UPDATE:Brinker International 2Q Profit More Than Doubles; Revenue Down

January 25 2011 - 10:21AM

Dow Jones News

Brinker International Inc.'s (EAT) fiscal second-quarter

earnings more than doubled, but both sales and traffic at banner

brand Chili's Grill & Bar continued to fall.

A key indicator of the casual-dining chain's performance,

same-store sales and customer traffic declines illustrate Brinker's

continued struggles coming out of the recession.

The parent company of Chili's and Maggiano's benefited from

stronger margins and lower overhead costs in its fiscal second

quarter, reporting results that beat analysts' expectations. But

sales at Chili's remained weak, as Brinker expected.

In the quarter ended Dec. 29, same-store sales dropped 3.5% at

company-owned restaurants, including a 4.9% slide at Chili's. The

quarter also included a 53rd week, without which sales performance

would be even more lackluster. Meanwhile, Maggiano's increased

same-store sales by 4.7%.

Chili's customer traffic was down 7.1%, though that was an

improvement from the fiscal first quarter when it dropped 8.1%.

Chili's capacity was down 3.1% due to fewer restaurants.

"Despite undeniably impressive margin improvements, we continue

to wait for evidence of top line momentum, which has yet to

materialize," Morgan Stanley analyst John Glass says in a note.

Chili's has emerged from the recession considerably smaller. It

still hasn't found the right recipe to increase sales, in contrast

to some of its rivals, and carve out a niche in an overly saturated

bar and grill sector.

Chili's biggest competitors in the space, Ruby Tuesday Inc. (RT)

and DineEquity Inc.'s (DIN) Applebee's have seen significant sales

improvement, implying they are leaving Chili with less of what

little market share the bar-and-grill space has left.

Brinker has been focused on spicing up its existing locations to

better stand up to the competition and striking a balance of

discounting without letting it cut too deep into profits.

Chili's latest discount is a lunch combo that offers an

appetizer, sandwich and fries for $6 to $8. Combined with quicker

order-serving times, it puts Chili's in a better competitive stance

against the growing fast-casual industry, including poster child

Chipotle Mexican Grill Inc. (CMG), which is said to be stealing

market share from Chili's.

Brinker had been losing customers, partly because it toned down

the aggressiveness of its promotions. Glass says Brinker has at

least another month or more "of tough promotional laps before a

clearer top line read."

Cost restructuring has been Brinker's only redemption, as it

lowers labor costs and makes kitchens more cost-efficient through

redesigns.

For the quarter, Brinker reported a profit of $37.5 million, or

41 cents a share, up from $18.3 million, or 18 cents a share, a

year earlier. Excluding restructuring related expenses and

restaurant closings, earnings from continuing operations were 38

cents a share, up from 25 cents.

Revenue decreased 4.8% to $671.9 million, though that was an

improvement from a year earlier, when revenue fell 18%, partly on

restaurant closures and the sale of the Romano's Macaroni Grill

locations.

Analysts polled by Thomson Reuters most recently forecast

earnings of 32 cents on revenue of $670 million.

Restaurant operating margin rose 2.1 percentage points to 17.4%.

Shares rose 8% to $22.59 in recent trading.

-By Annie Gasparro and Tess Stynes, Dow Jones Newswires;

212-416-2244; annie.gasparro@dowjones.com

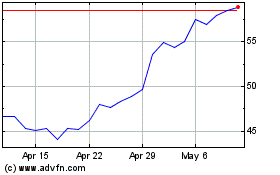

Brinker (NYSE:EAT)

Historical Stock Chart

From May 2024 to Jun 2024

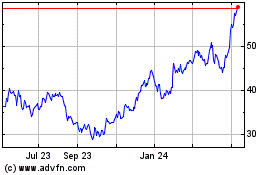

Brinker (NYSE:EAT)

Historical Stock Chart

From Jun 2023 to Jun 2024