Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 13 2023 - 9:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2023

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Osasco, February 13, 2023.

To

[B]³ – Brasil, Bolsa, Balcão.

Listing Oversight and Issuer Supervision

Attn. Mrs. Ana Lucia da Costa Pereira

Ref.: Official Letter B3 258/2023-SLS of February 10, 2023

Banco Bradesco S.A. (“Bradesco” or “Company”)

hereby sets forth its clarifications regarding the aforementioned Official Letter (“Official Letter 258/2023-SLS”), transcribed

at follows:

“In a News published by Valor Econômico newspaper,

on 2/10/2023, with the title “Result of Bradesco (BBDC4) plummets, and Americanas is not the only reason”, brings, among other

information, the one in which the bank works to recover a ROE of “at least 18% for this year”.

We request clarifications on the pointed out item, with your

confirmation or not, as well as other material information, by 9:00 a.m. of 2/13/2023.”

Clarification:

Regarding the Official Letter 258/2023-SLS´s subject,

Bradesco clarifies that, as stated at the 4Q22 Earnings Presentation, made available at its Investor Relations website (Home Page,

Latest Reports/2.10.2023 – Bradesco 4Q22 – Earnings Presentation – second slide), the Company “aims for a

sustainable and recurring return of at least 18%”. The mentioned presentation is available also at Securities Exchange

Commission – CVM and B3 S.A. – Brasil, Bolsa Balcão websites.

As seen, the sustainable return at least 18% is a goal to be

pursued by Bradesco management in the performance of its activities. However, this percentage is not a Company´s projection or estimate

and there is no, much less, any commitment that this goal will be reached in 2023 or in future years.

Sincerely,

Banco Bradesco S.A.

Carlos Wagner Firetti

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 13, 2023

|

BANCO BRADESCO S.A. |

|

|

By: |

|

/S/ Carlos Wagner Firetti

|

| |

|

Carlos Wagner Firetti

Department Officer and

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

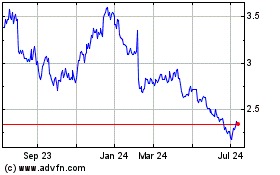

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Sep 2023 to Sep 2024