For Immediate Release

Chicago, IL – February 13, 2012 – Zacks Equity Research

highlights: Tractor Supply Co. (TSCO) as the

Bull of the Day and Sears Holdings Co. (SHLD)

as the Bear of the Day. In addition, Zacks Equity Research provides

analysis on NYSE Euronext (NYX), Arch

Coal (ACI) and

LinkedIn (LNKD).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

Tractor Supply Co.'s (TSCO) fourth-quarter

2011 earnings of $0.96 per share beat the Zacks Consensus Estimate

of $0.92 and surged 43.3% from the prior-period earnings on the

heels of strong same-store sales, improved merchandise mix and

prudent inventory management.

On the back of perked-up results and brighter sales trends, the

company is expecting earnings in the range of $3.38 to $3.46 per

share for fiscal 2012, reflecting year-over-year growth of 12% -

15%. Moreover, the company has set a long-term target of generating

25% of sales from private label brands and 13% from strategic

direct sourcing.

The economy is showing signs of stability in the housing market

as consumer spending on small projects are witnessing considerable

growth. Currently, we are maintaining a long-term Outperform

recommendation on the stock.

Bear of the Day:

Sears Holdings Co. (SHLD) continues to

disappoint with its overall performance. The company's

third-quarter 2011 adjusted loss of $2.57 per share was wider than

the Zacks Consensus Estimate of a loss of $2.14 as well as

prior-year quarter loss of $1.71, attributable to sluggish top-line

performance.

Moreover, Sears received a setback as the company reported a

decline of 5.2% in its comparable store sales during the busiest

shopping period of the year. Management's cost cutting initiatives

for boosting profits also did not bear fruit, rather improvement in

merchandise mix and customer services would have been a better

option.

Intense competition and exposure to adverse foreign currency

translations may further undermine the company's future operating

performance. Currently, we are maintaining a long-term Underperform

recommendation on the stock.

Latest Posts on the Zacks Analyst Blog:

Greek Drama Continues

If you thought the Thursday announcement of a Greek deal would

be the last word on the issue, then you were wrong. It seems that

we are back to square one again this morning, as a meeting of

Eurozone finance ministers in Brussels asked Greece to jump through

an extra hoop before it can expect to get a fresh bailout.

The Thursday deal announcement was among Greek political leaders

who had finally agreed to the very onerous fresh austerity measures

demanded of them. The fact that the political leaders have to face

the electorate in the next few months in fresh elections made it

all the more difficult for them to agree to the measures.

But now the Europeans are demanding some more cuts and also that

the deal needed to be enacted through an act of parliament. The

interim government of Prime Minister Loukas Papademos enjoys

the support of a big majority in parliament. But with public unions

on a 48-hour strike throughout Greece, this new development has the

potential of producing last-minute surprises that could unsettle

the markets.

On the home front, we have a relatively quiet economic and

earnings calendar today. The December trade deficit number came

essentially in-line with expectations, meaning that trade will not

cause a major revision to the fourth quarter GDP estimate later

this month that was originally reported at 2.8%.

We also have the preliminary University of Michigan consumer

sentiment data for February on deck for release a little later. The

expectation is for the measure to shrink a bit from the

late-January level of 75.

On the earnings front, NYSE

Euronext (NYX), the operator of New York Stock

Exchange, met EPS expectations, but modestly missed on the

top-line. The exchange operator, who was recently rebuffed by

European regulators from merging with Deutche Boerse on anti-trust

grounds, plans to focus on its trading technology business to grow

going forward.

Arch Coal (ACI) beat EPS expectations by a

penny, but missed on the revenue side and guided towards lower

production volumes. LinkedIn (LNKD) came

in with better-than-expected results after the close on Thursday

and guided higher.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

ARCH COAL INC (ACI): Free Stock Analysis Report

LINKEDIN CORP-A (LNKD): Free Stock Analysis Report

NYSE EURONEXT (NYX): Free Stock Analysis Report

SEARS HLDG CP (SHLD): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

To read this article on Zacks.com click here.

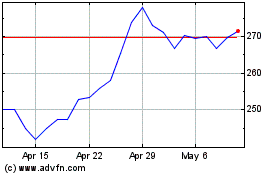

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Apr 2024 to May 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2023 to May 2024