CORRECT: Retailers Mum On How Their Much-Touted Online Channels Fared

January 08 2010 - 9:16AM

Dow Jones News

It is still a brick-and-mortar world for traditional retailers

who offered nary a word about how their online businesses performed

when they posted December same-store sales on Thursday.

Many major retailers spent a significant amount of time and

money promoting their Web sites during the holiday season, offering

everything from free shipping to online-only coupons to in-store

pick-ups of products.

This year was more of an image builder for brick-and-mortar

stores, said Michael Tsiros, chairman of the marketing department

at the University of Miami School of Business Administration.

However, overall, online shopping accounts for less than 5% of all

retail purchases, excluding gas and food.

"They wanted to show they have a presence, and doing so may

actually have cost them more than the sales they received," he

said

A handful of retailers talked about their online sales based on

a review of more than two dozen news releases and conference-call

transcripts from companies that reported holiday sales figures on

Thursday.

Macy's Inc. (M), which raised guidance in tandem with its

report, said combined online sales at its macys.com and

bloomingdales.com units rose 29.4% in December and 19.3% for the

year to date.

J.C. Penney Co. (JCP) said Internet sales rose 6.3% in December,

their best gain of the year, with several apparel divisions seeing

double-digit increases. Order increases were in the "high-teens"

during key holiday shopping periods including Black Friday weekend

and the week before Christmas, J.C. Penney said.

Aeropostale Inc. (ARO) said its e-commerce sales in December

rose 44% to $37.7 million.

Saks Inc. (SKS) said that its direct, or online unit did "well."

The retailer declined to elaborate.

Wal-Mart Stores Inc. (WMT) stopped issuing same-store sales

reports last year but in response to a query said it was "very

pleased" with its holiday performance online and that the most

popular categories included electronics, toys and video games.

Retailers may be reluctant to be more forthcoming or give fuller

elaboration right now because online makes up so little of their

sales, no matter how much they promote their sites, analysts

say.

Monthly same-store-sales incorporate the revenue retailers

receive from their online businesses, which they have been building

up over the past year as a way of being current with purchasing

trends and also building broader loyalty with shoppers.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

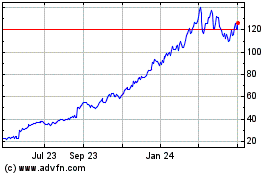

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jun 2024 to Jul 2024

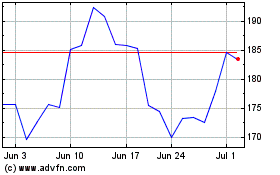

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jul 2023 to Jul 2024