UPDATE: BBVA Profit Slips On Spain Weakness, Trading Loss

October 26 2011 - 4:25AM

Dow Jones News

Banco Bilbao Vizcaya Argentaria SA (BBVA) Wednesday reported a

29% drop in third quarter, as a loss in trading income weighed on

the bank's earnings in Spain and elsewhere, offsetting relatively

robust results at its core retail banking operations.

Net profit for Spain's second-largest bank by assets behind

Banco Santander SA (STD) was EUR804 million compared with EUR1.14

billion a year earlier and below EUR840 million forecast by a Dow

Jones Newswires survey of seven analysts.

The bank reported a net trading loss of EUR25 million compared

with a trading profit EUR519 million a year earlier and BBVA said

it was due to a lower valuation of assets the bank holds for

trading purposes amid recent market turmoil and lower activity at

its wholesale bank.

"It was the worst quarter for this activity in a long time,"

Chief Operating Officer Angel Cano Fernandez said, adding that the

weak trading environment had affected all divisions.

Net interest income from its retail banking activities, its main

source of revenue, rose 1.3% to EUR3.29 billion, slightly above

market expectations for EUR3.22 billion.

By divisions, profit from Spain almost halved to EUR265 million

in the quarter from EUR515 million a year earlier, weighed down by

the loss in trading income. Loans shrunk 2.4% on the year, but the

bank said it managed to offset this drop by increasing its lending

margins. BBVA also said it keeps gaining market share as rival

banks in the country restructure.

Mexico delivered a more resilient quarter, though the result in

euros was down due to a depreciation of the peso against the euro.

Profit from the country fell 9.7% to EUR402 million while total

loans were up 8% on the year, led by strong growth in lending to

consumers and small businesses.

The recent incorporation of results from BBVA's stake in

Turkey's Turkiye Garanti Bankasi AS (GARAN.IS) helped boost the

bank's results in Europe--excluding Spain--and Asia. Profit from

the Eurasia division rose to EUR257 million from EUR147 million a

year earlier.

Analysts said that, barring the trading loss, results looked

broadly in line with expectations. Banesto Bolsa analyst Juan

Alberto Tuesta said that earnings from South America had been a

bright spot.

BBVA said loans in the region grew almost 31% on the year though

net profit fell to EUR225 million from EUR233 million a year

earlier. Excluding the effect of the depreciation of local

currencies against the euro, profit would have risen 7.9%, the bank

added.

At 0723 GMT, BBVA's shares were down 0.6% at EUR6.27, while the

Spanish market was down 0.3%. Like most banks in Europe, BBVA

shares have suffered in recent months from European debt crisis.

The stock is down 25% over the past year.

-By Christopher Bjork; Dow Jones Newswires; +34913958123;

christopher.bjork@dowjones.com

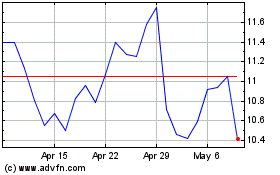

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

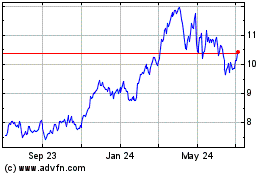

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Nov 2023 to Nov 2024