Statement of Changes in Beneficial Ownership (4)

August 23 2021 - 5:04PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

STILWELL JOSEPH |

2. Issuer Name and Ticker or Trading Symbol

Wheeler Real Estate Investment Trust, Inc.

[

WHLR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

111 BROADWAY, 12TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/19/2021 |

|

(Street)

NEW YORK, NY 10006

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | | | | | | | | 853747 | I | See footnote (1) |

| Common Stock | | | | | | | | 113814 | I | See footnote (2) |

| Common Stock | | | | | | | | 213775 | I | See footnote (3) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Subscription Rights (right to buy) (4) | (4) | 8/13/2021 (7) | | M | | | 729997 (4) | 7/22/2021 | 8/13/2021 | 7.00% Senior Subordinated Convertible Notes due 2031 | $18249925 | $0 | 0 | I | See footnote (1) |

| 7.00% Senior Subordinated Convertible Notes due 2031 | $6.25 (8) | 8/19/2021 (10) | | P | | $18249925 | | 8/19/2021 (10) | 12/31/2031 | Common Stock | 2919988 (8)(9) | $18249925 | $18249925 | I | See footnote (1) |

| Subscription Rights (right to buy) (5) | (5) | 8/13/2021 (7) | | M | | | 104998 (5) | 7/22/2021 | 8/13/2021 | 7.00% Senior Subordinated Convertible Notes due 2031 | $2624950 | $0 | 0 | I | See footnote (2) |

| 7.00% Senior Subordinated Convertible Notes due 2031 | $6.25 (8) | 8/19/2021 (10) | | P | | $2624950 | | 8/19/2021 (10) | 12/31/2031 | Common Stock | 419992 (8)(9) | $2624950 | $2624950 | I | See footnote (2) |

| Subscription Rights (right to buy) (6) | (6) | 8/13/2021 (7) | | M | | | 165000 (6) | 7/22/2021 | 8/13/2021 | 7.00% Senior Subordinated Convertible Notes due 2031 | $4125000 | $0 | 0 | I | See footnote (3) |

| 7.00% Senior Subordinated Convertible Notes due 2031 | $6.25 (8) | 8/19/2021 (10) | | P | | $4125000 | | 8/19/2021 (10) | 12/31/2031 | Common Stock | 660000 (8)(9) | $4125000 | $4125000 | I | See footnote (3) |

| Explanation of Responses: |

| (1) | These shares are owned directly by Stilwell Activist Investments, L.P. ("SAI") and indirectly by Joseph Stilwell in his capacity as the managing member and owner of Stilwell Value LLC ("Value"), which is the general partner of SAI. Joseph Stilwell disclaims beneficial ownership of all shares reported as owned indirectly except to the extent of his pecuniary interest therein. |

| (2) | These shares are owned directly by Stilwell Activist Fund, L.P. ("SAF") and indirectly by Joseph Stilwell in his capacity as the managing member and owner of Value, which is the general partner of SAF. Joseph Stilwell disclaims beneficial ownership of all shares reported as owned indirectly except to the extent of his pecuniary interest therein. |

| (3) | These shares are owned directly by Stilwell Value Partners VII, L.P. ("SVP VII") and indirectly by Joseph Stilwell in his capacity as the managing member and owner of Value, which is the general partner of SVP VII. Joseph Stilwell disclaims beneficial ownership of all shares reported as owned indirectly except to the extent of his pecuniary interest therein. |

| (4) | This represents SAI's exercise of non-transferable subscription rights (the "Rights") that were issued to SAI in the Issuer's offering of Rights (the "Rights Offering") to purchase up to $30 million in aggregate principal amount of 7.00% senior subordinated convertible notes due in 2031 (the "Notes"). Pursuant to the Rights Offering, each holder of the Issuer's common stock as of the record date received one Right for each eight shares of the Issuer's common stock owned, with each Right entitling such holder to purchase $25.00 principal amount of the Notes (the "basic subscription privilege") and, if such holder exercised the basic subscription privilege, an over-subscription privilege which allowed such holder to subscribe for an additional principal amount of the Notes issuable pursuant to Rights that were not exercised by other stockholders. |

| (5) | This represents SAF's exercise of Rights that were issued to SAF in the Rights Offering to purchase up to $30 million in aggregate principal amount of the Notes. Pursuant to the Rights Offering, each holder of the Issuer's common stock as of the record date received one Right for each eight shares of the Issuer's common stock owned, with each Right entitling such holder to the basic subscription privilege and, if such holder exercised the basic subscription privilege, an over-subscription privilege which allowed such holder to subscribe for an additional principal amount of the Notes issuable pursuant to Rights that were not exercised by other stockholders. |

| (6) | This represents SVP VII's exercise of Rights that were issued to SVP VII in the Rights Offering to purchase up to $30 million in aggregate principal amount of the Notes. Pursuant to the Rights Offering, each holder of the Issuer's common stock as of the record date received one Right for each eight shares of the Issuer's common stock owned, with each Right entitling such holder to the basic subscription privilege and, if such holder exercised the basic subscription privilege, an over-subscription privilege which allowed such holder to subscribe for an additional principal amount of the Notes issuable pursuant to Rights that were not exercised by other stockholders. |

| (7) | The Rights Offering expired at 5:00 p.m. New York City time on August 13, 2021. |

| (8) | The Notes are convertible, in whole or in part, at any time, at the option of the holders thereof, into shares of the Issuer's common stock at a conversion price of $6.25 per share (the "Conversion Price") (4 common shares for each $25.00 of principal amount of the Notes being converted); provided, however, that if at any time after September 21, 2023, holders of the Issuer's Series D Cumulative Convertible Preferred Stock ("Series D Preferred Stock") have elected to cause the Issuer to redeem (payable in cash or stock) at least 100,000 shares of Series D Preferred Stock in the aggregate, then the Conversion Price shall be adjusted to the lower of (i) a 45% discount to the Conversion Price or (ii) a 45% discount to the lowest price at which any holder of Series D Preferred Stock had its Series D Preferred Stock redeemed into shares of the Issuer's common stock. |

| (9) | Interest on the Notes may be payable, at the Issuer's election, in cash, in shares of the Issuer's Series B Convertible Preferred Stock (the "Series B Preferred Stock") or in shares of Series D Preferred Stock, in each case as set forth in the Notes. The Series B Preferred Stock and Series D Preferred Stock are both convertible into shares of the Issuer's common stock at the option of the holder thereof at any time. The Notes bear interest at the rate of 7% per annum. The number of shares of the Issuer's common stock indicated in the Table is based on the outstanding principal amount of the Notes held as of August 19, 2021, and assumes that the Issuer will pay all interest due thereon in cash. |

| (10) | The Notes subscribed for in the Rights Offering were delivered through the clearing system of the Depository Trust Company and such delivery was completed on August 19, 2021. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

STILWELL JOSEPH

111 BROADWAY, 12TH FLOOR

NEW YORK, NY 10006 | X | X |

|

|

Stilwell Value LLC

111 BROADWAY, 12TH FLOOR

NEW YORK, NY 10006 |

| X |

|

|

Stilwell Activist Investments, L.P.

111 BROADWAY, 12TH FLOOR

NEW YORK, NY 10006 |

| X |

|

|

Stilwell Activist Fund, L.P.

111 BROADWAY, 12TH FLOOR

NEW YORK, NY 10006 |

| X |

|

|

Stilwell Value Partners VII, L.P.

111 BROADWAY, 12TH FLOOR

NEW YORK, NY 10006 |

| X |

|

|

Signatures

|

| /s/ Joseph Stilwell | | 8/23/2021 |

| **Signature of Reporting Person | Date |

| /s/ Joseph Stilwell as authorized agent for Stilwell Value LLC | | 8/23/2021 |

| **Signature of Reporting Person | Date |

| /s/ Joseph Stilwell as authorized agent for Stilwell Activist Investments, L.P. | | 8/23/2021 |

| **Signature of Reporting Person | Date |

| /s/ Joseph Stilwell as authorized agent for Stilwell Activist Fund, L.P. | | 8/23/2021 |

| **Signature of Reporting Person | Date |

| /s/ Joseph Stilwell as authorized agent for Stilwell Value Partners VII, L.P. | | 8/23/2021 |

| **Signature of Reporting Person | Date |

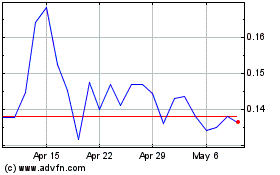

Wheeler Real Estate Inve... (NASDAQ:WHLR)

Historical Stock Chart

From May 2024 to Jun 2024

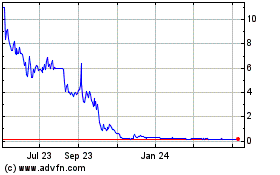

Wheeler Real Estate Inve... (NASDAQ:WHLR)

Historical Stock Chart

From Jun 2023 to Jun 2024