For Immediate Release

Chicago, IL – November 30, 2011 – Zacks Equity Research

highlights Cabela's, Inc. (CAB) as the Bull of the

Day and Willis Group Holdings, Plc (WSH) as the

Bear of the Day. In addition, Zacks Equity Research provides

analysis on Guess? Inc. (GES), Abercrombie

& Fitch Co. (ANF) and Gap Inc.

(GPS).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

Cabela's, Inc. (CAB) third-quarter 2011

earnings of $0.50 per share beat the Zacks Consensus Estimate of

$0.44, and surged 61.3% from the prior-year quarter. The quarter

witnessed healthy revenue growth and profitability at its retail

segment, sturdy performance at Cabela's CLUB Visa program, strong

merchandise gross margin and increased market share.

Merchandise gross margin expanded 140 basis points to 35.9%

during the quarter. Management reiterated its long-term goal of

increasing the margin by 200-300 basis points. Driven by improving

trends, the company now expects earnings to beat the consensus in

fiscal 2011 and increase at a low double-digit rate in fiscal

2012.

The company also remains focused on alleviating bad debt risk in

its credit card business. The gradual improvement in the economy

has lowered delinquencies and charge-offs.

Bear of the Day:

We are downgrading our recommendation on Willis Group

Holdings, Plc (WSH) to Underperform from Neutral due to

the headwind from The Loan Protector business that is expected to

weigh on North American results. The soft insurance market is

likely to continue.

Additionally, the weakness in the US economy will remain a

headwind and restrict any significant top-line growth in the

company. Willis also expects to incur pre-tax charges of

approximately $160 million in 2011, up from $130 million expected

earlier.

Our six-month target price of $31.00 equates to about 11.2x our

earnings estimate for 2011. This target price along with an annual

dividend of $1.04 implies an expected negative return of about 8%

over that period, which is consistent with our Underperform

recommendation.

Latest Posts on the Zacks Analyst Blog:

Earnings Preview: Guess? Inc.

Guess? Inc. (GES), one of the world’s leading

designer and distributor of lifestyle apparels, is scheduled to

report its third quarter 2012 financial results before the opening

bells on November 30, 2011.

The current Zacks Consensus Estimate for the quarter’s earnings

is pegged at 74 cents a share. The Zacks Consensus Estimate

projects revenues for the quarter to come in at $658 million.

Second Quarter 2012 Recap

Guess? Inc., which faces stiff competition from

Abercrombie & Fitch Co. (ANF) and Gap

Inc. (GPS), posted second quarter 2012 adjusted earnings

per share (EPS) of 84 cents, which surpassed the Zacks estimate by

3 cents. It also exceeded the year-ago earnings of 72 cents by

16.7%.

Revenues in the quarter soared 17.3% year over year to $677.2

million. In constant dollar terms, net revenue went up 9.5% from

the previous year.

Operating income grew 17.3% to $113.0 million, reflecting

favorable currency, volume/mix gains and lower overheads.

Operating Income margin remained flat with the prior year

quarter at 16.7%. Product margin climbed up owing to higher

relative occupancy, distribution and selling expenses.

Read The Whole Story at Guess? Beats; Profits Overseas

Management Guidance

Based on the results posted in the second quarter, the company

estimated the third quarter diluted earnings to be in the range of

71 cents to 74 cents. For fiscal 2012, the company expects earnings

in the range of $3.25 to $3.35 and GAAP diluted earnings per share

between $3.06 and $3.16.

Third-Quarter 2012 Zacks Consensus

Earnings estimates for the third quarter of 2012, as provided by

the analysts, range from a low of 70 cents to a high of 77 cents.

Thus, the current Zacks Consensus Estimate for the quarter is

pegged at 74 cents per share, reflecting a year-over-year decline

of one penny.

Over the past 30 days, none of the analysts have revised the

earnings estimate. Hence, the Zacks Consensus Estimate did not

change. However, the estimate increased by 1 penny over the last 90

days.

Earnings History: Ahead of Zacks

With respect to earnings surprises, Guess? topped the Zacks

Consensus Estimate in all the preceding four quarters. Over the

last four quarters, the earnings surprise ranged from 3.70% to

27.12%, with the average earnings surprise being 15.14%, suggesting

that Guess? has always outperformed the Zacks Consensus Estimate

over that period.

Recommendation

The company’s in-house team of dedicated designers and product

specialists enable the company to stay ahead in the face of

changing lifestyle and fashion trends by bringing innovative and

unique products to its customers. However, stiff competition from

numerous manufacturers, importers and distributors; having

significantly greater financial, distribution, advertising and

marketing resources concerns us.

Currently, we prefer to rate the stock as Neutral. However,

Guess? holds the Zacks #4 Rank, which translates into a short-term

'Sell' rating.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

ABERCROMBIE (ANF): Free Stock Analysis Report

CABELAS INC (CAB): Free Stock Analysis Report

GUESS INC (GES): Free Stock Analysis Report

GAP INC (GPS): Free Stock Analysis Report

WILLIS GP HLDGS (WSH): Free Stock Analysis Report

Zacks Investment Research

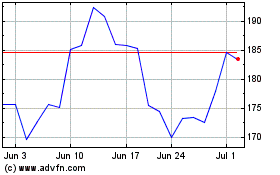

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jun 2024 to Jul 2024

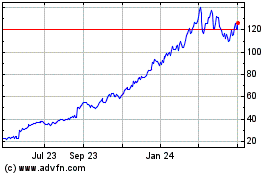

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jul 2023 to Jul 2024