Assisted Living Concepts, Inc. ("ALC") (NYSE: ALC) today released

supplemental financial information for the quarter and nine months

ended September 30, 2010. This supplemental information is intended

to provide investors, analysts and interested parties with further

detail regarding ALC's owned versus leased portfolio of properties.

"Recent real estate transactions have demonstrated the value of

senior housing owned assets," commented Laurie Bebo, President and

Chief Executive Officer. "We believe that providing additional

transparency into the value proposition of our owned and leased

assets is meaningful information to share with our investors."

At September 30, 2010, ALC owned 152 residences consisting of

6,780 units and operated an additional 59 residences consisting of

2,525 units under operating leases. On November 1, 2010 ALC

purchased nine residences consisting of 365 units it had previously

leased (the "Purchased Properties"). At the date of this release

ALC owned 161 residences consisting of 7,145 units and operated an

additional 50 residences consisting of 2,160 units under operating

leases.

Certain non-GAAP financial measures are used in this release.

See the attached table for definitions of Adjusted EBITDA,

reconciliations of net income to Adjusted EBITDA and non-GAAP

financial measure reconciliation information.

The following unaudited table presents selected financial

information for ALC's owned and leased properties: (dollars in

thousands)

Three Months Ended

September 30, 2010

----------------------------------------------------------------

Pro Forma Pro Forma

Net Adjusted Net Adjusted

Revenues Income (2) EBITDA (2) Income (2,3) EBITDA (2,4)

------------ ------------ ------------ ------------ ------------

Owned (1) $ 44,345 $ 4,203 $ 14,093 $ 4,368 $ 14,789

Leased 14,184 364 943 364 943

------------ ------------ ------------ ------------ ------------

Total $ 58,529 $ 4,567 $ 15,036 $ 4,732 $ 15,732

============ ============ ============ ============ ============

Nine Months Ended

September 30, 2010

----------------------------------------------------------------

Pro Forma Pro Forma

Net Adjusted Net Adjusted

Revenues Income (2) EBITDA (2) Income (2,3) EBITDA (2,4)

------------ ------------ ------------ ------------ ------------

Owned (1) $ 133,966 $ 10,774 $ 41,554 $ 11,236 $ 43,640

Leased 40,727 302 1,582 302 1,582

------------ ------------ ------------ ------------ ------------

Total $ 174,693 $ 11,076 $ 43,136 $ 11,538 $ 45,222

============ ============ ============ ============ ============

(1) Includes financial results associated with the Purchased Properties.

(2) All amounts previously reported in the ALC financial statements

as general and administrative expenses are allocated 100 percent

to owned properties.

(3) Includes pro forma adjustments (net of income tax affects) to:

i) eliminate amounts historically recorded in residence lease

expense, ii) add management's estimate of interest expense, and

iii) add or reduce depreciation expense from the Purchased Properties

as if the purchase occurred on the first day of the reported period.

See Reconciliation of Non-GAAP Financial Measures below.

(4) Includes pro forma adjustments to eliminate amounts historically

included in residence lease expense for the Purchased Properties as if

the purchase occurred on the first day of the reported periods. Residence

lease expense for the Purchased Properties was $696 and $2,086 for the

three and nine month periods ended September 30, 2010, respectively.

About Us

Assisted Living Concepts, Inc. and its subsidiaries operate 211

senior living residences comprising 9,305 units in 20 states. ALC's

senior living residences typically consist of 40 to 60 units and

offer residents a supportive, home-like setting and assistance with

the activities of daily living. ALC employs approximately 4,100

people.

Forward-looking Statements

Statements contained in this release other than statements of

historical fact, including statements regarding anticipated

financial performance, business strategy and management's plans and

objectives for future operations, including management's

expectations about improving occupancy and private pay mix, are

forward-looking statements. Forward-looking statements generally

include words such as "expect," "project," "point toward,"

"intend," "will," "indicate," "anticipate," "believe," "estimate,"

"plan," "strategy" or "objective." Forward-looking statements are

subject to risks and uncertainties that could cause actual results

to differ materially from those expressed or implied. In addition

to the risks and uncertainties referred to in the release, other

risks and uncertainties are contained in ALC's filings with United

States Securities and Exchange Commission and include, but are not

limited to, the following: changes in the health care industry in

general and the senior housing industry in particular because of

governmental and economic influences; changes in general economic

conditions, including changes in housing markets, unemployment

rates and the availability of credit at reasonable rates; changes

in regulations governing the industry and ALC's compliance with

such regulations; changes in government funding levels for health

care services; resident care litigation, including exposure for

punitive damage claims and increased insurance costs, and other

claims asserted against ALC; ALC's ability to maintain and increase

census levels; ALC's ability to attract and retain qualified

personnel; the availability and terms of capital to fund

acquisitions and ALC's capital expenditures; changes in

competition; and demographic changes. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

ALC's forward-looking statements. All forward-looking statements

contained in this release are necessarily estimates reflecting the

best judgment of the party making such statements based upon

current information. ALC assumes no obligation to update any

forward-looking statement.

Non-GAAP Financial Measures

Adjusted EBITDA and Pro Forma Adjusted EBITDA

Adjusted EBITDA is defined as net income before income taxes,

interest expense net of interest income, depreciation and

amortization, non-cash equity based compensation expense,

transaction costs and non-cash, non-recurring gains and losses,

including disposal of assets and impairment of long-lived assets

(including goodwill) and loss on refinancing and retirement of

debt. Pro Forma Adjusted EBITDA is defined as Adjusted EBITDA plus

historically recorded residence lease expense resulting from nine

residences consisting of 365 units that ALC previously leased and

subsequently purchased on November 1, 2010, as if they were

purchased on the first day of the reported period. Adjusted EBITDA

and Pro Forma Adjusted EBITDA are not measures of performance under

accounting principles generally accepted in the United States of

America, or GAAP. We use Adjusted EBITDA as a key performance

indicator.

We understand that EBITDA, or derivatives such as Pro Forma

Adjusted EBITDA, are customarily used by lenders, financial and

credit analysts, and many investors as a performance measure in

evaluating a company's ability to service debt and meet other

payment obligations or as a common valuation measurement in the

long-term care industry. Moreover, ALC's revolving credit facility

contains covenants in which a form of EBITDA is used as a measure

of compliance, and we anticipate EBITDA will be used in covenants

in any new financing arrangements that we may establish. We believe

Adjusted EBITDA and its derivatives provide meaningful supplemental

information regarding our core results because this measure

excludes the effects of non-operating factors related to our

capital assets, such as the historical cost of the assets.

We report specific line items separately, and exclude them from

Adjusted EBITDA and its derivatives because such items are

transitional in nature and would otherwise distort historical

trends. In addition, we use Adjusted EBITDA and its derivatives to

assess our operating performance and in making financing decisions.

In particular, we use Adjusted EBITDA and its derivatives in

analyzing potential acquisitions and internal expansion

possibilities. Adjusted EBITDA and its derivatives should not be

considered in isolation or as a substitute for net income, cash

flows from operating activities, and other income or cash flow

statement data prepared in accordance with GAAP, or as a measure of

profitability or liquidity. We present Adjusted EBITDA and its

derivatives on a consistent basis from period to period, thereby

allowing for comparability of operating performance.

Reconciliation of Non-Gaap Financial Measures

The following unaudited table sets forth a reconciliation of net

income to Adjusted EBITDA and Pro Forma Adjusted EBITDA: (in

thousands)

Three Months Ended Nine Months Ended

September 30, 2010 September 30, 2010

---------------------------- -----------------------------

Owned (a) Leased Total Owned (a) Leased Total

-------- --------- -------- --------- --------- ---------

Net income $ 4,203 $ 364 $ 4,567 $ 10,774 $ 302 $ 11,076

Add: provision

for income

taxes 2,389 210 2,599 6,167 173 6,340

-------- --------- -------- --------- --------- ---------

Income before

income taxes 6,592 574 7,166 16,941 475 17,416

Add: -

Depreciation

and

amortization 5,376 369 5,745 16,006 1,107 17,113

Interest

expense, net 1,891 - 1,891 5,670 - 5,670

Non-cash

equity based

compensation 252 - 252 614 - 614

Loss (gain) on

disposal of

fixed assets (36) - (36) 279 - 279

Write-down of

equity

investments - - 2,026 - 2,026

Transaction

expenses

associated

with property

acquisition 18 - 18 18 - 18

-------- --------- -------- --------- --------- ---------

Adjusted EBITDA $ 14,093 $ 943 $ 15,036 $ 41,554 $ 1,582 $ 43,136

-------- --------- -------- --------- --------- ---------

Pro forma

Adjustments

(b):

Net income $ 165 - $ 165 $ 462 - $ 462

Provision for

income taxes 94 - 94 266 - 266

-------- --------- -------- --------- --------- ---------

Pro forma

income before

income taxes 259 - 259 728 - 728

Add: - -

Pro forma

depreciation

and

amortization (10) - (10) 17 - 17

Pro forma

interest

expense, net 447 - 447 1,341 - 1,341

-------- --------- -------- --------- --------- ---------

Adjusted EBITDA

from pro forma

adjustments $ 696 - $ 696 $ 2,086 - $ 2,086

-------- --------- -------- --------- --------- ---------

Pro forma

Adjusted

EBITDA $ 14,789 $ 943 $ 15,732 $ 43,640 $ 1,582 $ 45,222

======== ========= ======== ========= ========= =========

(a) Includes financial results associated with the Purchased Properties.

(b) Includes pro forma adjustments (net of income tax affects) to: i)

eliminate amounts historically recorded in residence lease expense, ii) add

management's estimate of interest expense, and iii) add or reduce

depreciation expense from the Purchased Properties as if the purchase

occurred on the first day of the reported period.

For further information, contact: Assisted Living Concepts, Inc.

John Buono Sr. Vice President, Chief Financial Officer and

Treasurer Phone: (262) 257-8999 Fax: (262) 251-7562 Email: Email

Contact Visit ALC's Website @ www.alcco.com

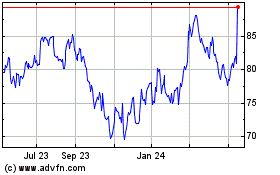

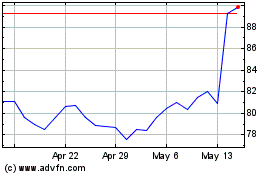

Alcon (NYSE:ALC)

Historical Stock Chart

From May 2024 to Jun 2024

Alcon (NYSE:ALC)

Historical Stock Chart

From Jun 2023 to Jun 2024