DineEquity Tops, Lowers Guidance - Analyst Blog

November 11 2011 - 3:45AM

Zacks

DineEquity Inc.

(DIN) reported third quarter adjusted earnings of $1.04 per share,

comfortably beating the Zacks Consensus Estimate 99 cents and the

prior-year earnings of 95 cents. Revenues in the reported quarter

plunged 21.2% year over year to $264.5 million.

Inside the Headline

Numbers

DineEquity operates under

Applebee's Neighborhood Grill & Bar and IHOP brands. Applebee's

domestic system-wide comparable-store sales inched down 0.3% during

the quarter, with franchise same-restaurant sales dipping 0.4% and

company-operated comparable restaurant sales rising 0.1%. Total

comparable-store sales declined for the first time since second

quarter 2010. The downside in Applebee's comparable store sales was

due to lighter traffic, partially offset by an uptick in average

guest check.

The domestic system-wide same-store

sales of IHOP dipped 1.5% during the quarter due to lower

traffic.

Restaurant operating margin at

Applebee's company-operated restaurants dropped 60 basis points

(bps) to 14.2% during the quarter, attributable to higher commodity

costs, and investment in local advertising, which was partially

compensated by refranchising of lower margin restaurants and

slightly lower labor costs.

Store Update

During the third quarter,

DineEquity opened 4 and closed 6 Applebee’s franchised restaurants.

The company also opened 13 IHOP franchised restaurants as well as

one area licensed restaurant and shut down 4 area-licensed units.

At the end of the quarter, DineEquity had 2,010 Applebee’s and 1532

IHOP restaurants.

The company continues to focus on

the franchise business model as it is less capital intensive and

reduces volatility of cash flow. DineEquity also expects to use the

sale proceeds for reducing its debt burden.

Financial

Position

DineEquity ended the reported

quarter with cash and cash equivalents of $53.9 million and

shareholders’ equity of $123.5 million.

The company is in a delevering

mode. It has reduced term loan balances by $110.0 million, retired

$39.8 million of the 9.5% senior notes and $43.3 million of

financing and capital lease obligations for the first nine months

of the year.

The company repurchased 534,101

shares of its common stock in the third quarter for a total of

$21.2 million.

Outlook

The largest full-service restaurant

company in the world expects Applebee's domestic system-wide

comparable-store sales in the range of 1.5% to 2.0% (previously 2%

to 4%) for fiscal 2011. The company also expects domestic

system-wide same-store sales decline of 2% to 2.4% (previously down

2% to up 1%) for IOHP.

For 2011, DineEquity continues to

expect capital expenditure of $26 million but toned down its

expectation for cash from operation to the range of $117–$127

million (earlier $125–$135 million) and free cash flow in the range

of $104–$114 million (earlier $112–$122 million).

Applebee's franchisees plan to open

24 to 28 restaurants by year-end 2011, half of which are expected

in the international market. IHOP franchisees expect to open 55 to

60 restaurants (previously 55-60), mostly in the domestic

market.

Our Take

We expect the estimates to go down

in the coming quarter as the company’s IHOP brand continues to

struggle. Additionally, the company cut down its expectation for

same-restaurant sales, restaurant operating margin as well as cash

flow operating activities. This indicates a tough operating

environment for the company.

However, with about 95% of

restaurants either franchised or soon to be franchised, DineEquity

remains on track to achieve its long-term goal. A share repurchase

program is also in place to boost stockholder value. Besides, the

company is all set to try a robust pipeline for menu for the

remainder of 2011and throughout 2012. Notably, the company either

upgraded or replaced over 90% of the offerings since December

2007.

DineEquity, which competes with

Brinker International Inc. (EAT), currently

retains a Zacks #3 Rank, which translates into a short-term Hold

rating. We are also maintaining our long-term Neutral

recommendation on the stock.

DINEEQUITY INC (DIN): Free Stock Analysis Report

BRINKER INTL (EAT): Free Stock Analysis Report

Zacks Investment Research

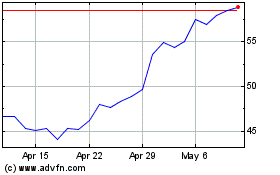

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

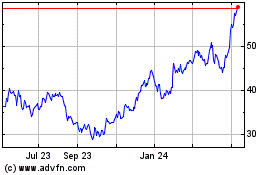

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024