Assisted Living Concepts, Inc. ("ALC") (NYSE: ALC) reported a net

loss of $2.6 million in the fourth quarter of 2012 as compared to

net income of $7.3 million in the fourth quarter of 2011.

During the fourth quarters of both 2012 and 2011, ALC recorded

One-Time Items described below. Excluding the One-Time Items, our

net loss in the fourth quarter of 2012 would have been $0.8 million

as compared to net income of $6.3 million in the fourth quarter of

2011.

Revenues in the fourth quarter of 2012 were $57.0 million as

compared to revenues of $58.9 million in the fourth quarter of

2011.

"In the fourth quarter of 2012, we increased our number of units

rented by 131, a significant improvement from recent history,"

commented Dr. Charles "Chip" Roadman, our President and Chief

Executive Officer. "Our continued progress in the regulatory arena

combined with quality initiatives were instrumental measures in

attaining this improvement."

For the year ended December 31, 2012, ALC reported a net loss of

$26.1 million as compared to net income of $24.4 million in the

year ended December 31, 2011.

Excluding the One-Time Items described below, net income for the

years ended December 31, 2012 and 2011 would have been $7.7 million

and $22.1 million, respectively.

Diluted earnings per common share for the fourth quarter and the

year ended December 31, 2012 and 2011 were:

Quarter ended Year ended

December 31, December 31,

2012 2011 2012 2011

--------- --------- --------- ---------

Diluted earnings/(loss) per

common share $ (0.11) $ 0.31 $ (1.14) $ 1.05

Pro forma diluted

earnings/(loss) per common

share excluding One-Time

Items $ (0.03) $ 0.27 $ 0.34 $ 0.95

One-Time Items (net of tax) in the quarter and year ended

December 31, 2012 included:

1. Charges related to the purchase of 12 previously leased

properties from Ventas Realty, Limited Partnership and MLD Delaware

Trust relating to the write off of $0.2 million and $22.4 million

related to a litigation settlement and a lease termination fee for

the quarter and year ended December 31, 2012, respectively, a $5.2

million write-off of an operating lease intangible, and $0.6

million of transaction costs, partially offset by $0.6 million of

rental savings for the year ended December 31, 2012. 2. The

write-off of construction costs associated with expansion projects

that management has determined will not be completed. ($0.0 million

and $0.3 million for the quarter and year ended December 31, 2012).

3. Expenses incurred in connection with an internal investigation,

litigation related to the Ventas transaction, public relations and

quality committee projects. ($1.1 million and $3.1 million for the

quarter and year ended December 31, 2012, respectively). 4. The

write down of long-lived assets determined to be impaired ($2.1

million for the year ended December 31, 2012). 5. The write-off of

deferred financing in connection with the amended U.S. Bank credit

facility ($0.7 million in both the quarter and year ended December

31, 2012). 6. Income recorded in connection with the sale of

investments ($0.1 million in both the quarter and year ended

December 31, 2012).

One-Time Items in the year ended December 31, 2011 included:

1. A reduction in tax expense associated with the settlement of

all issues associated with a tax allocation agreement with a

subsidiary of our former parent Extendicare Inc. (now Extendicare

Real Estate Investment Trust) and a reversal of tax reserves

associated with the completion of certain state audits ($0.6

million and $1.3 million for the quarter and year ended December

31, 2011, respectively). 2. Income associated with a mark to market

adjustment for interest rate swap agreements ($0.1 million and $0.0

million net of tax for the quarter and year ended December 31,

2011, respectively). 3. The write-off of deferred financing fees

associated with our refinanced debt ($0.0 million and $0.2 million

net of tax for the quarter and year ended December 31, 2011,

respectively). 4. Gains on sales of equity investments ($0.0

million and $0.6 million net of tax for the quarter and year ended

December 31, 2011, respectively). 5. Income associated with

purchase accounting adjustments ($0.4 million and $0.5 million net

of tax for the quarter and year ended December 31, 2011,

respectively).

Certain non-GAAP financial measures are used in the discussions

in this release in assessing the performance of the business. See

the attached tables for definitions of Adjusted EBITDA and Adjusted

EBITDAR, reconciliations of net income to Adjusted EBITDA and

Adjusted EBITDAR, calculations of Adjusted EBITDA and Adjusted

EBITDAR as a percentage of total revenues, and non-GAAP financial

measure reconciliation information.

As of December 31, 2012, ALC operated 211 senior living

residences comprising 9,348 units.

The following discussions include the impact of the One-Time

Items.

Quarters ended December 31, 2012, December 31,

2011 and September 30, 2012

Revenues of $57.0 million in the fourth quarter ended December

31, 2012 decreased $1.9 million or 3.2% as compared to $58.9

million in the fourth quarter of 2011 and increased $1.4 million or

2.5% from $55.6 million in the third quarter of 2012.

Adjusted EBITDAR for the fourth quarter of 2012 was $9.0 million

or 15.8% of revenues and

- decreased $13.8 million or 60.5% from $22.7 million and 38.6%

of revenues in the fourth quarter of 2011; and

- increased $0.8 million or 9.2% from $8.2 million and 14.8% of

revenues in the third quarter of 2012.

Adjusted EBITDA for the fourth quarter of 2012 was $6.3 million

or 11.0% of revenues and

- decreased $12.0 million or 65.6% from $18.3 million and 31.1%

of revenues in the fourth quarter of 2011; and

- increased $0.9 million or 16.8% from $5.4 million and 9.7% of

revenues in the third quarter of 2012.

Fourth quarter 2012 compared to fourth quarter

2011

Revenues in the fourth quarter of 2012 decreased by $1.9 million

from the fourth quarter of 2011 primarily due to a decrease in

rented private pay units ($2.4 million), and the planned reduction

in the number of units rented by Medicaid residents ($0.2 million),

partially offset by rate increases ($0.7 million). Average private

pay rates increased in the fourth quarter of 2012 by 1.2% from

average private pay rates for the fourth quarter of 2011. Average

overall rates, including the impact of improved payer mix,

increased in the fourth quarter of 2012 by 1.5% from comparable

rates for the fourth quarter of 2011.

Both Adjusted EBITDAR and Adjusted EBITDA decreased in the

fourth quarter of 2012 primarily due to an increase in residence

operations expenses ($8.5 million) (this excludes the gain on

disposal of fixed assets), an increase in general and

administrative expenses ($3.4 million) (this excludes non-cash

equity based compensation) and a decrease in revenue ($1.9 million)

partially offset, for Adjusted EBITDA only, a decrease in residence

lease expense ($1.8 million) resulting from the June 15, 2012,

purchase of twelve previously leased properties. Residence

operations expenses increased primarily from an increases in labor

expenses ($5.8 million), reserves associated with self-insured

liabilities ($1.0 million), maintenance expense ($0.6 million),

food expense ($0.5 million), legal and consulting expenses ($0.4

million) and other administrative expenses ($0.4 million),

partially offset by an improvement in bad debt expense ($0.3

million). General and administrative expenses increased as a result

of the SEC investigation, litigation, and expenses incurred in

connection with public relations and quality improvement

initiatives.

Fourth quarter 2012 compared to the third

quarter 2012

Revenues in the fourth quarter of 2012 increased by $1.4 million

from the third quarter of 2012 primarily due to an increase in the

number of rented units ($1.4 million), insurance proceeds from

business interruption at a residence ($0.4 million), partially

offset by lower average daily revenue as a result of promotional

discounts ($0.4 million). Average private pay rates (excluding

revenue related to the business interruption proceeds) declined in

the fourth quarter of 2012 by 0.6% from average private pay rates

for the third quarter of 2012.

Adjusted EBITDA and Adjusted EBITDAR increased in the fourth

quarter of 2012 as compared to the third quarter of 2012 primarily

from an increase in revenues discussed above ($1.4 million), a

reduction in residence operations expenses ($0.7 million) (this

excludes the gain on disposal of fixed assets), partially offset by

an increase in general and administrative expenses ($1.3 million)

(this excludes non-cash equity-based compensation) and, for

Adjusted EBITDA only, a decrease in residence lease expense ($0.1

million) resulting from the June 15, 2012, purchase of twelve

previously leased properties. Residence operations expenses

decreased primarily from a decrease in utilities expense ($0.6

million), a reduction in legal and consulting fees ($0.6 million),

an improvement in bad debt expense ($0.3 million), a reduction in

maintenance expense ($0.1 million), and an improvement in other

administrative expenses ($0.2 million), partially offset by an

increases in reserves associated with self-insured liabilities

($0.7 million), labor expenses ($0.2 million), and food expense

($0.2 million). General and administrative expenses increased as a

result of the SEC investigation, litigation and expenses incurred

in connection with public relations and quality improvement

initiatives.

Year ended December 31, 2012 and December 31,

2011

Revenues of $228.4 million in the year ended December 31, 2012

decreased $6.1 million or 2.6% from $234.5 million in the year

ended December 31, 2011.

Adjusted EBITDAR for the year ended December 31, 2012 was $55.4

million, or 24.3% of revenues and

- decreased $30.1 million or 35.2% from $85.5 million and 36.5%

of revenues in the year ended December 31, 2011.

Adjusted EBITDA for the year ended December 31, 2012 was $42.0

million, or 18.4% of revenues and

- decreased $25.8 million or 38.0% from $67.8 million and 28.9%

of revenues in the year ended December 31, 2011.

Year ended December 31, 2012 compared to the

year ended December 31, 2011

Revenues in the year ended December 31, 2012 decreased by $6.1

million from the year ended December 31, 2011 primarily due to a

decrease in rented private pay units ($7.5 million), and the

planned reduction in the number of units rented to by Medicaid

residents ($1.6 million), partially offset by higher average daily

revenue from rate increases ($2.4 million) and one additional day

in the 2012 period due to leap year ($0.6 million). Average rates

increased in the year ended December 31, 2012 by 1.5% over average

rates for the year ended December 31, 2011.

Both Adjusted EBITDA and Adjusted EBITDAR decreased in the year

ended December 31, 2012 primarily from an increase in residence

operations expenses ($17.2 million) (this excludes the gain on

disposal of fixed assets and write-off of construction costs), a

decrease in revenues discussed above ($6.1 million), and an

increase in general and administrative expenses ($6.8 million)

(this excludes non-cash equity based compensation) and, for

Adjusted EBITDA only, a decrease in residence lease expense ($4.3

million). Residence operations expenses increased as a result of

increased salaries and wages associated with quality restoration

efforts initiated in June 2012 and an increase in professional fees

from litigation and regulatory issues primarily in the southeast.

General and administrative expenses increased as a result of an

internal investigation, the SEC investigation, litigation and

expenses incurred in connection with public relations, and quality

improvement initiatives.

Liquidity

At December 31, 2012 ALC had cash of $10.2 million and

availability of $8.0 million under its credit agreement. At

December 31, 2012, ALC owned 94 unencumbered residences that may be

used to secure future capital.

Other Information

As previously announced, on February 25, 2013, ALC entered into

an Agreement and Plan of Merger (the "Merger Agreement") with

affiliates of TPG Capital, L.P. At the effective time of the

merger, each share of ALC Class A and Class B common stock issued

and outstanding immediately prior to the effective time of the

merger will be converted automatically into the right to receive

$12.00 and $12.90 in cash, respectively.

About Us

Assisted Living Concepts, Inc. and its subsidiaries operated 211

senior living residences comprising 9,348 resident units in 20

states at December 31, 2012. ALC's senior living facilities

typically consist of 40 to 60 units and offer residents a

supportive, home-like setting and assistance with the activities of

daily living. ALC employed approximately 4,600 people at December

31, 2012.

Forward-looking Statements

Statements contained in this release other than statements of

historical fact, including statements regarding anticipated

financial performance, business strategy and management's plans and

objectives for future operations, including management's

expectations about improving occupancy and private pay mix, are

forward-looking statements. Forward-looking statements generally

include words such as "expect," "point toward," "intend," "will,"

"indicate," "anticipate," "believe," "estimate," "target," "plan,"

"foresee," "strategy" or "objective." Forward-looking statements

are subject to risks and uncertainties that could cause actual

results to differ materially from those expressed or implied. In

addition to the risks and uncertainties referred to in the release,

other risks and uncertainties are contained in ALC's filings with

United States Securities and Exchange Commission and include, but

are not limited to, the following: any conditions imposed on the

parties in connection with consummation of the transactions

contemplated by the Merger Agreement; the ability to obtain

regulatory approvals of the transactions contemplated by the Merger

Agreement on the proposed terms and schedule; the failure of ALC's

stockholders to approve the transactions contemplated by the Merger

Agreement; ALC's ability to maintain relationships with customers,

employees or suppliers following the announcement of the Merger

Agreement; the ability of the parties to satisfy the conditions to

closing of the transactions contemplated by the Merger Agreement;

the risk that the transactions contemplated by the Merger Agreement

may not be completed in the time frame expected by the parties or

at all; the risk that ALC is unable to comply with covenants under

its credit agreement or ALC cannot obtain waivers of or amendments

to the covenants; changes in the health care industry in general

and the senior housing industry in particular because of

governmental and economic influences; changes in general economic

conditions, including changes in housing markets, unemployment

rates and the availability of credit at reasonable rates; changes

in regulations governing the industry and ALC's compliance with

such regulations; changes in government funding levels for health

care services; resident care litigation, including exposure for

punitive damage claims and increased insurance costs, and other

claims asserted against ALC; ALC's ability to maintain and increase

census levels; ALC's ability to attract and retain qualified

personnel; the availability and terms of capital to fund

acquisitions and ALC's capital expenditures; changes in

competition; and demographic changes. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

ALC's forward-looking statements. All forward-looking statements

contained in this report are necessarily estimates reflecting the

best judgment of the party making such statements based upon

current information. ALC assumes no obligation to update any

forward-looking statement.

ASSISTED LIVING CONCEPTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

Three Months Ended Year Ended

December 31, December 31,

2012 2011 2012 2011

Revenues $ 56,980 $ 58,863 $ 228,397 $ 234,452

Expenses:

Residence operations

(exclusive of

depreciation and

amortization and

residence lease expense

shown below) 42,329 33,515 154,194 136,659

General and administrative 6,173 2,803 19,822 13,361

Residence lease expense 2,686 4,461 13,369 17,686

Lease termination and

settlement 300 - 37,430 -

Depreciation and

amortization 6,827 5,843 24,915 23,103

Intangible impairment - - 8,650 -

Asset impairment - - 3,500 -

Transaction costs - - 1,046 -

Total operating expenses 58,315 46,622 262,926 190,809

(Loss)/income from

operations (1,335) 12,241 (34,529) 43,643

Other (expense) income:

Interest expense:

Debt (2,483) (1,826) (8,143) (7,872)

Change in fair value of

derivatives and

amortization - 94 - -

Write-off of deferred

financing costs (1,137) - (1,137) (279)

Interest income 1 4 9 12

Gain on sale of securities 257 46 257 956

(Loss)/income before income

taxes (4,697) 10,559 (43,543) 36,460

Income tax benefit/(expense) 2,074 (3,249) 17,418 (12,100)

Net (loss)/income $ (2,623) $ 7,310 $ (26,125) $ 24,360

Weighted average common

shares:

Basic 22,970 22,967 22,970 22,955

Diluted 22,970 23,239 22,970 23,256

Per share data:

Basic (loss)/earnings per

common share $ (0.11) $ 0.32 $ (1.14) $ 1.06

========= ========= ========= =========

Diluted (loss)/earnings per

common share: $ (0.11) $ 0.31 $ (1.14) $ 1.05

========= ========= ========= =========

Dividends declared and paid

per common share $ - $ 0.10 $ 0.20 $ 0.30

========= ========= ========= =========

Adjusted EBITDA (1) $ 6,292 $ 18,286 $ 42,040 $ 67,824

========= ========= ========= =========

Adjusted EBITDAR (1) $ 8,978 $ 22,747 $ 55,409 $ 85,510

========= ========= ========= =========

(1) See attached tables for definitions of

Adjusted EBITDA and Adjusted EBITDAR and reconciliations of net

income to Adjusted EBITDA and Adjusted EBITDAR

ASSISTED LIVING CONCEPTS, INC

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

December 31,

-------------------------

2012 2011

----------- -----------

ASSETS

Current Assets:

Cash and cash equivalents $ 10,182 $ 2,652

Cash and escrow deposits - restricted 2,714 3,150

Investments 900 1,840

Accounts receivable, less allowances of $3,461

and $2,903, respectively 4,294 4,609

Prepaid expenses, supplies and other

receivables 4,604 3,387

Income tax receivable 4,089 606

Deferred income taxes 4,640 4,027

----------- -----------

Total current assets 31,423 20,271

Property and equipment, net 481,913 430,733

Intangible assets, net - 9,028

Restricted cash 2,035 1,996

Other assets 398 2,025

----------- -----------

Total Assets $ 515,769 $ 464,053

=========== ===========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable $ 9,909 $ 7,086

Accrued liabilities 21,034 17,877

Deferred revenue 8,266 8,004

Current maturities of long-term debt 114,575 2,538

Current portion of self-insured liabilities 500 500

----------- -----------

Total current liabilities 154,284 36,005

Accrual for self-insured liabilities 1,700 1,557

Long-term debt 67,140 85,703

Deferred income taxes 8,701 23,961

Other long-term liabilities 6,301 9,107

----------- -----------

Total liabilities 238,126 156,333

----------- -----------

Preferred Stock, par value $0.01 per share,

25,000,000 shares authorized, no shares issued

and outstanding, respectively - -

Class A Common Stock, $0.01 par value,

160,000,000 authorized at December 31, 2012 and

December 31, 2011; 25,004,381 and 24,980,958

shares issued and 20,072,509 and 20,049,086

shares outstanding, respectively 250 250

Class B Common Stock, $0.01 par value,

30,000,000 authorized at December 31, 2012 and

December 31, 2011; 2,897,996 and 2,919,790

issued and outstanding, respectively 29 29

Additional paid-in capital 317,473 316,694

Accumulated other comprehensive income 19 156

Retained earnings 36,717 67,436

Treasury stock at cost, 4,931,872 and 4,931,872

shares, respectively (76,845) (76,845)

----------- -----------

Total stockholders' equity 277,643 307,720

----------- -----------

Total Liabilities and Stockholders' Equity $ 515,769 $ 464,053

=========== ===========

ASSISTED LIVING CONCEPTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

Year Ended December 31,

------------------------------------

2012 2011 2010

---------- ---------- ----------

OPERATING ACTIVITIES:

Net (loss)/income $ (26,125) $ 24,360 $ 16,484

Adjustments to reconcile net

(loss)/income to net cash provided

by operating activities:

Depreciation and amortization 24,915 23,103 22,807

Other-than-temporary investments

impairment - - 2,026

Deferred financing write off and

amortization 1,674 782 455

Loss due to property and

equipment impairment 3,500 - -

Intangible impairment 8,650 - -

Amortization of purchase

accounting adjustments for

leases and debt (402) (647) (645)

Provision for bad debts 559 1,489 676

Provision for self-insured

liabilities 1,638 554 639

Loss on sale or disposal of fixed

assets 249 (121) 401

Equity-based compensation expense 779 1,199 659

Deferred income taxes (15,888) 4,447 5,599

Gain on investments (195) (956) (78)

Changes in assets and liabilities:

Accounts receivable (244) (2,897) (1,209)

Prepaid expenses, supplies and

other receivables 760 (199) 517

Deposits in escrow 436 290 (378)

Current assets - discontinued

operations - - (132)

Accounts payable 2,873 1,268 (1,170)

Accrued liabilities 2,995 (1,376) 25

Deferred revenue 262 3,220 (1,584)

Current liabilities -

discontinued operations - - (34)

Payments of self-insured

liabilities (1,495) (592) (458)

Income taxes payable/receivable (3,483) (250) 367

Changes in other non-current

assets (43) 1,456 758

Other non-current assets -

discontinued operations - - 399

Other long-term liabilities (2,342) (455) 48

---------- ---------- ----------

Cash (used in)/provided by

operating activities (927) 54,675 46,172

INVESTING ACTIVITIES:

Payment for securities (218) (208) (818)

Proceeds on sales of securities 1,231 3,406 515

Payment for acquisitions (62,570) - (27,500)

Proceeds on sale of fixed assets 1,486 168 -

Payments for new construction

projects (2,327) (684) (5,619)

Payments for purchases of

property and equipment (16,572) (15,067) (11,000)

---------- ---------- ----------

Cash used in investing

activities (78,970) (12,385) (44,422)

FINANCING ACTIVITIES:

Payments of financing costs (1,391) (1,907) (310)

Purchase of treasury stock - (798) (2,803)

Proceeds from issuance of shares

for employee stock options - 283 31

Repayment of borrowings on

revolving credit facility (99,000) (137,500) -

Proceeds on borrowings on

revolving credit facility 195,000 99,500 -

Repayment of mortgage debt (2,588) (5,686) (1,914)

Proceeds from mortgage debt - - 12,250

Payment of dividends (4,594) (6,894) -

---------- ---------- ----------

Cash provided by/(used in)

financing activities 87,427 (53,002) 7,254

---------- ---------- ----------

Increase/(decrease) in cash and

cash equivalents 7,530 (10,712) 9,004

Cash and cash equivalents,

beginning of year 2,652 13,364 4,360

---------- ---------- ----------

Cash and cash equivalents, end of

year $ 10,182 $ 2,652 $ 13,364

========== ========== ==========

ASSISTED LIVING CONCEPTS, INC.

Financial and Operating Statistics

Continuing residences* Three Months Ended

-----------------------------------------------

December 31, September 30, December 31,

2012 2012 2011

Average Occupied Units by

Payer Source 5,382 5,251 5,642

============== ============= ==============

Average Revenue per

Occupied Unit Day $ 115.09 115.05 $ 113.41

============== ============= ==============

Occupancy Percentage* 60.9% 59.5% 62.7%

============== ============= ==============

* Depending on the timing of new additions and

temporary closures of our residences, we may increase or reduce the

number of units we actively operate. For the three months ended

December 31, 2012, September 30, 2012 and December 31, 2011 we

actively operated 8,837, 8,822 and 8,995 units,

respectively.

Same residence basis** Three Months Ended

------------------------------------------------

December 31, September 30, December 31,

2012 2012 2011

-------------- -------------- --------------

Average Occupied Units by

Payer Source 5,379 5,251 5,607

============== ============== ==============

Average Revenue per

Occupied Unit Day $ 115.04 $ 115.05 $ 113.47

============== ============== ==============

Occupancy Percentage* 61.0% 59.5% 63.6%

============== ============== ==============

** Excludes quarterly impact of 23 completed

expansion and 194 units temporarily closed for renovation in each

of the December 31, 2012, September 30, 2012 and December 31, 2011

three month periods.

Continuing residences* Year Ended

-------------------------------

December 31, December 31,

2012 2011

Average Occupied Units 5,369 5,612

============== ==============

Average Revenue per Occupied Unit Day $ 116.22 $ 114.16

============== ==============

Occupancy Percentage* 60.5% 62.4%

============== ==============

* Depending on the timing of new additions and

temporary closures of our residences, we may increase or reduce the

number of units we actively operate. For the year ended December

31, 2012 and December 31, 2011 we actively operated 8,872 and 8,992

units, respectively.

Same residence basis** Year Ended

---------------------------

December 31, December 31,

2012 2011

------------ ------------

Average Occupied Units 5,319 5,536

============ ============

Average Revenue per Occupied Unit Day $ 116.03 $ 114.38

============ ============

Occupancy Percentage* 60.9% 63.4%

============ ============

** Excludes impact of 43 completed expansion

units, 72 re-opened units and 217 units temporarily closed for

renovation in the 2012 year and units temporarily closed for

renovation in the 2011 year.

Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted EBITDAR

Adjusted EBITDA is defined as net loss/income from continuing

operations before income taxes, interest expense net of interest

income, depreciation and amortization, equity based compensation

expense, transaction costs and certain non-cash, gains and losses,

including disposal of assets, impairment of goodwill and other

long-lived assets, impairment of investments, impairment of

intangibles and non-recurring lease termination and settlement

fees. Adjusted EBITDAR is defined as Adjusted EBITDA before rent

expenses incurred for leased assisted living properties. Adjusted

EBITDA and Adjusted EBITDAR are not measures of performance under

accounting principles generally accepted in the United States of

America, or GAAP. We use Adjusted EBITDA and Adjusted EBITDAR as

key performance indicators and Adjusted EBITDA and Adjusted EBITDAR

expressed as a percentage of total revenues as a measurement of

margin.

We understand that EBITDA and EBITDAR, or derivatives thereof,

are customarily used by lenders, financial and credit analysts, and

many investors as a performance measure in evaluating a company's

ability to service debt and meet other payment obligations or as a

common valuation measurement in the long-term care industry.

Moreover, ALC's revolving credit facility contains covenants in

which a form of EBITDA is used as a measure of compliance, and we

anticipate EBITDA will be used in covenants in any new financing

arrangements that we may establish. We believe Adjusted EBITDA and

Adjusted EBITDAR provide meaningful supplemental information

regarding our core results because these measures exclude the

effects of non-operating factors related to our capital assets,

such as the historical cost of the assets.

We report specific line items separately, and exclude them from

Adjusted EBITDA and Adjusted EBITDAR because such items are

transitional in nature and would otherwise distort historical

trends. In addition, we use Adjusted EBITDA and Adjusted EBITDAR to

assess our operating performance and in making financing decisions.

In particular, we use Adjusted EBITDA and Adjusted EBITDAR in

analyzing potential acquisitions and internal expansion

possibilities. Adjusted EBITDAR performance is also used in

determining compensation levels for our senior executives. Adjusted

EBITDA and Adjusted EBITDAR should not be considered in isolation

or as a substitute for net income, cash flows from operating

activities, and other income or cash flow statement data prepared

in accordance with GAAP, or as a measure of profitability or

liquidity. We present Adjusted EBITDA and Adjusted EBITDAR on a

consistent basis from period to period, thereby allowing for

comparability of operating performance.

Adjusted EBITDA and Adjusted EBITDAR

Reconciliation Information

The following table sets forth a reconciliation of net income to

Adjusted EBITDA and Adjusted EBITDAR:

Three Months Ended Year Ended

-------------------------------- --------------------

December December September December December

31, 31, 30, 31, 31,

2012 2011 2012 2012 2011

--------- --------- ---------- --------- ---------

(in thousands)

Net income $ (2,623) $ 7,310 $ (4,042) $ (26,125) $ 24,360

Add provision for

income taxes (2,074) 3,249 (2,941) (17,418) 12,100

--------- --------- ---------- --------- ---------

Income before income

taxes $ (4,697) $ 10,559 $ (6,683) $ (43,543) $ 36,460

Add:

Depreciation and

amortization 6,827 5,843 6,526 24,915 23,103

Interest expense,

net 2,482 1,822 2,318 8,134 8,028

Non-cash equity

based

compensation 237 227 182 779 1,199

(Gain)/loss on

disposal of

fixed assets 263 (25) (433) (255) (121)

Write-down of cost

associated with

expansion

projects not

completed - - - 504 -

Gain on sale of

equity

investments (257) (46) - (257) (956)

Recovery of

purchase

accounting

associated with

early termination

of debt - - (168)

Write-off of

operating lease

intangible, lease

termination fee

and settlement 300 - (25) 46,080 -

Change in value of

derivative and

amortization - (94) -

Write-off of

deferred

financing fees 1,137 - - 1,137 279

Asset impairment 3,500 3,500

Transaction costs - - - 1,046 -

--------- --------- ---------- --------- ---------

Adjusted EBITDA $ 6,292 $ 18,286 $ 5,385 $ 42,040 $ 67,824

Add: Lease expense 2,686 4,461 2,834 13,369 17,686

--------- --------- ---------- --------- ---------

Adjusted EBITDAR $ 8,978 $ 22,747 $ 8,219 $ 55,409 $ 85,510

========= ========= ========== ========= =========

The following table sets forth the calculations of Adjusted

EBITDA, Adjusted EBITDAR, Adjusted EBITDA and Adjusted EBITDAR as

percentages of total revenue:

Three Months Ended Year Ended

------------------------------- --------------------

December December September December December

31, 31, 30, 31, 31,

2012 2011 2012 2012 2011

-------- --------- ---------- --------- ---------

(dollars in thousands)

Revenues 56,980 $ 58,863 $ 55,576 228,397 $ 234,452

======== ========= ========== ========= =========

Adjusted EBITDA 6,292 $ 18,286 $ 5,385 $ 42,040 $ 67,824

======== ========= ========== ========= =========

Adjusted EBITDAR 8,978 $ 22,747 $ 8,219 $ 55,409 $ 85,510

======== ========= ========== ========= =========

Adjusted EBITDA as

percent of total

revenues 11.0% 31.1% 9.7% 18.4% 28.9%

======== ========= ========== ========= =========

Adjusted EBITDAR as

percent of total

revenues 15.8% 38.6% 14.8% 24.3% 36.5%

======== ========= ========== ========= =========

ASSISTED LIVING CONCEPTS, INC.

Reconciliation of Non-GAAP Measure

(unaudited)

Three Three

Months months

Ended Ended Year Ended Year Ended

December December December December

31, 2012 31, 2011 31, 2012 31, 2011

(dollars in thousands except per share data)

Net income $ (2,623) $ 7,310 $ (26,125) $ 24,360

Add one time charges:

Expenses incurred in

connection with

internal investigation,

public relations and

Ventas litigation 2,118 - 5,393 -

Write-off of deferred

financing costs 1,137 - 1,137 279

Change in value of

derivative net of

amortization - - - -

Asset Impairment - - 3,500 -

Loss on disposal of

fixed assets related to

expansion project - - 504 -

Loss on write off of

lease intangible,

termination and

settlement fee and

transaction costs 300 - 47,126 -

Less one time credits:

Rent - - 906 -

Settlements relating to

tax allocation

agreement and state

audits - 570 - 1,320

Change in value of

derivative net of

amortization - 94 -

Gain on sale of equity

investments 257 46 257 956

Recovery of purchase

accounting associated

with early termination

of debt - 583 - 751

Net tax benefit/

(expense) from charges

and credits 1,457 (262) 22,655 (526)

----------- ----------- ----------- -----------

Pro forma net (loss)/

income excluding one-

time charges and

credits $ (782) $ 6,279 $ 7,717 $ 22,138

=========== =========== =========== ===========

Weighted average common

shares:

Basic 22,970 22,967 22,970 22,955

Diluted 22,970 23,239 22,970 23,256

Diluted earnings per

common share*

Net loss $ (0.11) $ 0.31 $ (1.14) $ 1.05

Less: gain/(loss)

from one time

charges and credits (0.08) 0.04 (1.47) 0.10

----------- ----------- ----------- -----------

Pro forma net

income/loss

excluding one-time

charges and credits $ (0.03) $ 0.27 $ 0.34 $ 0.95

=========== =========== =========== ===========

* Per share numbers may not add due to rounding

For further information, contact: Assisted Living Concepts, Inc.

John Buono Sr. Vice President, Chief Financial Officer and

Treasurer Phone: (262) 257-8999 Fax: (262) 251-7562 Email: Email

Contact Visit ALC's Website @ www.alcco.com

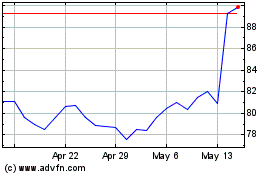

Alcon (NYSE:ALC)

Historical Stock Chart

From Jun 2024 to Jul 2024

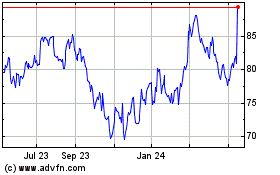

Alcon (NYSE:ALC)

Historical Stock Chart

From Jul 2023 to Jul 2024