Allegheny Reports Solid Quarter - Analyst Blog

January 25 2012 - 7:59AM

Zacks

Allegheny Technologies Inc. (ATI) reported

earnings of 31 cents per share in the fourth quarter of 2011,

excluding non-recurring charges, and substantially increasing by

107% from 15 cents per share in the fourth quarter of 2010.

However, it missed the Zacks Consensus Estimate of 54 cents per

share.

Including the restructuring and Ladish acquisition expenses,

earnings in the fourth quarter of 2011 came in at 29 cents per

share.

For full-year 2011, the company reported earnings of $2.23 per

share excluding non recurring charges, a jump of 210% from

2010.

Sales in the quarter increased 20.6% to $1.25 billion, driven by

higher shipments and higher raw material surcharges for most

high-value products. However, sales were lower than the Zacks

Consensus Estimate of $1.31 billion, and were offset by

significantly lower demand coupled with low base prices for its

standard stainless products.

For fiscal 2011, sales grew 28% to $5.18 billion from $4.05

billion in 2010.

Segment operating profit surged 30% to $114.4 million in the fourth

quarter, or 9.1% of sales, from $88.0 million, or 8.5% of sales, in

the fourth quarter of 2010.

Segment Results

Sales in the High Performance Metals segment

surged 50% to $524.6 million in the quarter. The increase in sales

in the quarter was driven by increased average mill product selling

prices for titanium and titanium alloys and nickel-based and

specialty alloys. This was primarily attributable to a favorable

product mix, higher raw material indices and improving base

prices.

Segment operating profit increased to $90.3 million, or 17.2% of

sales, from $63.5 million, or 18.2% of sales, in the fourth quarter

of 2010. Operating profit was partially offset by approximately

$18.4 million of start-up and idle facility costs. The company also

derived a benefit of $6.0 million on account of LIFO inventory

valuation reserve in the quarter.

Sales in the Flat-Rolled Products segment

inched up 2.0% to $598.5 million, driven by higher shipments and

improved base-selling prices for most high-value products and

offset by lower surcharges and weak demand for standard stainless

products.

Operating profit decreased to $17.5 million, or 2.9% of sales,

compared with $24.2 million, in the fourth quarter of 2010

due to weak demand and low base selling prices for standard

stainless products. The segment recognized a LIFO inventory

valuation reserve benefit of $5.0 million due to falling nickel

prices and facility restructuring charges of $2.6 million.

Sales in the Engineered Products segment soared

27.0% to $128.3 million, driven by higher demand for most of the

products. Segment operating profit was $6.6 million in the reported

quarter compared with $0.3 million in the fourth quarter of

2010.

Financials

Allegheny’s cash on hand was $380.6 million as of December 31,

2011, a decrease of $51.7 million from $432.3 million at the end of

December 31, 2010.

Cash flow provided by operations for the year 2011 was $296.8

million. Increased profitability was partially offset by an

investment of $273.3 million in managed working capital due to a

higher level of business activity.

Net debt as a percentage of total capitalization was 31.3% at

the end of 2011 compared with 23.6% at the end of 2010. Total

debt-to -capital ratio was 37.8% as of December 31, 2011 compared

with 34.3% at the end of 2010.

Outlook

Allegheny expects to continue to benefit from its new alloys and

products, diversified global growth markets and differentiated

product mix. The company expects revenue growth to be at

least 10% in 2012 and segment operating profit in the range of 13%

to 14% of sales.

In its High Performance Metals segment, the company forecasts to

have a strong demand for its products in its major markets. As per

Allegheny, its acquired company Ladish will start giving profitable

returns in 2012.

In its Flat-Rolled Products segment, the company anticipates

improved demand for its standard stainless products.

In the Engineered Products segment, the company expects

continued growth in demand for its tungsten-based products and

industrial forgings and castings.

The company expects 2012 retirement benefit expense to be

approximately $122 million, or $44 million higher than 2011.

Based in Pittsburgh, Pennsylvania, Allegheny Technologies,

produces and sells specialty metals worldwide. Its primary

competitor includes Carpenter Technology Corp.

(CRS). The company currently retains a Zacks #3 Rank on its stock,

which translates to a short-term (1 to 3 months) Hold” rating.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

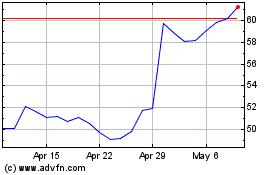

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

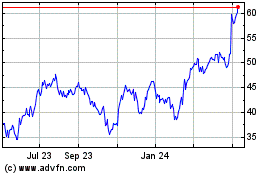

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024