UPDATE: Abercrombie Swings To Bigger-Than-Expected 1Q Profit

May 18 2011 - 11:37AM

Dow Jones News

Abercrombie & Fitch Co. (ANF) swung to a

bigger-than-expected fiscal first-quarter profit as margins

improved on international product offerings and lower average unit

costs.

Shares were recently trading up 3.2% at $75.48. Abercrombie's

stock has been on a hot streak, rising 97% in the past year. Sales

at the teen-apparel retailer began to recover in 2010, driven in

part by its international business, and the company has been

gaining market share from its teen rivals since adopting a more

promotional pricing approach.

International sales continued their surge in the fourth quarter,

growing 64%, and contributed to a 230 basis point gain in gross

margin as international products command premium pricing.

And although rising raw material costs are a main concern facing

apparel retailers, Abercrombie's margin was aided by lower average

unit costs. The company said on its conference call Wednesday that

is primarily due to timing, having locked in pricing about six

months ago before the latest escalation in prices.

But Abercrombie warned that it is expecting margin to be down in

the second quarter as it doesn't plan to raise prices until the

third quarter. The company added that it still expects double-digit

cost increases for the fall season and there's significant

uncertainty about how higher ticket prices are going to be digested

by the consumer.

The company is targeting a mid-single digit same-store sales

increase in the second quarter, following a 10% rise in the first

quarter.

Abercrombie said on its call that same-store sales were

partially tempered by the events in Japan, which weighed on the

international same-store sales rate, and a fire that closed the

Abercrombie & Fitch store on Fifth Avenue in New York City

during the quarter.

For the quarter ended April 30, Abercrombie reported a profit of

$25.1 million, or 28 cents a share, compared with a loss of $11.8

million, or 13 cents, a year earlier. Earnings from continuing

operations were 27 cents in the latest quarter. Analysts polled by

Thomson Reuters had most recently forecast earnings of 12 cents a

share.

Gross margin climbed to 65% from 62.7%, reflecting the lower

average unit cost, favorable international mix, including foreign

currency impact, and other gross margin items, such as a freight

benefit.

Earlier this month, the company said total sales jumped 22% to

$836.7 million.

U.S. sales rose 13% to $641 million, international sales rose

64% to $195.7 million, and direct sales rose 32% to $105.8 million.

By brand, same-store sales rose 8% for A&F, 11% for Abercrombie

Kids and 11% for Hollister.

Abercrombie plans to open five international Abercrombie &

Fitch flagship locations in fiscal 2011 as well as up to 40

international mall-based Hollister stores, primarily in the latter

part of the year.

-By Caitlin Nish, Dow Jones Newswires; 212-416-2076;

caitlin.nish@dowjones.com

--Melodie Warner contributed to this article

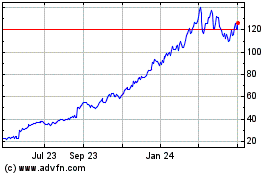

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jun 2024 to Jul 2024

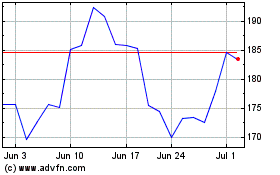

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jul 2023 to Jul 2024