Assisted Living Concepts, Inc. (NYSE: ALC)

Highlights:

-- Percent of revenue from private pay grows to 93% in 2008 fourth

quarter

-- Adjusted EBITDAR as a percent of revenues increases to 29.4% in 2008,

from 28.2 % in 2007

-- Private pay occupancy in 2008 fourth quarter maintains third quarter

level

-- Approximately 80 expansion units on line at year end

Assisted Living Concepts, Inc. ("ALC") (NYSE: ALC) reported net

income of $3.0 million in the 2008 fourth quarter as compared to

net income of $4.1 million in the 2007 fourth quarter. Net income

declined primarily from an increase in residence lease expense. For

the 2008 year, ALC reported net income of $14.3 million as compared

to net income of $17.2 million in 2007.

Diluted earnings per common share for the fourth quarter of 2008

were $0.05 per share as compared to $0.06 per share for the fourth

quarter of 2007. Diluted earnings per common share for the 2008

year were $0.23 per share as compared to $0.25 per share for

2007.

"Private pay occupancy remained flat in the fourth quarter of

2008, despite the numerous economic headwinds," commented Laurie

Bebo, President and Chief Executive Officer of Assisted Living

Concepts, Inc. "We look forward to the new year with the opening of

the remaining expansion units helping to offset the soft economic

outlook."

Certain non-GAAP financial measures are used in the discussions

in this release in evaluating the performance of the business. See

attached tables for definitions of adjusted EBITDA and adjusted

EBITDAR, reconciliations of net income to adjusted EBITDA and

adjusted EBITDAR, calculations of adjusted EBITDA and adjusted

EBITDAR as a percentage of total revenues, and non-GAAP financial

measure reconciliation information.

As of December 31, 2008, ALC operated 216 assisted living

residences representing 9,154 units.

Quarters ended December 31, 2008, December 31, 2007, September

30, 2008

Revenues of $57.6 million in the fourth quarter ended December

31, 2008 increased $1.1 million or 2.0% from $56.5 million in the

fourth quarter of 2007 and decreased $0.8 million or 1.3 % from

$58.4 million in the third quarter of 2008.

Adjusted EBITDA for the fourth quarter of 2008 was $11.2

million, and 19.5% of revenues and

-- decreased $1.2 million or 9.9% from $12.5 million and 22.1% of

revenues in the fourth quarter of 2007; and

-- decreased $0.3 million or 2.7% from $11.6 million and 19.8% of

revenues in the third quarter of 2008.

Adjusted EBITDAR for the fourth quarter of 2008 was $16.3

million, and 28.2% of revenues and

-- increased $0.2 million or 1.3% from $16.0 million and declined from

28.4% of revenues in the fourth quarter of 2007; and

-- decreased $0.3 million or 1.8% from $16.6 million and decreased from

28.4% of revenues in the third quarter of 2008.

Fourth quarter 2008 compared to fourth quarter 2007

Revenues in the fourth quarter of 2008 increased from the fourth

quarter of 2007 primarily due to additional revenues from acquired

residences ($4.0 million) and higher average daily revenue as a

result of rate increases ($2.0 million), partially offset by the

planned reduction in the number of units occupied by Medicaid

residents ($2.8 million) and a reduction in the number of units

occupied by private pay residents ($2.1 million).

Adjusted EBITDA decreased in the fourth quarter of 2008

primarily due to an increase in residence lease expense ($1.4

million) and an increase in residence operations expenses excluding

the loss on property from hurricanes ($1.2 million), partially

offset by increased revenues discussed above ($1.1 million) and a

decrease in general and administrative expenses excluding non-cash

equity based compensation ($0.3 million). Adjusted EBITDAR

increased for the reasons discussed above for adjusted EBITDA

excluding the increase in residence lease expense ($1.4 million).

Residence operations expenses decreased primarily from a reduction

in labor and food expenses associated with lower occupancy,

partially offset by less favorable experience in our self-insurance

programs as compared to the prior year. General and administrative

expenses decreased primarily from a decrease in salaries and bonus

expenses. Residence lease expense increased primarily from the

January 1, 2008, acquisition of the operations of BBLRG, LLC, doing

business as CaraVita.

Fourth quarter 2008 compared to the third quarter 2008

Revenues in the fourth quarter of 2008 decreased from the third

quarter of 2008 primarily due to the planned reduction in the

number of units occupied by Medicaid residents ($0.5 million) and

decreases in rates ($0.3 million).

Decreased adjusted EBITDA and adjusted EBITDAR in the fourth

quarter of 2008 as compared to the third quarter of 2008 resulted

primarily from decreased revenues as discussed above ($0.8

million), partially offset by a decrease in residence operations

expenses excluding the loss on property from hurricanes ($0.3

million) and general and administrative expenses excluding non-cash

equity based compensation ($0.2 million). Residence operations

expenses decreased primarily from seasonal decreases in utility

expenses and favorable experience in our self-insurance programs.

General and administrative expenses decreased primarily because our

all-company annual conference occurred in the third quarter of

2008.

Years ended December 31, 2008 and December 31, 2007

Revenues of $234.1 million in 2008 increased $4.7 million or

2.1% from $229.3 million in 2007.

Adjusted EBITDA for 2008 was $49.0 million, and 20.9% of

revenues and decreased $1.3 million or 2.5% from $50.3 million and

21.9% of revenues in 2007.

Adjusted EBITDAR for 2008 was $68.9 million, and 29.4% of

revenues and increased $4.3 million or 6.7% from $64.6 million and

28.2% of revenues in 2007.

2008 year compared to 2007 year

Revenues in 2008 increased from 2007 primarily due to additional

revenues from acquired residences ($18.3 million), higher average

daily revenue as a result of rate increases ($12.1 million), and

one additional day in 2008 due to leap year ($0.6 million),

partially offset by a reduction in the number of units occupied by

private pay residents ($9.8 million), the planned reduction in the

number of units occupied by Medicaid residents ($15.9 million), and

the absence of revenue from leasing ALC's corporate office ($0.6

million) in 2008 only.

Adjusted EBITDA decreased for 2008 as compared to 2007 primarily

from an increase in residence lease expense ($5.6 million) and an

increase in residence operations expenses excluding the loss on

property from hurricanes ($0.8 million), partially offset by higher

revenues as discussed above ($4.7 million) and a decrease in

general and administrative expenses excluding non-cash equity based

compensation ($0.4 million). Adjusted EBITDAR increased as a result

of the reasons discussed above for adjusted EBITDA excluding the

increase in residence lease expense ($5.6 million). Residence

operations expenses increased primarily from acquisitions,

partially offset by a reduction in labor and food expense

associated with lower occupancy. Residence lease expenses increased

primarily from the CaraVita acquisition.

Share repurchase program

On August 6, 2008, ALC's Board of Directors authorized an

increase in its Class A common stock repurchase program by $15

million bringing the total authorization to $80 million. In the

fourth quarter of 2008, ALC repurchased approximately 1.4 million

shares of its Class A common stock at an aggregate cost of

approximately $5.9 million and an average price of $4.24 per

share.

Expansion Program Update

We had completed, licensed, and begun accepting new residents in

approximately 80 units under our expansion program by the end of

the fourth quarter of 2008. Construction continues on the remaining

expansion units in our program to add 400 units to existing owned

buildings. Weather issues, primarily related to heavy rains and

flooding in the Midwest and hurricanes in the Texas and Louisiana

regions, obtaining regulatory approvals, and other unforeseen

circumstances have resulted in delays. We are currently targeting

completion of 170 units in the first quarter of 2009, 100 in the

second quarter, 25 units in the third quarter, and the remaining 25

in the fourth quarter. To date, cost estimates remain consistent

with our original estimates of $125,000 per unit.

Financing Activities and Liquidity

At December 31, 2008 ALC maintained a strong liquidity position

with cash of approximately $19 million and undrawn lines of $41

million. Expenses during the fourth quarter included $120 thousand

of costs associated with a financing proposal that was not

completed. ALC continues to seek additional financing on

unencumbered properties.

Investor Call

ALC has scheduled a conference call later this morning, February

24, 2009 at 10:00 a.m. (Eastern Time) to discuss financial results

for the fourth quarter. The toll-free number for the live call is

888-428-4476, or international 651-291-0618. A taped rebroadcast

will be available approximately three hours following the live call

until midnight on March 24, 2009. To access the rebroadcast of the

call, dial 800-475-6701, or international 320-365-3844 and use the

access code 984774.

About Us

Assisted Living Concepts, Inc. and its subsidiaries operate 216

assisted living residences with capacity for over 9,000 residents

in 20 states. ALC's assisted living facilities typically consist of

40 to 60 units and offer residents a supportive, home-like setting

and assistance with the activities of daily living. ALC employs

approximately 4,650 people.

Forward-looking Statements

Statements contained in this release other than statements of

historical fact, including statements regarding anticipated

financial performance, business strategy and management's plans and

objectives for future operations including managements expectations

about improving occupancy and private payer mix, are

forward-looking statements. These forward-looking statements

generally include words such as "expect," "point toward," "intend,"

"will," "indicate," "anticipate," "believe," "estimate," "plan,"

"strategy" or "objective." Forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed or implied. In addition to

the risks and uncertainties referred to in the release in

connection with forward-looking statements, other risks and

uncertainties are identified in ALC's' filings with United States

Securities and Exchange Commissions and include, but are not

limited to, the following: changes in the health care industry in

general and the long-term senior care industry in particular

because of political and economic influences; changes in general

economic conditions, including changes in the availability of

credit at reasonable rates; changes in regulations governing the

industry and ALC's compliance with such regulations; changes in

government funding levels for health care services; resident care

litigation, including exposure for punitive damage claims and

increased insurance costs, and other claims asserted against ALC;

ALC's ability to maintain and increase census levels; ALC's ability

to attract and retain qualified personnel; the availability and

terms of capital to fund ALC's capital expenditures; changes in

competition; and demographic changes. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

ALC's forward-looking statements. All forward-looking statements

contained in this report are necessarily estimates reflecting the

best judgment of the party making such statements based upon

current information. ALC assumes no obligation to update any

forward-looking statement.

ASSISTED LIVING CONCEPTS, INC.

Condensed Consolidated Statements of Income

(In thousands, except earnings per share)

Three Months Ended

December 31, Year Ended

(Unaudited) December 31,

--------------------- ---------------------

2008 2007 2008 2007

---------- ---------- ---------- ----------

Revenues $ 57,617 $ 56,502 $ 234,085 $ 229,347

Expenses:

Residence operations

(exclusive of depreciation

and amortization and

residence lease expense

shown below) 38,329 36,875 152,851 151,684

General and administrative 3,251 3,584 12,789 13,073

Residence lease expense 5,006 3,556 19,900 14,310

Depreciation and amortization 4,775 4,554 18,710 17,642

Transaction costs -- -- -- 56

---------- ---------- ---------- ----------

Total operating expenses 51,361 48,569 204,250 196,765

---------- ---------- ---------- ----------

Income from operations 6,256 7,933 29,835 32,582

Other expense:

Interest income 143 240 630 1,718

Interest expense (1,876) (1,854) (7,727) (6,809)

---------- ---------- ---------- ----------

Income before income taxes 4,523 6,319 22,738 27,491

Income tax expense (1,493) (2,264) (8,415) (10,312)

---------- ---------- ---------- ----------

Net income $ 3,030 $ 4,055 $ 14,323 $ 17,179

========== ========== ========== ==========

Weighted average common shares:

Basic 60,825 65,875 62,428 68,172

Diluted 61,457 66,532 63,084 68,863

Per share data:

Basic earnings per common

share $ 0.05 $ 0.06 $ 0.23 $ 0.25

========== ========== ========== ==========

Diluted earnings per

common share $ 0.05 $ 0.06 $ 0.23 $ 0.25

========== ========== ========== ==========

Adjusted EBITDA (1) $ 11,248 $ 12,487 $ 49,026 $ 50,280

========== ========== ========== ==========

Adjusted EBITDAR (1) $ 16,254 $ 16,043 $ 68,926 $ 64,590

========== ========== ========== ==========

(1) See attached tables for definitions of adjusted EBITDA and adjusted

EBITDAR and reconciliations of net income to adjusted EBITDA and

adjusted EBITDAR.

ASSISTED LIVING CONCEPTS, INC.

Consolidated Balance Sheets

(In thousands, except share and per share data)

December 31,

--------------------

2008 2007

--------- ---------

ASSETS

Current Assets:

Cash and cash equivalents $ 19,905 $ 14,066

Investments 3,139 5,252

Accounts receivable, less allowances of $689 and

$992, respectively 2,696 2,908

Prepaid expenses, supplies and other receivables 3,463 5,089

Deposits in escrow 2,343 2,482

Income tax receivable 3,147 --

Deferred income taxes 4,614 4,080

--------- ---------

Total current assets 39,307 33,877

Property and equipment, net 422,791 395,141

Goodwill 16,315 19,909

Intangible assets, net 13,443 827

Restricted cash 4,534 8,943

Cash designated for acquisition -- 14,864

Other assets 2,231 2,680

--------- ---------

Total Assets $ 498,621 $ 476,241

========= =========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts payable $ 13,574 $ 7,800

Accrued liabilities 17,898 17,951

Deferred revenue 6,739 6,346

Accrued income taxes -- 198

Current maturities of long-term debt 19,392 26,543

Current portion of self-insured liabilities 300 300

--------- ---------

Total current liabilities 57,903 59,138

Accrual for self-insured liabilities 1,176 941

Long-term debt 136,890 103,176

Deferred income taxes 11,811 9,008

Other long-term liabilities 11,102 9,444

Commitments and contingencies

--------- ---------

Total Liabilities 218,882 181,707

--------- ---------

Preferred stock, par value $0.01 per share,

25,000,000 shares authorized, no shares issued and

outstanding, respectively -- --

Class A Common Stock, par value $0.01 per share,

400,000,000 authorized, 52,296,246 and 56,131,873

issued and outstanding, respectively 595 595

Class B Common Stock, par value $0.01 per share,

75,000,000 authorized, 7,736,398 and 8,727,458

issued and outstanding, respectively 100 100

Additional paid-in capital 313,647 313,548

Accumulated other comprehensive (loss) income (1,989) 103

Retained earnings 33,641 19,318

Treasury stock at cost, 9,591,993 and 4,691,060

shares, respectively (66,255) (39,130)

--------- ---------

Total Stockholders' Equity 279,739 294,534

--------- ---------

Total Liabilities and Stockholders' Equity $ 498,621 $ 476,241

========= =========

ASSISTED LIVING CONCEPTS, INC.

Consolidated Statements of Cash Flows

(In thousands)

Year Ended December 31,

----------------------------

2008 2007 2006

-------- -------- --------

OPERATING ACTIVITIES:

Net income $ 14,323 $ 17,179 $ 9,009

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization 18,710 17,642 16,699

Amortization of purchase accounting

adjustments for:

Leases and debt (248) (1,076) (527)

Below market resident leases -- (39) (1,187)

Provision for bad debts (303) 94 214

Provision for self-insured liabilities 435 78 415

Payments of self-insured liabilities (200) (308) (271)

Loss on sale or disposal of fixed assets 196 -- --

Loss on impairment of long-lived assets,

including impairments in discontinued

operations -- -- 5,018

Equity-based compensation expense 99 -- --

Change in fair value of derivative (655) -- --

Deferred income taxes 5,878 1,334 335

Changes in assets and liabilities:

Accounts receivable 515 1,555 (1,258)

Supplies, prepaid expenses and other

receivables 1,626 1,507 (3,564)

Deposits in escrow 139 (62) 290

Accounts payable 230 2,666 107

Accrued liabilities (53) (363) (1,167)

Deferred revenue 393 5,080 480

Income taxes payable/ receivable (2,669) 597 (999)

Changes in other non-current assets 4,858 1,849 (7,264)

Other long-term liabilities 1,658 1,379 2,649

Current due to Extendicare -- -- 76

-------- -------- --------

Cash provided by operating activities 44,932 49,112 19,055

-------- -------- --------

INVESTING ACTIVITIES:

Payment for acquisitions (14,546) (24,444) (4,619)

Cash designated for acquisition 14,864 (14,864) --

Payments for new construction projects (21,333) (3,904) (3,338)

Payments for purchases of property and

equipment (17,764) (12,457) (12,832)

Proceeds from sales of property and

equipment -- -- 79

-------- -------- --------

Cash used in investing activities (38,779) (55,669) (20,710)

-------- -------- --------

FINANCING ACTIVITIES:

Capital contributions from Extendicare -- 74 43,678

Purchase of treasury stock (27,125) (39,130) --

Proceeds on borrowings on revolving credit

facility 37,000 42,000 --

Repayment of interest bearing advances to

Extendicare -- -- (25,200)

Repayment of mortgage debt (19,215) (6,573) (2,312)

Proceeds from mortgage debt 9,026 4,301 --

Payment of deferred financing fees -- -- (999)

-------- -------- --------

Cash (used in) provided by financing

activities (314) 672 15,167

-------- -------- --------

Increase (decrease) in cash and cash

equivalents 5,839 (5,885) 13,512

Cash and cash equivalents, beginning of year 14,066 19,951 6,439

-------- -------- --------

Cash and cash equivalents, end of year $ 19,905 $ 14,066 $ 19,951

======== ======== ========

ASSISTED LIVING CONCEPTS, INC.

Financial and Operating Statistics

All residences Three Months Ended

----------------------------------------

December 31, September 30, December 31,

2008 2008 2007

------------ ------------ ------------

Average Occupied Units by Payer Source

Private 5,499 5,498 5,316

Medicaid 602 677 1,032

------------ ------------ ------------

Total 6,101 6,175 6,348

============ ============ ============

Occupancy Mix by Payer Source

Private 90.1% 89.0% 83.7%

Medicaid 9.9% 11.0% 16.3%

Percent of Revenue by Payer Source

Private 93.0% 92.0% 88.1%

Medicaid 7.0% 8.0% 11.9%

Average Revenue per Occupied Unit Day by Payer Source

Private $ 105.90 $ 106.19 $ 101.75

Medicaid $ 72.99 $ 74.72 $ 70.97

Combined $ 102.65 $ 102.74 $ 96.75

Occupancy Percentage 67.2% 68.0% 74.4%

All residences Year Ended

--------------------------

December 31, December 31,

2008 2007

------------ ------------

Average Occupied Units by Payer Source

Private 5,527 5,297

Medicaid 728 1,357

------------ ------------

Total 6,255 6,654

============ ============

Occupancy Mix by Payer Source

Private 88.4% 79.6%

Medicaid 11.6% 20.4%

Percent of Revenue by Payer Source

Private 91.7% 85.0%

Medicaid 8.3% 15.0%

Average Revenue per Occupied Unit Day by Payer Source

Private $ 106.15 $ 100.61

Medicaid $ 72.61 $ 69.11

Combined $ 102.24 $ 94.19

Occupancy Percentage 68.9% 79.1%

ASSISTED LIVING CONCEPTS, INC.

Financial and Operating Statistics

Same residence basis* Three Months Ended

----------------------------------------

December 31, September 30, December 31,

2008 2008 2007

------------ ------------ ------------

Average Occupied Units by Payer Source

Private 5,018 5,017 5,316

Medicaid 602 677 1,032

------------ ------------ ------------

Total 5,620 5,694 6,348

============ ============ ============

Occupancy Mix by Payer Source

Private 89.3% 88.1% 83.7%

Medicaid 10.7% 11.9% 16.3%

Percent of Revenue by Payer Source

Private 92.4% 91.4% 88.1%

Medicaid 7.6% 8.6% 11.9%

Average Revenue per Occupied Unit Day by Payer Source

Private $ 106.43 $ 106.51 $ 101.75

Medicaid $ 72.99 $ 74.72 $ 70.97

Combined $ 102.85 $ 102.73 $ 96.75

Occupancy Percentage 65.9% 66.7% 74.4%

Same residences basis* Year Ended

--------------------------

December 31, December 31,

2008 2007

------------ ------------

Average Occupied Units by Payer Source

Private 4,999 5,297

Medicaid 728 1,357

------------ ------------

Total 5,727 6,654

============ ============

Occupancy Mix by Payer Source

Private 87.3% 79.6%

Medicaid 12.7% 20.4%

Percent of Revenue by Payer Source

Private 91.0% 85.0%

Medicaid 9.0% 15.0%

Average Revenue per Occupied Unit Day by Payer Source

Private $ 106.83 $ 100.61

Medicaid $ 72.61 $ 69.11

Combined $ 102.48 $ 94.19

Occupancy Percentage 67.9% 79.1%

* Same residence basis excludes the impact of residents added from the

acquisition of the 185 unit Dubuque, Iowa residence on July 20, 2007

and the 541 unit CaraVita operations on January 1, 2008, and includes

changes in these acquisitions' occupancy since their respective dates

of acquisition.

Weighted Average Basic and Diluted Shares

The basic weighted average number of shares of common stock is

based upon the number of shares of Class A and Class B common stock

of ALC outstanding. For purposes of determining the diluted

weighted average number of shares, the Class B shares were deemed

to have been converted into Class A shares at the 1 to 1.075

conversion rate applicable to the Class B common stock. This

resulted in an additional 0.7 million shares included in the fully

diluted weighted average number of shares outstanding in the

quarter and year ended December 31, 2007 and 0.6 million shares

included in the quarter and year ended December 31, 2008 .

Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted EBITDAR

Adjusted EBITDA is defined as net income from continuing

operations before income taxes, interest expense net of interest

income, depreciation and amortization, equity based compensation

expense, transaction costs and non-cash, non-recurring gains and

losses, including disposal of assets and impairment of long-lived

assets and loss on refinancing and retirement of debt. Adjusted

EBITDAR is defined as adjusted EBITDA before rent expenses incurred

for leased assisted living properties. Adjusted EBITDA and adjusted

EBITDAR are not measures of performance under accounting principles

generally accepted in the United States of America, or GAAP. We use

adjusted EBITDA and adjusted EBITDAR as key performance indicators

and adjusted EBITDA and adjusted EBITDAR expressed as a percentage

of total revenues as a measurement of margin.

We understand that EBITDA and EBITDAR, or derivatives thereof,

are customarily used by lenders, financial and credit analysts, and

many investors as a performance measure in evaluating a company's

ability to service debt and meet other payment obligations or as a

common valuation measurement in the long-term care industry.

Moreover, ALC's revolving credit facility contains covenants in

which a form of EBITDA is used as a measure of compliance, and we

anticipate EBITDA will be used in covenants in any new financing

arrangements that we may establish. We believe adjusted EBITDA and

adjusted EBITDAR provide meaningful supplemental information

regarding our core results because these measures exclude the

effects of non-operating factors related to our capital assets,

such as the historical cost of the assets.

We report specific line items separately, and exclude them from

adjusted EBITDA and adjusted EBITDAR because such items are

transitional in nature and would otherwise distort historical

trends. In addition, we use adjusted EBITDA and adjusted EBITDAR to

assess our operating performance and in making financing decisions.

In particular, we use adjusted EBITDA and adjusted EBITDAR in

analyzing potential acquisitions and internal expansion

possibilities. Adjusted EBITDAR performance is also used in

determining compensation levels for our senior executives. Adjusted

EBITDA and adjusted EBITDAR should not be considered in isolation

or as a substitute for net income, cash flows from operating

activities, and other income or cash flow statement data prepared

in accordance with GAAP, or as a measure of profitability or

liquidity. We present adjusted EBITDA and adjusted EBITDAR on a

consistent basis from period to period, thereby allowing for

comparability of operating performance.

Adjusted EBITDA and Adjusted EBITDAR Reconciliation Information

The following table sets forth a reconciliation of net income to adjusted

EBITDA and adjusted EBITDAR:

Three Months Ended Three Months Ended Year Ended

December 31, September 30, December 31,

------------------- ------------------ -------------------

2008 2007 2008 2007 2008 2007

-------- --------- --------- -------- --------- ---------

(In thousands, unaudited)

Net income $ 3,030 $ 4,055 $ 2,966 $ 4,225 $ 14,323 $ 17,179

Provision for

income taxes 1,493 2,264 1,819 2,594 8,415 10,312

-------- --------- --------- -------- --------- ---------

Income from

operations

before income

taxes 4,523 6,319 4,785 6,819 22,738 27,491

Add:

Depreciation

and

amortization 4,775 4,554 4,691 4,584 18,710 17,642

Interest

expense, net 1,733 1,614 1,869 1,405 7,097 5,091

Transaction

costs -- -- -- -- -- 56

Loss on

disposal of

assets 222 -- 160 -- 382 --

Non-cash

equity based

compensation (5) -- 60 (192) 99 --

-------- --------- --------- -------- --------- ---------

Adjusted EBITDA 11,248 12,487 11,565 12,616 49,026 50,280

Add: Lease

expense 5,006 3,556 4,987 3,595 19,900 14,310

-------- --------- --------- -------- --------- ---------

Adjusted

EBITDAR $ 16,254 $ 16,043 $ 16,552 $ 16,211 $ 68,926 $ 64,590

======== ========= ========= ======== ========= =========

The following table sets forth the calculations of adjusted EBITDA and

adjusted EBITDAR as percentages of total revenue:

Three Months Ended Three Months Ended Year Ended

December 31, September 30, December 31,

------------------ ------------------ ------------------

(Dollars amounts in thousands, unaudited)

----------------------------------------------------------

2008 2007 2008 2007 2008 2007

-------- -------- -------- -------- -------- --------

Revenues $ 57,617 $ 56,502 $ 58,367 $ 57,898 $234,085 $229,347

-------- -------- -------- -------- -------- --------

Adjusted EBITDA $ 11,248 $ 12,487 $ 11,565 $ 12,616 $ 49,026 $ 50,280

-------- -------- -------- -------- -------- --------

Adjusted

EBITDAR $ 16,254 $ 16,043 $ 16,552 $ 16,211 $ 68,926 $ 64,590

-------- -------- -------- -------- -------- --------

Adjusted EBITDA

as percent of

total revenues 19.5% 22.1% 19.8% 21.8% 20.9% 21.9%

-------- -------- -------- -------- -------- --------

Adjusted EBITDAR

as percent of

total revenues 28.2% 28.4% 28.4% 28.0% 29.4% 28.2%

-------- -------- -------- -------- -------- --------

For further information, contact: Assisted Living Concepts, Inc.

John Buono Sr. Vice President, Chief Financial Officer and

Treasurer Phone: (262) 257-8999 Fax: (262) 251-7562 Email: Email

Contact Visit ALC's Website @ www.alcco.com

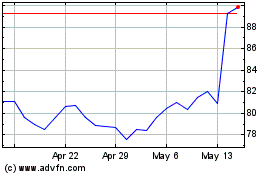

Alcon (NYSE:ALC)

Historical Stock Chart

From Jun 2024 to Jul 2024

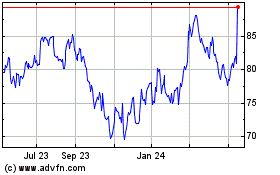

Alcon (NYSE:ALC)

Historical Stock Chart

From Jul 2023 to Jul 2024