Zacks Industry Outlook Highlights: AK Steel Holding, Allegheny Technologies and Nucor - Press Releases

November 30 2011 - 3:30AM

Zacks

For Immediate Release

Chicago, IL – November 30, 2011 – Today, Zacks Equity Research

discusses the Steel, including AK Steel Holding

(AKS), Allegheny Technologies Inc. (ATI) and

Nucor Corporation (NUE).

A synopsis of today’s Industry Outlook is presented below. The

full article can be read at

http://www.zacks.com/stock/news/65436/Steel+Industry+Stock+Outlook+-+November+2011

The commercial metals company AK Steel Holding

(AKS) posted its third-quarter 2011 results, delivering a net loss

of $3.5 million or $0.03 cents compared with a net loss of $59.2

million or $0.54 cents during the year-ago quarter. However,

results were below the Zacks Consensus Estimate of $0.00 cents per

share.

Net sales, as reported by the company, were $1,585.8 million on the

shipments of 1,368,800 tons versus $1,575.9 million and 1,465,800

tons in the prior-year quarter. Net sales also missed the Zacks

Estimate of $1,662 million. Average selling price for the third

quarter of 2011 was $1,158 per ton, up 8% year over year, but down

2% sequentially.

Value-added shipments for stainless/electrical increased to 229.3

tons compared with 226.9 tons in the prior-year quarter.

Value-added shipments for Coated, Cold-rolled and Tubular product

decreased to 577.2, 278.3 and 32.4 tons, respectively, compared

with 624.4, 322.5 and 33.2 tons, respectively, in the year-earlier

quarter.

Non-value-added shipments including Hot-rolled increased to 222.6

tons from 213.6 tons in the year-earlier quarter. Non-value-added

shipments including secondary products decreased to 29.0 tons from

45.2 tons in the prior-year quarter. AK Steel currently retains a

Zacks #3 Rank (short-term Hold rating). Our long-term

recommendation also remains Neutral.

Allegheny Technologies Inc. (ATI) also earned

$70.6 million or 63 cents per share (excluding acquisition related

expenses of $8.3 million, net of tax) in the third quarter of 2011

up from $1.0 million or 1 cent in the same quarter of 2010. Results

exceeded the Zacks Consensus Estimate of 61 cents.

Sales in the quarter increased 28% to $1.35 billion, driven by

higher shipments for most high-value products, higher raw material

surcharges and increases in average base selling prices for many

products. However, sales were lower than the Zacks Consensus

Estimate of $1.39 billion.

Segment operating profit surged 157% to $161.8 million, or 12.0% of

sales, from $63.0 million, or 6.0% of sales, in the third quarter

of 2010.

Allegheny expects to continue to benefit from its new alloys and

products, diversified global growth markets and differentiated

product mix over the next 3 to 5 years. Demand is expected to be

strong for its mill products and highly engineered forged and cast

components from the aerospace market.

Strong growth is also expected from the oil and gas/chemical

process industry for its titanium-based alloys, nickel-based alloys

and specialty alloys, and tungsten products. We currently have a

Neutral long-term recommendation on the stock, which is the same as

reflected in the Zacks #3 Rank (Hold) rating.

Nucor Corporation (NUE) reported net earnings of

$181.5 million, or 57 cents per diluted share (excluding special

items) in the third quarter of 2011, beating the Zacks Consensus

Estimate of 51 cents per share. This was a significant increase

from $23.5 million, or 7 cents per diluted share (excluding special

items) reported in the year-ago quarter. Nucor’s third-quarter

earnings exceeded those of last year's quarter, but they declined

from the second quarter of this year on lower steel prices and

significantly lower metal margins.

Consolidated sales surged 27% year over year to $5.25 billion,

beating the Zacks Consensus Estimate of $4.86 billion. The growth

was attributable to an increase of 24% in average price per ton and

a rise of 3% in shipments (to 5.8 million tons) to outside

customers. The company’s end-markets such as automotive, heavy

equipment, energy and general manufacturing demonstrated strength

compared to 2010 but showed very little improvement compared with

the first half of 2011.

Steel mill shipments grew 9% to 4.2 million tons during the

quarter. The average scrap and scrap substitute cost per ton

accelerated 27% to $449.

Although Nucor expects to see only slight improvement in demand in

its non-residential construction markets through the end of 2011,

it remains optimistic about its combined construction businesses

(steel mills and downstream facilities) and anticipates that it

will continue to operate profitably.

Nucor expects fourth-quarter earnings to be below its third-quarter

level. The company expects margin compression in the sheet market

in the fourth quarter of 2011. Furthermore, the company forecasts a

smaller compression in plate margins due to imports. The magnitude

of margin compression will be favorably impacted by expected lower

scrap costs through the quarter.

The company has a Zacks #3 Rank (Hold) on its stock.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=2679.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4581.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/ZacksInvestmentResearch

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

AK STEEL HLDG (AKS): Free Stock Analysis Report

ALLEGHENY TECH (ATI): Free Stock Analysis Report

NUCOR CORP (NUE): Free Stock Analysis Report

Zacks Investment Research

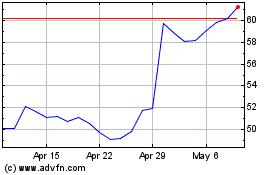

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

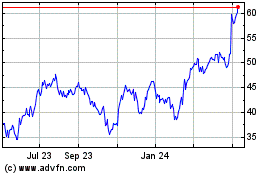

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024