Xyratex Ltd. - Aggressive Growth

January 26 2012 - 7:00PM

Zacks

Xyratex Ltd. (XRTX) has seen some good earnings surprises

and fights off the pressure of the Thailand floods. The stock is a

Zacks #1 Rank (Strong Buy).

Company Description

Xyratex provides modular enterprise-class data storage

subsystems and hard disk drive capital equipment for original

equipment manufacturers (OEM), and hard disk drive manufacturers

and their component suppliers in North America, Asia, and Europe.

It operates in two segments, Networked Storage Solutions and

Storage Infrastructure.

Earnings Estimates Increase

Earnings estimates for 2012 have moved around quite a bit over

the last year. In August of 2011, analysts weren't as positive on

XRTX as the Zacks Consensus Estimate moved as low as $0.75. Since

that time, there have been some revisions and the outlook has

improved. The current Zacks Consensus Estimate is calling for EPS

of $1.46 for 2012.

The Zacks Consensus Estimate for 2013 has seen some similar

moves. In September of 2011, the outlook wasn't as positive, and

analysts were expecting earnings of $1.02. The recent increase in

expectations translated to a new Zacks Consensus Estimate of

$1.39.

Flooding in Thailand

Earlier floods in Thailand have wreaked havoc on the hard disk

drive industry. XRTX was not immune to this idea as many analysts

took down estimates and expectations as the supply chain was

compromised.

Two Big Earnings Surprises

The last two earnings reports are the kind that aggressive

growth investors like to see. The August 2011 quarter saw EPS come

in 100% ahead of estimates. The company reported earnings of $0.32

or a full $0.16 ahead of the $0.16 Zacks Consensus Estimate. The

November quarter, reported in the beginning of January of 2012, saw

a bigger beat. In reporting $0.70 per share of earnings, the

company beat expectations by 133% coming in $0.40 ahead of the

$0.30 expectation. The caveats on these massive beats are that

there are only three analysts covering the stock and the company

missed in expectations in the May 2011 quarter.

Valuations

Aggressive growth investors might be confused for value

investors when looking at the valuations metrics for XRTX. The

company trades at a discount to the industry for both trailing and

forward PE. At 15x, the PE is just below the industry average of

17x trailing earnings. What really stands out is the price to book

and price to sales. The 1.2x price to book is well below the

industry average of 4x and the 0.3x price to sales is also well

below the 2x industry average for the metric. Both of those metrics

could make possible suitors interested in at least kicking the

tires for a potential acquisition.

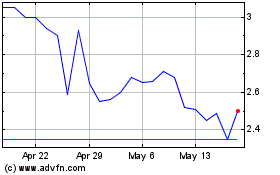

The Chart

The recent price action shows some dramatic growth over the last

few months, as concerns over the floods abated and earnings

expectations increased. Growth in sales and M&A speculation may

take this stock even higher in the future.

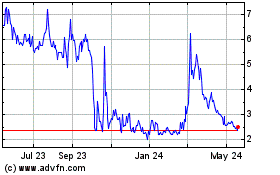

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Jun 2024 to Jul 2024

XORTX Therapeutics (NASDAQ:XRTX)

Historical Stock Chart

From Jul 2023 to Jul 2024