Tractor Supply Tops on Sturdy Comps - Analyst Blog

April 21 2011 - 4:45AM

Zacks

Tractor Supply Co. (TSCO), a leading retail

firm and ranch store brand, recorded yet another quarter of good

growth. Earnings per share in the first quarter of fiscal 2011 came

in at 24 cents, breezing past the Zacks Consensus Estimate of 16

cents as well as the prior-year earnings of 14 cents per share.

Strong performance in consumable, usable and edible categories −

for instance, pet food and animal feed − acted as a catalyst for a

10.7% increase in same-store sales compared with a mere 2.8% rise

in the prior-year quarter. Tractor Supply has been witnessing

increasing trends in same-store sales.

During the recession Tractor Supply had suffered setbacks as

buyers avoided big-ticket purchases such as mowers, but recent

quarters have positively seen an up tick in results. The company’s

impressive merchandising improvement strategy and solid same-store

sales trend resulted in double-digit top-line growth for the

company. Net sales in the quarter surged 17.7% to $836.6 million

from $710.9 million in the prior-year quarter. Total revenue beat

the Zacks Consensus Estimate of $794.0 million.

Better direct product margin was partially offset by higher

transportation costs. The resultant gross profit surged 18.5% to

$273.6 million compared with $230.9 million in the prior-year

quarter. Gross margin expanded 20 basis points to 32.7% in the

quarter.

Strong same-store sales resulted in a 90 basis point improvement

in selling and administration expenses, as a percentage of sales,

which came in at 29.3% versus 30.2% in the prior-year quarter.

Tractor Supply earned $18.3 million in the quarter, far exceeding

the prior-year quarter net income of $10.6 million.

Financial Position

Tractor Supply’s balance sheet had cash and cash equivalents of

$140.4 million at the end of the quarter, compared with $138.1

million at the completion of the prior-year period. Stockholders’

equity came in at $912.1 million compared with $792.4 million in

the first quarter of fiscal 2010. The company generated $44.8

million in cash from operations in the quarter.

Store Update

In the quarter under review, Tractor Supply opened 26 new

stores. The company currently runs as many as 1,027 stores in 44

states.

Guidance and Zacks Consensus

Tractor is well positioned to capitalize on positive long-term

trends. The company now expects sales for fiscal 2011 to range

between $4.04 billion and $4.11 billion backed by expectation of

same-store sales increase of 3.5% to 5.0%. This is higher from the

previous sales and same-store sales guidance of $4.00 to $4.07

billion and 2.5% and 4.5%, respectively.

On the back of perked-up results and brighter sales trends,

Tractor Supply raised its earnings expectation for 2011 to range

between $2.62 and $2.70 per share from $2.54 to $2.62 per

share.

Competition

The company operates in a highly fragmented industry and faces

competition from larger retailers like The Home Depot

Inc. (HD) and Lowe's Companies Inc.

(LOW).

Tractor Supply’s shares maintain a Zacks #2 Rank, which

translates into a short-term Buy recommendation. Our long-term

recommendation on the stock remains Outperform.

HOME DEPOT (HD): Free Stock Analysis Report

LOWES COS (LOW): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

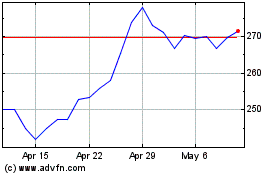

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024