UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 21, 2015

____________________________________

Washington Federal, Inc.

(Exact name of registrant as specified in its charter)

____________________________________

|

| | | | |

| | | | |

Washington | | 001-34654 | | 91-1661606 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

425 Pike Street, Seattle, Washington 98101

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code (206) 624-7930

Not Applicable

(Former name or former address, if changed since last report)

____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition |

On October 21, 2015, the Company announced by press release its earnings for the quarter ended September 30, 2015. A copy of the press release is attached to this filing as Exhibit 99.1. A copy of the September 30, 2015 Fact Sheet, which presents certain detailed financial information about the Company, is attached as Exhibit 99.2. This information is being furnished under Item 2.02 (Results of Operations and Financial Condition) of Form 8-K.

|

| |

Item 7.01 | Regulation FD Disclosure |

A copy of the September 30, 2015 Fact Sheet, which presents certain detailed financial information about the Company is attached as Exhibit 99.2.

|

| |

Item 9.01 | Financial Statements and Exhibits |

(a) Not applicable

(b) Not applicable

(c) Not applicable

(d) The following exhibits are being furnished herewith:

99.1 Press release dated October 21, 2015

99.2 Fact Sheet as of September 30, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | | | | |

| | | | | | |

Date: October 26, 2015 | | | | WASHINGTON FEDERAL, INC. |

| | | |

| | | | By: | | /s/ BRENT J. BEARDALL |

| | | | | | Brent J. Beardall |

| | | | | | Executive Vice President and Interim Chief Financial Officer |

Exhibit 99.1

Wednesday October 21, 2015

FOR IMMEDIATE RELEASE

Washington Federal Concludes its Fiscal Year with Record Earnings

SEATTLE, WASHINGTON - Washington Federal, Inc. (Nasdaq: WAFD), parent company of Washington Federal, today announced completion of its 98th fiscal year with record earnings of $160,316,000 or $1.67 per diluted share, compared to $157,364,000 or $1.55 per diluted share for the fiscal year ended September 30, 2014, a 7.7% increase in earnings per diluted share. Net income for the quarter ended September 30, 2015 amounted to $42,498,000 or $.45 per diluted share, compared to $40,561,000 or $.41 per diluted share for the same period one year ago, a 9.8% increase in earnings per diluted share.

Chairman, President & CEO Roy M. Whitehead commented, “Fiscal 2015 was a very successful year for the Company. Record earnings were driven primarily by increased commercial lending activity and steadily improving asset quality, two quite positive trends that we expect to continue. Although expenses will be somewhat higher over the next two quarters due to costs associated with completing a significant upgrade to our technology platform, efficiencies are expected thereafter. We look forward to 2016 and believe that it will add yet another year to the very long track record of prosperity at Washington Federal."

Total assets decreased by $188 million to $14.6 billion at September 30, 2015 from $14.8 billion at September 30, 2014. Cash and cash equivalents decreased by $498 million as low yielding cash was redeployed to higher earning loans. During fiscal 2015, the Company had an average balance of $418 million in cash and cash equivalents invested overnight at a yield of approximately 0.25%, which is a decrease of $150 million or 26% from the average cash balance during fiscal 2014.

Net loans receivable grew by $949 million or 11.7% during fiscal year 2015. Loan originations for fiscal year 2015 reached a record level of $3.1 billion, which was a $932 million or 42.9% increase over the prior fiscal year. Somewhat offsetting the record loan originations was a record level of repayments on loans which for the year totaled $2.5 billion, an increase of $630 million or 34.5% over the prior fiscal year. Commercial loans represented 62.3% of all loan originations during fiscal 2015 with consumer loans accounting for the remaining 37.7%. The Company views organic loan growth as the highest and best use of its capital and prefers commercial loans in this low rate environment for their shorter duration. The weighted average interest rate on loans decreased to 4.45% as of September 30, 2015 from 4.75% as of the prior year-end. Actual yield earned on loans is greater than the weighted-average rate due to net deferred loan fees and discounts on acquired loans, which are accreted into income over the term of the loans.

Asset quality continued to improve as the ratio of non-performing assets to total assets decreased to 0.88% as of September 30, 2015, compared to 1.00% as of last fiscal year end. The 0.88% is the lowest level experienced by the Company since June 2008. Delinquencies on loans decreased from 1.44% last year to 0.84% as of September 30, 2015. The Company realized net-recoveries on loans (as opposed to charge-offs) of $5 million, which is the second consecutive year of net recoveries. The allowance for loan losses and reserve for unfunded commitments totals $110 million as of September 30, 2015 and is 1.13% of gross loans outstanding.

Investments, which include both available-for-sale and held-to-maturity securities decreased by $574 million or 12.5% during the fiscal year as the Company chose to reinvest maturing securities into its higher yielding loan portfolio.

Customer deposits decreased by $85 million during the year to $10.6 billion as of September 30, 2015. The mix of customer deposits continued to shift toward core transaction accounts. Transaction accounts increased by $330 million or 6.0% during the year while time deposits decreased $415 million or 7.9% during the year. Over the last several years the Company has focused on growing transaction accounts to lessen sensitivity to rising interest rates. As of September 30, 2015, 54.8% of the Company’s deposits were in transaction accounts.

Total stockholders’ equity decreased by $18 million as the Company utilized more than its $160 million in net income to repurchase stock ($127 million) and pay cash dividends ($51 million). For the fiscal years 2015, 2014 and 2013, the Company returned to shareholders in the form of share repurchases or cash dividends 111%, 93% and 97%, of net income, respectively.

On August 21, 2015, the Company paid a cash dividend of 13 cents per share to common stockholders of record on August 7, 2015. This was the Company’s 130th consecutive quarterly cash dividend. During the fiscal year, the Company repurchased 5.8 million shares of stock at a weighted average price of $21.70 per share and has authorization to repurchase an additional 4 million shares.

Tangible common stockholders’ equity per share increased $0.81 or 4.8% to $17.82 and the ratio of tangible common equity to tangible assets remained strong at 11.61%.

Net interest income was $413 million for the year, an $8 million or 1.9% increase from the prior year. Net interest income for the quarter was $107 million, a $3 million or 3.3% increase from the same quarter one year ago. Net interest income was higher for the quarter and year due to increasing loan balances generating higher interest income on loans and reduced funding costs.

Net interest margin was 3.08% for fiscal year 2015 as compared to 3.05% for the prior year. Net interest margin was 3.19% for the quarter ended September 30, 2015 compared to 3.02% for the prior quarter and 3.00% for the quarter ended September 30, 2014.

The provision for loan losses was a reversal of $11.1 million for fiscal year 2015 compared to a reversal of $15.4 million for 2014. This decrease was the result of continued improvement in credit quality as mentioned earlier, offset partially by the significant growth in the loan portfolio.

Total other income increased by $10 million or 31.8% in 2015, driven primarily by increased deposit fee income resulting from higher transaction volumes on checking accounts. The year produced a return on assets of 1.10% and a return on equity of 8.21%. Return on assets for the quarter was 1.17% while return on equity was 8.72%.

Total operating expenses increased by $21 million or 10.2% in 2015, driven by 1) an increase in the number of employees and branch locations provided by the acquisition of seventy-

four branches from Bank of America located in Eastern Washington, Oregon, Idaho, New Mexico, Arizona and Nevada during fiscal 2014 and 2) increased product delivery costs associated with increased usage of online banking and debit card transactions. Despite the increased operating costs year over year, the Company’s efficiency ratio of 49.54% remains among the lowest in the industry.

Net gain on real estate acquired through foreclosure amounted to $9.3 million for fiscal year 2015 compared to a net loss of $2.7 million for the prior year. Net gain on real estate acquired through foreclosure for the quarter was $4.3 million compared to $0.7 million in the same quarter of the prior year. Net gain or loss on real estate acquired through foreclosure includes gains and losses on sales, ongoing maintenance expenses and any additional net valuation adjustments.

For the year ended September 30, 2015 the Company expensed state and federal income taxes of $89 million, which equates to a 35.75% effective tax rate.

Washington Federal, a national bank with headquarters in Seattle, Washington, has 247 branches in eight western states. To find out more about Washington Federal, please visit our website. Washington Federal uses its website to distribute financial and other material information about the Company, which is routinely posted on and accessible at www.washingtonfederal.com.

Important Cautionary Statements

The foregoing information should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2014 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

This press release contains statements about the Company’s future that are not statements of historical fact. These statements are “forward looking statements” for purposes of applicable securities laws, and are based on current information and/or management's good faith belief as to future events. The words “believe,” “expect,” “anticipate,” “project,” and similar expressions signify forward-looking statements. Forward-looking statements should not be read as a

guarantee of future performance. By their nature, forward-looking statements involve inherent risk and uncertainties, which change over time; and actual performance could differ materially from those anticipated by any forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statement.

# # #

Contact:

Washington Federal, Inc.

425 Pike Street, Seattle, WA 98101

Cathy Cooper, SVP Marketing Communications

206-777-8246

cathy.cooper@wafd.com

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(UNAUDITED)

|

| | | | | | | |

| September 30, 2015 | | September 30, 2014 |

| (In thousands, except share data) |

ASSETS | | | |

Cash and cash equivalents | $ | 284,049 |

| | $ | 781,843 |

|

Available-for-sale securities, at fair value | 2,380,563 |

| | 3,049,442 |

|

Held-to-maturity securities, at amortized cost | 1,643,216 |

| | 1,548,265 |

|

Loans receivable, net | 9,097,738 |

| | 8,148,322 |

|

Covered loans, net | 72,896 |

| | 176,476 |

|

Interest receivable | 40,429 |

| | 52,037 |

|

Premises and equipment, net | 276,247 |

| | 257,543 |

|

Real estate held for sale | 54,119 |

| | 55,072 |

|

Real estate held for investment | 3,576 |

| | 4,808 |

|

Covered real estate held for sale | 3,403 |

| | 24,082 |

|

FDIC indemnification asset | 16,275 |

| | 36,860 |

|

FHLB and FRB stock | 107,198 |

| | 158,839 |

|

Bank owned life insurance | 102,496 |

| | — |

|

Intangible assets, net | 299,358 |

| | 302,909 |

|

Federal and state income tax assets, net | 14,513 |

| | 16,515 |

|

Other assets | 172,248 |

| | 143,028 |

|

| $ | 14,568,324 |

| | $ | 14,756,041 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Liabilities | | | |

Customer accounts | | | |

Transaction deposit accounts | $ | 5,820,878 |

| | $ | 5,490,687 |

|

Time deposit accounts | 4,810,825 |

| | 5,226,241 |

|

| 10,631,703 |

| | 10,716,928 |

|

FHLB advances | 1,830,000 |

| | 1,930,000 |

|

Advance payments by borrowers for taxes and insurance | 50,224 |

| | 29,004 |

|

Accrued expenses and other liabilities | 100,718 |

| | 106,826 |

|

| 12,612,645 |

| | 12,782,758 |

|

Stockholders’ equity | | | |

Common stock, $1.00 par value, 300,000,000 shares authorized; 133,695,803 and 132,322,909 shares issued; 92,936,395 and 98,404,705 shares outstanding | 133,696 |

| | 133,323 |

|

Paid-in capital | 1,643,712 |

| | 1,638,211 |

|

Accumulated other comprehensive income, net of taxes | 353 |

| | 20,708 |

|

Treasury stock, at cost; 40,759,408 and 34,918,204 shares | (651,836 | ) | | (525,108 | ) |

Retained earnings | 829,754 |

| | 706,149 |

|

| 1,955,679 |

| | 1,973,283 |

|

| $ | 14,568,324 |

| | $ | 14,756,041 |

|

CONSOLIDATED FINANCIAL HIGHLIGHTS | | | |

Common stockholders' equity per share | $ | 21.04 |

| | $ | 20.05 |

|

Tangible common stockholders' equity per share | 17.82 |

| | 17.01 |

|

Stockholders' equity to total assets | 13.42 | % | | 13.40 | % |

Tangible common stockholders' equity to tangible assets | 11.61 |

| | 11.58 |

|

|

| | | | | | | |

| | | |

| | | |

Weighted average rates at period end | | | |

Loans and mortgage-backed securities | 3.94 | % | | 4.17 | % |

Combined loans, mortgage-backed securities and investments | 3.63 |

| | 3.63 |

|

Customer accounts | 0.48 |

| | 0.51 |

|

Borrowings | 3.35 |

| | 3.52 |

|

Combined cost of customer accounts and borrowings | 0.90 |

| | 0.97 |

|

Interest rate spread | 2.73 |

| | 2.66 |

|

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |

| | | | | | | | | | | | | | | |

| Quarter Ended September 30, | | Year Ended September 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (In thousands, except per share data) | | (In thousands, except per share data) |

INTEREST INCOME | | | | | | | |

Loans & covered assets | $ | 112,185 |

| | $ | 109,200 |

| | $ | 437,002 |

| | $ | 430,850 |

|

Mortgage-backed securities | 17,079 |

| | 19,313 |

| | 71,392 |

| | 80,260 |

|

Investment securities and cash equivalents | 6,075 |

| | 6,564 |

| | 22,159 |

| | 22,587 |

|

| 135,339 |

| | 135,077 |

| | 530,553 |

| | 533,697 |

|

INTEREST EXPENSE | | | | | | | |

Customer accounts | 12,550 |

| | 14,007 |

| | 51,054 |

| | 58,524 |

|

FHLB advances and other borrowings | 15,936 |

| | 17,677 |

| | 66,018 |

| | 69,553 |

|

| 28,486 |

| | 31,684 |

| | 117,072 |

| | 128,077 |

|

Net interest income | 106,853 |

| | 103,393 |

| | 413,481 |

| | 405,620 |

|

Provision (reversal) for loan losses | 219 |

| | (3,465 | ) | | (11,162 | ) | | (15,401 | ) |

Net interest income after provision for loan losses | 106,634 |

| | 106,858 |

| | 424,643 |

| | 421,021 |

|

| | | | | | | |

OTHER INCOME | | | | | | | |

Loan fee income | 2,760 |

| | 2,038 |

| | 8,788 |

| | 7,706 |

|

Deposit fee income | 5,921 |

| | 5,186 |

| | 22,459 |

| | 14,306 |

|

Gain (loss) on sale of investments | 2 |

| | — |

| | 9,641 |

| | — |

|

Prepayment penalty on long-term debt | — |

| | — |

| | (10,554 | ) | | — |

|

Other Income (loss) | 3,708 |

| | 2,873 |

| | 10,089 |

| | 8,647 |

|

| 12,391 |

| | 10,097 |

| | 40,423 |

| | 30,659 |

|

OTHER EXPENSE | | | | | | | |

Compensation and benefits | 30,486 |

| | 27,822 |

| | 119,939 |

| | 109,730 |

|

Occupancy | 9,090 |

| | 8,589 |

| | 33,956 |

| | 30,452 |

|

FDIC insurance premiums | 2,485 |

| | 2,331 |

| | 7,916 |

| | 11,009 |

|

Product delivery | 5,103 |

| | 5,011 |

| | 22,325 |

| | 14,973 |

|

Information Technology | 4,281 |

| | 3,938 |

| | 15,976 |

| | 14,303 |

|

Other | 5,763 |

| | 6,846 |

| | 24,739 |

| | 23,542 |

|

| 57,208 |

| | 54,537 |

| | 224,851 |

| | 204,009 |

|

Gain (loss) on real estate acquired through foreclosure, net | 4,328 |

| | 711 |

| | 9,304 |

| | (2,743 | ) |

Income before income taxes | 66,145 |

| | 63,129 |

| | 249,519 |

| | 244,928 |

|

Income tax provision | 23,647 |

| | 22,568 |

| | 89,203 |

| | 87,564 |

|

NET INCOME | $ | 42,498 |

| | $ | 40,561 |

| | $ | 160,316 |

| | $ | 157,364 |

|

| | | | | | | |

PER SHARE DATA | | | | | | | |

Basic earnings | $ | 0.45 |

| | $ | 0.41 |

| | $ | 1.68 |

| | $ | 1.56 |

|

Diluted earnings | 0.45 |

| | 0.41 |

| | 1.67 |

| | 1.55 |

|

Cash dividends per share | 0.13 |

| | 0.11 |

| | 0.54 |

| | 0.41 |

|

|

| | | | | | | | | | | | | | | |

Basic weighted average number of shares outstanding | 93,593,763 |

| | 99,320,940 |

| | 95,644,639 |

| | 101,154,030 |

|

Diluted weighted average number of shares outstanding, including dilutive stock options | 94,055,345 |

| | 99,696,612 |

| | 96,053,959 |

| | 101,590,351 |

|

| | | | | | | |

PERFORMANCE RATIOS | | | | | | | |

Return on average assets | 1.17 | % | | 1.10 | % | | 1.10 | % | | 1.10 | % |

Return on average common equity | 8.72 |

| | 8.20 |

| | 8.21 |

| | 7.99 |

|

Net Interest Margin | 3.19 |

| | 3.00 |

| | 3.08 |

| | 3.05 |

|

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | | |

Exhibit 99.2 | | | | | | | | | | | | |

| 3/15 QTR | | | | 6/15 QTR | | | | 9/15 QTR | | | |

| | | | | | | | | | | | |

Loan Loss Reserve - Total | $ | 110,221 |

| | | | $ | 107,977 |

| | | | $ | 109,914 |

| | | |

General and Specific Allowance | $ | 108,323 |

| | | | $ | 105,611 |

| | | | $ | 106,829 |

| | | |

Commitments Reserve | 1,898 |

| | | | 2,366 |

| | | | 3,085 |

| | | |

Allowance as a % of Gross Loans | 1.22 | % | | | | 1.17 | % | | | | 1.13 | % | | | |

| | | | | | | | | | | | |

Regulatory Capital Ratios | | | | | | | | | | | | |

Common equity tier 1 risk-based | 1,641,962 |

| | 19.97% | | 1,630,586 |

| | 19.35% | | 1,652,569 |

| | 18.73% | |

Tier 1 risk-based | 1,641,962 |

| | 19.97% | | 1,630,586 |

| | 19.35% | | 1,652,569 |

| | 18.73% | |

Total risk-based (excludes holding co.) | 1,745,636 |

| | 21.23% | | 1,736,830 |

| | 20.61% | | 1,763,171 |

| | 19.98% | |

Tier 1 leverage (excludes holding co.) | 1,641,962 |

| | 11.52% | | 1,630,586 |

| | 11.49% | | 1,652,569 |

| | 11.66% | |

| | | | | | | | | | | | |

| 3/15 QTR | 3/15 YTD | | 6/15 QTR | 6/15 YTD | | 9/15 QTR | 9/15 YTD | |

Loan Originations - Total | $ | 691,472 |

| $1,270,460 | | $ | 752,787 |

| $2,023,247 | | $ | 1,080,268 |

| $3,103,515 |

|

Single-Family Residential | 130,636 |

| 297,935 | | 196,613 |

| 494,548 | | 211,193 |

| $705,741 | |

Construction - Speculative | 49,051 |

| 99,209 | | 72,466 |

| 171,675 | | 91,857 |

| $263,532 | |

Construction - Custom | 67,410 |

| 155,808 | | 92,120 |

| 247,928 | | 117,292 |

| $365,220 | |

Land - Acquisition & Development | 29,573 |

| 46,140 | | 10,901 |

| 57,041 | | 21,777 |

| $78,818 | |

Land - Consumer Lot Loans | 2,132 |

| 4,736 | | 7,880 |

| 12,616 | | 8,806 |

| $21,422 | |

Multi-Family | 73,918 |

| 136,199 | | 123,886 |

| 260,085 | | 89,357 |

| $349,442 | |

Commercial Real Estate | 202,498 |

| 262,338 | | 108,226 |

| 370,564 | | 230,046 |

| $600,610 | |

Commercial & Industrial | 119,812 |

| 234,599 | | 121,632 |

| 356,231 | | 286,078 |

| $642,309 | |

HELOC | 16,077 |

| 32,347 | | 18,622 |

| 50,969 | | 23,486 |

| $74,455 | |

Consumer | 365 |

| 1,149 | | 441 |

| 1,590 | | 376 |

| $1,966 | |

| | | | | | | | | | | | |

Purchased Loans (including acquisitions) | $ | 100,001 |

| $146,832 | | $ | 36,574 |

| $183,406 | | $ | 96,530 |

| $279,936 | |

| | | | | | | | | | | | |

Net Loan Fee and Discount Accretion | $ | 7,071 |

| $14,792 | | $ | 6,161 |

| $20,953 | | $ | 8,783 |

| $29,736 | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| 3/15 QTR | 3/15 YTD | | 6/15 QTR | 6/15 YTD | | 9/15 QTR | 9/15 YTD | |

Repayments | | | | | | | | | |

Loans | $ | 596,801 |

| $ | 1,113,727 | | | $ | 651,123 |

| $ | 1,764,850 | | | $ | 692,418 |

| $ | 2,457,268 | | |

MBS | 114,836 |

| 216,330 | | | 126,951 |

| 343,281 | | | 115,910 |

| 459,191 | | |

| | | | | | | | | |

MBS Premium Amortization | $ | 2,704 |

| $ | 5,101 | | | $ | 3,298 |

| $ | 8,399 | | | $ | 3,644 |

| $ | 12,043 | | |

| | | | | | | | | |

Efficiency | | | | | | | | | |

Operating Expenses/Average Assets | 1.58 | % | 1.52 | % | | 1.57 | % | 1.54 | % | | 1.58 | % | 1.55 | % | |

Efficiency Ratio | 49.97 |

| 49.90 | | | 50.47 |

| 50.09 | | | 47.98 |

| 49.54 | | |

Amortization of Intangibles | $ | 982 |

| $ | 2,006 | | | $ | 794 |

| $ | 2,800 | | | $ | 751 |

| $ | 3,551 | | |

| | | | | | | | | | | | |

EOP Numbers | | | | | | | | | |

Shares Issued and Outstanding | 95,088,294 |

| | | | 93,982,148 |

| | | | 92,936,395 |

| | | |

| | | | | | | | | | | | |

Share repurchase information | | | | | | | | | |

Remaining shares auth. for repurchase | 1,426,269 |

| 1,426,269 | | | 5,254,607 |

| 5,254,607 | | | 4,201,230 |

| 4,201,230 | | |

Shares repurchased | 2,500,018 |

| 3,616,165 | | | 1,171,662 |

| 4,787,827 | | | 1,053,377 |

| 5,841,204 | | |

Average share repurchase price | $ | 21.21 |

| $ | 21.39 | | | $ | 21.93 |

| $ | 21.52 | | | $ | 22.48 |

| $ | 21.70 | | |

| | | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | |

Tangible Common Book Value | 3/15 QTR | | | | 6/15 QTR | | | | 9/15 QTR | | |

$ Amount | $ | 1,667,237 |

| | | | $ | 1,659,012 |

| | | | $ | 1,656,321 |

| | |

Per Share | 17.53 |

| | | | 17.65 |

| | | | 17.82 |

| | |

| | | | | | | | | | | |

# of Employees | 1,865 |

| | | | 1,839 |

| | | | 1,838 |

| | |

Tax Rate - Going Forward | 35.75 | % | | | | 35.75 | % | | | | 35.75 | % | | |

| | | | | | | | | | | |

Investments | | | | | | | | | | | |

Available-for-sale: | | | | | | | | | | | |

Agency MBS | $ | 1,567,607 |

| | | | $ | 1,436,457 |

| | | | $ | 1,263,205 |

| | |

Other | 1,189,299 |

| | | | 1,187,917 |

| | | | 1,117,358 |

| | |

| $ | 2,756,906 |

| | | | $ | 2,624,374 |

| | | | $ | 2,380,563 |

| | |

Held-to-maturity: | | | | | | | | | | | |

Agency MBS | $ | 1,479,781 |

| | | | $ | 1,586,514 |

| | | | $ | 1,643,216 |

| | |

Other | — |

| | | | — |

| | | | — |

| | |

| $ | 1,479,781 |

| | | | $ | 1,586,514 |

| | | | $ | 1,643,216 |

| | |

| | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | |

| AS OF 3/31/15 | | AS OF 6/30/15 | | AS OF 9/30/15 |

Gross Loan Portfolio by Category (a) | AMOUNT | | % | | AMOUNT | | % | | AMOUNT | | % |

Single-Family Residential | $ | 5,546,402 |

| | 61.5% | | $ | 5,568,929 |

| | 60.1% | | $ | 5,670,960 |

| | 58.2% |

Construction - Speculative | 163,657 |

| | 1.8 | | 181,668 |

| | 2.0 | | 200,509 |

| | 2.1 |

Construction - Custom | 370,693 |

| | 4.1 | | 375,425 |

| | 4.1 | | 396,307 |

| | 4.1 |

Land - Acquisition & Development | 107,181 |

| | 1.2 | | 90,252 |

| | 1.0 | | 96,679 |

| | 1.0 |

Land - Consumer Lot Loans | 104,558 |

| | 1.2 | | 105,463 |

| | 1.1 | | 106,815 |

| | 1.1 |

Multi-Family | 1,012,915 |

| | 11.2 | | 1,093,374 |

| | 11.8 | | 1,129,045 |

| | 11.6 |

Commercial Real Estate | 885,177 |

| | 9.8 | | 981,824 |

| | 10.6 | | 1,152,652 |

| | 11.8 |

Commercial & Industrial | 466,208 |

| | 5.2 | | 512,973 |

| | 5.5 | | 657,222 |

| | 6.7 |

HELOC | 136,439 |

| | 1.5 | | 137,837 |

| | 1.5 | | 139,692 |

| | 1.4 |

Consumer | 221,525 |

| | 2.5 | | 208,956 |

| | 2.3 | | 197,481 |

| | 2.0 |

| 9,014,755 |

| | 100.0% | | 9,256,701 |

| | 100.0% | | 9,747,362 |

| | 100.0% |

Less: | | | | | | | | | | | |

ALL | 108,323 |

| | | | 105,611 |

| | | | 106,829 |

| | |

Loans in Process | 426,836 |

| | | | 438,941 |

| | | | 476,777 |

| | |

Discount on Acquired Loans | 20,845 |

| | | | 16,716 |

| | | | 14,713 |

| | |

Deferred Net Origination Fees | 37,763 |

| | | | 49,824 |

| | | | 51,305 |

| | |

Sub-Total | 593,767 |

| | | | 611,092 |

| | | | 649,624 |

| | |

| $ | 8,420,988 |

| | | | $ | 8,645,609 |

| | | | $ | 9,097,738 |

| | |

| | | | | | | | |

| | |

| | | | | |

Net Loan Portfolio by Category (a) | AMOUNT | | % | | AMOUNT | | % | | AMOUNT | | % |

Single-Family Residential | $ | 5,464,292 |

| | 64.9% | | $ | 5,482,853 |

| | 63.4% | | $ | 5,588,491 |

| | 61.4% |

Construction - Speculative | 99,261 |

| | 1.2 | | 110,800 |

| | 1.3 | | 122,386 |

| | 1.3 |

Construction - Custom | 199,257 |

| | 2.4 | | 201,908 |

| | 2.3 | | 202,616 |

| | 2.2 |

Land - Acquisition & Development | 84,922 |

| | 1.0 | | 69,342 |

| | 0.8 | | 70,564 |

| | 0.8 |

Land - Consumer Lot Loans | 100,789 |

| | 1.2 | | 101,655 |

| | 1.2 | | 103,076 |

| | 1.1 |

Multi-Family | 934,864 |

| | 11.1 | | 1,006,301 |

| | 11.6 | | 1,059,406 |

| | 11.6 |

Commercial Real Estate | 748,850 |

| | 8.9 | | 848,173 |

| | 9.8 | | 994,865 |

| | 10.9 |

Commercial & Industrial | 438,047 |

| | 5.2 | | 484,930 |

| | 5.6 | | 625,792 |

| | 6.9 |

HELOC | 133,662 |

| | 1.6 | | 135,102 |

| | 1.6 | | 137,225 |

| | 1.5 |

Consumer | 217,044 |

| | 2.6 | | 204,545 |

| | 2.4 | | 193,316 |

| | 2.1 |

| $ | 8,420,988 |

| | 100.0% | | $ | 8,645,609 |

| | 100.0% | | $ | 9,097,738 |

| | 100.0% |

(a) Excludes covered loans | | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AS OF 3/31/15 | | | AS OF 6/30/15 | | AS OF 9/30/15 | | |

Deposits by State | AMOUNT | | % | | # | | AMOUNT | | % | | # | | AMOUNT | | % | | # | |

WA | $ | 5,028,312 |

| | 47.0 | % | | 81 |

| | $ | 4,992,642 |

| | 47.2 | % | | 82 |

| | $ | 5,031,982 |

| | 47.3 | % | | 83 |

| |

ID | 797,117 |

| | 7.5 |

| | 26 |

| | 773,269 |

| | 7.3 |

| | 26 |

| | 788,271 |

| | 7.4 |

| | 26 |

| |

OR | 1,991,272 |

| | 18.6 |

| | 49 |

| | 1,977,131 |

| | 18.7 |

| | 48 |

| | 2,002,606 |

| | 18.8 |

| | 48 |

| |

UT | 299,222 |

| | 2.8 |

| | 10 |

| | 295,548 |

| | 2.8 |

| | 10 |

| | 291,260 |

| | 2.7 |

| | 10 |

| |

NV | 349,807 |

| | 3.3 |

| | 11 |

| | 350,109 |

| | 3.3 |

| | 11 |

| | 347,127 |

| | 3.3 |

| | 11 |

| |

TX | 89,890 |

| | 0.8 |

| | 5 |

| | 91,759 |

| | 0.9 |

| | 5 |

| | 89,564 |

| | 0.8 |

| | 5 |

| |

AZ | 1,244,294 |

| | 11.6 |

| | 36 |

| | 1,222,910 |

| | 11.6 |

| | 35 |

| | 1,213,401 |

| | 11.4 |

| | 35 |

| |

NM | 892,711 |

| | 8.3 |

| | 29 |

| | 875,017 |

| | 8.3 |

| | 28 |

| | 867,492 |

| | 8.2 |

| | 28 |

| |

Total | $ | 10,692,625 |

| | 100.0 | % | | 247 |

| | $ | 10,578,385 |

| | 100.0 | % | | 245 |

| | $ | 10,631,703 |

| | 100.0 | % | | 246 |

| |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Deposits by Type | AMOUNT | | % | | | | AMOUNT | | % | | | | AMOUNT | | % | | | |

Checking (noninterest) | $ | 922,589 |

| | 8.6 | % | | | | $ | 933,645 |

| | 8.8 | % | | | | $ | 976,250 |

| | 9.2 | % | | | |

NOW (interest) | 1,574,294 |

| | 14.7 |

| | | | 1,556,136 |

| | 14.7 |

| | | | 1,579,516 |

| | 14.9 |

| | | |

Savings (passbook/stmt) | 663,863 |

| | 6.2 |

| | | | 671,426 |

| | 6.3 |

| | | | 700,793 |

| | 6.6 |

| | | |

Money Market | 2,547,050 |

| | 23.8 |

| | | | 2,535,329 |

| | 24.0 |

| | | | 2,564,319 |

| | 24.1 |

| | | |

CD's | 4,984,829 |

| | 46.6 |

| | | | 4,881,849 |

| | 46.1 |

| | | | 4,810,825 |

| | 45.2 |

| | | |

Total | $ | 10,692,625 |

| | 100.0 | % | | | | $ | 10,578,385 |

| | 100.0 | % | | | | $ | 10,631,703 |

| | 100.0 | % | | | |

| | | | | | | | | | | | | | | | | | |

Deposits greater than $250,000 - EOP | $ | 1,998,536 |

| | | | | | $ | 1,999,908 |

| | | | | | $ | 2,096,690 |

| | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | |

| AS OF 3/31/15 | | AS OF 6/30/15 | AS OF 9/30/15 |

Non-Performing Assets | AMOUNT | | % | | AMOUNT | | % | | AMOUNT | | % |

Non-accrual loans: | | | | | | | | | | | |

Single-Family Residential | $ | 60,781 |

| | 79.0% | | $ | 56,638 |

| | 86.7% | | $ | 59,074 |

| | 87.1% |

Construction - Speculative | 1,152 |

| | 1.5 | | 762 |

| | 1.2 | | 754 |

| | 1.1 |

Construction - Custom | — |

| | — | | 355 |

| | 0.5 | | 732 |

| | 1.1 |

Land - Acquisition & Development | — |

| | — | | — |

| | — | | — |

| | — |

Land - Consumer Lot Loans | 2,458 |

| | 3.2 | | 1,308 |

| | 2.0 | | 1,273 |

| | 1.9 |

Multi-Family | — |

| | — | | 786 |

| | 1.2 | | 2,558 |

| | 3.8 |

Commercial Real Estate | 5,735 |

| | 7.5 | | 2,852 |

| | 4.4 | | 2,176 |

| | 3.2 |

Commercial & Industrial | 5,018 |

| | 6.5 | | 1,205 |

| | 1.8 | | — |

| | — |

HELOC | 1,175 |

| | 1.5 | | 889 |

| | 1.4 | | 563 |

| | 0.8 |

Consumer | 576 |

| | 0.7 | | 513 |

| | 0.8 | | 680 |

| | 1.0 |

Total non-accrual loans | 76,895 |

| | 100.0% | | 65,308 |

| | 100.0% | | 67,810 |

| | 100.0% |

Total REO | 72,239 |

| | | | 59,239 |

| | | | 57,191 |

| | |

Total REHI | 4,068 |

| | | | 4,336 |

| | | | 3,576 |

| | |

Total non-performing assets | $ | 153,202 |

| | (b) | | $ | 128,883 |

| | (b) | | $ | 128,577 |

| | (b) |

(b) Includes $10 million from former Horizon Bank | | | | | | | | | | |

| | | | | | | | | | | |

Total non-performing loans | 0.91 | % | | | | 0.76 | % | | | | 0.75 | % | | |

Total non-performing assets | 1.05 | % | | | | 0.90 | % | | | | 0.88 | % | | |

As a % of total assets | | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | |

| 3/15 QTR | | 6/15 QTR | | 9/15 QTR |

| AMOUNT | | % | | AMOUNT | | % | | AMOUNT | | % |

Restructured loans: | | | | | | | | | | | |

Single-Family Residential | $ | 290,950 |

| | 85.6 | | $ | 275,428 |

| | 85.7 | | $ | 259,460 |

| | 85.7 |

Construction - Speculative | 6,408 |

| | 1.9 | | 6,370 |

| | 2.0 | | 4,989 |

| | 1.6 |

Construction - Custom | — |

| | — | | — |

| | — | | — |

| | — |

Land - Acquisition & Development | 4,179 |

| | 1.2 | | 3,536 |

| | 1.1 | | 2,486 |

| | 0.8 |

Land - Consumer Lot Loans | 12,501 |

| | 3.7 | | 11,539 |

| | 3.6 | | 11,289 |

| | 3.7 |

Multi-Family | 3,862 |

| | 1.1 | | 3,843 |

| | 1.2 | | 3,823 |

| | 1.3 |

Commercial Real Estate | 20,673 |

| | 6.1 | | 19,251 |

| | 6.0 | | 19,124 |

| | 6.3 |

Commercial & Industrial | — |

| | — | | — |

| | — | | — |

| | — |

HELOC | 1,394 |

| | 0.4 | | 1,394 |

| | 0.4 | | 1,443 |

| | 0.5 |

Consumer | 122 |

| | — | | 120 |

| | — | | 99 |

| | — |

Total restructured loans | $ | 340,089 |

| | 100.0% | | $ | 321,481 |

| | 100.0% | | $ | 302,713 |

| | 100.0% |

| | | | | | | | | | | |

Restructured loans were as follows: | | | | | | | | | | | |

Performing | $ | 327,386 |

| | 96.3% | | $ | 308,355 |

| | 95.9% | | $ | 289,587 |

| | 95.7% |

Non-performing (c) | 12,703 |

| | 3.7 | | 13,126 |

| | 4.1 | | 13,126 |

| | 4.3 |

Total restructured loans | $ | 340,089 |

| | 100.0% | | $ | 321,481 |

| | 100.0% | | $ | 302,713 |

| | 100.0% |

(c) Included in "Total non-accrual loans" above | | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | | | | | | | | |

| 3/15 QTR | | 6/15 QTR | | 9/15 QTR |

| AMOUNT | | CO % (d) | | AMOUNT | | CO % (d) | | AMOUNT | | CO % (d) |

Net Charge-offs (Recoveries) by Category | | | | | | | | | | | |

Single-Family Residential | $ | (2,713 | ) | | (0.20)% | | $ | (2,181 | ) | | (0.16)% | | $ | (2,128 | ) | | (0.15)% |

Construction - Speculative | (75 | ) | | (0.18) | | — |

| | — | | (45 | ) | | (0.09) |

Construction - Custom | — |

| | — | | — |

| | — | | — |

| | — |

Land - Acquisition & Development | (204 | ) | | (0.76) | | (1 | ) | | — | | (1 | ) | | — |

Land - Consumer Lot Loans | 17 |

| | 0.07 | | 89 |

| | 0.34 | | 96 |

| | 0.36 |

Multi-Family | — |

| | — | | — |

| | — | | — |

| | — |

Commercial Real Estate | (453 | ) | | (0.20) | | 1,361 |

| | 0.55 | | 68 |

| | 0.02 |

Commercial & Industrial | 338 |

| | 0.29 | | 1,210 |

| | 0.94 | | 468 |

| | 0.28 |

HELOC | — |

| | — | | 25 |

| | 0.07 | | 39 |

| | 0.11 |

Consumer | (33 | ) | | (0.06) | | (192 | ) | | (0.37) | | (215 | ) | | (0.44) |

Total net charge-offs | $ | (3,123 | ) | | (0.14)% | | $ | 313 |

| | 0.01% | | $ | (1,718 | ) | | (0.07)% |

(d) Annualized Net Charge-offs divided by Gross Balance | | | | | | | | | | | |

| | | | | | | | | | | |

SOP 03-3 Acquired Loans | | | | | | | | | | | |

Accretable Yield | $ | 91,290 |

| | | | $ | 83,640 |

| | | | $ | 76,917 |

| | |

Non-Accretable Yield | 167,603 |

| | | | 167,603 |

| | | | 167,603 |

| | |

Total Contractual Payments | $ | 258,893 |

| | | | $ | 251,243 |

| | | | $ | 244,520 |

| | |

| | | | | | | | | | | |

Interest Rate Risk | | | | | | | | | | | |

One Year GAP | | | (10.3 | )% | | | | (13.2 | )% | | | | (13.4 | )% |

NPV post 200 bps shock (e) | | | 16.50 | % | | | | 16.53 | % | | | | 15.91 | % |

Change in NII after 200 bps shock (e) | | | (1.1 | )% | | | | (2.2 | )% | | | | (2.2 | )% |

(e) Assumes no balance sheet management | | | | | | | | | | | |

| | | | | |

CD's Repricing | Amount | | Rate | | Amount | | Rate | | Amount | | Rate |

Within 3 months | $ | 612,836 |

| | 0.60 | % | | $ | 621,694 |

| | 0.45 | % | | $ | 897,917 |

| | 0.49 | % |

From 4 to 6 months | 883,166 |

| | 0.50 | % | | 913,269 |

| | 0.50 | % | | 977,012 |

| | 0.54 | % |

From 7 to 9 months | 708,921 |

| | 0.58 | % | | 620,542 |

| | 0.61 | % | | 444,042 |

| | 0.68 | % |

From 10 to 12 months | 745,590 |

| | 0.47 | % | | 678,536 |

| | 0.56 | % | | 497,525 |

| | 0.86 | % |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

($ in Thousands)

|

| | | | | | | | | | | | | |

Historical CPR Rates (f) | | | | | | | | |

| WAFD | | WAFD | | | | | | | | |

Average for Quarter Ended: | SFR Mortgages | | GSE MBS | | | | | | | | |

| | | | | | | | | | | |

9/30/2013 | 21.4 | % | | 15.9 | % | | | | | | | | |

12/31/2013 | 13.5 | % | | 8.7 | % | | | | | | | | |

3/31/2014 | 10.1 | % | | 8.5 | % | | | | | | | | |

6/30/2014 | 13.8 | % | | 10.6 | % | | | | | | | | |

9/30/2014 | 14.6 | % | | 13.4 | % | | | | | | | | |

12/31/2014 | 15.9 | % | | 12.1 | % | | | | | | | | |

3/31/2015 | 16.4 | % | | 13.9 | % | | | | | | | | |

6/30/2015 | 18.7 | % | | 15.9 | % | | | | | | | | |

9/30/2015 | 17.8 | % | | 14.5 | % | | | | | | | | |

| | | | | | | | | | | |

(f) The CPR Rate (conditional payment rate) is the rate that is equal to the proportion of the principal of a pool of loans that is paid off prematurely in each period. Also, the comparison is not precise in that Washington Federal is a portfolio lender and not required to follow GSE servicing rules/regulations. | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

Average Balance Sheet

($ in Thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarters Ended |

| March 31, 2015 | | June 30, 2015 | | September 30, 2015 |

| Average | | | | Average | | Average | | | | Average | | Average | | | | Average |

| Balance | | Interest | | Rate | | Balance | | Interest | | Rate | | Balance | | Interest | | Rate |

Assets | | | | | | | | | | | | | | | | | |

Loans and covered loans | $ | 8,487,458 |

| | $ | 109,275 |

| | 5.22 | % | | $ | 8,628,344 |

| | $ | 107,249 |

| | 4.99 | % | | $ | 8,908,562 |

| | $ | 112,185 |

| | 5.00 | % |

Mortgage-backed securities | 3,070,002 |

| | 18,144 |

| | 2.40 |

| | 3,024,821 |

| | 16,995 |

| | 2.25 |

| | 2,965,534 |

| | 17,079 |

| | 2.28 |

|

Cash & Investments | 1,688,076 |

| | 4,813 |

| | 1.16 |

| | 1,543,556 |

| | 4,625 |

| | 1.20 |

| | 1,429,487 |

| | 5,509 |

| | 1.53 |

|

FHLB & FRB Stock | 154,342 |

| | 399 |

| | 1.05 |

| | 134,692 |

| | 430 |

| | 1.28 |

| | 106,849 |

| | 566 |

| | 2.10 |

|

| | | | | | | | | | | | | | | | | |

Total interest-earning assets | 13,399,878 |

| | 132,630 |

| | 4.01 | % | | 13,331,414 |

| | 129,300 |

| | 3.89 | % | | 13,410,432 |

| | 135,339 |

| | 4.00 | % |

Other assets | 1,150,996 |

| | | | | | 1,124,750 |

| | | | | | 1,114,484 |

| | | | |

| | | | | | | | | | | | | | | | | |

Total assets | $ | 14,550,874 |

| | | | | | $ | 14,456,164 |

| | | | | | $ | 14,524,916 |

| | | | |

| | | | | | | | | | | | | | | | | |

Liabilities and Equity | | | | | | | | | | | | | | | | | |

Customer accounts | 10,659,570 |

| | 12,574 |

| | 0.48 | % | | 10,635,364 |

| | 12,485 |

| | 0.47 | % | | 10,650,672 |

| | 12,550 |

| | 0.47 | % |

FHLB advances | 1,830,000 |

| | 16,176 |

| | 3.58 |

| | 1,820,110 |

| | 16,250 |

| | 3.58 |

| | 1,824,565 |

| | 15,936 |

| | 3.47 |

|

Other borrowings | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| | | | | | | | | | | | | | | | | |

Total interest-bearing liabilities | 12,489,570 |

| | 28,750 |

| | 0.93 | % | | 12,455,474 |

| | 28,735 |

| | 0.93 | % | | 12,475,237 |

| | 28,486 |

| | 0.91 | % |

Other liabilities | 114,628 |

| | | | | | 46,980 |

| | | | | | 100,023 |

| | | | |

| | | | | | | | | | | | | | | | | |

Total liabilities | 12,604,198 |

| | | | | | 12,502,454 |

| | | | | | 12,575,260 |

| | | | |

Stockholders’ equity | 1,946,676 |

| | | | | | 1,953,710 |

| | | | | | 1,949,656 |

| | | | |

| | | | | | | | | | | | | | | | | |

Total liabilities and equity | $ | 14,550,874 |

| | | | | | $ | 14,456,164 |

| | | | | | $ | 14,524,916 |

| | | | |

| | | | | | | | | | | | | | | | | |

Net interest income | | | $ | 103,881 |

| | | | | | $ | 100,565 |

| | | | | | $ | 106,853 |

| | |

| | | | | | | | | | | | | | | | | |

Net interest margin | | | | | 3.10 | % | | | | | | 3.02 | % | | | | | | 3.19 | % |

| | | | | | | | | | | |

(Annualized net interest income divided by average interest-earning assets) | | | | | | | | | | | |

Washington Federal, Inc.

Fact Sheet

September 30, 2015

Delinquency Summary (excludes covered loans)

($ in Thousands)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | AMOUNT OF LOANS | | # OF LOANS | | % based | | | | % based |

TYPE OF LOANS | | #LOANS | | AVG Size | | NET OF LIP & CHG-OFFs | | 30 | | 60 | | 90 | | Total | | on # | | $ Delinquent | | on $ |

| | | | | | | | | | | | | | | | | | | | |

September 30, 2015 | | | | | | | | | | | | | | | | | | | | |

Single-Family Residential | | 27,768 |

| | 204 |

| | $ | 5,666,725 |

| | 95 |

| | 42 |

| | 182 |

| | 319 |

| | 1.15 | % | | $ | 64,908 |

| | 1.15 | % |

Construction - Speculative | | 618 |

| | 211 |

| | 130,121 |

| | — |

| | — |

| | — |

| | — |

| | — | % | | — |

| | — | % |

Construction - Custom | | 812 |

| | 253 |

| | 205,692 |

| | 4 |

| | 1 |

| | 2 |

| | 7 |

| | 0.86 | % | | 1,524 |

| | 0.74 | % |

Land - Acquisition & Development | | 141 |

| | 546 |

| | 76,944 |

| | 2 |

| | — |

| | 2 |

| | 4 |

| | 2.84 | % | | 924 |

| | 1.20 | % |

Land - Consumer Lot Loans | | 1,259 |

| | 85 |

| | 106,752 |

| | 10 |

| | 4 |

| | 11 |

| | 25 |

| | 1.99 | % | | 2,578 |

| | 2.41 | % |

Multi-Family | | 994 |

| | 1,077 |

| | 1,070,874 |

| | 1 |

| | 1 |

| | 4 |

| | 6 |

| | 0.60 | % | | 2,371 |

| | 0.22 | % |

Commercial Real Estate | | 1,005 |

| | 1,015 |

| | 1,019,625 |

| | 3 |

| | — |

| | 3 |

| | 6 |

| | 0.60 | % | | 1,700 |

| | 0.17 | % |

Commercial & Industrial | | 1,175 |

| | 560 |

| | 657,490 |

| | 3 |

| | 1 |

| | 2 |

| | 6 |

| | 0.51 | % | | 943 |

| | 0.14 | % |

HELOC | | 2,175 |

| | 64 |

| | 139,682 |

| | 8 |

| | 1 |

| | 6 |

| | 15 |

| | 0.69 | % | | 982 |

| | 0.70 | % |

Consumer | | 5,076 |

| | 39 |

| | 197,481 |

| | 85 |

| | 35 |

| | 40 |

| | 160 |

| | 3.15 | % | | 1,836 |

| | 0.93 | % |

| | 41,023 |

| | 226 |

| | $ | 9,271,386 |

| | 211 |

| | 85 |

| | 252 |

| | 548 |

| | 1.34 | % | | $ | 77,766 |

| | 0.84 | % |

| | | | | | | | | | | | | | | | | | | | |

June 30, 2015 | | | | | | | | | | | | | | | | | | | | |

Single-Family Residential | | 28,055 |

| | 198 |

| | $ | 5,566,121 |

| | 90 |

| | 39 |

| | 234 |

| | 363 |

| | 1.29 | % | | $ | 73,236 |

| | 1.32 | % |

Construction - Speculative | | 608 |

| | 194 |

| | 117,711 |

| | — |

| | — |

| | 1 |

| | 1 |

| | 0.16 | % | | — |

| | — | % |

Construction - Custom | | 765 |

| | 268 |

| | 204,914 |

| | 1 |

| | 1 |

| | 1 |

| | 3 |

| | 0.39 | % | | 774 |

| | 0.38 | % |

Land - Acquisition & Development | | 138 |

| | 549 |

| | 75,726 |

| | 2 |

| | — |

| | 2 |

| | 4 |

| | 2.90 | % | | 1,498 |

| | 1.98 | % |

Land - Consumer Lot Loans | | 1,250 |

| | 84 |

| | 105,403 |

| | 6 |

| | 3 |

| | 17 |

| | 26 |

| | 2.08 | % | | 2,852 |

| | 2.71 | % |

Multi-Family | | 1,000 |

| | 1,017 |

| | 1,017,437 |

| | — |

| | 1 |

| | 2 |

| | 3 |

| | 0.30 | % | | 1,041 |

| | 0.10 | % |

Commercial Real Estate | | 978 |

| | 890 |

| | 870,691 |

| | 3 |

| | 1 |

| | 8 |

| | 12 |

| | 1.23 | % | | 3,196 |

| | 0.37 | % |

Commercial & Industrial | | 1,173 |

| | 437 |

| | 512,966 |

| | 3 |

| | — |

| | 3 |

| | 6 |

| | 0.51 | % | | 930 |

| | 0.18 | % |

HELOC | | 2,151 |

| | 64 |

| | 137,837 |

| | 8 |

| | 3 |

| | 8 |

| | 19 |

| | 0.88 | % | | 1,792 |

| | 1.30 | % |

Consumer | | 5,432 |

| | 38 |

| | 208,956 |

| | 103 |

| | 34 |

| | 36 |

| | 173 |

| | 3.18 | % | | 1,097 |

| | 0.53 | % |

| | 41,550 |

| | 212 |

| | $ | 8,817,761 |

| | 216 |

| | 82 |

| | 312 |

| | 610 |

| | 1.47 | % | | $ | 86,416 |

| | 0.98 | % |

| | | | | | | | | | | | | | | | | | | | |

March 31, 2015 | | | | | | | | | | | | | | | | | | | | |

Single-Family Residential | | 28,365 |

| | 195 |

| | $ | 5,543,851 |

| | 92 |

| | 41 |

| | 243 |

| | 376 |

| | 1.33 | % | | $ | 78,895 |

| | 1.42 | % |

Construction - Speculative | | 577 |

| | 183 |

| | 105,568 |

| | 23 |

| | — |

| | 2 |

| | 25 |

| | 4.33 | % | | 2,525 |

| | 2.39 | % |

Construction - Custom | | 766 |

| | 263 |

| | 201,777 |

| | 2 |

| | 2 |

| | — |

| | 4 |

| | 0.52 | % | | 1,169 |

| | 0.58 | % |

Land - Acquisition & Development | | 144 |

| | 654 |

| | 94,179 |

| | — |

| | — |

| | 2 |

| | 2 |

| | 1.39 | % | | 868 |

| | 0.92 | % |

Land - Consumer Lot Loans | | 1,271 |

| | 82 |

| | 104,477 |

| | 6 |

| | 4 |

| | 20 |

| | 30 |

| | 2.36 | % | | 3,621 |

| | 3.47 | % |

Multi-Family | | 994 |

| | 951 |

| | 944,937 |

| | 1 |

| | — |

| | 3 |

| | 4 |

| | 0.40 | % | | 947 |

| | 0.10 | % |

Commercial Real Estate | | 983 |

| | 830 |

| | 815,978 |

| | 3 |

| | 4 |

| | 9 |

| | 16 |

| | 1.63 | % | | 10,670 |

| | 1.31 | % |

Commercial & Industrial | | 1,140 |

| | 416 |

| | 474,090 |

| | 1 |

| | — |

| | 4 |

| | 5 |

| | 0.44 | % | | 2,994 |

| | 0.63 | % |

HELOC | | 2,084 |

| | 65 |

| | 136,439 |

| | 7 |

| | 3 |

| | 9 |

| | 19 |

| | 0.91 | % | | 1,393 |

| | 1.02 | % |

Consumer | | 5,921 |

| | 37 |

| | 221,525 |

| | 111 |

| | 33 |

| | 42 |

| | 186 |

| | 3.14 | % | | 1,064 |

| | 0.48 | % |

| | 42,245 |

| | 205 |

| | $ | 8,642,822 |

| | 246 |

| | 87 |

| | 334 |

| | 667 |

| | 1.58 | % | | $ | 104,145 |

| | 1.20 | % |

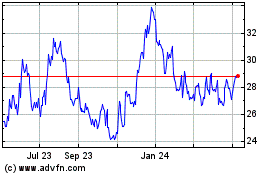

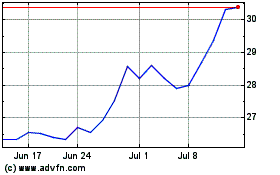

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Sep 2024 to Oct 2024

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Oct 2023 to Oct 2024