66.4 Other impairment charges 53.2 0.4 Income taxes and

other, net 134.5 14.1 Net cash provided by (used for) operating

activities of continuing operations (12.1) 344.1 Net cash used for

operating activities of discontinued operations - (29.8) Net cash

provided by (used for) operating activities (12.1) 314.3 Cash flows

from investing activities Capital expenditures (102.0) (207.7)

Acquisitions of businesses, net of cash acquired - (6.2)

Investments 20.0 4.1 Proceeds from investment sales 45.5 - Proceeds

from sale of property, plant and equipment 28.3 10.1 Other, net

17.2 25.6 Net cash provided by (used for) investing activities of

continuing operations 9.0 (174.1) Net cash provided by investing

activities of discontinued operations - 75.6 Net cash provided by

(used for) investing activities 9.0 (98.5) Cash flows from

financing activities Net issuances of short-term debt (7.4) - Net

proceeds from issuance of long-term debt 252.0 0.7 Payments of

long-term debt including current maturities (251.0) (0.9) Cash

dividends paid (4.4) (52.6) Stock repurchases - (125.8) Stock

options exercised - 10.8 Net cash used for financing activities of

continuing operations (10.8) (167.8) Net cash used for financing

activities of discontinued operations - - Net cash used for

financing activities (10.8) (167.8) Net increase (decrease) in cash

and cash equivalents (13.9) 48.0 Cash and cash equivalents at

beginning of period 331.4 283.4 Cash and cash equivalents at end of

period $317.5 $331.4 Free Cash Flow from Continuing Operations Net

cash provided by (used for) operating activities of continuing

operations $(12.1) $344.1 Net cash provided by (used for): Capital

expenditures (102.0) (207.7) Proceeds from investment sales 45.5 -

Proceeds from sale of property, plant and equipment 28.3 10.1

Other, net 17.2 25.6 Total free cash flow from continuing

operations $(23.1) $172.1 DATASOURCE: Brunswick Corporation

CONTACT: Bruce Byots, Vice President - Corporate and Investor

Relations, +1-847-735-4612, or Daniel Kubera, Director - Media

Relations and Corporate Communications, +1-847-735-4617, , both of

Brunswick Corporation Web site: http://www.brunswick.com/

Copyright

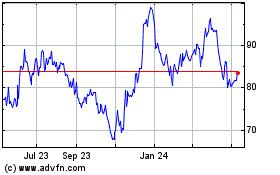

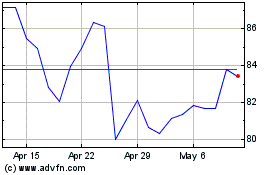

Brunswick (NYSE:BC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Brunswick (NYSE:BC)

Historical Stock Chart

From Nov 2023 to Nov 2024