Allegheny's Labor Contract with USW - Analyst Blog

July 01 2011 - 4:00AM

Zacks

Allegheny Technologies

Incorporated (ATI) announced that the United

Steelworkers (USW) represented employees at Allegheny's Ludlum

plants and Albany, Ore., titanium operations ratified new four-year

labor agreements. The new agreements wil expire on June 30,

2015, and succeed the existing contracts that run through

August 1, 2011.

In April 2011, the company released

its first-quarter 2011 results and earned $56.3 million or 54 cents

per share, surpassing the Zacks Consensus Estimate of 49 cents and

last year's $18.2 million, or 18 cents per share.

Quarterly revenues soared 36.5%

year over year to $1.23 billion from $899.4 million on higher

shipments and rising raw material prices. Revenues were above the

Zacks Consensus Estimate of $1.12 billion.

Allegheny continues to expect 2011

revenue growth in the range of 15% to 20% compared with 2010, and

anticipates segment operating profit to be approximately 15% of

sales. The company targets a minimum of

$100 million in new gross cost reductions. Capital expenditures are

forecasted in the range of $300 to $350 million.

Based in Pittsburgh, PA,

Allegheny Technologies Inc. is one of the largest and most

diversified specialty materials producers in the world. The

aerospace market has started recovering, boosting the demand for

Allegheny’s products.

Allegheny has been

addressing cost-pressures associated with high raw material costs

by implementing price hikes through surcharges. The High

Performance Metals segment internally sources sponge, which is

processed for use in titanium and titanium alloys, and zirconium

and hafnium alloy products. The Engineered Products segment is also

similarly integrated. Allegheny’s integrated business model

provides a competitive advantage.

The company’s competitors

include Carpenter Technology

Corp. (CRS) and

Sutor

Technology Group Limited (SUTR).

Currently, Allegheny has a

short-term (1 to 3 months) Zacks #2 Rank (Buy) and a long-term

Neutral recommendation.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

SUTOR TECH GRP (SUTR): Free Stock Analysis Report

Zacks Investment Research

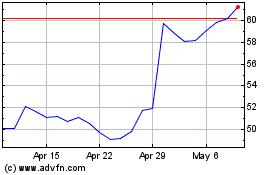

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

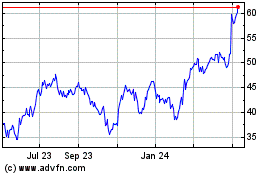

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024