0001604028False00016040282023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2023

ADVANCED DRAINAGE SYSTEMS, INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | 001-36557 | 51-0105665 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

| 4640 Trueman Boulevard, | | 43026 |

| Hilliard, | Ohio |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (614) 658-0050

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WMS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 3, 2023, Advanced Drainage Systems, Inc. (the "Company") issued a press release setting forth the Company’s unaudited results for the fiscal first quarter ended June 30, 2023. A copy of the Company’s press release with the results is being furnished as Exhibit 99.1 and hereby incorporated by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities under Section 18 of the Exchange Act and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 7.01 Regulation FD Disclosure

As previously announced, at 10:00 a.m. (Eastern time) on August 3, 2023, the Company’s President and Chief Executive Officer, Scott Barbour, and Chief Financial Officer, Scott Cottrill, will host a conference call and webcast to discuss the Company’s unaudited results for the first quarter ended June 30, 2023. A copy of the Company’s slides forming the basis of the presentation is being furnished as Exhibit 99.2 and hereby incorporated by reference.

The live webcast will also be accessible via the "Events Calendar" section of the Company’s Investor Relations website, www.investors.ads-pipe.com. An archived version of the webcast will be available following the call.

Item 8.01 Other Events

On August 3, 2023, the Company issued a press release announcing the approval by the Board of Directors (the "Board") of the Company of the declaration of a cash dividend of $0.14 per share, payable on September 15, 2023, to stockholders of record at the close of business on September 1, 2023. A copy of the Company’s press release is attached hereto as Exhibit 99.3 and hereby incorporated by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

The following exhibits are being furnished as part of this report:

| | | | | | | | |

| 99.1 | | |

| | | |

| 99.2 | | |

| | | |

| 99.3 | | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| ADVANCED DRAINAGE SYSTEMS, INC. |

| | | |

| Date: August 3, 2023 | By: | | /s/ Scott A. Cottrill |

| Name: | | Scott A. Cottrill |

| Title: | | EVP, CFO & Secretary |

ADVANCED DRAINAGE SYSTEMS ANNOUNCES FIRST QUARTER

FISCAL 2024 RESULTS

HILLIARD, Ohio – (August 3, 2023) – Advanced Drainage Systems, Inc. (NYSE: WMS) (“ADS” or the “Company”), a leading provider of innovative water management solutions in the stormwater and onsite septic wastewater industries today announced financial results for the fiscal first quarter ended June 30, 2023.

First Quarter Fiscal 2024 Results

•Net sales decreased 14.9% to $778.0 million

•Net income decreased 7.7% to $173.9 million

•Net income per diluted share decreased 1.7% to $2.18

•Adjusted EBITDA (Non-GAAP) decreased 5.9% to $281.3 million

•Cash provided by operating activities decreased 2.3% to $244.0 million

•Free cash flow (Non-GAAP) decreased 5.5% to $201.9 million

Scott Barbour, President and Chief Executive Officer of ADS commented, "The first quarter net sales and Adjusted EBITDA results exceeded expectations, primarily driven by better-than-expected performance from the Infiltrator business and the Allied products portfolio. We had an excellent quarter from a profitability standpoint, as the Adjusted EBITDA margin increased to a new quarterly record of 36.2%, 350 basis points above the same quarter last year. This reflects the continued disciplined execution in pricing, good control over material and operational costs, and benefits from actions we took during the second half of last year to reduce manufacturing and transportation costs in the lower demand environment."

“From a top line perspective, the decrease in revenue of the domestic pipe business was generally in-line with our expectations. Allied products performed better than expected and Infiltrator benefited from the improvement in single-family housing starts outlook compared to the beginning of the calendar year. The overall sales decline of 15% in the quarter was modestly better than expected.”

"The need for water management solutions provided by ADS and Infiltrator remains highly relevant due to the increasing effects of heavy rainfall patterns and water scarcity. As communities and developers deal with these emerging issues, ADS is a trusted resource in the development of standards and practices around management of water, the world’s most precious resource, helping to safeguard our environment and communities. Developers, contractors and distributors recognize our expertise and value proposition as they continue to choose ADS and Infiltrator as the premier partner for water management solutions."

Barbour concluded, "We will continue to invest capital to increase manufacturing and recycling capacity, improve productivity and further automation so that we are in a favorable position as the market rebounds. We will focus on opportunities in key states and market segments, large scale development projects, and market penetration opportunities for products such as our HP pipe, Allied products, onsite septic tanks and active onsite treatment solutions to drive sales through our proven go to market capabilities."

First Quarter Fiscal 2024 Results

Net sales decreased $136.1 million, or 14.9%, to $778.0 million, as compared to $914.2 million in the prior year quarter. Domestic pipe sales decreased $96.3 million, or 18.3%, to $428.6 million. Domestic allied products & other sales decreased $15.5 million, or 7.8%, to $183.4 million. Infiltrator sales decreased $24.8 million, or 14.9%, to $141.5 million. The decrease in domestic net sales was primarily driven by lower demand in the U.S. construction end markets. International sales decreased $18.7 million, or 26.2%, to $52.8 million.

Gross profit decreased $20.6 million, or 5.9%, to $331.5 million as compared to $352.1 million in the prior year. The decrease in gross profit is primarily due to the decrease in volume and higher manufacturing costs, partially offset by favorable pricing and material costs.

Net income per diluted share decreased $0.04, or 1.7%, to $2.18, as compared to $2.22 per share in the prior year. Results for the first quarter of fiscal 2024 include a $14.9 million gain on the sale of assets, which after considering the income tax impact of this gain impacted net income per diluted share by $0.14.

Adjusted EBITDA (Non-GAAP) decreased $17.7 million, or 5.9%, to $281.3 million, as compared to $299.0 million in the prior year, primarily due to the factors mentioned above. As a percentage of net sales, Adjusted EBITDA was 36.2% as compared to 32.7% in the prior year.

Reconciliations of GAAP to Non-GAAP financial measures for Adjusted EBITDA and Free Cash Flow have been provided in the financial statement tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Balance Sheet and Liquidity

Net cash provided by operating activities was $244.0 million, as compared to $249.8 million in the prior year. Free cash flow (Non-GAAP) was $201.9 million, as compared to $213.6 million in the prior year. Net debt (total debt and finance lease obligations net of cash) was $953.7 million as of June 30, 2023, a decrease of $154.0 million from March 31, 2023.

ADS had total liquidity of $955.0 million, comprised of cash of $366.1 million as of June 30, 2023 and $588.9 million of availability under committed credit facilities. As of June 30, 2023, the Company’s trailing-twelve-month leverage ratio was 1.1 times Adjusted EBITDA.

In the three months ended June 30, 2023, the Company repurchased 0.5 million shares of its common stock for a total cost of $47.8 million. As of June 30, 2023, approximately $377.2 million of common stock may be repurchased under the Company's existing share repurchase authorization.

Fiscal 2024 Outlook

Based on current visibility, backlog of existing orders and business trends, the Company confirmed its financial targets for fiscal 2024. Net sales are expected to be in the range of $2.600 billion to $2.800 billion. Adjusted EBITDA is expected to be in the range of $725 to $825 million. Capital expenditures are expected to be in the range of $200 million to $225 million.

Conference Call Information

Webcast: Interested investors and other parties can listen to a webcast of the live conference call by logging in through the Investor Relations section of the Company's website at https://investors.ads-pipe.com/events-and-presentations. An online replay will be available on the same website following the call.

Teleconference: To participate in the live teleconference, participants may register at https://conferencingportals.com/event/gnGtWRav using Conference ID: 45786. After registering, participants will receive a confirmation through email, including dial in details and unique conference call codes for entry. Registration is open through the live call. To ensure participants are connected for the full call, please register at least 10 minutes before the start of the call.

About the Company

Advanced Drainage Systems is a leading manufacturer of innovative stormwater and onsite septic wastewater solutions that manages the world’s most precious resource: water. ADS and its subsidiary, Infiltrator Water Technologies, provide superior stormwater drainage and onsite septic wastewater products used in a wide variety of markets and applications including commercial, residential, infrastructure and agriculture, while delivering unparalleled customer service. ADS manages the industry’s largest company-owned fleet, an expansive sales team, and a vast manufacturing network of approximately 70 manufacturing plants and 40 distribution centers. The company is one of the largest plastic recycling companies in North America, ensuring over half a billion pounds of plastic is kept out of landfills every year. Founded in 1966, ADS’ water management solutions are designed to last for decades. To learn more, visit the Company’s website at www.adspipe.com.

Forward Looking Statements

Certain statements in this press release may be deemed to be forward-looking statements. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; disruption or volatility in general business and economic conditions in the markets in which we operate; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets; uncertainties surrounding the integration and realization of anticipated benefits of acquisitions; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; the risk associated with manufacturing processes; the effect of global climate change; cybersecurity risks; our ability to manage our supply purchasing and customer credit policies; our ability to control labor costs and to attract, train and retain highly qualified employees and key personnel; our ability to protect our

intellectual property rights; changes in laws and regulations, including environmental laws and regulations; the risks associated with our current levels of indebtedness, including borrowings under our existing credit agreement and outstanding indebtedness under our existing senior notes; and other risks and uncertainties described in the Company’s filings with the SEC. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information, please contact:

Michael Higgins

VP, Corporate Strategy & Investor Relations

(614) 658-0050

Michael.Higgins@adspipe.com

Financial Statements

ADVANCED DRAINAGE SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| (In thousands, except per share data) | 2023 | | 2022 | | | | | | | | |

| Net sales | $ | 778,046 | | | $ | 914,186 | | | | | | | | | |

| Cost of goods sold | 446,586 | | | 562,079 | | | | | | | | | |

| Gross profit | 331,460 | | | 352,107 | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Selling, general and administrative | 86,511 | | | 86,520 | | | | | | | | | |

(Gain) loss on disposal of assets and costs from exit and disposal activities | (13,304) | | | 303 | | | | | | | | | |

| Intangible amortization | 12,802 | | | 13,677 | | | | | | | | | |

| Income from operations | 245,451 | | | 251,607 | | | | | | | | | |

| Other expense: | | | | | | | | | | | |

| Interest expense | 21,712 | | | 11,072 | | | | | | | | | |

| Derivative gains and other income, net | (3,549) | | | (1,902) | | | | | | | | | |

| Income before income taxes | 227,288 | | | 242,437 | | | | | | | | | |

| Income tax expense | 55,058 | | | 55,065 | | | | | | | | | |

| Equity in net income of unconsolidated affiliates | (1,675) | | | (1,110) | | | | | | | | | |

| Net income | 173,905 | | | 188,482 | | | | | | | | | |

| Less: net income attributable to noncontrolling interest | 253 | | | 1,336 | | | | | | | | | |

| Net income attributable to ADS | 173,652 | | | 187,146 | | | | | | | | | |

| | | | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | |

| Basic | 78,908 | | | 83,144 | | | | | | | | | |

| Diluted | 79,634 | | | 84,389 | | | | | | | | | |

| Net income per share: | | | | | | | | | | | |

| Basic | $ | 2.20 | | | $ | 2.25 | | | | | | | | | |

| Diluted | $ | 2.18 | | | $ | 2.22 | | | | | | | | | |

| Cash dividends declared per share | $ | 0.14 | | | $ | 0.12 | | | | | | | | | |

ADVANCED DRAINAGE SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

| | As of |

| (Amounts in thousands) | June 30, 2023 | | March 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash | $ | 366,104 | | | $ | 217,128 | |

| Receivables, net | 342,338 | | | 306,945 | |

| Inventories | 434,631 | | | 463,994 | |

| Other current assets | 25,450 | | | 29,422 | |

| Total current assets | 1,168,523 | | | 1,017,489 | |

| Property, plant and equipment, net | 747,312 | | | 733,059 | |

| Other assets: | | | |

| Goodwill | 620,428 | | | 620,193 | |

| Intangible assets, net | 394,837 | | | 407,627 | |

| Other assets | 117,569 | | | 122,757 | |

| Total assets | $ | 3,048,669 | | | $ | 2,901,125 | |

| LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current maturities of debt obligations | $ | 13,806 | | | $ | 14,693 | |

| Current maturities of finance lease obligations | 10,447 | | | 8,541 | |

| Accounts payable | 205,591 | | | 210,111 | |

| Other accrued liabilities | 137,511 | | | 142,400 | |

| Accrued income taxes | 52,232 | | | 3,057 | |

| Total current liabilities | 419,587 | | | 378,802 | |

| Long-term debt obligations, net | 1,266,797 | | | 1,269,391 | |

| Long-term finance lease obligations | 28,795 | | | 32,272 | |

| Deferred tax liabilities | 158,942 | | | 159,056 | |

| Other liabilities | 62,682 | | | 66,744 | |

| Total liabilities | 1,936,803 | | | 1,906,265 | |

| Mezzanine equity: | | | |

| Redeemable common stock | 148,397 | | | 153,220 | |

| Total mezzanine equity | 148,397 | | | 153,220 | |

| Stockholders’ equity: | | | |

| Common stock | 11,654 | | | 11,647 | |

| Paid-in capital | 1,147,449 | | | 1,134,864 | |

| Common stock in treasury, at cost | (977,812) | | | (920,999) | |

| Accumulated other comprehensive loss | (25,399) | | | (27,580) | |

| Retained earnings | 788,780 | | | 626,215 | |

| Total ADS stockholders’ equity | 944,672 | | | 824,147 | |

| Noncontrolling interest in subsidiaries | 18,797 | | | 17,493 | |

| Total stockholders’ equity | 963,469 | | | 841,640 | |

| Total liabilities, mezzanine equity and stockholders’ equity | $ | 3,048,669 | | | $ | 2,901,125 | |

ADVANCED DRAINAGE SYSTEMS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| | Three Months Ended June 30, |

| (Amounts in thousands) | 2023 | | 2022 |

| Cash Flow from Operating Activities | | | |

| Net income | $ | 173,905 | | | $ | 188,482 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 37,240 | | | 35,578 | |

| Deferred income taxes | 573 | | | (1,272) | |

| (Gain) loss on disposal of assets and costs from exit and disposal activities | (13,304) | | | 303 | |

| Stock-based compensation | 6,903 | | | 6,273 | |

| Amortization of deferred financing charges | 511 | | | 344 | |

| Fair market value adjustments to derivatives | (36) | | | (90) | |

| Equity in net income of unconsolidated affiliates | (1,675) | | | (1,110) | |

| Other operating activities | 501 | | | (3,535) | |

| Changes in working capital: | | | |

| Receivables | (33,406) | | | (79,616) | |

| Inventories | 30,860 | | | 8,039 | |

| Prepaid expenses and other current assets | (3,699) | | | (4,840) | |

| Accounts payable, accrued expenses, and other liabilities | 45,594 | | | 101,209 | |

| Net cash provided by operating activities | 243,967 | | | 249,765 | |

| Cash Flows from Investing Activities | | | |

| Capital expenditures | (42,078) | | | (36,189) | |

| Proceeds from disposition of assets | 19,979 | | | — | |

| Acquisition, net of cash acquired | — | | | (47,492) | |

| Other investing activities | 155 | | | 13 | |

| Net cash used in investing activities | (21,944) | | | (83,668) | |

| Cash Flows from Financing Activities | | | |

| Payments on syndicated Term Loan Facility | (1,750) | | | (1,750) | |

| Proceeds from Revolving Credit Agreement | — | | | 26,200 | |

| Payments on Revolving Credit Agreement | — | | | (140,500) | |

| Proceeds from Amended Revolving Credit Agreement | — | | | 97,000 | |

| Payments on Amended Revolving Credit Agreement | — | | | (97,000) | |

| Proceeds from Senior Notes due 2030 | — | | | 500,000 | |

| Debt issuance costs | — | | | (11,575) | |

| Payments on Equipment Financing | (2,256) | | | (3,548) | |

| Payments on finance lease obligations | (2,769) | | | (1,721) | |

| Repurchase of common stock | (47,778) | | | (57,699) | |

| Cash dividends paid | (11,084) | | | (10,170) | |

| Proceeds from exercise of stock options | 867 | | | 1,249 | |

| Payment of withholding taxes on vesting of restricted stock units | (8,742) | | | (22,809) | |

| Net cash (used in) provided by financing activities | (73,512) | | | 277,677 | |

| Effect of exchange rate changes on cash | 465 | | | (203) | |

| Net change in cash | 148,976 | | | 443,571 | |

| Cash at beginning of period | 217,128 | | | 20,125 | |

| Cash at end of period | $ | 366,104 | | | $ | 463,696 | |

Selected Financial Data

The following tables set forth net sales by reportable segment for each of the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | |

| June 30, 2023 | | June 30, 2022 | | |

| (In thousands) | Net Sales | | Intersegment Net Sales | | Net Sales from External Customers | | Net Sales | | Intersegment Net Sales | | Net Sales from External Customers | | | | | | | |

| Pipe | $ | 428,572 | | | $ | (8,144) | | | $ | 420,428 | | | $ | 524,857 | | | $ | (9,874) | | | $ | 514,983 | | | | | | | | |

| Infiltrator | 141,486 | | | (18,578) | | | 122,908 | | | 166,290 | | | (28,906) | | | 137,384 | | | | | | | | |

| International | | | | | | | | | | | | | | | | | | |

| International - Pipe | 37,178 | | | (528) | | | 36,650 | | | 53,419 | | | (5,859) | | | 47,560 | | | | | | | | |

| International - Allied Products & Other | 15,598 | | | — | | | 15,598 | | | 18,095 | | | — | | | 18,095 | | | | | | | | |

| Total International | 52,776 | | | (528) | | | 52,248 | | | 71,514 | | | (5,859) | | | 65,655 | | | | | | | | |

| Allied Products & Other | 183,445 | | | (983) | | | 182,462 | | | 198,909 | | | (2,745) | | | 196,164 | | | | | | | | |

| Intersegment Eliminations | (28,233) | | | 28,233 | | | — | | | (47,384) | | | 47,384 | | | — | | | | | | | | |

| Total Consolidated | $ | 778,046 | | | $ | — | | | $ | 778,046 | | | $ | 914,186 | | | $ | — | | | $ | 914,186 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Non-GAAP Financial Measures

This press release contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). ADS management uses non-GAAP measures in its analysis of the Company’s performance. Investors are encouraged to review the reconciliation of non-GAAP financial measures to the comparable GAAP results available in the accompanying tables.

Reconciliation of Non-GAAP Financial Measures

This press release includes references to organic results, Adjusted EBITDA and Free Cash Flow, non-GAAP financial measures. These non-GAAP financial measures are used in addition to and in conjunction with results presented in accordance with GAAP. These measures are not intended to be substitutes for those reported in accordance with GAAP. Adjusted EBITDA and Free Cash Flow may be different from non-GAAP financial measures used by other companies, even when similar terms are used to identify such measures.

EBITDA and Adjusted EBITDA are non-GAAP financial measures that comprise net income before interest, income taxes, depreciation and amortization, stock-based compensation, non-cash charges and certain other expenses. The Company’s definition of Adjusted EBITDA may differ from similar measures used by other companies, even when similar terms are used to identify such measures. Adjusted EBITDA is a key metric used by management and the Company’s board of directors to assess financial performance and evaluate the effectiveness of the Company’s business strategies. Accordingly, management believes that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as the Company’s management and board of directors. In order to provide investors with a meaningful reconciliation, the Company has provided below reconciliations of Adjusted EBITDA to net income.

Free Cash Flow is a non-GAAP financial measure that comprises cash flow from operating activities less capital expenditures. Free Cash Flow is a measure used by management and the Company’s board of directors to assess the Company’s ability to generate cash. Accordingly, management believes that Free Cash Flow provides useful information to investors and others in understanding and evaluating our ability to generate cash flow from operations after capital expenditures. In order to provide investors with a meaningful reconciliation, the Company has provided below a reconciliation of cash flow from operating activities to Free Cash Flow.

The following tables present a reconciliation of EBITDA and Adjusted EBITDA to Net Income and Free Cash Flow to Cash Flow from Operating Activities, the most comparable GAAP measures, for each of the periods indicated.

Reconciliation of Adjusted Gross Profit to Gross Profit

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | |

| (Amounts in thousands) | 2023 | | 2022 | | | | | | | | |

| Segment Adjusted Gross Profit | | | | | | | | | | | |

| Pipe | $ | 160,649 | | | $ | 168,579 | | | | | | | | | |

| Infiltrator | 74,264 | | | 75,794 | | | | | | | | | |

| International | 16,029 | | | 20,484 | | | | | | | | | |

| Allied Products & Other | 106,185 | | | 109,041 | | | | | | | | | |

| Intersegment Elimination | (2,055) | | | (815) | | | | | | | | | |

| Total Segment Adjusted Gross Profit | 355,072 | | | 373,083 | | | | | | | | | |

| Depreciation and amortization | 22,799 | | | 20,302 | | | | | | | | | |

| ESOP and stock-based compensation | 813 | | | 674 | | | | | | | | | |

| Total Gross Profit | $ | 331,460 | | | $ | 352,107 | | | | | | | | | |

Reconciliation of Adjusted EBITDA to Net Income

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | |

| (Amounts in thousands) | 2023 | | 2022 | | | | | | | | |

| Net income | $ | 173,905 | | | $ | 188,482 | | | | | | | | | |

| Depreciation and amortization | 37,240 | | | 35,578 | | | | | | | | | |

| Interest expense | 21,712 | | | 11,072 | | | | | | | | | |

| Income tax expense | 55,058 | | | 55,065 | | | | | | | | | |

| EBITDA | 287,915 | | | 290,197 | | | | | | | | | |

(Gain) loss on disposal of assets and costs from exit and disposal activities | (13,304) | | | 303 | | | | | | | | | |

| Stock-based compensation expense | 6,903 | | | 6,273 | | | | | | | | | |

| Transaction costs | 1,972 | | | 1,715 | | | | | | | | | |

| Interest income | (3,489) | | | (117) | | | | | | | | | |

Other adjustments(a) | 1,316 | | | 672 | | | | | | | | | |

| Adjusted EBITDA | $ | 281,313 | | | $ | 299,043 | | | | | | | | | |

(a)Includes derivative fair value adjustments, foreign currency transaction (gains) losses, the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense.

Reconciliation of Free Cash Flow to Cash flow from Operating Activities

| | | | | | | | | | | |

| | Three Months Ended

June 30, |

| (Amounts in thousands) | 2023 | | 2022 |

| Net cash flow from operating activities | $ | 243,967 | | | $ | 249,765 | |

| Capital expenditures | (42,078) | | | (36,189) | |

| Free cash flow | $ | 201,889 | | | $ | 213,576 | |

2

3

4 • • • • • • • • • • • • • •

5

6

7

8

10

11 • • • • • • • • • • • • • • • • • •

Reconciliations 12 (In thousands) Net Sales Intersegment Net Sales Net Sales from External Customers Net Sales Intersegment Net Sales Net Sales from External Customers Pipe $ 428,572 $ (8,144) $ 420,428 $ 524,857 $ (9,874) $ 514,983 Infiltrator Water Technologies 141,486 (18,578) 122,908 166,290 (28,906) 137,384 International International - Pipe 37,178 (528) 36,650 53,419 (5,859) 47,560 International - Allied Products & Other 15,598 - 15,598 18,095 - 18,095 Total International 52,776 (528) 52,248 71,514 (5,859) 65,655 Allied Products & Other 183,445 (983) 182,462 198,909 (2,745) 196,164 Intersegment Eliminations (28,233) 28,233 - (47,384) 47,384 - Total Consolidated $ 778,046 $ - $ 778,046 $ 914,186 $ - $ 914,186 Three Months Ended June 30, 2023 June 30, 2022

Reconciliations 13 Notes: a) Includes derivative fair value adjustments, foreign currency transaction (gains) losses, the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense. (Amounts in thousands) 2023 2022 Segment adjusted gross profit Pipe $ 160,649 $ 168,579 Infiltrator Water Technologies 74,264 75,794 International 16,029 20,484 Allied Products & Other 106,185 109,041 Intersegment Eliminations (2,055) (815) Total Segment Adjusted Gross Profit 355,072 373,083 Depreciation and amortization 22,799 20,302 ESOP and stock-based compensation expense 813 674 Total Gross Profit $ 331,460 $ 352,107 (Amounts in thousands) 2023 2022 Net income $ 173,905 $ 188,482 Depreciation and amortization 37,240 35,578 Interest expense 21,712 11,072 Income tax expense 55,058 55,065 EBITDA 287,915 290,197 (Gain) loss on disposal of assets and costs from exit and disposal activities (13,304) 303 Stock-based compensation expense 6,903 6,273 Transaction costs 1,972 1,715 Interest income (3,489) (117) Other adjustments (a) 1,316 672 Adjusted EBITDA $ 281,313 $ 299,043 Three Months Ended June 30, Three Months Ended June 30,

ADVANCED DRAINAGE SYSTEMS ANNOUNCES QUARTERLY CASH DIVIDEND

HILLIARD, Ohio – (August 3, 2023) – Advanced Drainage Systems, Inc. (NYSE: WMS) (“ADS” or the “Company”), a leading provider of innovative water management solutions in the stormwater and on-site septic waste water industries, today announced that its Board of Directors (the “Board”) has approved a quarterly cash dividend to its shareholders in the amount of $0.14 per share, a 17% increase over the prior year dividend amount.

Scott Barbour, President and Chief Executive Officer of Advanced Drainage Systems commented, “Today’s dividend announcement is predicated on the strength of our balance sheet, formidable cash generation, and ongoing commitment to returning capital to shareholders. Our strong financial performance and operational excellence initiatives provide us with the confidence and financial flexibility to return excess cash to our shareholders while simultaneously continuing to strategically invest in our business.”

The quarterly cash dividend of $0.14 per share will be paid on September 15, 2023, to shareholders of record at the close of business on September 1, 2023.

About the Company

Advanced Drainage Systems is a leading manufacturer of innovative stormwater and onsite septic wastewater solutions that manages the world’s most precious resource: water. ADS and its subsidiary, Infiltrator Water Technologies, provide superior stormwater drainage and onsite septic wastewater products used in a wide variety of markets and applications including commercial, residential, infrastructure and agriculture, while delivering unparalleled customer service. ADS manages the industry’s largest company-owned fleet, an expansive sales team, and a vast manufacturing network of approximately 70 manufacturing plants and 40 distribution centers. The company is one of the largest plastic recycling companies in North America, ensuring over half a billion pounds of plastic is kept out of landfills every year. Founded in 1966, ADS’ water management solutions are designed to last for decades. To learn more more, visit the Company’s website at www.adspipe.com.

Forward Looking Statements

Certain statements in this press release may be deemed to be forward-looking statements. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; disruption or volatility in general business and economic conditions in the markets in which we operate; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets; uncertainties surrounding the integration and realization of anticipated benefits of acquisitions; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; the risk associated with manufacturing processes; the effect of global climate change; cybersecurity risks; our ability to manage our supply purchasing and customer credit policies; our ability to control labor costs and to attract, train and retain highly qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; the risks associated with our current levels of indebtedness, including borrowings under our existing credit agreement and outstanding indebtedness under our existing senior notes; and other risks and uncertainties described in the Company’s filings with the SEC. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information, please contact:

Michael Higgins

VP, Corporate Strategy & Investor Relations

(614) 658-0050

Michael.Higgins@adspipe.com

v3.23.2

Cover

|

Aug. 03, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 03, 2023

|

| Entity Registrant Name |

ADVANCED DRAINAGE SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36557

|

| Entity Tax Identification Number |

51-0105665

|

| Entity Address, Address Line One |

4640 Trueman Boulevard,

|

| Entity Address, City or Town |

Hilliard,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43026

|

| City Area Code |

614

|

| Local Phone Number |

658-0050

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

WMS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001604028

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

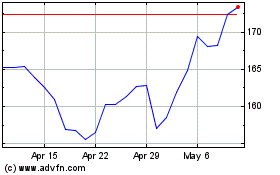

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Advanced Drainage Systems (NYSE:WMS)

Historical Stock Chart

From Nov 2023 to Nov 2024