Brinker Keeps a Neutral Rec - Analyst Blog

January 12 2012 - 8:00AM

Zacks

We are maintaining our long-term

Neutral recommendation on Brinker International

Inc. (EAT), which owns, develops, operates and franchises

the Chili's Grill & Bar (Chili's) and Maggiano's Little Italy

(Maggiano's) restaurant brands primarily in the United States.

The Dallas, Texas-based company

reported adjusted earnings of 30 cents in the first quarter of

fiscal 2012, surpassing the Zacks Consensus Estimate by 3 cents,

benefiting from same-store sales growth, higher restaurant margin

as well as lower share count.

Total revenue jumped 2.1% year over

year to $668.4 million due to a 2.0% increase in system-wide

comparable restaurants sales. Restaurant operating margin enhanced

80 basis points (bps) year over year to 15.8%.

The casual dining restaurant

company also reaffirmed its adjusted earnings guidance range of

$1.80 to $1.95 for fiscal 2012. The company continues to expect

full-year revenues and comparable-restaurant sales to increase

2%–3% year over year.

Brinker’s effort to reposition its

Chili’s brand and several sales initiatives, particularly

value-oriented lunch combo, Happy Hour program and two-course meals

for $20 to drive traffic and improve comps seem to be paying off as

during the first quarter comparable restaurant sales at Chili's

restaurant escalated 1.7%. In a bid to attract customers, Brinker

is making efforts to innovate two-course meals for $20 and

lunch offering.

Moreover, Brinker continues to

concentrate on more product-based promotions like day parts

initiatives, rather than discounting, in order to attract the

attention of casual diners.

Additionally, to drive top-line

growth, the company remains connected to its guests through social

media programs and email database.

Furthermore, to increase customer

visitation, the company plans to remodel its restaurants; the first

remodeled unit was opened at Oklahoma city, where the guest

response was positive.

Brinker has currently renovated 70

units and expects to extend the re-image program to about 200

restaurants by the end of 2012. The investment cost for remodeling

is $250,000 with an estimated sales lift of 3%-4%.

The company also remains on track

to double its EPS and achieve margin expansion of 400 bps by 2015.

To attain its target, the major cost-saving initiatives still in

the pipeline are the second phase of kitchen equipment retrofit

program and the new point of sale (POS) system.

In the first quarter of 2012, the

second phase of the kitchen retrofit program has been deployed in

66 company-owned restaurants and four franchise restaurants.

The company plans to aggressively

roll out the second phase of the program– the new cooking equipment

initiative– at 500 units in 2012. Brinker expects to complete the

deployment of new line equipment to kitchens in all company-owned

restaurants by the end of second quarter of 2013. New equipment

benefits include labor productivity gains, improved and more

consistent food quality, and quicker preparation times. The company

estimates a benefit of 100 bps from the second phase of kitchen

retrofit program and a gain of 50-70 bps from the first phase of

the program. The new POS system has been implemented in 86

restaurants so far and the company expects to install an additional

56 units in second quarter of 2012 and expects the complete roll

out by early 2013.

The company’s strategy to shift to

franchised operation, focus on international expansion in order to

move away from the over-supplied domestic market and enhancement of

shareholder value looks promising for its business.

However, we remain cautious on the

stock based on the ongoing stiff competition with respect to price,

service, location and concept in order to drive traffic and these

may adversely affect Brinker’s top and bottom-line growth and cost

inflation, which is expected to remain in the range of 3.5%-4.5% in

2012.

Currently, Brinker is 79%

contracted through the remainder of 2011 and 51% through the end of

fiscal 2012. In 2012, Brinker forecasts cost of sales to remain in

the range of 27–27.5% of revenues. Additionally, we believe that

lower consumer spending due to economic uncertainty will likely

restrict Brinker’s revenue growth in the near term.

BRINKER INTL (EAT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

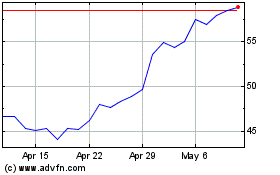

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

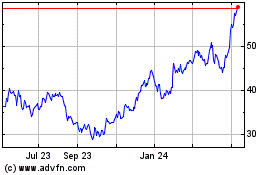

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024