Earnings Preview: Allegheny - Analyst Blog

April 25 2011 - 4:30AM

Zacks

Allegheny Technologies Inc. (ATI) isslated to

release its first quarter 2011 results on Wednesday, April 27,

before the market opens. The current Zacks Consensus Estimate for

the first quarter is 49 cents, representing a significant

annualized growth of 103.13%.

With respect to

earnings surprise, over the trailing four quarters, Alleghenyout

performedthe Zacks Consensus Estimate in the two quarters and

lagged behind in the other two quarters. The average earnings

surprise was a negative 15.42%, implying that the company was

behind the Zacks Consensus Estimate by the same magnitude over the

last four quarters.

Fourth-Quarter Performance

On January 26,

Allegheny reported its results for the fourth quarter of fiscal

2010. In the fourth quarter, Allegheny reported earnings per share

(EPS) of $0.15, missing the Zacks Consensus Estimate of $0.30 and

falling significantly short from last year's $0.36 per share.

Fourth-quarter results were impacted by a $19.5 million LIFO

inventory valuation reserve charge and $20.4 million in start-up

and idle facility costs, which reduced earnings by 26 cents per

share.

For full-year

2010, earnings were $0.82 per share, higher than $0.49 per share in

the year-ago period. This also missed the Zacks Consensus Estimate

of $0.94 per share.

Quarterly

revenues soared 27.2% year over year to $1.04 billion from $815

million on higher shipments and rising raw material prices. Yet

revenues fell short of the Zacks Consensus Estimate at $1.06

billion. Yearly revenues jumped 33% to $4.05 billion from $3.1

billion, beating the Zacks Consensus Estimate of $4.1 billion.

Segment wise,

revenue increases were distinct in the Engineered Products segment

(56%) and in the Flat-Rolled Products segment (34%), while sales in

the Higher Performance Material segment increased modestly

(12%).

Allegheny’s

operating profit declined 25.7% to $88.0 million due to a LIFO

inventory valuation reserve charge of $19.5 million in the fourth

quarter of 2010 compared with a benefit of $43.8 million in the

fourth quarter of 2009. Results were adversely affected by idled

facilities and start-up costs.

For fiscal year

2011, Allegheny expects revenue growth to be in the range of 15% to

20% compared with 2010, and expects segment operating profit to be

approximately 15% of sales. The company targets a minimum of $100

million in new gross cost reductions. Capital expenditures

are forecasted in the range of $300 to $350 million.

Allegheny

expects rising demand in the aerospace market to drive sales going

forward. The company expects the global oil and gas/chemical

process industry to remain strong due to increased demand from

offshore oil and gas projects, large sour gas pipelines,

desalination projects and increasing orders for chemical processing

projects from several parts of the world.

In the

electrical energy market, Allegheny expects demand for

grain-oriented electrical steel for power distribution to remain

essentially flat. The company also expects demand from the

nuclear electrical energy market to remain flat in 2011, although

growth opportunities exist for new nuclear plants under

construction over the next several years.

The medical

market reached a record of nearly 6% of 2010 sales and Allegheny

remains optimistic and expects demand to continue in 2011.

Agreement of Estimate Revisions

In the last 30

days, out of the 8 analysts covering the stock, none increased nor

decreased their EPS estimate for first-quarter 2011. For fiscal

year 2011, in the last 30 days, out of the 7 analysts covering the

stock, 1 analyst raised its EPS estimates, while none decreased the

estimate.

|

Agreement - Estimate

Revisions

|

|

|

Current Qtr

(03/2011)

|

Next Qtr

(06/2011)

|

Current Year

(12/2011)

|

Next Year

(12/2012)

|

|

|

Up Last 7 Days

|

0

|

0

|

0

|

0

|

|

|

Up Last 30 Days

|

0

|

1

|

1

|

1

|

|

|

Down Last 7 Days

|

0

|

0

|

0

|

0

|

|

|

Down Last 30 Days

|

0

|

0

|

0

|

0

|

|

Magnitude of Estimate Revisions

Earnings

estimates for first quarter 2011, in the last 30 days, decreased by

1 cent to $0.49 from $0.50. For fiscal year 2011, earnings

estimates, in the last 30 days, increased by 5 cents to $4.26 from

$4.21.

|

Magnitude - Consensus Estimate

Trend

|

|

|

Current Quarter

(03/2011)

|

Next Quarter

(06/2011)

|

Current Year

(12/2011)

|

Next Year

(12/2012)

|

|

|

Current

|

0.49

|

0.73

|

3.00

|

4.26

|

|

|

7 Days Ago

|

0.50

|

0.74

|

3.00

|

4.24

|

|

|

30 Days Ago

|

0.50

|

0.73

|

2.99

|

4.21

|

|

|

60 Days Ago

|

0.49

|

0.73

|

2.99

|

4.25

|

|

|

90 Days Ago

|

0.52

|

0.67

|

2.83

|

3.88

|

|

Our

Take

Based in

Pittsburgh, PA, Allegheny Technologies Inc. is one of the largest

and most diversified specialty materials producers in the world.

The aerospace market has started recovering, which boosted the

demand for Allegheny’s products.

Allegheny is a

significant supplier to commercial aircraft engine manufacturers

and is also expanding in the commercial airframes market. However,

Allegheny has been battling cost-pressures associated with high raw

material costs by implementing price hikes through surcharges.

Allegheny is

facing an overcapacity of competitive stainless steel. A

significant portion of the sales under the High Performance Metals

segment is attributed to customers in the commercial aerospace

industry. The commercial aerospace industry has historically been

cyclical. Although the aerospace market has shown some improvement

recently, we expect Allegheny to see a slower growth in its High

Performance Segment, which generates a major chunk of revenues.

Moreover, increasing input costs are putting margin pressure on all

domestic steel manufacturers.

The company’s competitors include

Carpenter Technology Corp. (CRS) and Sutor

Technology Group Limited (SUTR).

Currently, Allegheny has a

short-term (1 to 3 months) Zacks #3 Rank ('Hold') and a long-term

Neutral recommendation.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

SUTOR TECH GRP (SUTR): Free Stock Analysis Report

Zacks Investment Research

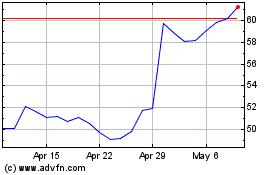

ATI (NYSE:ATI)

Historical Stock Chart

From May 2024 to Jun 2024

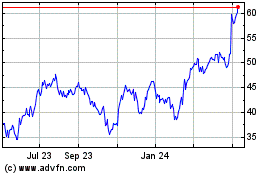

ATI (NYSE:ATI)

Historical Stock Chart

From Jun 2023 to Jun 2024