Titanium and Boeing Extend Deal - Analyst Blog

July 14 2011 - 11:52AM

Zacks

Titanium Metals

Corporation (TIE)

announced that it has extended its titanium supply agreement

with The Boeing

Company (BA) through December 31,

2018.

In November

last year, Titanium entered into a long-term supply agreement with

Boeing, which was scheduled to expire on December 31, 2015. As per

the agreement, the company will continue to provide, among other

things, mutual annual purchase and supply commitments, the

extension of the global titanium scrap recycling program and the

utilization of the TIMET Global Service Center Network.

Through its

focused efforts over the past few years, Titanium has included

significant capacity and flexibility to its operations, increasing

its ability to respond to future industry growth and demand.

Through these efforts and this agreement, the company continues to

be a key supplier and strategic partner in Boeing's current and

future programs.

In May 2011,

Titanium released its results for the first quarter of 2011. The

company reported net earnings of $28.9 million or 16 cents per

share in the first quarter of 2011, surpassing the Zacks Consensus

Estimate of 14 cents and increasing from the prior-year earnings of

$16.7 million or 9 cents per share.

Quarterly

revenues of $252 million increased 15.9% year over year, beating

the Zacks Consensus Estimate of $232 million. The rise in sales was

attributable to an increase in product volumes and higher average

selling prices. Improved demand for titanium products in the

commercial aerospace and industrial sectors led to the increase in

volumes.

Cost of

sales jumped by 13.4% over the prior-year quarter to $203.8

million.

Titanium

Metals faced increased demand in the industrial sector as

infrastructure and chemical projects were reinvigorated by the

global economic recovery. The company expects this trend to

continue in 2011 and also plans to drive efficiency through process

technology and cost-reduction initiatives.

Based in

Delaware, Titanium Metals is a leading worldwide producer of

titanium metal products.

Titanium

Metals has been successful over the last several years in

establishing significant flexibility and cost advantages in its

entire manufacturing process. The company’s fiscal discipline and

industry experience have allowed it to manage its production rates

and costs effectively while investing capital conservatively and

maintaining a strong, debt-free balance sheet.

Titanium

Metals’ financial strength and operating flexibility put it in a

good position to take advantage of opportunities that strengthen

and expand its presence in key markets.

The company

competes with Allegheny Technologies

Inc. (ATI) and

RTI

International Metals Inc. (RTI).

We maintain

a Neutral recommendation on Titanium. Currently, it holds a Zacks

#3 Rank (Hold).

ALLEGHENY TECH (ATI): Free Stock Analysis Report

BOEING CO (BA): Free Stock Analysis Report

RTI INTL METALS (RTI): Free Stock Analysis Report

TITANIUM METALS (TIE): Free Stock Analysis Report

Zacks Investment Research

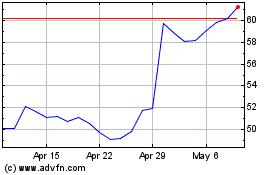

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

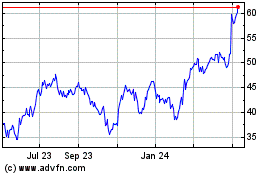

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024