Air Products Hikes Prices - Analyst Blog

August 17 2011 - 1:04PM

Zacks

The

industrial gases company Air Products &

Chemicals Inc. (APD) announced price increases

of 15% for liquid and bulk helium gases in North America effective

September 1, 2011.

Strong

demand for helium and its tight supply have resulted in the price

increase. The supply of helium across the globe has been tight

with product allocations implemented by the U.S. Bureau of

Land Management and with many other global helium sources producing

below capacity.

Also, helium sources located primarily outside of the U.S. are

extremely expensive; wholesale prices for crude and processed

liquid helium have increased, and costs have escalated for power

and diesel.

It is expected that demand will exceed supply for the next two

to three years, thus creating ongoing shortages in the market.

Recently, the company reported third quarter fiscal 2011 EPS of

$1.46, versus $1.17 in the year-earlier quarter and matched the

Zacks Consensus Estimate of $1.46. The results exclude a 4-cent

gain in discontinued operations recognizing a tax benefit from the

sale of the company's U.S. healthcare operations in 2009.

Net sales amounted to $2.6 billion, versus $2.3 billion in the

prior-year quarter, moving ahead of the Zacks Consensus Estimate of

$2.5 billion. The improved results were mainly driven by higher

volumes in the Electronics and Performance Materials and Tonnage

Gases segments.

The company witnessed strong volume growth across a number of

businesses mainly in the Asia Merchant business and the energy and

electronics markets. However, U.S. and Europe Merchant businesses

saw slower growth.

For the

quarter ahead, the company forecasts strong revenue growth in the

Tonnage, and Electronics and Performance Materials segments. The

company also expects to improve margins in the next quarter based

on its actions to improve Merchant segment performance.

Management

expects fourth quarter EPS between $1.48 and $1.53. The company

raised the full fiscal year EPS guidance between $5.70 and

$5.75 per share from $5.65 and $5.75 previously.

Last month, the company also announced new financial targets for

the 2015 timeframe. The company expects to deliver top line growth

of 11% to 13% per year over the next four years, which would take

its total revenues to over $15 billion in 2015. Air Products also

expects to improve its operating margin to 20% and its return on

capital to 15% by 2015.

Based in Pennsylvania, Air Products benefits from a long-term

take-or-pay contract, a consolidated industry structure, a diverse

customer base and sustained pricing power. However, soaring energy

and raw material costs pose a threat to margin expansion.

In order to compensate for escalating raw material costs, Air

Products has been increasing the price for a range of chemicals it

makes for industrial use. Air Products faces stiff competition from

Praxair Inc. (PX) and The Linde Group.

We currently have a Zacks #3 Rank (short-term Hold

recommendation) on the stock.

AIR PRODS & CHE (APD): Free Stock Analysis Report

PRAXAIR INC (PX): Free Stock Analysis Report

Zacks Investment Research

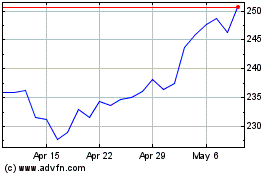

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Jun 2024 to Jul 2024

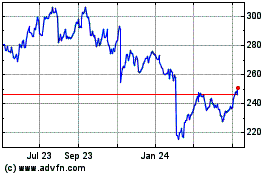

Air Products and Chemicals (NYSE:APD)

Historical Stock Chart

From Jul 2023 to Jul 2024