Ethanol Stocks Struggle as Scrutiny Increases

September 21 2011 - 8:16AM

Marketwired

The ethanol industry continues to face scrutiny from the media. The

favorable US governmental policies that promote corn being used by

US-based ethanol plants have sent corn demand surging, leading many

analysts to argue that ethanol is -- at least partially --

responsible for the higher corn prices in recent years. The Bedford

Report examines the outlook for companies in the Ethanol Industry

and provides investment research on Pacific Ethanol Corporation

(NASDAQ: PEIX) and Archer Daniels Midland Company (NYSE: ADM).

Access to the full company reports can be found at:

www.bedfordreport.com/PEIX

www.bedfordreport.com/ADM

Last week a hearing of the House Subcommittee on Livestock,

Dairy, and Poultry focused on the limited feed availability and

resulting higher feed costs. The panel accused the ethanol industry

as a key cause of livestock/poultry producers' dipping profits and

a coming rise in consumer prices. Steven Meyer, President of

Paragon Economics, an Iowa-based livestock and grain market

analyst, argues, "subsidized ethanol has meant record high corn

prices, record-high costs of production for meat and poultry,

resulting lower per capita meat and poultry output and, finally,

record-high meat prices. The U.S. pork industry lost $6 billion in

equity from 2007 through 2009, but improved profitability did not

stop the exodus of pork producers in 2010."

The Bedford Report releases regular market updates on the

Ethanol Industry so investors can stay ahead of the crowd and make

the best investment decisions to maximize their returns. Take a few

minutes to register with us free at www.bedfordreport.com and get

exclusive access to our numerous analyst reports and industry

newsletters.

New EPA regulations set forth this year have likely solidified

ethanol's future in gasoline. The EPA approved the use of up to 15

percent ethanol in gasoline in vehicles produced during 2001-2006.

The EPA had already approved the 15 percent ethanol tolerance for

vehicles made in 2007 or later.

Archer Daniels Midland said net income for the most recent

quarter was $381.0 million, or 58 cents per share, compared with

$446.0 million, or 69 cents per share, in the year-ago quarter.

Archer Daniels explained that profit from making ethanol was up

sharply, but that was offset by escalating costs in other

businesses, including sweeteners and starches that also rely on

corn.

Pacific Ethanol reported revenue of $215 million, up from $77

million in the second quarter last year. Total gallons sold were

100.6 million for the second quarter of 2011, an increase of 54%

over the 65.4 million gallons sold in the second quarter of

2010.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

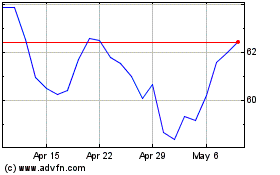

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From May 2024 to Jun 2024

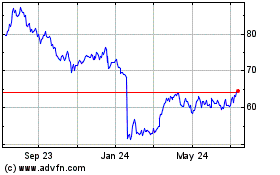

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Jun 2023 to Jun 2024