Bread Financial Announces Approval of $150 Million Share Repurchase Program

March 05 2025 - 7:43AM

Bread Financial® Holdings, Inc. (NYSE: BFH) (“Bread Financial” or

the “Company”) today announced that its Board of Directors (the

“Board”) has authorized a new plan to repurchase up to $150 million

of shares of its common stock. There is no expiration date for the

repurchase plan.

“Aligned with our capital priorities, we have prudently focused

on strengthening our balance sheet over the past five years,

including building capital and reducing debt. The issuance of Tier

2 capital and this share repurchase authorization will further

strengthen our total capital ratios, while providing capital

flexibility for future growth and further optimization of our

capital position over time,” said Ralph Andretta, president and

chief executive officer of Bread Financial.

Any decision to repurchase shares will be subject to market

conditions and other factors, including legal and regulatory

restrictions and required approvals, up to the aggregate amount

authorized by the Board. The repurchase plan does not obligate the

Company to acquire any specific number of shares and may be

suspended or terminated at any time.

About Bread Financial®Bread

Financial® (NYSE: BFH) is a tech-forward financial services company

that provides simple, personalized payment, lending and saving

solutions to millions of U.S. consumers. The Company’s payment

solutions, including Bread Financial general purpose credit cards

and savings products, empower its customers and their passions for

a better life. Additionally, the Company delivers growth for some

of the most recognized brands in travel & entertainment, health

& beauty, jewelry and specialty apparel through their private

label and co-brand credit cards and pay-over-time products

providing choice and value to their shared customers.

Forward-Looking StatementsThis release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, including, among other things, statements regarding

the Company’s intended share repurchases and the expected impact on

share count dilution. The Company believes that its expectations

are based on reasonable assumptions. Forward-looking statements,

however, are based only on currently available information and the

Company’s current beliefs, expectations and assumptions, and are

subject to a number of risks and uncertainties that are difficult

to predict and, in many cases, beyond the Company’s control,

including risk and uncertainties described in greater detail under

the headings “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in the

Company’s Annual Report on Form 10-K for the most recently ended

fiscal year, which may be updated in Item 1A of, or elsewhere in,

the Company’s Quarterly Reports on Form 10-Q filed for periods

subsequent to such Form 10-K. The Company’s forward-looking

statements speak only as of the date made, and it undertakes no

obligation, other than as required by applicable law, to update or

revise any forward-looking statements, whether as a result of new

information, subsequent events, anticipated or unanticipated

circumstances or otherwise.

Contacts

Brian Vereb — Investor

RelationsBrian.Vereb@breadfinancial.com

Susan Haugen — Investor

RelationsSusan.Haugen@breadfinancial.com

Rachel Stultz —

MediaRachel.Stultz@breadfinancial.com

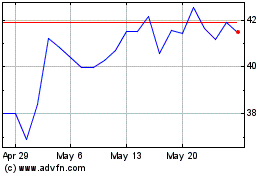

Bread Financial (NYSE:BFH)

Historical Stock Chart

From Feb 2025 to Mar 2025

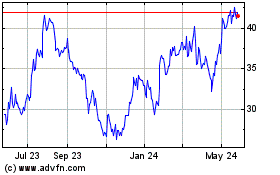

Bread Financial (NYSE:BFH)

Historical Stock Chart

From Mar 2024 to Mar 2025