0001829794

false

0001829794

2023-10-30

2023-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13

OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 30, 2023

__________________________

Volcon, Inc.

(Exact Name of Registrant as Specified in its Charter)

__________________________

| Delaware |

001-40867 |

84-4882689 |

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification Number) |

3121

Eagles Nest Street, Suite 120

Round Rock, TX 78665

(Address of principal executive offices and zip

code)

(512) 400-4271

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

|

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)). |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share |

|

VLCN |

|

NASDAQ |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry into a Material Definitive Agreement. |

On October 30, 2023, in an

effort for Volcon, Inc. (the “Company”) to raise cash, the Company entered into an inducement offer letter agreement (the

“Inducement Letter”) with three holders (each, a “Holder”) of the Company’s existing warrants amended and

restated on May 24, 2023 (the “Existing Warrants”). Pursuant to the Inducement Letter, in exchange for an aggregate cash payment

of $346,500, the Company reduced the exercise price with respect to Existing Warrants exercisable into an aggregate of 350,000 shares

of Common Stock from $1.369 per share to $0.01 per share. The resale of the shares of common stock underlying the Existing Warrants have

been registered pursuant to an existing registration statement on Form S-1 (File No. 333-272564), declared effective by the Securities

and Exchange Commission on June 27, 2023.

The

form of Inducement Letter is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The description

of the terms of the Inducement Letter are not intended to be complete and is qualified in its entirety by reference to such exhibit. The

Inducement Letter contains customary representations, warranties and covenants by the Company which were made only for the purposes of

such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations

agreed upon by the contracting parties.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits:

| Exhibit Number |

| Description |

| |

| |

| 10.1 |

| Form of Inducement Letter |

| 104 |

| Cover Page Interactive Data File - the cover page XBRL tags are

embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of

the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Volcon, Inc. |

| |

(Registrant) |

| |

|

| Date: October 30, 2023 |

/s/ Greg Endo |

| |

Greg Endo

Chief Financial Officer |

Exhibit 10.1

VOLCON, INC.

October 29, 2023

Holder of Common Stock Purchase Warrant

Re: Inducement

Offer to Reprice Common Stock Purchase Warrants

Dear Holder:

In an effort for Volcon, Inc.

(the “Company”) to raise cash, the Company is pleased to offer to you (the “Holder”) the opportunity,

with respect to ________ of the Amended and Restated Common Stock Purchase Warrants exercisable into _________ Warrant Shares (as defined

below) currently held by you (the “Applicable Warrants”), to receive a permanent reduction of the exercise price (pursuant

to Section 3(i) of the Applicable Warrants) to $0.01 per share (such reduced price, the “Warrants Exercise Price”).

The reduction of the exercise price to the Warrants Exercise Price shall be in effect until the Termination Date. The shares underlying

the Applicable Warrants (“Warrant Shares”) have been registered for resale pursuant to registration statement Form

S-1 (File No. 333-272564) (the “Registration Statement”). The Registration Statement is currently effective and, upon

exercise of the Applicable Warrants as contemplated by this letter agreement, will be effective for the resale of the Warrant Shares.

Capitalized terms not otherwise defined herein shall have the meanings set forth in the Applicable Warrants.

In consideration for the Company’s

agreement to reprice the exercise price of the portion of the Amended and Restated Common Stock Purchase Warrants currently held by you

comprising the Applicable Warrants to the Warrants Exercise Price, Holder hereby agrees that no later than October 31, 2023 to pay to

the Company a cash payment of $_________ (the “Repricing Payment”).

By acceptance of this offer,

Holder agrees that the reduction of the exercise price of the Applicable Warrants shall not be deemed to be a Dilutive Issuance pursuant

to the notes and other warrants issued to Holder, or amended and restated, on May 24, 2023.

Expressly subject to the paragraph

immediately preceding this paragraph, Holder may accept this offer by signing this letter below and remitting the Repricing Payment to

the Company pursuant to the terms contemplated hereby.

Additionally, the Company

agrees to the representations, warranties and covenants set forth on Annex A attached hereto.

On or about 6:00 am ET on

October 30, 2023, the Company shall file a Current Report on Form 8-K with the SEC disclosing all material terms of the transactions contemplated

hereunder. The Company represents, warrants and covenants that, upon acceptance of this offer, the shares underlying any of the Applicable

Warrants that are exercised after the date hereof shall be issued free of any legends or restrictions on resale by Holder and all of the

Warrant Shares shall be delivered electronically through the Depository Trust Company within 1 Business Day of the date the Company receives

the applicable Warrants Exercise Price for each Applicable Warrant exercised from time to time on or prior to the Termination Date. The

terms of the Applicable Warrants, including but not limited to the obligations to deliver the Warrant Shares, shall otherwise remain in

effect (including but not limited to any liquidated damages and compensation in the event of late delivery of the Warrant Shares).

***************

To accept this offer, Holder

must counter execute this letter agreement, return the fully executed agreement to the Company by e-mail at: greg@volcon.com, and remit

the Repricing Payment pursuant to the terms contemplated hereby.

Please do not hesitate to

call me if you have any questions.

Sincerely yours,

VOLCON, INC.

By: _______________________

Name:

Title:

Accepted and Agreed to:

Name of Holder: ___________________

By: _____________________________

Signature of Authorized Signatory of Holder:

_________________________________

Name of Authorized Signatory: _______________________

Title of Authorized Signatory: ________________________

Annex A

Representations, Warranties

and Covenants of the Company. The Company hereby makes the following representations and warranties to the Holder:

(a) Affirmation of Prior Representations, Warranties and Covenants. The Company hereby represents and warrants to the Holder

that the Company’s representations and warranties as set forth in Article III and the Company’s covenants listed in Article

IV of that certain Securities Purchase Agreement, dated August 22, 2022, between the Company and the investors listed thereto (the “SPA”),

together with any updates in the Company’s public reports filed with the SEC subsequent to the SPA, are true and correct as of the

date hereof and have been fully performed as of the date hereof.

(b) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate

the transactions contemplated by this letter agreement and otherwise to carry out its obligations hereunder and thereunder. The execution

and delivery of this letter agreement by the Company and the consummation by the Company of the transactions contemplated hereby have

been duly authorized by all necessary action on the part of the Company and no further action is required by the Company, its board of

directors or its stockholders in connection therewith. This letter agreement has been duly executed by the Company and, when delivered

in accordance with the terms hereof, will constitute the valid and binding obligation of the Company enforceable against the Company in

accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization,

moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating

to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution

provisions may be limited by applicable law.

(c) No Conflicts. The execution, delivery and performance of this letter agreement by the Company and the consummation by the

Company of the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s

certificate or articles of incorporation, bylaws or other organizational or charter documents; or (ii) conflict with, or constitute a

default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any liens,

claims, security interests, other encumbrances or defects upon any of the properties or assets of the Company in connection with, or give

to others any rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any material

agreement, credit facility, debt or other material instrument (evidencing Company debt or otherwise) or other material understanding to

which such Company is a party or by which any property or asset of the Company is bound or affected; or (iii) conflict with or result

in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority

to which the Company is subject (including federal and state securities laws and regulations), or by which any property or asset of the

Company is bound or affected, except, in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected

to result in a material adverse effect upon the business, prospects, properties, operations, condition (financial or otherwise) or results

of operations of the Company, taken as a whole, or in its ability to perform its obligations under this letter agreement.

(d) Nasdaq Corporate Governance. The transactions contemplated under this letter agreement, comply with all rules of the Nasdaq

Capital Market.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

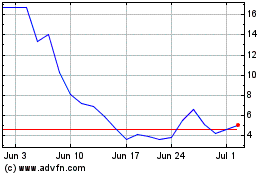

Volcon (NASDAQ:VLCN)

Historical Stock Chart

From Oct 2024 to Nov 2024

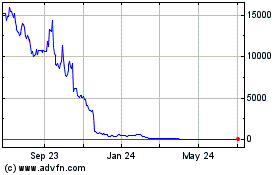

Volcon (NASDAQ:VLCN)

Historical Stock Chart

From Nov 2023 to Nov 2024