Darden Plans To Focus On Value In New Olive Garden Campaign

July 01 2011 - 3:26PM

Dow Jones News

Darden Restaurants Inc. (DRI) plans to focus more on value in

promotions for its Olive Garden chain as the company tries to

extend the recent growth it is seeing in the casual-dining

industry.

Casual-dining restaurants have been hurt by the economic

downturn and higher commodity costs; however, Darden noted that

recent industry data suggest restaurant sales are improving. To

help build on that trend, Darden unveiled a plan Friday to target

households with annual incomes below $60,000, a group that has

pulled back on its share of casual-dining visits in recent

years.

"We believe the ability to offer greater affordability to guests

without eroding margins will continue to be very important going

forward," President and Chief Operating Officer Andrew Madsen said

Friday on a conference call following the company's quarterly

report. Late Thursday, Darden reported a 19% increase in

fourth-quarter earnings on a 6.8% increase in revenue.

Throughout the recession, Darden refrained from offering the

extensive deep discounts of its competitors, saying it didn't want

to hurt its business model or the long-term image of its brand. The

strategy helped the company outperform the industry.

This week, though, Olive Garden began promoting two new "twist

on classics" dishes that offer more price certainty, Darden said,

and that have a more "short-term, call-to-action" marketing

approach than it has used in the past. The new ads represent a

change from the chain's promotions the past two quarters, which the

company said proved to be too "culinary forward" for its customers

and hurt sales.

Darden's changes at Olive Garden come after a similar focus on

value at Red Lobster showed initial success. In June, Darden

launched a $15 "four-course feast" at Red Lobster. Madsen said the

company is able to "do so at a margin that contributes to profit

growth in absolute and percent terms with appropriate guest count

growth."

"Through the first four weeks of the promotion," Madsen said,

"we are generating substantially more incremental traffic than we

require." Darden didn't break out Red Lobster's June results, but

said the chain led the company's combined growth of 5% to 6% in

sales at restaurants opened at least 16 months.

Despite the focus on value, Darden is preparing to raise prices

at Olive Garden after refraining from taking its annual increase

there in the fourth quarter. Darden said Olive Garden's sales were

flat for the second quarter in a row, in part because it raised

prices there early in the fourth quarter of 2010 but didn't do so

in 2011.

Historically, the company had made a 2%-to-3% annual price

increase. Darden said Friday that the coming rise will probably be

on the low end of that, recognizing consumers' demand for

value.

Friday, Darden shares set an all-time high at $53.57, helped by

the company's comments about Olive Garden's strategy and its strong

guidance for fiscal 2012. Darden said it sees same-restaurant sales

rising 2.5% and earnings growing 12% to 15%, which is at the high

end of its long-term target of 10% to 15% growth.

Darden shares recently rose 6.6% to $53.02.

Darden's bullish view of the casual-dining industry--comments

that also lifted the stocks of rivals Brinker International Inc.

(EAT), P.F. Chang's China Bistro Inc. (PFCB) and Ruby Tuesday Inc.

(RT)--also contributed to its gains Friday.

Darden said the casual dining industry is holding up well

despite elevated gas prices, higher commodity costs and other

economic headwinds. "We are encouraged by the gradual and sustained

improvement of our industry, and we anticipate continued modest

recovery during fiscal 2012," Madsen said.

The company noted that according to recent industry data,

casual-dining restaurants had their best quarterly growth in

same-restaurant sales in more than five years and their best

performance in same-restaurant guest counts in six years.

Darden said it expects commodity costs to be up for the fiscal

year, but that food prices will begin to decline in the second half

of fiscal 2012.

-By Annie Gasparro, Dow Jones Newswires; 212-416-2244;

annie.gasparro@dowjones.com

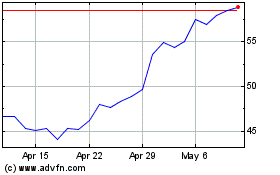

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

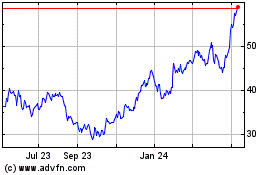

Brinker (NYSE:EAT)

Historical Stock Chart

From Jul 2023 to Jul 2024