2nd UPDATE: ADM Profit Falls 15% On Higher Taxes, Corn Costs

August 02 2011 - 1:21PM

Dow Jones News

Archer Daniels Midland Co. (ADM) executives said Tuesday that a

four-fold jump in its tax bill last quarter was an anomaly as it

derived more of its profits from U.S. operations.

The world's largest grain processor by revenue reported a 15%

drop in fiscal fourth-quarter earnings, weighed by the tax charge

and rising corn costs, with analysts also questioning the

transparency of its hedging program.

Pat Woertz, chairman and chief executive, said on a call with

analysts that ADM has been putting an increased emphasis on

transparency in recent months, but added that in some cases

volatile crop markets make forecasting difficult.

Profits became concentrated in the U.S. during the last quarter

because of improved oilseed processing margins here and

weaker-than-expected international merchandising results.

The 2011 earnings mix included "a lot of unique items that will

not replicate itself in 2012," Chief Financial Officer Ray Young

said.

Profit from ADM's corn-processing unit fell 16% despite a 15%

increase in volume. Corn futures at the Chicago Board of Trade hit

an all-time record of nearly $8 a bushel in early June, an increase

of over $4.50 a bushel over the prior year.

ADM's corn sweetener profits dwindled to $9 million from $110

million a year ago due to the rising corn prices. Young said prior

corn sweetener profits included hedging gains on corn that did not

extend to the fourth quarter.

A lack of transparency on hedging is the reason the stock has

"gotten killed" over the past three months, Citi analyst David

Driscoll told ADM executives during the conference call. The stock

is down 21% during that period. It was down 3.67% Tuesday to

$29.36.

"It's days like today where people say, 'See? You can't predict

it,'" Driscoll said.

ADM and other grain merchandisers have largely benefitted during

the past year from a grain export ban in the Black Sea region that

sent buyers scrambling elsewhere to secure supplies. Companies such

as ADM, with a global network of grain storage and transportation,

were well-positioned.

Supplies remain tight, but the environment is shifting. Black

Sea exports have resumed, and ADM and other companies are now

focusing on strengthening their presence in the region. ADM

announced Tuesday it would expand its network along the Danube

River in Romania with 12 new river elevators and an export terminal

on the Black Sea. The project would resemble its storage network

along the Mississippi River in the U.S., Woertz said.

For the quarter ended June 30, ADM reported a profit of $381

million, or 58 cents a share, down from $446 million, or 69 cents a

share, a year earlier. Revenue soared 45% to $22.87 billion.

-By Ian Berry, Dow Jones Newswires; 312-750-4072;

ian.berry@dowjones.com

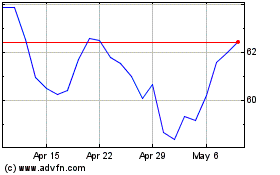

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From May 2024 to Jun 2024

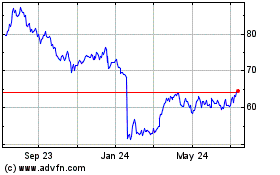

Archer Daniels Midland (NYSE:ADM)

Historical Stock Chart

From Jun 2023 to Jun 2024