Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the

“Company”), Latin America’s largest restaurant chain and the

world’s largest McDonald’s franchisee, today reported unaudited

results for the second quarter ended June 30, 2011.

Second Quarter 2011 Highlights

- Revenues increased by 28.7%

year-over-year, or by 18.5% on a constant currency basis, to US$

888.5 million

- Systemwide comparable sales increased

by 14.8% year-over-year

- 72 net additions of restaurants over

the last 12 months

- Adjusted EBITDA1 increased by 47.6%

year-over-year, or by 29% on a constant currency basis, to US$ 67.9

million; Net income increased by 5.6% to US$ 14.2 million

- Guidance for 2011 revised upward:

Revenue growth of 22-24%, Adjusted EBITDA1 growth of 18-20% and Net

Income growth of 35-45% in 2011

“In the second quarter, Arcos Dorados continued to build upon

its solid foundation for market growth and development. With the

completion of our IPO and debt restructuring, the Company is

continuing to implement its strategic priorities and deliver long

term attractive returns for its shareholders,” said Sergio Alonso,

COO of Arcos Dorados.

“In addition to the robust results we achieved in Brazil, SLAD

also made strong contributions during the period, with revenue

growth of 43.2% year-over-year. Our ability to maintain growth and

profitability in the face of inflationary pressure in several of

our key operating countries highlights the success of the Arcos

Dorados’ menu offering, our ability to achieve the right mix of

products and constantly enhance operating efficiencies,” Mr. Alonso

concluded.

Second Quarter Results

Arcos Dorados’ second quarter revenues increased by 28.7% to US$

888.5 million. On a constant currency basis, revenue growth was

18.5%. The increase was driven by systemwide comparable sales

growth of 14.8% and the net addition of 72 restaurants over the

last 12-month period.

The Company’s solid revenue performance was driven by growth

across all of its divisions. Brazil, the Company’s largest

division, reported revenue growth of 26.9% year-over-year,

including 10.2% growth in systemwide comparable sales. NOLAD’s

(Mexico, Panama and Costa Rica) revenues increased by 21.8%

year-over-year, with a systemwide comparable sales increase of

9.7%. SLAD’s (Argentina, Venezuela, Colombia, Chile, Perú, Ecuador,

and Uruguay) revenues grew by 43.2% compared to the second quarter

of 2010, mainly driven by a 33.1% increase in systemwide comparable

sales. The Caribbean division (Puerto Rico, Martinique, Guadeloupe,

Aruba, Curaçao, F. Guiana, US Virgin Islands of St. Thomas and St.

Croix) reported revenue growth of 3.9% above the second quarter of

2010, and stable systemwide comparable sales.

Adjusted EBITDA1 for the second quarter of 2011 was US$ 67.9

million, a 47.6% increase over the same period of 2010 (or 29% on a

constant currency basis). Arcos Dorados’ Adjusted EBITDA1

improvement in the second quarter of 2011 was driven by revenue

growth and improvements in labor productivity in the Company’s

Brazilian division, controlled salary increases in SLAD, and

increased operating leverage in NOLAD. These improvements were

partially offset by (i) higher corporate expenses, which included

increased outsourced and professional services in line with the

expansion of the Company; (ii) as well as higher payroll resulting

mainly from the impact of higher inflation in Argentina, where the

majority of corporate headcount is located; (iii) higher

share-based compensation (primarily related to ongoing CAD and EIP

grant) and, to a lesser degree, by (iv) lower Adjusted EBITDA1 in

the Caribbean Division of US$ 1.7 million.

The Adjusted EBITDA1 margin as a percentage of total revenues

was 7.6% for the quarter, up 98 bps compared to the second quarter

of 2010. Overall, the Company continued driving revenue growth

through new product launches and offering relevant food and

beverage choices, while also effectively managing costs as a

percentage of revenues.

Additionally, during the second quarter, the Company registered

a special charge of US$ 13.6 million, which was excluded from

adjusted EBITDA1 and is related to (i) an incremental compensation

expense related to its existing liability awards (CADs) and which

corresponds to the remeasurement of the accrued liability based on

the opening share price on the first day of trading (US$ $21 per

share); and (ii) IPO-related special awards.

Net income attributable to the Company was US$ 14.2 million in

the second quarter of 2011, up 5.6% from the US$ 13.5 million

reported in the second quarter of 2010. This is mainly due to

improved operating and foreign currency exchange results. These

were partially offset by higher losses on derivative instruments.

The above-mentioned mark-to-market charges are expected to be

reduced going forward, given the cancellation of many of these

derivative instruments in July 2011 (please refer to “Debt

Restructuring”). Income tax expense for the period totaled US$ 4.8

million, resulting in an effective tax rate of 24.8% for the

quarter.

The Company reported basic earnings per share (EPS) of US$ 0.07

in the second quarter of 2011, compared to US$ 0.06 in the second

quarter of 2010. This increase of 22.8% was a result of the 5.6%

growth in net income, as well as a lower weighted-average number of

outstanding shares (please refer to Axis Split-off and IPO

explanations in previous releases).

Balance Sheet & Cash Flow Highlights

Cash and cash equivalents were US$ 254.4 million at June 30,

2011. The Company’s total financial debt (including derivative

instruments) was US$ 573.9 million, with net debt (total financial

debt less cash and cash equivalents) of US $ 319.5 million and a

Net Debt/Adjusted EBITDA1 ratio of 1.0x at June 30, 2011. Cash

generated from operating activities was US$ 50.1 million in the

second quarter of 2011, increasing over the same period last year,

and driven by improvements in operating results. In addition,

during April 2011, the Company collected net proceeds from its

Initial Public Offering in the amount of US$ 152.3 million and on

April 1, 2011, the Company paid a dividend of US$ 12.5 million.

Capital expenditures (CapEx) for the period were US$ 71.5 million,

with the funds mainly being utilized for restaurant openings and

re-imagings during the quarter.

First Half 2011

For the six months ended June 30, 2011, the Company’s revenues

grew by 25.9% (17.4% on a constant currency basis) to US$ 1,715

million, with all divisions posting revenue growth. Additionally,

adjusted EBITDA1 reached US$ 140.2 million, an increase of 21.6%

compared to the first half of 2010, which was driven by growth in

the Brazil, SLAD, and NOLAD divisions. The Company has managed

overall operating costs, while G&A has grown in anticipation of

the expansion of new units. Year-to-date consolidated net income

amounted to US$ 49.7 million, increasing by 39.1% over the first

half of last year. Additionally, total CapEx amounted to US$ 104.3

million for the period, compared to US$ 40.8 million in the first

half of 2010.

Quarter Highlights & Recent Developments

Revised Guidance 2011

Based on stronger than forecasted year-to-date results and the

current outlook for operations and currencies for the remainder of

2011, Arcos Dorados has modified its outlook for the full-year

2011. The Company now expects year-over-year consolidated revenue

growth of 22-24% and Adjusted EBITDA1 growth of 18-20%.

Additionally, the Company estimates an increase in net income of

35-45% in 2011.

New Independent Board Member

Appointed

On June 6, 2011 Arcos Dorados announced the appointment of José

Alberto Vélez, CEO of Cementos Argos, S.A. as an independent

Director of its Board.

Dividend

On July 6, 2011, the Company paid a cash dividend of US$ 12.5

million or US$ 0.0597 per share of outstanding Class A and Class B

shares to shareholders of record at June 17, 2011.

Debt Restructuring

In July 2011, the Company concluded a series of transactions to

restructure its debt profile: On July 8, 2011, the Company issued

5-year R$ 400 million BRL-denominated Senior Unsecured Notes at a

rate of 10.25% (US$ equivalent of approximately $255.1 million).

The Notes mature on July 13, 2016. Subsequently, on July 18, 2011,

the Company redeemed a portion (31.42% or $141.4 million) of its

outstanding 7.50% Senior Notes due in 2019 at a redemption price

equal to 107.50%, plus accrued and unpaid interest. Finally, in

July 2011, the Company cancelled certain derivative instruments in

the amount of US$ 91.6 million.

As a result of the aforementioned transactions, the Company was

able to:

i. reduce its cost of funding generating future savings of

approximately 300-400 basis points per year without significantly

changing its gross debt position;

ii. maintain an adequate level of US Dollar exposure in its debt

structure in accordance with its financial policies; and

iii. significantly reduce the foreign exchange volatility on its

Income Statement related to the use of derivatives

In the third quarter of 2011, the Company will recognize

one-time charges before taxes associated with the senior notes

redemption as well as the unwinding of its derivative instruments,

of approximately US$ 16.6 million.

Expanded Menu Options

On July 26, 2011, Arcos Dorados announced its plans to expand

menu options on October 1, 2011 for all of its territories to

include an array of fresh produce, reduced calorie and sodium

content for some of its menu items, as well as certain reduced

portion sizes. In addition, it will offer a new lower calorie Happy

Meal. This initiative complements the Company’s iconic menu items

and strengthens Arcos Dorados’ portfolio and overall nutritional

profile. Arcos Dorados seeks to offer a wide array of options to

customers while actively balancing flavor with the nutritional

attributes of each new menu item.

Senior Management Appointment

The Company has appointed José Valledor to the position of

Divisional President of the Brazil Division. Mr. Valledor was most

recently the Regional Director for the Southern Cone operations

since 2008 and has over 20 years’ experience in the McDonald´s

system. Brazil’s current Divisional President, Marcelo Rabach, has

been named Vice President of Operations Development for the

Company.

Definitions:

Systemwide comparable sales growth

refers to the change, measured in constant currency, in our

Company-operated and franchised restaurant sales in one period from

a comparable period for restaurants that have been open for

thirteen months or longer. While sales by our franchisees are not

recorded as revenues by us, we believe the information is important

in understanding our financial performance because these sales are

the basis on which we calculate and record franchised revenues, and

are indicative of the financial health of our franchisee base.

Constant currency basis refers to

amounts calculated using the same exchange rate over the periods

under comparison to remove the effects of currency fluctuations

from this trend analysis.

About Arcos Dorados

Arcos Dorados is the world’s largest McDonald’s franchisee in

terms of systemwide sales and number of restaurants, operating the

largest quick service restaurant (“QSR”) chain in Latin America and

the Caribbean. It has the exclusive right to own, operate and grant

franchises of McDonald’s restaurants in 19 Latin American and

Caribbean countries and territories, including Argentina, Aruba,

Brazil, Chile, Colombia, Costa Rica, Curaçao, Ecuador, French

Guyana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico,

St. Croix, St. Thomas, Uruguay and Venezuela. The Company operates

or franchises 1,755 McDonald’s-branded restaurants with over 80,000

employees serving approximately 4 million customers a day.

Recognized as one of the best companies to work for in Latin

America, Arcos Dorados is traded on the New York Stock Exchange

(NYSE: ARCO). To learn more about the Company, please visit our

website: www.arcosdorados.net

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its affordable platform, its expectation for revenue

generation and its outlook for 2011. These statements are subject

to the general risks inherent in Arcos Dorados' business. These

expectations may or may not be realized. Some of these expectations

may be based upon assumptions or judgments that prove to be

incorrect. In addition, Arcos Dorados' business and operations

involve numerous risks and uncertainties, many of which are beyond

the control of Arcos Dorados, which could result in Arcos Dorados'

expectations not being realized or otherwise materially affect the

financial condition, results of operations and cash flows of Arcos

Dorados. Additional information relating to the uncertainties

affecting Arcos Dorados' business is contained in its filings with

the Securities and Exchange Commission. The forward-looking

statements are made only as of the date hereof, and Arcos Dorados

does not undertake any obligation to (and expressly disclaims any

obligation to) update any forward-looking statements to reflect

events or circumstances after the date such statements were made,

or to reflect the occurrence of unanticipated events.

Use of Non-GAAP Financial Measures(1)

In addition to financial measures prepared in accordance with

the general accepted accounting principles (GAAP), within this

press release and the accompanying tables, we use a financial

measure titled ‘Adjusted EBITDA’. We use Adjusted EBITDA to

facilitate operating performance comparisons from period to period.

Adjusted EBITDA is defined as our operating income plus

depreciation and amortization plus/minus the following losses/gains

included within other operating expenses, net and within general

and administrative expenses in our statement of income:

compensation expense related to a special award granted to our

chief executive officer, incremental compensation expense related

to our 2008 long-term incentive plan, gains from sale of property

and equipment, write-off of property and equipment, contract

termination losses, and impairment of long-lived assets and

goodwill, and stock-based compensation and bonuses incurred in

connection with the Company’s initial public listing.

Second Quarter 2011 Consolidated

Results (Unaudited)

(In thousands of U.S. dollars, except per

share data)

For Three Months ended

June 30, 2011 2010 REVENUES Sales by

Company-operated restaurants 852,042 663,460 Revenues from

franchised restaurants 36,447 27,126

Total Revenues 888,489

690,586 OPERATING COSTS AND EXPENSES

Company-operated restaurant expenses: Food and paper (302,336 )

(238,117 ) Payroll and employee benefits (167,791 ) (136,273 )

Occupancy and other operating expenses (231,302 ) (184,288 )

Royalty fees (41,484 ) (32,553 ) Franchised restaurants - occupancy

expenses (11,973 ) (9,516 ) General and administrative expenses

(95,698 ) (54,788 ) Other operating income/(expenses), net

(1,801 ) (2,534 )

Total operating costs and expenses

(852,385 ) (658,069 )

Operating income 36,104

32,517 Net interest expense (10,415 ) (10,065 ) Loss

from derivative instruments (7,898 ) (2,892 ) Foreign currency

exchange results 2,105 (343 ) Other non-operating expenses, net

(745 ) (834 )

Income before income taxes

19,151 18,383 Income tax

expense (4,754 ) (4,989 )

Net income

14,397 13,394 Net (income) loss

attributable to non-controlling interests (162 ) 85

Net income attributable to Arcos Dorados Holdings

Inc. 14,235 13,479

Earnings per share information ($ per share):

Basic net income per common share attributable to Arcos

Dorados Holdings Inc.

$ 0.07 $

0.06 Weighted-average number of common shares

outstanding-Basic 208,063,349 241,882,966

Adjusted EBITDA Reconciliation Operating

income 36,104 32,517 Depreciation and amortization 15,998 13,997

Other operating expenses classified as non-cash 1,367 553 Other

operating (income) expenses classified as non-recurring 810 (1,080

) Special charges 13,590 0

Adjusted

EBITDA 67,869 45,987

Adjusted EBITDA Margin as % of total revenues 7.6

% 6.7 %

First Half 2011 Consolidated Results

(Unaudited)

(In thousands of U.S. dollars, except per

share data)

For Six Months ended June 30,

2011 2010 REVENUES Sales by

Company-operated restaurants 1,643,394 1,307,104 Revenues from

franchised restaurants 71,752 54,707

Total Revenues 1,715,146

1,361,811 OPERATING COSTS AND EXPENSES

Company-operated restaurant expenses: Food and paper (580,170 )

(463,499 ) Payroll and employee benefits (327,706 ) (257,973 )

Occupancy and other operating expenses (442,654 ) (358,593 )

Royalty fees (79,955 ) (63,970 ) Franchised restaurants - occupancy

expenses (24,393 ) (19,281 ) General and administrative expenses

(164,445 ) (105,140 ) Other operating income/(expenses), net

862 (8,122 )

Total operating costs and

expenses (1,618,461 )

(1,276,578 ) Operating income

96,685 85,233 Net interest

expense (20,199 ) (19,637 ) Loss from derivative instruments

(12,225 ) (7,990 ) Foreign currency exchange results 1,864 (3,110 )

Other non-operating expenses, net (1,183 ) (1,918 )

Income before income taxes 64,942

52,578 Income tax expense (14,946 )

(16,873 )

Net income 49,996

35,705 Net (income) loss attributable to

non-controlling interests (271 ) 39

Net

income attributable to Arcos Dorados Holdings Inc.

49,725 35,744 Earnings

per share information ($ per share): Basic net

income per common share attributable to Arcos Dorados Holdings Inc.

$ 0.22 $ 0.15

Weighted-average number of common shares outstanding-Basic

221,408,769 241,882,966

Adjusted

EBITDA Reconciliation Operating income 96,685 85,233

Depreciation and amortization 31,123 28,368 Other operating

expenses classified as non-cash 1,685 754 Other operating (income)

expenses classified as non-recurring (2,889 ) 982 Special charges

13,590 0

Adjusted EBITDA

140,194 115,337 Adjusted

EBITDA Margin as % of total revenues 8.2 %

8.5 %

Second Quarter and First Half 2011

Results by Division (Unaudited)

(In thousands of U.S. dollars)

For Three Months ended % Increase For Six

Months ended % Increase June 30, / June

30, / 2011 2010

(Decrease)

2011

2010 (Decrease)

Revenues

Brazil 461,936 363,902 27% 892,063 718,520 24%

Caribbean 67,483 64,919 4% 132,056 127,385 4% NOLAD 89,510 73,463

22% 171,743 141,464 21% SLAD 269,560 188,302

43% 519,284 374,442 39%

TOTAL

888,489 690,586 29%

1,715,146 1,361,811 26%

Adjusted EBITDA

(1)

Brazil 62,074 40,962 52% 128,566 99,241 30% Caribbean 3,074 4,760

-35% 6,282 9,531 -34% NOLAD 4,883 2,204 122% 7,868 4,202 87% SLAD

23,568 14,442 63% 42,933 32,742 31% Corporate and Other (25,730)

(16,381) 57% (45,455) (30,379)

50%

TOTAL 67,869 45,987

48% 140,194 115,337

22%

Total Restaurants (eop) &

Systemwide Comparable Sales Growth

TotalRestaurants*

Comp. Sales 2Q11vs. 2Q10

(%)

Brazil 625 10.2 % Caribbean 144 (0.3 )% NOLAD 473 9.7 % SLAD 525

33.1 % TOTAL 1,767 14.8 %

* Considers company-operated and

franchised restaurants at period-end

Summarized Consolidated Balance

Sheet

(In thousands of U.S. dollars)

As of, As of,

June 30, 2011(Unaudited)

December 31,2010

ASSETS Current assets Cash and cash

equivalents 254,404 208,099 Accounts and notes receivable, net

82,917 79,821 Other current assets (1) 189,323 264,435

Total

current assets 526,644 552,355

Non-current assets Property and equipment, net 1,015,671

911,730 Net intangible assets and goodwill 56,436 47,264 Deferred

income taxes 206,361 190,764 Other non-current assets (2) 68,085

82,153

Total non-current assets 1,346,553

1,231,911 Total assets 1,873,197

1,784,266 LIABILITIES AND EQUITY Current

liabilities Accounts payable 118,604 186,700 Taxes payable (3)

110,835 124,677 Accrued payroll and other liabilities 217,162

211,231 Other non-current liabilities (4) 24,682 24,631 Financial

debt (5) 65,281 57,909

Total current liabilities

536,564 605,148 Non-current liabilities

Accrued payroll and other liabilities 55,077 53,475 Provision for

contingencies 52,337 63,940 Financial debt (5) 508,645 506,130

Deferred income taxes 8,658 6,378

Total non-current

liabilities 624,717 629,923 Total

liabilities 1,161,281 1,235,071 Shareholders’

equity Class A shares of common stock 351,654 226,528 Class B

shares of common stock 132,915 151,018 Additional paid-in capital

(48) (2,468) Retained earnings 296,103 271,387 Accumulated other

comprehensive loss (70,135) (98,664)

Total Arcos Dorados

Holdings Inc shareholders’ equity 710,489 547,801

Non-controlling interest in subsidiaries 1,427 1,394

Total shareholders’ equity 711,916 549,195

Total liabilities and shareholders’ equity

1,873,197 1,784,266 (1) Includes "Other

receivables", "Inventories", "Prepaid expenses and other current

assets" and "Deferred income taxes". (2) Includes "Miscellaneous",

"Collateral deposits" and "McDonald´s Corporation´ indemnification

for contingencies". (3) Includes "Income taxes payable" and "Other

taxes payable". (4) Includes "Royalties payable to McDonald´s

Corporation" and "Interest payable". (5) Includes "Short-term

debt", "Long-term debt" and "Derivative instruments"

Consolidated Financial Ratios

(In thousands of U.S. dollars, except

ratios)

As of As of

June 30, 2011 December 31, (Unaudited)

2010 Cash & cash equivalents 254,404 208,099 Total

Financial Debt (i) 573,926 564,039 Net Financial Debt (ii) 319,522

355,940 Total Financial Debt / LTM Adjusted EBITDA ratio 1.8 1.9

Net Financial Debt / LTM Adjusted EBITDA ratio 1.0 1.2 (i)

Total financial debt includes short-term debt, long-term debt and

derivative instruments

(ii) Total financial debt less cash and

cash equivalents

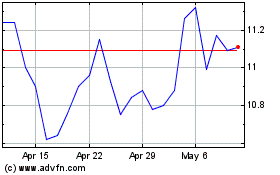

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From May 2024 to Jun 2024

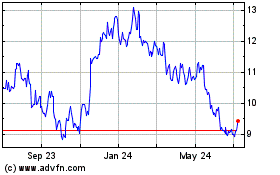

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Jun 2023 to Jun 2024