Compuware Reports 4Q Prelim Results - Analyst Blog

April 04 2013 - 5:40AM

Zacks

Compuware

(CPWR) announced preliminary fourth

quarter results on Apr 3, 2013. For the quarter ended Mar 31,

Compuware expects to report non-GAAP earnings per share (“EPS”) in

the range of 5 cents to 6 cents. Currently, the Zacks Consensus

Estimate is pegged at 16 cents.

Compuware expects total revenue to

be in the range of $237.0 million to $241.0 million for the

quarter. The Zacks Consensus Estimate of revenues currently stands

at $281.0 million. Compuware noted that approximately 75% to 80% of

committed deals for the fourth quarter were pushed to fiscal 2014,

primarily due to uncertain IT budgets and slow recovery in the

European IT spending environment.

Application Performance Management

revenues are expected to be in the range of $76.0 million to $78.0

million, while Mainframe revenues are projected in the range of

$79.0 million to $81.0 million.

Compuware forecasts license fees to

be in the range of $46.0 million to $48.0 million. Maintenance

revenues are expected to be between $99.0 million and $101.0

million. Services revenues are expected to be in the range of $45.0

million to $46.0 million. Covisint revenues are expected to be in

the range of $25.0 million to $26.0 million. Subscription revenues

are expected to be approximately $21 million for the fourth

quarter.

Earlier, in Jan 2013, Compuware

reported impressive third quarter 2013 earnings of 12 cents per

share that surpassed the Zacks Consensus Estimate by 9% (11 cents).

Quarterly results were primarily aided by modest revenue growth and

margin expansion.

Compuware also rejected a $3.2

billion bid from activist investor Elliott Management Corp.

Compuware cited the $11.00 per share offer as inadequate and

announced a number of initiatives that included a dividend payment

for the first time in its history.

Compuware will pay a dividend of 50

cents per share beginning first quarter of fiscal 2014. The company

announced a 3-year restructuring plan that will save $60.0 million

annually. For fiscal 2014, the plan is expected to save a minimum

of $20 million. Additionally, Compuware announced plans to

distribute its remaining shares in Covisint Corp directly to

shareholders after completing the IPO of the 20% Class A stock.

Over the last couple of months,

several new private equity funds, such as Apax Partners LLP and

Hellman & Friedman LLC, have emerged as prospective buyers for

Compuware. Although a better buyout offer will be positive for

investors, we believe that the prevailing sluggish macroeconomic

conditions will likely act as an impediment toward fetching a

higher price.

We believe that Compuware’s

recently announced initiatives are positive for shareholders over

the long term. Moreover, new program wins, innovative product

pipeline and partnership with International Business

Machines (IBM) will help Compuware to

counter strong competition from the likes of BMC Software

Inc. (BMC) and CA Technologies

(CA) going forward.

Currently, Compuware has a Zacks

Rank #3 (Hold).

BMC SOFTWARE (BMC): Free Stock Analysis Report

CA INC (CA): Free Stock Analysis Report

COMPUWARE CORP (CPWR): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

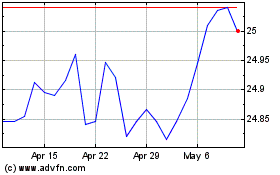

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Jun 2024 to Jul 2024

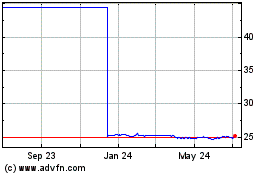

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Jul 2023 to Jul 2024