Washington Federal, Inc. (Nasdaq: WAFD) (the "Company"), parent

company of Washington Federal Bank, N.A. ("WaFd Bank"), today

announced record annual earnings and diluted earnings per share of

$210,256,000 and $2.61 for the fiscal year ended September 30,

2019, compared to $203,850,000 or $2.40 per diluted share for the

year ended September 30, 2018, a $0.21 or 8.8% increase in earnings

per diluted share. Return on equity for the fiscal year ended

September 30, 2019 was 10.46% compared to 10.16% for the year ended

September 30, 2018. Return on assets for the year ended September

30, 2019 was 1.28% compared to 1.31% for the prior year.

President and Chief Executive Officer Brent J. Beardall

commented, “We are pleased to report that thanks to the efforts of

our colleagues and clients, Washington Federal closed its 102nd

year in business with a record year on multiple fronts. Record

earnings and earnings per share were the direct result of record

loans and deposits that were built through organic growth.

Especially noteworthy is the fact the Company was able to produce

these results despite a challenging interest rate environment for

the majority of the year. Higher short-term interest rates caused

interest expense to increase year-over-year by $55 million or 41%

and yet, due to strong growth in core deposits and loans, the

growth of interest income more than offset this increase. Net

interest income increased by $9 million or 2%. With the Federal

Reserve Bank recently decreasing short-term rates by 50 basis

points, we have the potential to benefit from decreasing interest

expense going forward.

We are cognizant that the duration of this bull run in the

economy is now at historic levels and that cycles will occur. To

prepare for a potential downturn, our balance sheet has $1.7

billion of tangible common equity plus an additional $138 million

of reserves for credit losses. Non-performing assets of $44 million

are at a 12-year low, representing only 0.27% of assets.

Strong financial performance enabled the Company to return 89%

of earnings to shareholders during fiscal year 2019 in the form of

cash dividends and share repurchases while still finishing the year

with a tangible common equity to tangible asset ratio of 10.66%,

placing us in the top 10% of the largest 100 publicly traded banks

in the United States. Total shareholder return for fiscal 2019 was

18%. While we have invested heavily in technology and processes to

improve compliance and customer experience, we recognize there is

more work to be done as we compete to grow our market share. We are

gratified to see our net promoter score improve from 17 to 47 over

the last three years. Bottom line, this indicates that our clients

are significantly more likely to recommend us to others, which we

believe is a very good thing for our future prospects.”

Total assets were $16.5 billion as of September 30, 2019, a $609

million or 3.8% increase from September 30, 2018. Asset growth

since September 30, 2018 resulted primarily from a $453 million or

4.0% increase in net loans receivable.

Customer deposits were $12.0 billion as of September 30, 2019,

an increase of $604 million or 5.3% since September 30, 2018.

Transaction accounts increased by $501 million or 7.6% during the

fiscal year 2019, while time deposits increased $102 million or

2.1%. As of September 30, 2019, 59.1% of the Company’s deposits

were in transaction accounts. Core deposits, defined as all

transaction accounts and time deposits less than $250,000, totaled

93.0% of deposits at September 30, 2019. Strong deposit growth led

to an improved loan-to-deposit ratio of 99.5% at September 30, 2019

compared to 100.8% at September 30, 2018.

Borrowings from the Federal Home Loan Bank ("FHLB") totaled

$2.25 billion as of September 30, 2019, a net decrease of $80

million or 3.4% since September 30, 2018. The weighted average rate

for FHLB borrowings was 2.49% as of September 30, 2019 and 2.66% at

September 30, 2018. The decline of 17 basis points is due to lower

rates on new FHLB advances and maturing advances with higher rates.

$1.30 billion of the $2.25 billion advances outstanding at

September 30, 2019 have effective maturities greater than one

year.

Loan originations totaled $4.1 billion for fiscal year 2019

compared to the total of $3.8 billion in fiscal year 2018.

Partially offsetting the loan origination volume in 2019 were loan

repayments of $3.6 billion. During fiscal 2018, loan repayments

totaled $3.3 billion. Commercial loans represented 72% of all loan

originations during fiscal 2019 with consumer loans accounting for

the remaining 28%. The Company views organic loan growth as the

highest and best use of its capital and prefers commercial loans in

this low-rate environment due to the fact they generally have

floating interest rates and shorter durations. The weighted average

interest rate on loans increased to 4.52% as of September 30, 2019

from 4.48% at September 30, 2018. The increase was due primarily to

changes in loan mix as commercial loans increased to 49.3% of the

portfolio as of September 30, 2019 compared to 46.9% at September

30, 2018.

Asset quality remained strong as the ratio of non-performing

assets to total assets improved to 0.27% as of September 30, 2019,

compared to 0.44% at September 30, 2018. Since September 30, 2018,

real estate owned decreased by $4.5 million and non-accrual loans

decreased by $22.0 million. Delinquencies on loans were 0.29% of

total loans at September 30, 2019 compared to 0.42% at September

30, 2018. The Company realized net recoveries on loans (as opposed

to charge-offs) of $3.6 million for fiscal year 2019 compared to

net recoveries of $11.1 million in fiscal 2018. The allowance for

loan losses and reserve for unfunded commitments increased by $1.9

million to $138.4 million as of September 30, 2019 and was 1.04% of

gross loans outstanding, as compared to 1.06% of gross loans as of

September 30, 2018. The Company has recorded net recoveries for 17

consecutive quarters, and in 24 of the last 25 quarters.

On August 23, 2019, the Company paid a cash dividend of $0.21

per share to common stockholders of record on August 9, 2019. This

was the Company’s 146th consecutive quarterly cash dividend. During

fiscal 2019, the Company repurchased 4.1 million shares of common

stock at a weighted average price of $30.46 per share and has

authorization to repurchase approximately 8.0 million additional

shares. The Company varies the pace of share repurchases depending

on several factors, including share price, business opportunities

and capital levels. Tangible common stockholders’ equity per share

increased by $1.48 or 7.28% during fiscal 2019 to $21.86 and the

ratio of tangible common equity to tangible assets was 10.66% as of

September 30, 2019.

Net interest income was $481.1 million for fiscal 2019, an

increase of $8.9 million or 1.9% from the prior year. The increase

in net interest income was primarily due to a $744 million, or

5.1%, increase in average interest-earning assets in fiscal 2019.

This was partially offset by a 3.1% decrease in net interest margin

to 3.16% in fiscal 2019 from 3.27% for the prior year.

Due to the strong asset quality indicators previously mentioned,

the Company recorded a release of loan loss allowance of $1.7

million for fiscal 2019. For fiscal 2018, the Company recorded a

release of loan loss allowance of $5.5 million.

Total other income was $62.3 million for fiscal year 2019, an

increase of $18.2 million from $44.1 million in the prior year. The

increase from the prior year was primarily due to a net gain of

$10.2 million recognized in fiscal year 2019 from sales of fixed

assets and $8.6 million of expense in fiscal year 2018 from

valuation adjustments associated with the termination of the

Company's FDIC loss-share agreements. Deposit fee income was $1.0

million lower in fiscal year 2019 than in 2018.

Total operating expenses were $283.1 million for fiscal 2019, an

increase of $18.7 million or 7.1% from the prior year. Increased

operating expenses are the result of ongoing investments in people,

process and technology with the objectives of enhancing compliance,

growing market share and ultimately earnings. Compensation and

benefits costs increased $10.0 million year-over-year primarily due

to the aforementioned investments. Information technology costs

increased by $4.3 million and other expenses increased by $4.5

million as both were elevated primarily due to Bank Secrecy Act

("BSA") program enhancements and other technology platform

improvements. Operating expenses were $72.5 million for the 4th

fiscal quarter of 2019, an increase of $2.9 million or 4.2% from

the same quarter a year ago. Compensation and benefits costs were

$1.5 million higher in the 4th fiscal quarter of 2019 than they

were in the same quarter of the prior year. The Company’s

efficiency ratio increased to 52.1% for fiscal 2019 as compared to

50.4% for the prior year. The efficiency ratio was 53.1% for the

4th fiscal quarter of 2019 as compared to 52.9% for the same

quarter a year ago. The increased efficiency ratios are due to

higher expenses noted above partially offset by higher revenue in

the respective periods.

For the year ended September 30, 2019, the Company recorded

federal and state income tax expense of $52.5 million, which

equates to a 19.99% effective tax rate. This compares to an

effective tax rate of 20.76% for fiscal year 2018. The Company’s

effective tax rate for fiscal 2019 is lower than the statutory rate

mainly due to state taxes, tax-exempt income and the resolution of

a previously unrecognized tax benefit. The Company estimates that

its effective tax rate going forward will be approximately 21%.

Washington Federal Bank, a national bank with headquarters in

Seattle, Washington, has 234 branches in eight western states and

does business as “WaFd Bank.” To find out more, please visit our

website www.wafdbank.com. The Company uses its website to

distribute financial and other material information.

Important Cautionary

Statements

The foregoing information should be read in conjunction with the

financial statements, notes and other information contained in the

Company’s 2018 Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K.

This press release contains statements about the Company’s

future that are not statements of historical fact. These statements

are “forward-looking statements” for purposes of applicable

securities laws and are based on current information and/or

management’s good faith belief as to future events. The words

“estimate,” “believe,” “expect,” “anticipate,” “project,” and

similar expressions signify forward-looking statements.

Forward-looking statements should not be read as a guarantee of

future performance. By their nature, forward-looking statements

involve inherent risk and uncertainties, which change over time;

and actual performance, could differ materially from those

anticipated by any forward-looking statements. The Company

undertakes no obligation to update or revise any forward-looking

statement.

WASHINGTON FEDERAL, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

FINANCIAL CONDITION

(UNAUDITED)

September 30, 2019

September 30, 2018

(In thousands, except share and

ratio data)

ASSETS

Cash and cash equivalents

$

419,158

$

268,650

Available-for-sale securities, at fair

value

1,485,742

1,314,957

Held-to-maturity securities, at amortized

cost

1,443,480

1,625,420

Loans receivable, net of allowance for

loan losses of $131,534 and $129,257

11,930,575

11,477,081

Interest receivable

48,857

47,295

Premises and equipment, net

274,015

267,995

Real estate owned

6,781

11,298

FHLB and FRB stock

123,990

127,190

Bank owned life insurance

222,076

216,254

Intangible assets, including goodwill of

$301,368 and $301,368

309,247

311,286

Federal and state income tax assets,

net

—

1,804

Other assets

210,989

196,494

$

16,474,910

$

15,865,724

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities

Customer accounts

Transaction deposit accounts

$

7,083,801

$

6,582,343

Time deposit accounts

4,906,963

4,804,803

11,990,764

11,387,146

FHLB advances

2,250,000

2,330,000

Advance payments by borrowers for taxes

and insurance

57,830

57,417

Federal and state income tax liabilities,

net

5,104

—

Accrued expenses and other liabilities

138,217

94,253

14,441,915

13,868,816

Stockholders’ equity

Common stock, $1.00 par value, 300,000,000

shares authorized; 135,539,806 and 135,343,417 shares issued;

78,841,463 and 82,710,911 shares outstanding

135,540

135,343

Paid-in capital

1,672,417

1,666,609

Accumulated other comprehensive (loss)

income, net of taxes

15,292

8,294

Treasury stock, at cost; 56,698,343 and

52,632,506 shares

(1,126,163

)

(1,002,309

)

Retained earnings

1,335,909

1,188,971

2,032,995

1,996,908

$

16,474,910

$

15,865,724

CONSOLIDATED FINANCIAL

HIGHLIGHTS

Common stockholders' equity per share

$

25.79

$

24.14

Tangible common stockholders' equity per

share

21.86

20.38

Stockholders' equity to total assets

12.34

%

12.59

%

Tangible common stockholders' equity to

tangible assets

10.66

10.84

TCE + allowance for loan losses to

tangible assets

11.48

11.67

Weighted average rates at period

end

Loans and mortgage-backed securities

4.25

%

4.19

%

Combined loans, all interest-earning

assets

4.10

4.07

Customer accounts

1.08

0.87

Borrowings

2.49

2.66

Combined cost of customer accounts and

borrowings

1.30

1.17

Net interest spread

2.80

2.90

WASHINGTON FEDERAL, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

Three Months Ended September

30,

Twelve Months Ended September

30,

2019

2018

2019

2018

(In thousands, except share and

ratio data)

(In thousands, except share and

ratio data)

INTEREST INCOME

Loans receivable

$

144,480

$

133,226

$

568,096

$

515,807

Mortgage-backed securities

17,231

17,819

74,485

70,407

Investment securities and cash

equivalents

7,725

6,107

28,885

20,869

169,436

157,152

671,466

607,083

INTEREST EXPENSE

Customer accounts

33,640

22,553

122,216

72,492

FHLB advances and other borrowings

15,624

15,348

68,190

62,452

49,264

37,901

190,406

134,944

Net interest income

120,172

119,251

481,060

472,139

Provision (release) for loan losses

(1,900

)

(5,500

)

(1,650

)

(5,450

)

Net interest income after provision

(release)

122,072

124,751

482,710

477,589

OTHER INCOME

Gain (loss) on sale of investment

securities

—

—

(9

)

—

FDIC loss share valuation adjustments

—

—

—

(8,550

)

Loan fee income

970

895

3,941

3,804

Deposit fee income

6,495

6,404

24,882

25,904

Other income

8,992

4,946

33,504

22,920

16,457

12,245

62,318

44,078

OTHER EXPENSE

Compensation and benefits

32,634

31,087

133,588

123,554

Occupancy

9,797

9,674

38,579

36,453

FDIC insurance premiums

2,409

2,970

9,808

11,592

Product delivery

4,456

4,395

15,934

16,372

Information technology

11,225

7,815

38,955

34,643

Other expense

12,005

13,676

46,199

41,708

72,526

69,617

283,063

264,322

Gain (loss) on real estate owned, net

(671

)

(38

)

810

(102

)

Income before income taxes

65,332

67,341

262,775

257,243

Income tax provision

12,970

15,826

52,519

53,393

NET INCOME

$

52,362

$

51,515

$

210,256

$

203,850

PER SHARE DATA

Basic earnings

$

0.66

$

0.62

$

2.61

$

2.40

Diluted earnings

0.66

0.62

2.61

2.40

Cash dividends per share

0.21

0.18

0.79

0.67

Basic weighted average shares

outstanding

79,154,252

83,280,730

80,471,316

85,008,040

Diluted weighted average shares

outstanding

79,201,083

83,361,122

80,495,163

85,109,843

PERFORMANCE RATIOS

Return on average assets

1.26

%

1.31

%

1.28

%

1.31

%

Return on average common equity

10.32

10.29

10.46

10.16

Net interest margin

3.12

3.26

3.16

3.27

Efficiency ratio

53.08

52.94

52.09

50.37

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191015006165/en/

Investor Relations Washington Federal, Inc. 425 Pike Street,

Seattle, WA 98101 Brad Goode, SVP / Director of Communications

206-626-8178 brad.goode@wafd.com

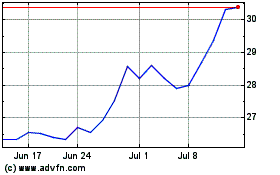

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Oct 2024 to Nov 2024

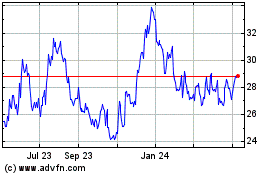

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Nov 2023 to Nov 2024