Fourth Quarter Net Income Increases to $198.2 Million; NEW ALBANY,

Ohio, Feb. 21 /PRNewswire-FirstCall/ -- Abercrombie & Fitch Co.

(NYSE:ANF) today reported unaudited results which reflected net

income of $198.2 million and net income per diluted share of $2.14

for the fourteen weeks ended February 3, 2007, a 20% increase over

net income of $164.6 million and a 19% increase over $1.80 per

diluted share for the thirteen week period ended January 28, 2006.

The Company also reported net income of $422.2 million and net

income per diluted share of $4.59 for the fifty-three week fiscal

year ended February 3, 2007, a 26% increase over net income of

$334.0 million and a 25% increase over $3.66 per diluted share for

the fifty-two week fiscal year ended January 28, 2006. Fourth

Quarter Highlights * Total Company net sales increased 18% to

$1.139 billion; comparable store sales declined 3%, versus a 28%

increase for the fourth quarter of Fiscal 2005 * Abercrombie &

Fitch net sales increased 6% to $504.0 million; Abercrombie &

Fitch comparable store sales decreased 6%, versus an 18% increase

for the fourth quarter of Fiscal 2005 * abercrombie net sales

increased 19% to $144.5 million; abercrombie comparable store sales

increased 2%, versus a 59% increase for the fourth quarter of

Fiscal 2005 * Hollister Co. net sales increased 33% to $476.8

million; Hollister Co. comparable store sales were flat to last

year, versus a 34% increase for the fourth quarter of Fiscal 2005 *

RUEHL net sales increased 89% to $13.4 million; RUEHL comparable

store sales increased 6%, versus an 18% increase for the fourth

quarter of Fiscal 2005 * Net income for the fourth quarter

increased 20% to $198.2 million from $164.6 million in Fiscal 2005

* Net income per diluted share increased 19% to $2.14 in the fourth

quarter of Fiscal 2006 from $1.80 in Fiscal 2005 Mike Jeffries,

Chief Executive Officer and Chairman of the Board of Abercrombie

& Fitch Co., said: "This was an excellent year for Abercrombie

& Fitch, capped off by a solid fourth quarter. Our strong

performance demonstrates the proper positioning of our brands and

strength of our business model. Investments made in our brands and

business continue to pay off in the form of high quality sales and

earnings growth. We are confident that this deliberate strategy

will continue to provide top-line expansion over the long term

resulting in more leveraged growth." Fourth Quarter and Fiscal Year

2006 Financial Results Net sales for the fourteen weeks ended

February 3, 2007 increased 18% to $1.139 billion from $961.4

million for the thirteen weeks ended January 28, 2006. Total

Company direct-to-consumer net sales increased 58% to $74.8 million

for the fourteen week period ended February 3, 2007, compared to

the thirteen week period ended January 28, 2006. The fiscal 2006

retail calendar includes a fifty-third week; fourth quarter comps

are compared to the fourteen week period ended February 4, 2006.

Total Company fourth quarter comparable store sales decreased 3%

for the corresponding fourteen week period ended February 4, 2006.

For the fifty-three week fiscal year ended February 3, 2007, the

Company reported a net sales increase of 19% to $3.318 billion from

$2.785 billion for the fifty-two week period ended January 28,

2006. Total Company direct-to-consumer net sales increased 42% to

$174.1 million for the fifty- three week period ended February 3,

2007, compared to the fifty-two week period ended January 28, 2006.

The fiscal 2006 retail calendar includes a fifty-third week; full

year Fiscal 2006 comps are compared to the fifty-three week period

ended February 4, 2006. Fiscal 2006 comparable store sales

increased 2%. The gross profit rate for the quarter was 66.4%,

decreasing 10 basis points compared to last year. The decline in

gross profit rate was primarily due to higher shrink and a slightly

higher markdown rate versus last year. For Fiscal 2006, the gross

profit rate was 66.6% versus 66.5% last year, an increase of 10

basis points. Stores and Distribution expense for the quarter, as a

percentage of sales, increased 20 basis points to 30.7% from 30.5%.

The increase in rate versus last year primarily resulted from

increased distribution center and direct-to- consumer expenses,

partially offset by decreased store expenses as a percentage of

sales. For Fiscal 2006, stores and distribution expense, as a

percentage of sales, decreased 10 basis points to 35.8% versus

35.9% last year. Marketing, General and Administrative expense

(MG&A) for the quarter, as a percentage of sales, increased 50

basis points to 8.9% from 8.4%. The increase in rate was primarily

attributed to an increase in home office payroll and consulting

expenses as a percentage of sales. For Fiscal 2006, MG&A

expense was 11.3% of sales, flat to last year's rate of 11.3%.

Operating income for the fourth quarter increased 15% to $308.8

million compared to $267.5 million last year. For Fiscal 2006,

operating income was $658.1 million versus $542.7 million last

year, an increase of 21%. The effective tax rate for the fourth

quarter was 36.8% compared to 39.0% for the 2005 comparable period.

The decrease in the effective tax rate relates to an increase in

tax-exempt income over the prior year comparable period, favorable

settlements of certain tax audits and favorable changes in

estimates of potential outcomes of certain state tax matters. The

Company expects the full year Fiscal 2007 effective tax rate to be

approximately 39%. Net income for the fourth quarter increased 20%

to $198.2 million compared to $164.6 million last year. Net income

per diluted share increased 19% to $2.14 compared to $1.80 per

diluted share for the fourth quarter of Fiscal 2005. Net income for

Fiscal 2006 increased 26% to $422.2 million compared to $334.0

million last year. For Fiscal 2006, net income per diluted share

increased 25% to $4.59 versus $3.66 last year. 2007 Outlook The

Company expects net income per diluted share for the first half of

Fiscal 2007 to be in the range of $1.47 to $1.52, representing

between 10% and 13% earnings growth over the first half of Fiscal

2006. Due to the impact of the Company's London pre-opening store

costs, along with the difficult comparisons to last year's tax rate

favorability, diluted earnings per share growth in the first

quarter of 2007 is expected to be in the mid-single digit range.

The low end of the earnings guidance reflects a flat comparable

store sales scenario for the first half of Fiscal 2007. The Company

plans total capital expenditures for Fiscal 2007 to be between $360

million and $370 million with approximately $220 million of this

amount allocated to new store construction and store remodels.

Approximately $60 million is allocated to "refresh" improvements

and other brand enhancing investments planned for existing stores

with the balance related to home office, information technology,

and direct-to-consumer infrastructure investments. For Fiscal 2007,

the Company expects to increase gross square-footage by

approximately 12%, primarily through the addition of six new

Abercrombie & Fitch stores, 67 new Hollister Co. stores, 27 new

abercrombie stores, and ten new RUEHL stores. The Company also

intends to introduce its next concept in January 2008 with the

opening of three stores. Dividend Declared The Board of Directors

declared a quarterly cash dividend of $0.175 per share on the Class

A Common Stock of Abercrombie & Fitch Co. payable on March 27,

2007 to shareholders of record at the close of business on March 6,

2007. London Flagship Store On March 22, 2007, the Company plans to

open its first European location, a flagship store in London, at 7

Burlington Gardens. The Company will hold a security analyst tour

of the store on March 20, 2007. Analysts interested in attending

the event should contact Jill Swansegar, Investor Relations and

Communications Coordinator at (614) 283-6751 or via email at . The

Company operated 357 Abercrombie & Fitch stores, 177

abercrombie stores, 390 Hollister Co. stores, and 14 RUEHL stores

in the United States at the end of Fiscal 2006. The Company also

operated three Abercrombie & Fitch stores and three Hollister

Co. stores in Canada. The Company operates e- commerce websites at

http://www.abercrombie.com/, http://www.abercrombiekids.com/, and

http://www.hollisterco.com/. Today at 4:30 PM, Eastern Time, the

Company will conduct a conference call. Management will discuss the

Company's performance, its plans for the future and will accept

questions from participants. To listen to the live conference call,

dial (800) 811-0667 or internationally at (913) 981-4901. To listen

via the internet, go to http://www.abercrombie.com/, select the

Investors page and click on Calendar of Events. Replays of the call

will be available shortly after its completion. The audio replay

can be accessed for two weeks following the reporting date by

calling (888) 203-1112 or internationally at (719) 457-0820

followed by the conference ID number 6004097 or for 12 months by

visiting the Company's website at http://www.abercrombie.com/. SAFE

HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT

OF 1995 A&F cautions that any forward-looking statements (as

such term is defined in the Private Securities Litigation Reform

Act of 1995) contained in this Press Release or made by management

of A&F involve risks and uncertainties and are subject to

change based on various important factors, many of which may be

beyond the Company's control. Words such as "estimate," "project,"

"plan," "believe," "expect," "anticipate," "intend," and similar

expressions may identify forward-looking statements. The following

factors, in addition to those included in the disclosure under the

heading "FORWARD-LOOKING STATEMENTS AND RISK FACTORS" in "ITEM 1A.

RISK FACTORS" of A&F's Annual Report on Form 10-K for the

fiscal year ended January 28, 2006, in some cases have affected and

in the future could affect the Company's financial performance and

could cause actual results for the 2007 fiscal year and beyond to

differ materially from those expressed or implied in any of the

forward-looking statements included in this Press Release or

otherwise made by management: changes in consumer spending patterns

and consumer preferences; the effects of political and economic

events and conditions domestically and in foreign jurisdictions in

which the Company operates, including, but not limited to, acts of

terrorism or war; the impact of competition and pricing; changes in

weather patterns; postal rate increases and changes; paper and

printing costs; market price of key raw materials; ability to

source product from its global supplier base; political stability;

currency and exchange risks and changes in existing or potential

duties, tariffs or quotas; availability of suitable store locations

at appropriate terms; ability to develop new merchandise; ability

to hire, train and retain associates; and the outcome of pending

litigation. Future economic and industry trends that could

potentially impact revenue and profitability are difficult to

predict. Therefore, there can be no assurance that the

forward-looking statements included in this Press Release will

prove to be accurate. In light of the significant uncertainties in

the forward- looking statements included herein, the inclusion of

such information should not be regarded as a representation by the

Company, or any other person, that the objectives of the Company

will be achieved. The forward-looking statements herein are based

on information presently available to the management of the

Company. Except as may be required by applicable law, the Company

assumes no obligation to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any projected results expressed or implied

therein will not be realized. Abercrombie & Fitch Co. Condensed

Consolidated Statements of Income (Unaudited) Fourteen Weeks Ended

February 3, 2007 and Thirteen Weeks Ended January 28, 2006 (in

thousands except per share data) ACTUAL ACTUAL % of % of 2006 Sales

2005 Sales Net Sales $1,138,744 100.0% $961,392 100.0% Cost of

Goods Sold 383,109 33.6% 321,974 33.5% Gross Profit 755,635 66.4%

639,418 66.5% Total Stores and Distribution Expense 349,770 30.7%

293,488 30.5% Total Marketing, General and Administrative Expense

101,623 8.9% 80,783 8.4% Other Operating Income, Net (4,592) -0.4%

(2,341) -0.2% Operating Income 308,834 27.1% 267,488 27.8% Interest

Income, Net (4,714) -0.4% (2,376) -0.2% Income Before Income Taxes

313,548 27.5% 269,864 28.1% Income Tax Expense 115,356 10.1%

105,240 10.9% Effective Rate 36.8% 39.0% Net Income $198,192 17.4%

$164,624 17.1% Net Income Per Share: Basic $2.25 $1.88 Diluted

$2.14 $1.80 Weighted-Average Shares Outstanding: Basic 88,159

87,647 Diluted 92,572 91,275 Abercrombie & Fitch Co. Condensed

Consolidated Statements of Income (Unaudited) Fifty-Three Weeks

Ended February 3, 2007 and Fifty-Two Weeks Ended January 28, 2006

(in thousands except per share data) ACTUAL ACTUAL % of % of 2006

Sales 2005 Sales Net Sales $3,318,158 100.0% $2,784,711 100.0% Cost

of Goods Sold 1,109,152 33.4% 933,295 33.5% Gross Profit 2,209,006

66.6% 1,851,416 66.5% Total Stores and Distribution Expense

1,187,071 35.8% 1,000,755 35.9% Total Marketing, General and

Administrative Expense 373,828 11.3% 313,457 11.3% Other Operating

Income, Net (9,983) -0.3% (5,534) -0.2% Operating Income 658,090

19.8% 542,738 19.5% Interest Income, Net (13,896) -0.4% (6,672)

-0.2% Income Before Income Taxes 671,986 20.3% 549,410 19.7% Income

Tax Expense 249,800 7.5% 215,426 7.7% Effective Rate 37.2% 39.2%

Net Income $422,186 12.7% $333,984 12.0% Net Income Per Share:

Basic $4.79 $3.83 Diluted $4.59 $3.66 Weighted Average Shares

Outstanding Basic 88,052 87,161 Diluted 92,010 91,221 Abercrombie

& Fitch Co. Condensed Consolidated Balance Sheets (in

thousands) (unaudited) ASSETS February 3, 2007 January 28, 2006

Current Assets Cash and Equivalents $81,959 $50,687 Marketable

Securities 447,793 411,167 Receivables 43,240 41,855 Inventories

427,447 362,536 Deferred Income Taxes 33,196 29,654 Other Current

Assets 58,469 51,185 Total Current Assets 1,092,104 947,084

Property and Equipment, Net 1,092,282 813,603 Other Assets 63,707

29,031 Total Assets $2,248,093 $1,789,718 LIABILITIES AND

SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable and

Outstanding Checks $128,310 $145,313 Accrued Expenses 260,219

215,034 Deferred Lease Credits 35,423 31,727 Income Taxes Payable

86,675 99,480 Total Current Liabilities 510,627 491,554 Long-Term

Liabilities Deferred Income Taxes 30,394 38,496 Deferred Lease

Credits 203,943 191,225 Other Liabilities 97,806 73,326 Total

Long-Term Liabilities 332,143 303,047 Total Shareholders' Equity

1,405,323 995,117 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

$2,248,093 $1,789,718 DATASOURCE: Abercrombie & Fitch CONTACT:

Thomas D. Lennox, Vice President, Corporate Communications, of

Abercrombie & Fitch, +1-614-283-6751 Web site:

http://www.abercrombie.com/ http://www.abercrombiekids.com/

http://www.hollisterco.com/

Copyright

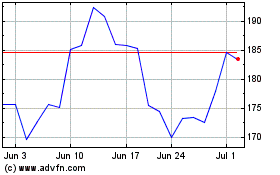

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jun 2024 to Jul 2024

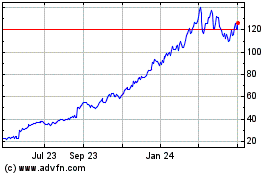

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Jul 2023 to Jul 2024