Abercrombie & Fitch Reports January Sales Results

February 04 2010 - 8:00AM

PR Newswire (US)

NEW ALBANY, Ohio, Feb. 4 /PRNewswire-FirstCall/ -- Abercrombie

& Fitch (NYSE:ANF) today reported net sales of $222.8 million

for the four-week period ended January 30, 2010, a 16% increase

from net sales of $191.5 million for the four-week period ended

January 31, 2009. January comparable store sales increased 8%.

Total Company direct-to-consumer net merchandise sales increased 8%

to $28.0 million. As of January 30, 2010, the Company completed the

closure of its Ruehl branded stores and related direct-to-consumer

operations. Reported net sales for the month include $1.4 million

of net sales for Ruehl, as compared to $4.4 million in the prior

year. Ruehl net sales for current and prior periods will be

reclassified into and reported as discontinued operations when the

Company reports its fourth quarter results on February 16, 2010.

For the fourth quarter, the Company reported a net sales decrease

of 5% to $951.0 million from $998.0 million last year. Comparable

store sales decreased 13% for the quarter. Total Company

direct-to-consumer net sales increased 1% to $96.4 million for the

fourth quarter. Reported net sales for the quarter include $14.8

million of net sales for Ruehl, as compared to $17.1 million in the

prior year. For Fiscal 2009, the Company reported a net sales

decrease of 16% to $2.977 billion from $3.540 billion last year.

Comparable store sales decreased 23% for the fiscal year. Total

Company direct-to-consumer net merchandise sales decreased 5% to

$258.1 million for Fiscal 2009. Reported net sales for the year

include $48.2 million of net sales for Ruehl, as compared to $56.2

million in the prior year. During fiscal November and fiscal

December, the Company conducted special events in most of its North

American stores and direct-to-consumer channels in which

complimentary gift cards, redeemable on or before January 30, 2010,

were issued to customers who made purchases above defined amounts.

At the beginning of the fiscal month, the value of complimentary

gift cards issued but not redeemed was approximately $22 million,

substantially all of which has been recognized in sales in January.

Additional information regarding sales for fiscal January can be

found in a pre-recorded message accessible by dialing (800)

395-0662, or, internationally, by dialing (402) 220-1262. January

2010 Developments -- Total Company net sales increased 16% -- Total

Company comparable store sales increased 8% -- Total Company

direct-to-consumer net merchandise sales increased 8% --

Abercrombie & Fitch comparable store sales increased 12% --

abercrombie kids comparable store sales increased 10% -- Hollister

Co. comparable store sales increased 5% -- Ruehl comparable store

sales decreased 47% Other Developments The Company continues to

anticipate that its fiscal year-end review of long-lived,

store-related assets will result in a non-cash impairment charge in

the fourth quarter. In addition, as stated above, the results of

Ruehl for the current and prior periods will be reclassified into

and reported as discontinued operations when the Company reports

its fourth quarter results on February 16, 2010. The Company will

release its fourth quarter results on Tuesday, February 16, 2010,

prior to the opening of the market and hold a conference call at

8:30 AM Eastern Time. To listen to the conference call, dial (888)

204-4317 and ask for the Abercrombie & Fitch Quarterly Call or

go to http://www.abercrombie.com/. The international call-in number

is (913) 981-5589. This call will be recorded and made available by

dialing the replay number (888) 203-1112 or the international

number (719) 457-0820 followed by the conference ID number 6042496

or through http://www.abercrombie.com/. At the end of Fiscal 2009,

the Company operated a total of 1,096 stores. The Company operated

340 Abercrombie & Fitch stores, 205 abercrombie kids stores,

507 Hollister Co. stores and 16 Gilly Hicks stores in the United

States. The Company also operated six Abercrombie & Fitch

stores, four abercrombie stores and 18 Hollister Co. stores

internationally. The Company also operates e-commerce websites at

http://www.abercrombie.com/, http://www.abercrombiekids.com/,

http://www.hollisterco.com/ and http://www.gillyhicks.com/. SAFE

HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT

OF 1995 A&F cautions that any forward-looking statements (as

such term is defined in the Private Securities Litigation Reform

Act of 1995) contained in this Press Release or made by management

of A&F involve risks and uncertainties and are subject to

change based on various important factors, many of which may be

beyond the Company's control. Words such as "estimate," "project,"

"plan," "believe," "expect," "anticipate," "intend," and similar

expressions may identify forward-looking statements. The following

factors, in addition to those included in the disclosure under the

heading "FORWARD-LOOKING STATEMENTS AND RISK FACTORS" in "ITEM 1A.

RISK FACTORS" of A&F's Annual Report on Form 10-K for the

fiscal year ended January 31, 2009, in some cases have affected and

in the future could affect the Company's financial performance and

could cause actual results for the 2009 fiscal year and beyond to

differ materially from those expressed or implied in any of the

forward-looking statements included in this Press Release or

otherwise made by management: current general and financial

economic conditions; changes in consumer spending patterns and

consumer preferences; the effects of political and economic events

and conditions domestically and in foreign jurisdictions in which

the Company operates, including, but not limited to, acts of

terrorism or war; the impact of competition and pricing; changes in

weather patterns; availability and market prices of key raw

materials; ability to source product from its global supplier base;

political stability; currency and exchange risks and changes in

existing or potential duties, tariffs or quotas; availability of

suitable store locations at appropriate terms; ability to develop

new merchandise; ability to hire, train and retain associates;

estimates of expenses which the Company may incur in connection

with the closure of the Ruehl stores and related direct-to-consumer

operations; and the outcome of pending litigation or other

adversarial proceedings. Future economic and industry trends that

could potentially impact revenue and profitability are difficult to

predict. Therefore, there can be no assurance that the

forward-looking statements included in this Press Release will

prove to be accurate. In light of the significant uncertainties in

the forward-looking statements included herein, the inclusion of

such information should not be regarded as a representation by the

Company, or any other person, that the objectives of the Company

will be achieved. The forward-looking statements herein are based

on information presently available to the management of the

Company. Except as may be required by applicable law, the Company

assumes no obligation to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any projected results expressed or implied

therein will not be realized. DATASOURCE: Abercrombie & Fitch

CONTACT: Eric Cerny, Manager, Investor Relations of Abercrombie

& Fitch, +1-614-283-6385 Web Site: http://www.abercrombie.com/

Copyright

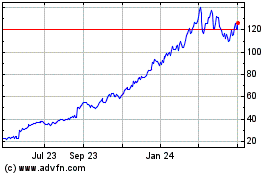

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jul 2024 to Aug 2024

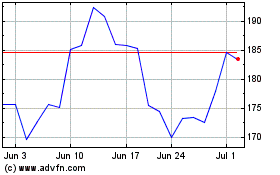

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Aug 2023 to Aug 2024