Bladex Increases Quarterly Dividend to $0.15 Per Share, Declares Special Dividend of $1.00 per Share ($39 Million), and Approves

August 05 2004 - 3:40PM

PR Newswire (US)

Bladex Increases Quarterly Dividend to $0.15 Per Share, Declares

Special Dividend of $1.00 per Share ($39 Million), and Approves $50

Million Stock Repurchase Program PANAMA CITY, Aug. 5

/PRNewswire-FirstCall/ -- Banco Latinoamericano de Exportaciones,

S.A. (NYSE:BLX) ("Bladex" or the "Bank") announced today that its

Board of Directors has approved a capital management program, which

includes an increase in quarterly dividends, a special dividend,

and a stock repurchase program. The Board of Directors has

authorized an increase in the quarterly cash dividend from $0.10

per share to $0.15 per share of common stock, starting with the

dividend payable on October 7, 2004, to stockholders of record as

of September 27, 2004. The Board of Directors also declared a

special dividend of $1.00 per share of common stock, or

approximately $39 million, payable on October 7, 2004, to

stockholders of record as of September 27, 2004. The Board of

Directors also authorized a three-year stock repurchase program

under which Bladex may, from time to time, repurchase up to an

aggregate of $50 million of its Class E shares of common stock, on

the open market at the then prevailing market price. Such purchases

under the program will be made in accordance with applicable law

and subject to all required regulatory approvals. The repurchases

will be made using Bladex's cash resources, and the program may be

suspended or discontinued at any time without prior notice. As of

July 31, 2004, Bladex had 39,352,738 shares of common stock of all

classes outstanding. Commenting on the foregoing, Jaime Rivera,

Chief Executive Officer said, "With our objectives regarding

portfolio quality, liquidity, capitalization, growth and

profitability on track, the Board of Directors and management feel

confident of the Bank's sustained ability to provide shareholders

with improved cash flows." "The three elements of the capital

management program are designed to preserve the Bank's solid

capitalization and ability to withstand volatility in its markets,

as well as allow for the execution of its business plan," Rivera

said. "The increased quarterly dividend reflects Bladex' enhanced

core profitability prospects. The special dividend reflects, among

other considerations, the amount of provision reversals realized

since January 1, 2004, in our Argentine portfolio. Finally, the

stock repurchase program provides an opportunity to enhance

earnings per share in light of what the Bank believes is an

undervalued stock." "This is a well-balanced, prudent, timely plan,

consistent with our commitment to strong financial fundamentals and

shareholder value," Rivera concluded. BLADEX is a multinational

bank established by the Central Banks of Latin America and

Caribbean countries. Based in Panama, its shareholders include

central banks and/or government entities in 23 countries of the

region, and commercial banks, as well as institutional and retail

investors. For further information, please access

http://www.blx.com/ or contact: Carlos Yap, Senior Vice President

-- CFO Tel.: (country code 507) 210-8581, E-mail: -or- i-advize

Corporate Communications, Inc., 80 Wall Street, Suite 515, New

York, NY 10005 Attention: Melanie Carpenter / Peter Majeski Tel.:

(212) 406-3690, E-mail: DATASOURCE: Banco Latinoamericano de

Exportaciones, S.A. CONTACT: Carlos Yap, Senior Vice President,

CFO, Bladex, +1-507-210-8581, or ; or Melanie Carpenter or Peter

Majeski, both of i-advize Corporate Communications, Inc.,

+1-212-406-3690, or , for Bladex Web site: http://www.blx.com/

Copyright

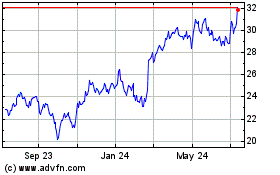

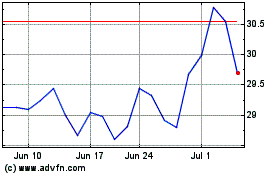

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From May 2024 to Jun 2024

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jun 2023 to Jun 2024