First Horizon Swings to Profit - Analyst Blog

April 21 2011 - 1:50PM

Zacks

First Horizon National Corp.’s (FHN) first

quarter 2011 earnings of 15 cents per share were well ahead of the

Zacks Consensus Estimate of 4 cents per share.

Results also came in favorably compared with a loss of 20 cents

per share in the prior quarter and a loss of 12 cents per share in

the year-ago quarter. First quarter 2011 net income available to

common shareholders was $40 million, compared to a loss of $49

million in the prior quarter.

First Horizon’s results significantly benefited from a drop in

loan loss provisions and lower expenses. Net loan charge-offs and

non-performing assets continued to trend downward. However, this

was partially offset by lower-than expected revenue, driven by a

drop in net interest income.

Revenue came in at $370.3 million, below the Zacks Consensus

Estimate of $385 million. The revenue figure also reported a 13%

year-over-year drop. The sluggish economic recovery remains an

overhang on the company's results and loan demand continues to be

weak.

On the other hand, provision for loan losses shrank to $1.0

million from $45.0 million in the prior quarter and $105.0 million

in the prior-year quarter.

Inside the Headline Numbers

Revenue decreased 5% sequentially to $370.3 million, due to a 5%

decline in net interest income, which was partially offset by a 3%

increase in non-interest income. Net interest margin increased 4

bps both sequentially and year over year to 3.22%. The company

continued to experience lower outstanding loan balances.

Nevertheless, non-interest expense decreased 4% sequentially to

$315.1 million. The improvement was fuelled by lower compensation,

reduced mortgage repurchase expense and productivity and efficiency

gains from technology investments and improvements to business

processes and procurement.

Credit Quality

Credit quality improved in the quarter and the company continued

with its efforts to wind down the higher-risk non-strategic

portfolios. Net loan charge-offs and non-performing assets were

down in the first quarter to the lowest levels in three years.

Net charge-offs were down 23% sequentially to $76.7 million. Net

charge-offs as a percentage of average loans were 1.90%, down 48

basis points (bps) from the prior quarter. Non-performing assets

decreased 2% sequentially to $819.0 million.

Evaluation of Capital

During the first quarter, First Horizon repurchased the warrant

issued to the U.S. Department of the Treasury in 2008 under the

Capital Purchase Program.

Tier 1 capital ratio was 14.19%, up from 13.99% in the prior

quarter. Tangible common equity ratio decreased 2 bps sequentially

to 8.91%. Book value came in at $8.90 per share, down from $9.05

per share reported in the prior quarter.

Dividend

Earlier this week, the company announced a 1 cent per share

quarterly cash dividend. The dividend is payable on July 1, 2011 to

the common shareholders of record on June 10, 2011.

Our Take

Lower credit costs have been the trend in first quarter results.

Wall Street biggies such as U.S. Bancorp (USB) and

Citigroup Inc. (C) have benefited from credit

quality improvement. These banks have reduced their loan provisions

and results could match or exceed market expectations. However,

revenue growth remains elusive at many of the Wall Street banks and

we do not expect a significant turnaround in the near term.

First Horizon has undertaken several measures to reduce its

exposure to problem loans, control costs and boost capital levels.

It has executed several strategic repositioning efforts to improve

long-term profitability by focusing on growing its core Tennessee

banking franchise.

Recently, First Horizon is shedding its insurance unit. The

company has announced its agreement to sell First Horizon Insurance

Inc. to insurer Brown & Brown Inc. (BRO),

through its principal subsidiary First Tennessee Bank. The move

came as part of its effort to improve its focus on banking and

capital markets.

Though the wind-down of the non-strategic part of the loan

portfolio bodes well, we believe that it will remain a drag on the

company's earnings in the near future. A shrinking revenue base,

mortgage repurchase risk and regulatory issues remain our

concerns.

First Horizon currently retains a Zacks #3 Rank, which

translates into a short-term 'Hold' rating.

BROWN & BROWN (BRO): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

FIRST HRZN NATL (FHN): Free Stock Analysis Report

US BANCORP (USB): Free Stock Analysis Report

Zacks Investment Research

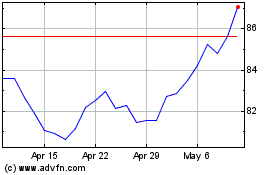

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Apr 2024 to May 2024

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From May 2023 to May 2024