Announced Positive Updated Data from

Ongoing Investigator-Initiated Phase 1/2 FRAME Study Evaluating

VS-6766 and Defactinib Combination in Patients with Low-Grade

Serous Ovarian Cancer

On Track to Commence Company-Sponsored Phase 2

Registration-Directed Trials by Year-End 2020 in Both Low-Grade

Serous Ovarian Cancer and KRAS Mutant Non-Small Cell Lung

Cancer

Strong Balance Sheet with Cash, Cash

Equivalents and Investments Totaling $205.7 Million; Strategic Sale

of COPIKTRA® (duvelisib) Provides Cash Runway Until at Least

2024

Verastem, Inc. (Nasdaq:VSTM) (also known as Verastem Oncology),

a biopharmaceutical company committed to advancing new medicines

for patients battling cancer, today reported financial results for

the three months ending September 30, 2020, and provided an

overview of recent corporate highlights.

“The third quarter of 2020 was marked most notably by the sale

of the COPIKTRA (duvelisib) franchise to Secura Bio in a deal

valued at up to $311 million, plus royalties. This strategic

transaction allows us to focus our resources and efforts on

advancing the VS-6766 and defactinib combination program in KRAS

mutant solid tumors and provides us with a cash runway until at

least 2024,” said Brian Stuglik, Chief Executive Officer of

Verastem Oncology. “Looking ahead to the remainder of the year, we

remain on track to commence two new company-sponsored,

registration-directed Phase 2 clinical trials by year end, one in

low-grade serous ovarian cancer (LGSOC) and one in KRAS mutant

non-small cell lung cancer (NSCLC).”

Third Quarter 2020 and Recent Highlights

- Presented Updated Data from the Phase 1/2 FRAME Study in

Patients with LGSOC. In mid-September, Verastem reported

positive updated results from the ongoing investigator-initiated

Phase 1/2 FRAME study coinciding with a virtual oral presentation

by Dr. Udai Banerji, Institute of Cancer Research and The Royal

Marsden, at the 2nd Annual RAS-Targeted Drug Development (RTDD)

Summit. The FRAME study is evaluating VS-6766, Verastem’s RAF/MEK

inhibitor, in combination with defactinib, its FAK inhibitor, in

patients with LGSOC. The results demonstrated that the novel,

intermittent, combination dosing schedule used in the FRAME study

continues to show encouraging clinical activity, durability and a

favorable safety profile in patients with KRAS mutant LGSOC,

including patients who had previously progressed following

treatment with a MEK inhibitor.

- New Data Published in The Lancet Oncology Supports Potential

of VS-6766. An investigator-initiated Phase 1 study evaluating

the intermittent dosing schedule of VS-6766 was published in the

November issue of The Lancet Oncology. Tolerability and antitumor

activity were observed across various cancers with RAS/RAF/MEK

pathway mutations. The dose escalation study was the first to

evaluate a dual RAF/MEK inhibitor using innovative intermittent

dosing schedules in patients harboring RAS/RAF pathway

mutations.

- On Track to Commence Phase 2 Registration-Directed Trials in

Lead Indications This Year. Following a meeting with the U.S.

Food and Drug Administration (FDA), Verastem reported that the FDA

is supportive of its adaptive study design for the planned Phase 2

registration-directed trial evaluating VS-6766 and defactinib in

patients with recurrent LGSOC. Verastem expects to commence

registration-directed clinical trials in both recurrent LGSOC and

KRAS mutant non-small cell lung cancer by the end of 2020. Assuming

a positive outcome from these registration-directed trials,

Verastem expects to submit New Drug Applications to the FDA

requesting accelerated approval for VS-6766 alone or in combination

with defactinib in both LGSOC and KRAS mutant NSCLC.

- Closed COPIKTRA Sale to Secura Bio in a Deal Totaling $311

Million, Plus Royalties. Verastem recently announced the

closing of a strategic transaction selling global commercial and

development rights to COPIKTRA in all oncology indications to

Secura Bio, Inc. The transaction, which carries a total deal value

of up to $311 million, plus royalties, provides Verastem with a

cash runway until at least 2024 and will allow the Company to focus

its resources and efforts on the clinical development of VS-6766

and defactinib in KRAS mutant solid tumors.

- Presented New Preclinical Research Demonstrating Synergy and

Tumor Regression with VS-6766 in Combination with G12C

Inhibitors. In a virtual poster presentation, also at the RTDD

Summit, Verastem highlighted new preclinical researchwhere VS-6766

showed synergy with KRAS-G12C inhibitors in reducing cancer cell

viability across a panel of KRAS-G12C mutant NSCLC and colorectal

cancer (CRC) cell lines. This enhanced cellular anti-cancer

activity of the combination correlated with deeper and more durable

inhibition of ERK pathway signaling compared to G12C inhibition

alone. The anti-tumor effects of VS-6766 were stronger than the

effects of trametinib at a comparable dose.

Third Quarter 2020 Financial Results

Total Revenue for the three months ending September 30, 2020

(2020 Quarter) was $78.6 million, compared to $9.0 million for the

three months ending September 30, 2019 (2019 Quarter).

Sale of COPIKTRA license and related assets revenue for the 2020

Quarter was $70.0 million, compared to $0.0 for the 2019 Quarter.

The 2020 Quarter was comprised of a $70.0 million upfront payment

recognized as part of the COPIKTRA sale to Secura Bio Inc.

License and collaboration revenue for the 2020 Quarter was $2.8

million, compared to $5.0 million for the 2019 Quarter. The 2019

Quarter included a $5.0 million upfront payment received pursuant

to a license and collaboration agreement executed between Verastem

Oncology and Sanofi in July 2019. The 2020 Quarter was primarily

comprised of $2.5 million for Sanofi achieving two development

milestones under the license and collaboration agreement.

Net product revenue for the 2020 Quarter was $5.8 million,

compared to $4.0 million for the 2019 Quarter.

Cost of sales as a result of the sale of COPIKTRA license and

related assets for the 2020 Quarter was $31.2 million, compared to

$0.0 million for the 2019 Quarter. The 2020 Quarter comprised of

the intangible asset, certain duvelisib inventory, net duvelisib

contract prepaid balances and certain manufacturing equipment for

the amounts of $19.2 million, $6.0 million, $5.8 million, and $0.2

million, respectively, delivered to Secura Bio Inc. as part of the

COPIKTRA sale.

Total research and development (R&D) and selling, general

and administrative (SG&A) expenses for the 2020 Quarter were

$31.6 million, compared to $34.4 million for the 2019 Quarter.

R&D expense for the 2020 Quarter was $11.0 million, compared

to $12.2 million for the 2019 Quarter. The decrease of $1.2

million, or 10%, was primarily related to a decrease in contract

research organization costs and lower employee related expense.

SG&A expense for the 2020 Quarter was $20.6 million,

compared to $22.2 million for the 2019 Quarter. The decrease of

$1.6 million, or 7%, primarily resulted from the company’s shift in

strategic direction which led to lower commercial program and

employee related expense. The 2020 Quarter includes $3.5 million of

nonrecurring transaction expenses directly attributable to the

COPIKTRA sale to Secura Bio Inc.

Net income (loss) for the 2020 Quarter was $13.1 million, or

$0.08 per share (basic and diluted), compared to $(30.1) million,

or $(0.41) per share (basic and diluted), for the 2019 Quarter.

For the 2020 Quarter, non-GAAP adjusted net income was $18.8

million, or $0.11 per share (diluted), compared to non-GAAP

adjusted net loss of $26.2 million, or $0.35 per share (diluted),

for the 2019 Quarter. Please refer to the GAAP to Non-GAAP

Reconciliation attached to this press release.

Verastem Oncology ended the third quarter of 2020 with cash,

cash equivalents and short-term investments of $205.7 million.

Financial Guidance and Outlook

With the proceeds from the sale of COPIKTRA, Verastem has a cash

runway until at least 2024 to deliver on the current programs for

VS-6766 and defactinib, including clinical and regulatory

milestones and development in LGSOC and KRAS mutant NSCLC. Verastem

expects its 2020 operating expenses to be approximately 40% lower

than its 2019 operating expenses. As a result of its new strategic

direction and operating plans, along with the sale of the COPIKTRA

franchise during the third quarter 2020 and associated transition

activities, the Company expects total operating expenses for the

full year 2020 to be in the range of $80 million to $90 million.

Beginning in 2021 Verastem expects its annual operating expenses to

be approximately $50 million.

Use of Non-GAAP Financial Measures

To supplement Verastem Oncology’s condensed consolidated

financial statements, which are prepared and presented in

accordance with generally accepted accounting principles in the

United States (GAAP), the Company uses the following non-GAAP

financial measures in this press release: non-GAAP adjusted net

loss and non-GAAP net loss per share. These non-GAAP financial

measures exclude certain amounts or expenses from the corresponding

financial measures determined in accordance with GAAP. Management

believes this non-GAAP information is useful for investors, taken

in conjunction with the Company’s GAAP financial statements,

because it provides greater transparency and period-over-period

comparability with respect to the Company’s operating performance

and can enhance investors’ ability to identify operating trends in

the Company’s business. Management uses these measures, among other

factors, to assess and analyze operational results and trends and

to make financial and operational decisions. Non-GAAP information

is not prepared under a comprehensive set of accounting rules and

should only be used to supplement an understanding of the Company’s

operating results as reported under GAAP, not in isolation or as a

substitute for, or superior to, financial information prepared and

presented in accordance with GAAP. In addition, these non-GAAP

financial measures are unlikely to be comparable with non-GAAP

information provided by other companies. The determination of the

amounts that are excluded from non-GAAP financial measures is a

matter of management judgment and depends upon, among other

factors, the nature of the underlying expense or income amounts.

Reconciliations between these non-GAAP financial measures and the

most comparable GAAP financial measures for the three months ended

March 31, 2020 and 2019 are included in the tables accompanying

this press release after the unaudited condensed consolidated

financial statements.

About VS-6766

VS-6766 (formerly known as CH5126766, CKI27 and RO5126766) is a

unique inhibitor of the RAF/MEK signaling pathway. In contrast to

other MEK inhibitors in development, VS-6766 blocks both MEK kinase

activity and the ability of RAF to phosphorylate MEK. This unique

mechanism allows VS-6766 to block MEK signaling without the

compensatory activation of MEK that appears to limit the efficacy

of other inhibitors.

About Defactinib

Defactinib (VS-6063) is an oral small molecule inhibitor of FAK

and PYK2 that is currently being evaluated as a potential

combination therapy for various solid tumors. The Company has

received Orphan Drug designation for defactinib in ovarian cancer

and mesothelioma in the US, EU and Australia. Preclinical research

by Verastem Oncology scientists and collaborators at world-renowned

research institutions has described the effect of FAK inhibition to

enhance immune response by decreasing immuno-suppressive cells,

increasing cytotoxic T cells, and reducing stromal density, which

allows tumor-killing immune cells to enter the tumor.i,ii

About the VS-6766/Defactinib Combination

RAS mutant tumors are present in ~30% of all human cancers, have

historically presented a difficult treatment challenge and are

often associated with significantly worse prognosis. Challenges

associated with identifying new treatment options for these types

of cancers include resistance to single agents, identifying

tolerable combination regimens with MEK inhibitors and new RAS

inhibitors in development addressing only a minority of all RAS

mutated cancers.

The combination of VS-6766 and defactinib has been found to be

clinically active in patients with KRAS mt tumors. In an ongoing

investigator-initiated Phase 1/2 FRAME study, the combination of

VS-6766 and defactinib is being evaluated in patients with LGSOC,

KRASmt NSCLC and colorectal cancer (CRC). Updated interim data from

this study presented at the 2nd Annual RAS-Targeted Drug

Development Summit in September 2020 demonstrated a 56% overall

response rate and long duration of therapy among patients with

KRAS-G12 mt LGSOC. Based on an observation of higher response rates

seen in NSCLC patients with KRAS-G12V mutations in the study,

Verastem will also be further exploring the role of VS-6766 and

defactinib in KRAS-G12V NSCLC. The FRAME study was expanded in

August 2020 to include new cohorts in pancreatic cancer, KRASmt

endometrial cancer and KRAS-G12V NSCLC.

About Verastem Oncology

Verastem Oncology (Nasdaq: VSTM) is a development-stage

biopharmaceutical company committed to the development and

commercialization of new medicines to improve the lives of patients

diagnosed with cancer. Our pipeline is focused on novel small

molecule drugs that inhibit critical signaling pathways in cancer

that promote cancer cell survival and tumor growth, including

RAF/MEK inhibition and focal adhesion kinase (FAK) inhibition. For

more information, please visit www.verastem.com.

Forward-Looking Statements Notice

This press release includes forward-looking statements about

Verastem Oncology’s strategy, future plans and prospects, including

statements related to the potential clinical value of the

RAF/MEK/FAK combination and the timing of commencing

registration-directed trials for the RAF/MEK/FAK combination. The

words "anticipate," "believe," "estimate," "expect," "intend,"

"may," "plan," "predict," "project," "target," "potential," "will,"

"would," "could," "should," "continue," “can,” “promising” and

similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Each forward-looking statement is subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed or implied in such

statement.

Applicable risks and uncertainties include the risks and

uncertainties, among other things, regarding: the success in the

development and potential commercialization of our product

candidates, including defactinib in combination with VS-6766; the

occurrence of adverse safety events and/or unexpected concerns that

may arise from additional data or analysis or result in

unmanageable safety profiles as compared to their levels of

efficacy; our ability to obtain, maintain and enforce patent and

other intellectual property protection for our product candidates;

the scope, timing, and outcome of any legal proceedings; decisions

by regulatory authorities regarding labeling and other matters that

could affect the availability or commercial potential of our

product candidates; whether preclinical testing of our product

candidates and preliminary or interim data from clinical trials

will be predictive of the results or success of ongoing or later

clinical trials; that the timing, scope and rate of reimbursement

for our product candidates is uncertain; that third-party payors

(including government agencies) may not reimburse; that there may

be competitive developments affecting our product candidates; that

data may not be available when expected; that enrollment of

clinical trials may take longer than expected; that our product

candidates will experience manufacturing or supply interruptions or

failures; that we will be unable to successfully initiate or

complete the clinical development and eventual commercialization of

our product candidates; that the development and commercialization

of our product candidates will take longer or cost more than

planned; that we or Chugai Pharmaceutical Co., Ltd. will fail to

fully perform under the VS-6766 license agreement; that we may not

have sufficient cash to fund our contemplated operations; that we

may be unable to make additional draws under our debt facility or

obtain adequate financing in the future through product licensing,

co-promotional arrangements, public or private equity, debt

financing or otherwise; that we will be unable to execute on our

partnering strategies for defactinib in combination with VS-6766;

that we will not pursue or submit regulatory filings for our

product candidates; and that our product candidates will not

receive regulatory approval, become commercially successful

products, or result in new treatment options being offered to

patients.

Other risks and uncertainties include those identified under the

heading “Risk Factors” in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2019 as filed with the Securities

and Exchange Commission (SEC) on March 11, 2020 and in any

subsequent filings with the SEC. The forward-looking statements

contained in this press release reflect Verastem Oncology’s views

as of the date hereof, and the Company does not assume and

specifically disclaims any obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise, except as required by law.

Verastem, Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

(unaudited)

September 30,

December 31,

2020

2019

Cash, cash equivalents, &

investments

$

170,470

$

75,506

Accounts receivable, net

5,685

2,524

Inventory

—

3,096

Restricted cash, prepaid expenses and

other current assets

12,400

3,835

Property and equipment, net

497

947

Intangible assets, net

—

20,008

Right-of-use asset, net

2,820

3,077

Restricted cash and other assets

25,898

36,053

Total assets

$

217,770

$

145,046

Current Liabilities

$

37,678

$

29,890

Long-term debt

26,397

35,067

Convertible senior notes

20,841

68,556

Lease Liability, long-term

3,081

3,489

Other liabilities

—

870

Stockholders’ equity

129,773

7,174

Total liabilities and stockholders’

equity

$

217,770

$

145,046

Verastem, Inc.

Condensed Consolidated

Statements of Operations

(in thousands, except per share

amounts)

(unaudited)

Three months ended September

30,

Nine months ended September

30,

2020

2019

2020

2019

Revenue:

Product revenue, net

$

5,829

$

4,032

$

15,098

$

8,722

License and collaboration revenue

2,818

5,000

2,912

5,118

Sale of COPIKTRA license and related

assets revenue

70,000

—

70,000

—

Total revenue

78,647

9,032

88,010

13,840

Operating expenses:

Cost of sales - product

866

371

1,753

906

Cost of sales - intangible

amortization

8

392

793

1,177

Cost of sales – sale of COPIKTRA license

and related assets

31,187

—

31,187

—

Research and development

10,955

12,219

31,223

33,322

Selling, general and administrative

20,614

22,153

55,660

77,484

Total operating expenses

63,630

35,135

120,616

112,889

Income (Loss) from operations

15,017

(26,103)

(32,606)

(99,049)

Other expense

—

—

(1,313)

—

Interest income

19

1,005

497

3,770

Interest expense

(1,898)

(5,041)

(14,440)

(15,156)

Net income (loss)

$

13,138

$

(30,139)

$

(47,862)

$

(110,435)

Net income (loss) per share—basic

$

0.08

$

(0.41)

$

(0.32)

$

(1.49)

Net income (loss) per share—diluted

$

0.08

$

(0.41)

$

(0.32)

$

(1.49)

Weighted average common shares outstanding

used in computing:

Net income (loss) per share – basic

169,510

74,228

147,766

73,988

Net income (loss) per share - diluted

169,760

74,228

147,766

73,988

Verastem, Inc.

Reconciliation of GAAP to

Non-GAAP Financial Information

(in thousands, except per share

amounts)

(unaudited)

Three months ended September

30,

Nine months ended September

30,

2020

2019

2020

2019

Net income (loss)

Reconciliation

Net income (loss) (GAAP basis)

$

13,138

$

(30,139)

$

(47,862)

$

(110,435)

Adjust:

Amortization of acquired intangible

asset

8

392

793

1,177

Stock-based compensation expense

2,156

1,915

5,185

7,228

Non-cash interest, net

506

1,611

9,765

4,426

Severance and Other

2,993

40

4,781

2,034

Change in fair value of derivative

—

—

1,313

—

Chugai license payment

—

—

3,000

—

Adjusted Net income (loss) (non-GAAP

basis)

$

18,801

$

(26,181)

$

(23,025)

$

(95,570)

Reconciliation of Net Loss Per

Share

Net income (loss) per share – diluted

(GAAP Basis)

$

0.08

$

(0.41)

$

(0.32)

$

(1.49)

Adjust per diluted share

Amortization of acquired intangible

asset

—

0.01

—

0.01

Stock-based compensation expense

0.01

0.03

0.03

0.10

Non-cash interest, net

—

0.02

0.07

0.06

Severance and Other

0.02

—

0.03

0.03

Change in fair value of derivative

—

—

0.01

—

Chugai license payment

—

—

0.02

—

Adjusted Net income(loss) per share –

diluted

(non-GAAP Basis)

$

0.11

$

(0.35)

$

(0.16)

$

(1.29)

Weighted average common shares outstanding

used in computing net loss per share—diluted

169,760

74,228

147,766

73,988

References ________________________________________

i Gerber D. et al. Phase 2 study of the focal adhesion kinase

inhibitor defactinib (VS-6063) in previously treated advanced KRAS

mutant non-small cell lung cancer. Lung Cancer 2020: 139:60-67.

ii Chénard-Poirier, M. et al. Results from the biomarker-driven

basket trial of RO5126766 (CH5127566), a potent RAF/MEK inhibitor,

in RAS- or RAF-mutated malignancies including multiple myeloma.

Journal of Clinical Oncology 2017: 35.

10.1200/JCO.2017.35.15_suppl.2506.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201109005778/en/

Verastem Oncology Contacts: Investors: John Doyle Vice

President, Investor Relations & Finance +1 781-469-1546

jdoyle@verastem.com

Sherri Spear Argot Partners +1 212 600 1902

sherri@argotpartners.com

Media: Lisa Buffington Corporate Communications +1 781-292-4205

lbuffington@verastem.com

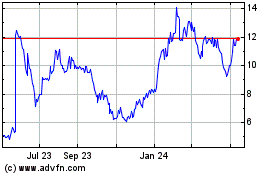

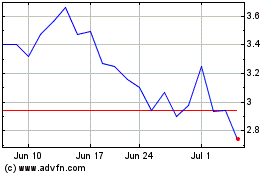

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Verastem (NASDAQ:VSTM)

Historical Stock Chart

From Nov 2023 to Nov 2024