UPDATE: Enel Green Power Prepares EUR3 Billion IPO To Price In November

October 04 2010 - 1:07PM

Dow Jones News

Enel Green Power, the renewable energy unit of Enel SpA

(ENEL.MI), Monday started pre-marketing its planned EUR3 billion

initial public offering in what is set to be Europe's largest IPO

in nearly three years.

Following an email to potential investors Monday from the

arranging banks, people working on the transaction said the price

range will be set around Oct. 18, when Enel Green Power executives

will start formal meetings with investors. Final pricing will be in

about a month, at the start of November.

Enel is expected to offer about 30% of the company as part of a

broader selloff of assets to cut debt. Enel Chief Executive Fulvio

Conti previously said he expects the stake to raise at least EUR3

billion, tallying with analyst estimates that Enel Green Power's

equity is worth roughly EUR9 billion.

A company spokeswoman declined to comment Monday.

Earnings before interest, tax, depreciation and amortization

were EUR651 million in the first half of 2010, the same as in the

2009 first half. Net debt was just under EUR3 billion at June

30.

At EUR3 billion, the IPO would be the largest since Enel's

Spanish rival, Iberdrola SA (IBE.MC), raised EUR4.1 billion from

the flotation of renewables unit Iberdrola Renovables SA (IBR.MC)

in December 2007. It comes in a mixed year for European IPOs,

though, with volume up nearly tenfold in the first nine months of

the year compared with the same 2009 period, but in a market

littered with deals that had to be pulled because of insufficient

investor demand.

The share sale is seen as crucial to Enel to meet its net debt

target of EUR45 billion by the end of December. Enel is Europe's

most-indebted utility after going on an international shopping

spree, which included netting Spain's Endesa SA (ELEZF). Net debt

totaled EUR53.89 billion at the end of June.

The IPO global coordinators are Mediobanca SpA (MB.MI), Intesa

Sanpaolo SpA (ISP.MI), Credit Suisse Group (CS) and Goldman Sachs

Group Inc. (GS).

Bookrunners are UniCredit SpA (UCG.MI), J.P. Morgan Chase &

Co. (JPM), Morgan Stanley (MS), Barclays PLC (BCS), Bank of America

Corp.'s (BAC) Merrill Lynch and Banco Bilbao Vizcaya Argentaria SA

(BBVA).

-By Margot Patrick, Dow Jones Newswires; +44 (0)20 7842 9451;

margot.patrick@dowjones.com

(Liam Moloney in Rome contributed to this article.)

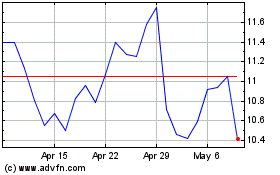

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

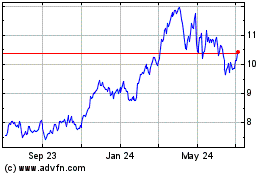

BBVA Bilbao Vizcaya Arge... (NYSE:BBVA)

Historical Stock Chart

From Nov 2023 to Nov 2024