Bladex Reports Third Quarter Net Income of $14.0 Million, Versus $14.8 Million in the Third Quarter 2007

October 08 2008 - 8:52AM

PR Newswire (US)

Year to Date Net Income Was $59.4 Million, $2.8 Million Higher Than

the Same Period 2007 PANAMA CITY, Oct. 8 /PRNewswire-FirstCall/ --

Banco Latinoamericano de Exportaciones, S.A. (NYSE:BLX) ("Bladex"

or the "Bank") announced today its results for the third quarter

ended September 30, 2008. Third Quarter's Results were driven by:

-- Commercial Division's net operating income(1) for the quarter

was $16.7 million, representing a 29% increase compared to the

second quarter 2008, and an increase of 55% compared to the third

quarter 2007. -- Although the year to date return of Bladex's

investment in our Asset Management Division was 11.6%, its net

operating loss for the third quarter was $2.2 million, a decrease

of $12.3 million when compared to the second quarter 2008, and a

decrease of $5.9 million compared to the third quarter 2007. --

Treasury Division's net operating loss was $0.7 million, compared

to a $3.0 million gain in the second quarter 2008, and compared to

a $0.8 million gain in the third quarter 2007, due to the carry

cost of strong liquidity and the absence of gains on the sale of

securities during the third quarter 2008. -- The combined effect of

these factors was a net income for the third quarter of $14.0

million, a decline of $12.3 million compared to the second quarter

2008, and compared to the third quarter 2007, net income decreased

by $0.8 million. -- As of September 30, 2008, the Bank had no

credits in non-accrual or past due status. -- As of September 30,

2008, liquidity(2) stood at $469 million, representing an increase

of $96 million, or 26% from the previous quarter. Tier 1 capital

ratio stood at 18.4%, compared to 19.0% in the prior quarter. Mr.

Jaime Rivera, Bladex's Chief Executive Officer, stated the

following regarding the quarter's results: "Bladex's performance

during the third quarter reflected business conducted in an

environment that was tougher than usual, but for which the Bank was

well prepared. "Most importantly, during the third quarter 2008,

the Commercial Division performed at record levels. As strong as

the Commercial Division's performance was, however, it could not

fully offset the impact of diminished performance in the Asset

Management Division. "On a year to date basis, Bladex remains ahead

of its results for 2007, which validates the benefits of its

diversified business model. "Under current market conditions,

liquidity management, always one of our strengths, has become

paramount. Starting in August 2007, we established stringent

guidelines in anticipation of a deteriorating market. The placement

of a $245 million oversubscribed syndicated term loan facility on

August 8th, 2008, was part of the plan we put in effect. Once

conditions deteriorated starting in mid September, we slowed our

portfolio growth to quickly build a comfortable $469 million

liquidity position, none of which is deposited in any of the

institutions that have gone bankrupt in recent weeks. "Asset

quality, which Bladex has been monitoring with special care ever

since a slowdown in the U.S. economy became a possibility, remains

solid. While Bladex has noted some pressure developing on the

absolute levels of EBITDA in some industries as commodity prices

come off their record levels, debt coverage ratios remain sound.

"As we have stated before, Bladex does not own, nor has it ever

owned, any of the asset classes that have come to be generally

known as "toxic debt" in the industry. "As of the end of the third

quarter, Bladex Asset Management had invested 99.9% of its funds

under management in U.S. treasuries. Bladex's share of trading

losses(3) incurred during the quarter was $1.1 million, not an

inconsequential amount, but a relatively modest one in the context

of the $15.5 million trading gains(3) realized year to date.

"Regarding other indicators, expenses during the quarter decreased

$1.5 million, or 13%, loan loss reserve coverage strengthened to

2%, and Tier 1 capitalization stood at a strong 18.4%. "This was a

quarter where Bladex's strengths in terms of its sound strategy,

effective business model, skilled and experienced management, and a

strong brand came to the forefront. It was also a period during

which Bladex's ability to support Latin America's trade flows in

times of market stress once again proved Bladex's strategic

importance to companies, governments, and people in our Region."

Footnotes: (1) Net Operating Income (Loss) refers to net interest

income plus non-interest operating income, minus operating

expenses. (2) Liquidity ratio refers to liquid assets as a

percentage of total assets. Liquid assets consist of

investment-grade 'A' securities, and cash and due from banks,

excluding pledged deposits and cash balances in the Asset

Management Division. (3) Includes trading gains (losses) and net

gains (losses) on investment fund. SAFE HARBOR STATEMENT This press

release contains forward-looking statements of expected future

developments. The Bank wishes to ensure that such statements are

accompanied by meaningful cautionary statements pursuant to the

safe harbor established by the Private Securities Litigation Reform

Act of 1995. The forward-looking statements in this press release

refer to the growth of the credit portfolio, including the trade

portfolio, the increase in the number of the Bank's corporate

clients, the positive trend of lending spreads, the increase in

activities engaged in by the Bank that are derived from the Bank's

client base, anticipated operating income and return on equity in

future periods, including income derived from the Treasury Division

and Asset Management Division, the improvement in the financial and

performance strength of the Bank and the progress the Bank is

making. These forward-looking statements reflect the expectations

of the Bank's management and are based on currently available data;

however, actual experience with respect to these factors is subject

to future events and uncertainties, which could materially impact

the Bank's expectations. Among the factors that can cause actual

performance and results to differ materially are as follows: the

anticipated growth of the Bank's credit portfolio; the continuation

of the Bank's preferred creditor status; the impact of

increasing/decreasing interest rates and of improving macroeconomic

environment in the Region on the Bank's financial condition; the

execution of the Bank's strategies and initiatives, including its

revenue diversification strategy; the adequacy of the Bank's

allowance for credit losses; the need for additional provisions for

credit losses; the Bank's ability to achieve future growth, to

reduce its liquidity levels and increase its leverage; the Bank's

ability to maintain its investment-grade credit ratings; the

availability and mix of future sources of funding for the Bank's

lending operations; potential trading losses; the possibility of

fraud; and the adequacy of the Bank's sources of liquidity to

replace large deposit withdrawals. About Bladex Bladex is a

supranational bank originally established by the Central Banks of

Latin American and Caribbean countries to support trade finance in

the Region. Based in Panama, its shareholders include central banks

and state-owned entities in 23 countries in the Region, as well as

Latin American and international commercial banks, along with

institutional and retail investors. Through September 30, 2008,

Bladex had disbursed accumulated credits of over $157 billion.

Conference Call Information There will be a conference call to

discuss the Bank's quarterly results on Thursday, October 9, 2008,

at 11:00 a.m., New York City time (Eastern Time). For those

interested in participating, please dial (800) 311-9401 in the

United States or, if outside the United States, (334) 323-7224.

Participants should use conference ID# 8034, and dial in five

minutes before the call is set to begin. There will also be a live

audio web cast of the conference at http://www.bladex.com/. The

conference call will become available for review on Conference

Replay one hour after its conclusion, and will remain available

through December 9, 2008. Please dial (877) 919-4059 or (334)

323-7226, and follow the instructions. The Conference ID# for the

replayed call is 56208326. For more information, please access

http://www.bladex.com/ or contact: Mr. Jaime Celorio Chief

Financial Officer Bladex Calle 50 y Aquilino de la Guardia P.O.

Box: 0819-08730 Panama City, Panama Tel: (507) 210-8563 Fax: (507)

269-6333 E-mail address: Investor Relations Firm: i-advize

Corporate Communications, Inc. Mrs. Melanie Carpenter / Mr. Peter

Majeski 82 Wall Street, Suite 805 New York, NY 10005 Tel: (212)

406-3690 E-mail address: DATASOURCE: Banco Latinoamericano de

Exportaciones, S.A. CONTACT: Jaime Celorio, Chief Financial

Officer, Bladex, +011-507-269-6333, , or Investor Relations,

Melanie Carpenter or Peter Majeski, +1-212-406-3690, , of i-advize,

for Bladex Web site: http://www.bladex.com/

Copyright

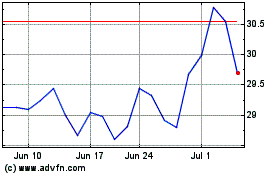

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Oct 2024 to Nov 2024

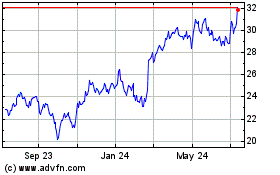

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Nov 2023 to Nov 2024