- Report of Foreign Issuer (6-K)

June 13 2011 - 5:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

|

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

|

For the month of June, 2011

Commission File Number: 001-35129

Arcos Dorados Holdings Inc.

(Exact name of registrant as specified in its charter)

Roque Saenz Peña 432

B1636FFB Olivos, Buenos Aires, Argentina

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

ARCOS DORADOS HOLDINGS INC.

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Press Release entitled “Arcos Dorados Announces Redemption of a Portion of Outstanding 7.50% Senior Notes Due 2019” dated June 13, 2011

|

Item 1

FOR IMMEDIATE RELEASE

ARCOS DORADOS ANNOUNCES REDEMPTION OF A PORTION

OF OUTSTANDING 7.50% SENIOR NOTES DUE 2019

Buenos Aires, Argentina, June 13, 2011

– Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the “Company”), Latin America’s largest restaurant chain and the world’s largest McDonald’s franchisee, today announced that its indirectly wholly-owned subsidiary, Arcos Dorados B.V., has exercised its option to redeem 31.42% (or US$141.4 million) of the outstanding principal amount of its 7.50% Senior Notes due 2019 (the “Notes”) at a redemption price equal to 107.50% of the principal amount of the Notes, plus accrued and unpaid interest to the redemption date. The Notes will be redeemed on July 18, 2011. The aggregate purchase price of the Notes to be redeemed is US$152.0 million, plus accrued and unpaid interest from April 1, 2011 to the redemption date.

Concurrently with the redemption of the Notes, the Company intends to enter into a new financing, the proceeds of which will be used to satisfy the Company’s previously announced capital expenditure and reinvestment plans, as agreed with McDonald’s.

By taking this opportunity to restructure a portion of its corporate debt, Arcos Dorados expects to reduce its overall cost of funding without increasing its net debt position.

# # #

About Arcos Dorados

Arcos Dorados is the world's largest McDonald's franchisee, in terms of systemwide sales and number of restaurants. The Company is the largest quick service restaurant chain in Latin America and the Caribbean, with restaurants in 19 countries and territories. To learn more, please visit

www.arcosdorados.net

.

Investor Relations Contact

Sofia Chellew

sofia.chellew@ar.mcd.com

T: +54 11 4711 2515

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The forward-looking statements contained herein include statements about the Company’s potential financing activities and its intended use of the proceeds therefrom. These expectations may or may not be realized. Some of these expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Arcos Dorados' business and operations involve numerous risks and uncertainties, many of which are beyond the control of Arcos Dorados, which could result in Arcos Dorados' expectations not

being realized or otherwise materially affect the financial condition, results of operations and cash flows of Arcos Dorados. Additional information relating to the uncertainties affecting Arcos Dorados' business is contained in its filings with the Securities and Exchange Commission. The forward-looking statements are made only as of the date hereof, and Arcos Dorados does not undertake any obligation to (and expressly disclaims any obligation to) update any forward-looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events.

This press release is not an offer to sell any securities and is not soliciting an offer to buy any securities. Any securities which may be offered in the future, if any, will not be or have not been registered under the Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Arcos Dorados Holdings Inc.

|

|

|

|

|

By:

|

/s/ Juan David Bastidas

|

|

|

|

|

|

Name:

|

Juan David Bastidas

|

|

|

|

|

|

Title:

|

Chief Legal Counsel

|

Date: June 13, 2011

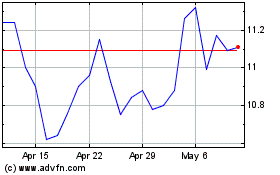

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From May 2024 to Jun 2024

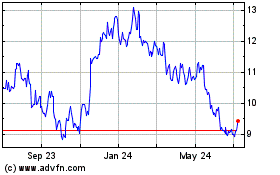

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Jun 2023 to Jun 2024