Initial Statement of Beneficial Ownership (3)

April 16 2021 - 4:27PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Valor Buyer LP |

2. Date of Event Requiring Statement (MM/DD/YYYY)

4/6/2021

|

3. Issuer Name and Ticker or Trading Symbol

VERINT SYSTEMS INC [VRNT]

|

|

(Last)

(First)

(Middle)

C/O APAX PARTNERS US, LLC, 601 LEXINGTON AVENUE |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director ___X___ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Street)

NEW YORK, NY 10022

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

___ Form filed by One Reporting Person

_X_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series A Convertible Perpetual Preferred Stock | (1) | (1) | Common Stock, par value $0.001 | 5497526.11 (2) | (1) | D (3) | |

| Series B Convertible Perpetual Preferred Stock | (4) | (4) | Common Stock, par value $0.001 | 3980099.5 (5) | (4) | D (3) | |

| Explanation of Responses: |

| (1) | Verint Systems Inc.'s (the "Issuer") Series A Convertible Perpetual Preferred Stock, par value $0.001 per share (the "Series A Preferred Stock"), is convertible at the option of a holder at any time into shares of the Issuer's common stock, par value $0.001 per share ("Common Stock") at an initial conversion price of $36.38 per share. The Series A Preferred Stock has no expiration date. |

| (2) | Represents 5,497,526.11 shares of Common Stock issuable upon the conversion of 200,000 shares of Series A Preferred Stock directly held by Valor Buyer LP ("Valor Buyer") at an initial conversion price of $36.38 per share. |

| (3) | Valor Buyer GP LLC ("Valor GP") is the general partner of Valor Buyer and 100% of the equity interests in Valor GP is held by Valor Topco Limited ("Valor Limited"). Apax X GP Co. Limited ("Apax Limited"), in its capacity as investment manager of the Apax X fund (other than Apax X EUR SCSp), holds 99.34% of the shares of Valor Limited. Apax X GP S.a r.l. ("Apax X"), in its capacity as managing general partner of Apax X EUR SCSp, holds 0.66% of the shares of Valor Limited. Apax Guernsey (Holdco) PCC Limited Apax X Cell ("Apax PCC") is the sole parent of Apax Limited and Apax X. As a result, Valor GP, Valor Limited, Apax Limited, Apax X and Apax PCC may be deemed to beneficially own, and have shared voting and dispositive power with respect to the underlying Common Stock. Valor GP, Valor Limited, Apax Limited, Apax X and Apax PCC disclaim beneficial ownership of the underlying Common Stock, except to the extent of their pecuniary interest therein. |

| (4) | The Issuer's Series B Convertible Perpetual Preferred Stock, par value $0.001 per share (the "Series B Preferred Stock"), is convertible at the option of a holder at any time into shares of the Common Stock at an initial conversion price of $50.25 per share. The Series B Preferred Stock has no expiration date. |

| (5) | Represents 3,980,099.50 shares of Common Stock issuable upon the conversion of 200,000 shares of Series B Preferred Stock directly held by Valor Buyer at an initial conversion price of $50.25 per share. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Valor Buyer LP

C/O APAX PARTNERS US, LLC

601 LEXINGTON AVENUE

NEW YORK, NY 10022 |

| X |

|

|

Valor Topco Ltd

P.O. BOX 656, EAST WING,

TRAFALGAR COURT, LES BANQUES

ST. PETER PORT, Y7 GY1 3PP |

| X |

|

|

Apax X GP Co. Ltd

THIRD FLOOR, ROYAL BANK PLACE,

1 GLATEGNY ESPLANADE

ST. PETER PORT, Y7 GY1 2HJ |

| X |

|

|

Apax Guernsey (Holdco) PCC Ltd

THIRD FLOOR, ROYAL BANK PLACE,

1 GLATEGNY ESPLANADE

ST. PETER PORT, Y7 GY1 2HJ |

| X |

|

|

Apax X GP S.a r.l.

1-3 BOULEVARD DE LA FOIRE

LUXEMBOURG, L-1528 |

| X |

|

|

Valor Buyer GP LLC

C/O APAX PARTNERS US, LLC

601 LEXINGTON AVENUE

NEW YORK, NY 10022 |

| X |

|

|

Signatures

|

| See Exhibit 99.1 | | 4/16/2021 |

| **Signature of Reporting Person | Date |

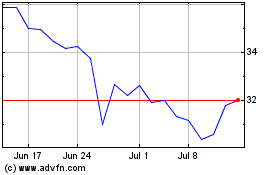

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Sep 2024 to Oct 2024

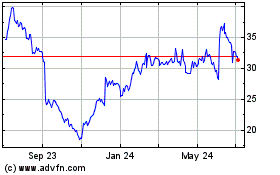

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Oct 2023 to Oct 2024